Loom Network (LOOM) is a ERC20 token with a platform developed to build scalable games and Decentralized Applications (DApps) on the Ethereum network.

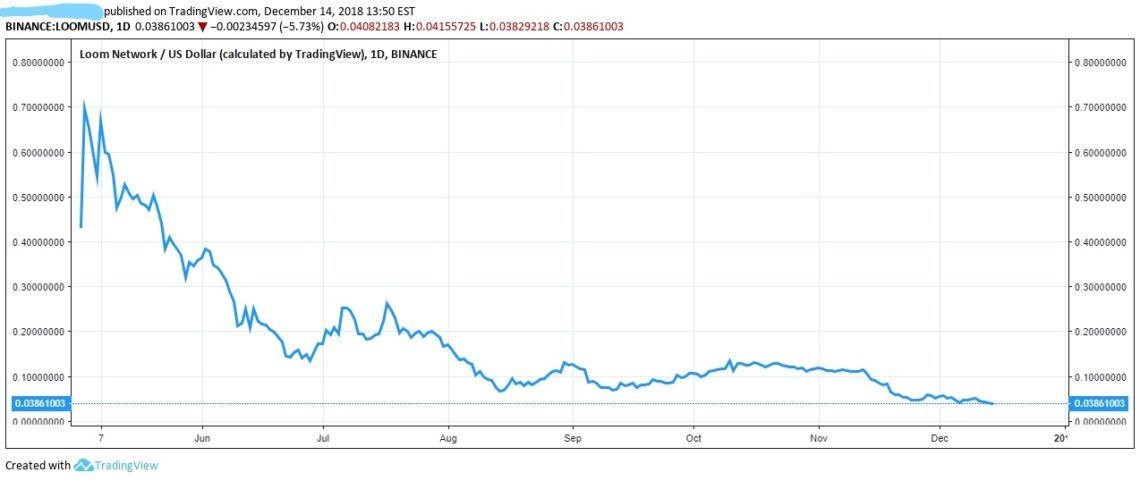

On May 2, 2018, LOOM was listed on Binance. The following day, it reached an all-time high. On Dec 13, it reached an all-time closing low.

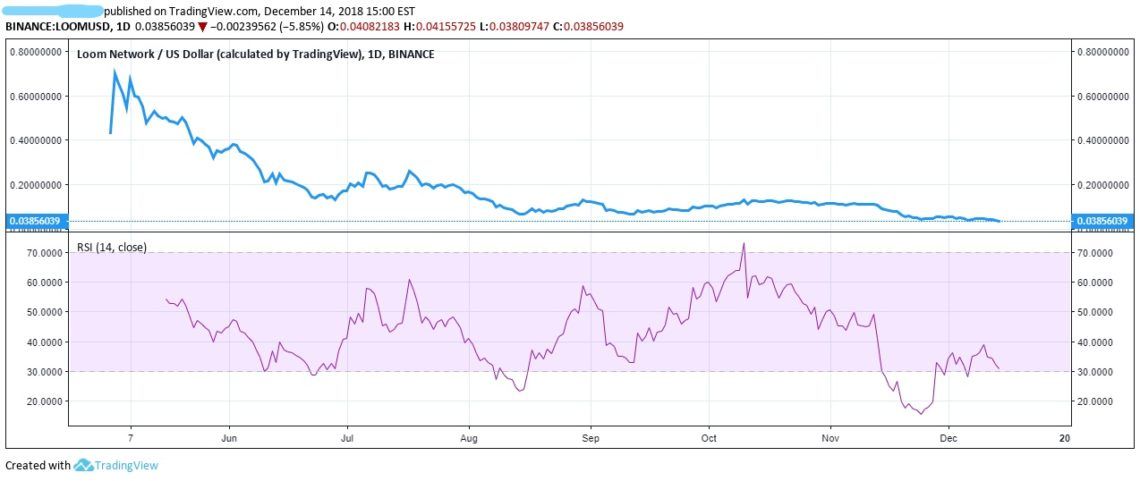

In this technical analysis, price fluctuations and trends are given more attention. As well, RSI is used to highlight when LOOM was overbought and oversold. Periods of overbuying and selling are correlated to price fluctuations.

