MANA is an ERC20 token used within Decentraland to purchase digital LAND, goods, and services.

Decentraland is one of the first truly decentralized virtual universe in the world. To gain access, users must use virtual reality goggles.

Development of Decentraland began in 2015. Its ICO was introduced in August of 2017. On Dec 7, 2018, it was listed on Coinbase Pro with three other ERC20 tokens.

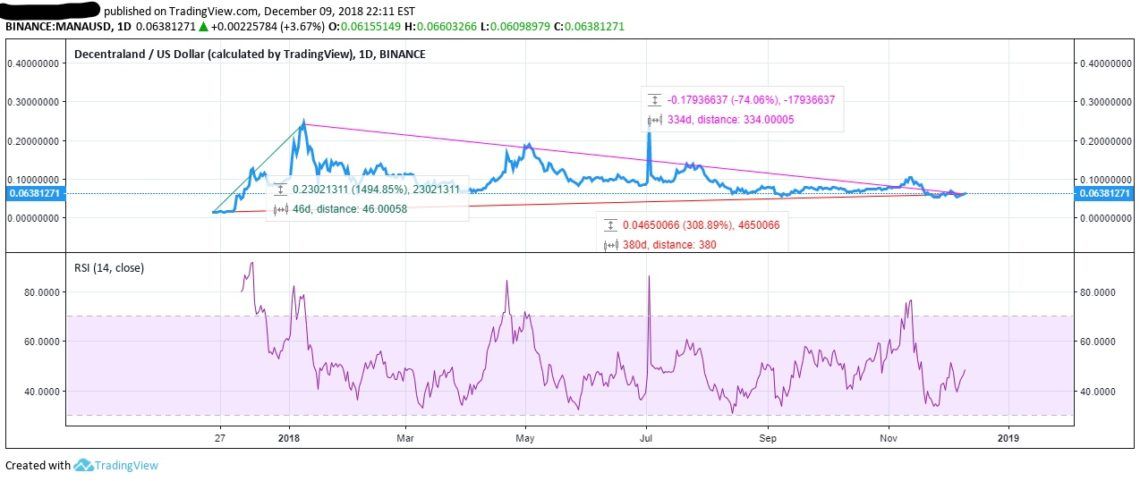

In the following technical analysis, price trends, RSI, and StochRSI are used to analyze the performance of MANA over the last 380 days.

Price Fluctuations and Three Trends

Nov 24, 2017, is the first day that MANA is charted by TradingView. This is where our analysis begins. It ends on Dec 9, generating a data set with 380 unique data points.

RSI Never Oversold

When the Relative Strength Index (RSI) is included as an indicator, no point can be isolated in which MANA is oversold. Though the lowest RSI recorded is 31.0075 on Aug 14, 2018, RSI never crosses below the 30-point threshold.

- Between Dec 8 and 20, 2017

- Between Jan 3 and 10, 2017, though on Jan 5, RSI dropped below the 70-point threshold hitting 68.866

- Between April 20 and 24, 2018

- Between Nov 12 and 13, 2018

Using Stochastic RSI to Determine Periods of Overselling

RSI is derived using standard price data in order to determine whether an asset is being overbought or oversold based on the price of that asset at a given time. Stochastic RSI (StochRSI), however, applies a stochastic oscillator formula to RSI, not to standard price data. In so doing, StochRSI suggests to traders at what points the value of RSI, not asset price, is overbought or oversold. It was developed for usage in circumstances like this: when RSI values are too heavily limited between the 30-70 range to be used feasibly as an indicator for buying or selling of an asset.

Conclusion

Despite large fluctuations in price over the last 380 days, the value of MANA in USD increased between Nov 24, 2017, and Dec 9, 2018. The lowest USD value of MANA was encountered on the first data point of the series and the highest appeared only 46 days later with a negative trend following for the following 336 days. Nonetheless, the positive trend of 380 days proved significant enough to overcome this negative trend. Further, using RSI it was observed that MANA traders are prone to overbuying but have managed to prevent overselling. For this reason, StochRSI was introduced. With the use of StochRSI, multiple periods in which RSI was oversold were graphed. What do you think is going to happen with MANA? Will the price continue to increase over time despite rapid fluctuations within the data series? Or will the negative trend that emerged at data point 46 eventually overcome positive price growth? Let us know your thoughts in the comments below!

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Alexander Fred

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

READ FULL BIO

Sponsored

Sponsored