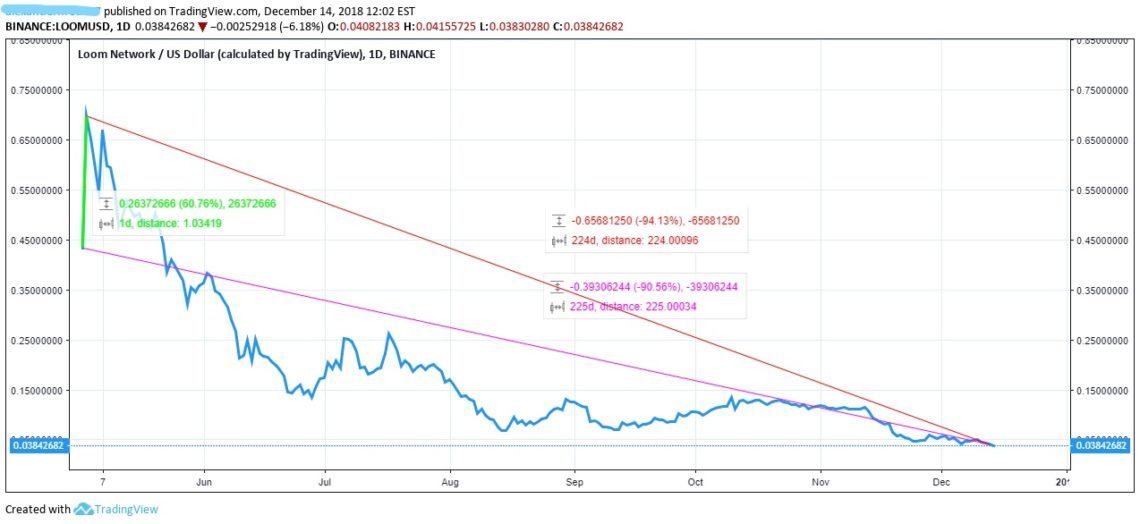

Major Price Fluctuations with trends

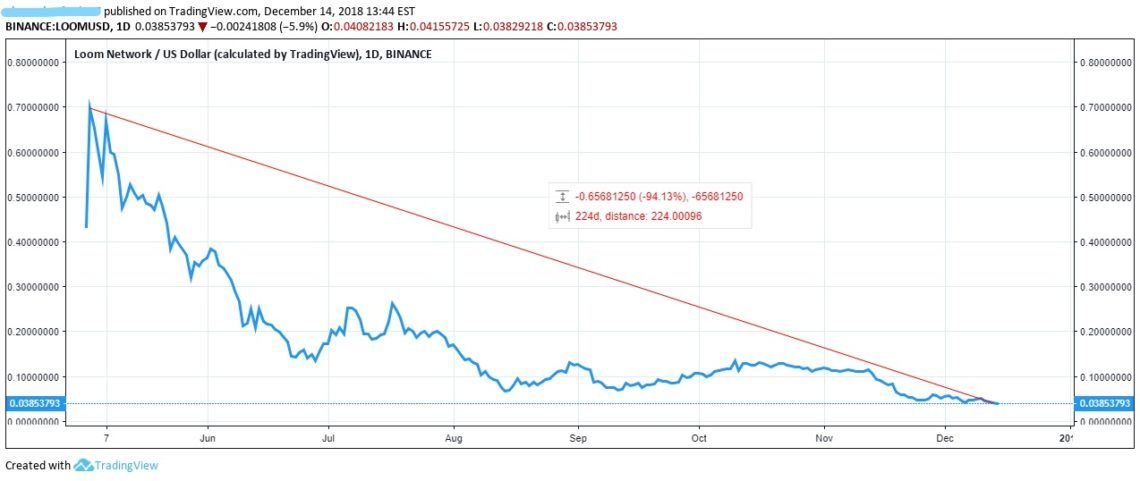

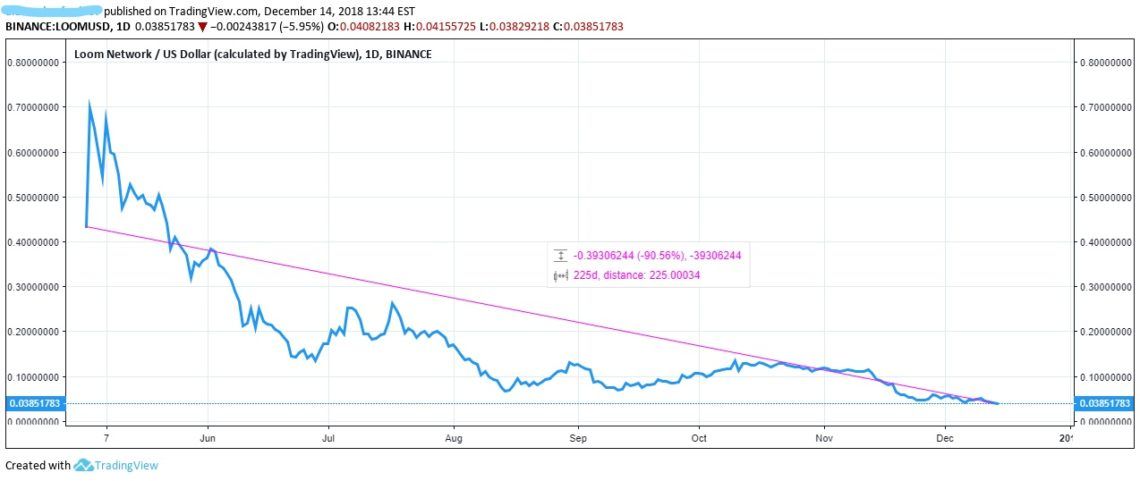

224 days elapsed between May 2 and December 13, 2018. The closing price of each day during this period is included in this graph: To highlight important data, three trends are added to the graph:

To highlight important data, three trends are added to the graph:

- The increase from the closing value on May 2 to the closing high on May 3 (green trend line)

- The decrease between the May 3 high and December 13 ending point (red trend line)

- The overall decrease in value from the May 2 starting point to the December 13 ending point (purple trend line)

The increase from the closing value on May 2 to the closing high on May 3

When a coin or token is first listed on Binance, it receives a substantial “bump” in value. This is evidenced with LOOM. On May 2, when first listed on Binance, LOOM closed at USD($)0.43401844.

On May 3, LOOM reached $0.711, the highest realized value seen since being listed on Binance. It closed at $0.69785, the highest closing value in this data set.

The increase in closing value from $0. 43401844 to $0.69785 marks a 60.76 percent increase in value in a single day, quite a substantial bump.

On May 2, when first listed on Binance, LOOM closed at USD($)0.43401844.

On May 3, LOOM reached $0.711, the highest realized value seen since being listed on Binance. It closed at $0.69785, the highest closing value in this data set.

The increase in closing value from $0. 43401844 to $0.69785 marks a 60.76 percent increase in value in a single day, quite a substantial bump.

The decrease between the May 3 high and December 13 ending point (red trend line)

Following the Binance bump, the listed coin or token typically faces a dump. Again, this is evidenced with LOOM whose value immediately begins to plummet following May 3. By Dec 13, LOOM would reach an all-time closing low of $0.040956. There is a 94.13 percent difference between LOOM’s all-time closing high and all-time closing low since listed on Binance.

There is a 94.13 percent difference between LOOM’s all-time closing high and all-time closing low since listed on Binance.

The overall decrease in value from the May 2 starting point to the December 13 ending point

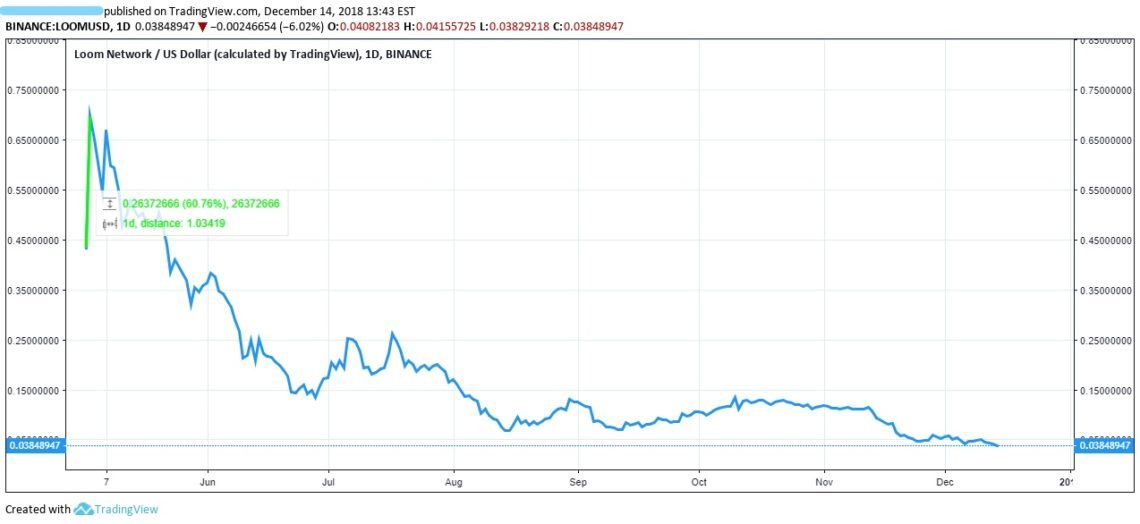

In total, LOOM has lost 90.56 percent of its value since being listed on Binance (between May 2 and Dec 13, 2018). After being listed on Coinbase Pro on Dec 7, a similar bump and dump is observed. After closing at $0.04127739 on Dec 6, LOOM increased to $0.0473328 on Dec 7. Value continued to continued until Dec 10 when LOOM closed at $0.05076643.

This bump was subsequently followed by a dump that saw LOOM reach an all-time closing low of $0.040956 on Dec 13. Both trends are tracked in the graph below:

After being listed on Coinbase Pro on Dec 7, a similar bump and dump is observed. After closing at $0.04127739 on Dec 6, LOOM increased to $0.0473328 on Dec 7. Value continued to continued until Dec 10 when LOOM closed at $0.05076643.

This bump was subsequently followed by a dump that saw LOOM reach an all-time closing low of $0.040956 on Dec 13. Both trends are tracked in the graph below:

Overselling in November

Overselling in November

Using RSI, we find relatively few periods of significant overbuying or overselling of LOOM. In fact, Oct 10 marks the only day in which LOOM was overbought with RSI reaching 73.3499.

Overselling occurs periodically with the most significant period occurring between Nov 15 and Nov 27. This period of overselling followed a drop in RSI, however, that began on Nov 12. The drop in RSI and price continued until Nov 25, at which point both began to increase.

Increases and decreases of RSI were observed as generally correlating with increases and decreases in price, though RSI remained with the normal buying range (between 30 and 70 points) during the majority of these fluctuations.

Overselling occurs periodically with the most significant period occurring between Nov 15 and Nov 27. This period of overselling followed a drop in RSI, however, that began on Nov 12. The drop in RSI and price continued until Nov 25, at which point both began to increase.

Increases and decreases of RSI were observed as generally correlating with increases and decreases in price, though RSI remained with the normal buying range (between 30 and 70 points) during the majority of these fluctuations.

Compared to MANA and CIVIC

Three other ERC20 tokens were listed on Coinbase Pro on Dec 7. CIVIC, one of these tokens, suffered an average loss similar to LOOM. However, over the 514 days, CIVIC was charted on TradingView, CIVIC lost only 68.82 percent of its value whereas LOOM lost 90.56 percent. Of course, LOOM’s data set is only 214 days, less than half of CIVIC’s, and LOOM may recover some of its original value.

MANA, one of the other ERC20 tokens listed, increased in overall value during its 380 days series. When first charted on TradingView, it was listed at $0.150040 (Nov 24, 2017). On Dec 9, it closed at $0.04650066, increasing 308.89 percent in value.

However, over the 514 days, CIVIC was charted on TradingView, CIVIC lost only 68.82 percent of its value whereas LOOM lost 90.56 percent. Of course, LOOM’s data set is only 214 days, less than half of CIVIC’s, and LOOM may recover some of its original value.

MANA, one of the other ERC20 tokens listed, increased in overall value during its 380 days series. When first charted on TradingView, it was listed at $0.150040 (Nov 24, 2017). On Dec 9, it closed at $0.04650066, increasing 308.89 percent in value.

Conclusion

Conclusion

The price of LOOM has dropped considerably since first being listed on Binance.

Following a brief bump, LOOM reached an all-time closing low on Dec 13. However, LOOM is not the only ERC20 token to lose value since being listed on Coinbase Pro. CIVIC has also reached an all-time closing low on Dec 11.

While CIVIC and LOOM are losing value, MANA is doing phenomenally well with an increase in value of over 300 percent since being charted on TradingView.

Questions have been raised as to whether tokens like LOOM deserve to be listed on Coinbase. Rumors of collusion and poor average yields have raised eyebrows.

But what do you think about LOOM? Can it recover any of its lost value? Or is just another S***coin? Let us know your thoughts in the comments below!

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Alexander Fred

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

READ FULL BIO

Sponsored

Sponsored

Overselling in November

Overselling in November Conclusion

Conclusion