After failing to scale the $100 resistance last week, Litecoin’s (LTC) price has stagnated within the $92 – $95 territory. Ahead of the August 2 Halving date, Whale investors and Litecoin miners have placed opposing bets. Who will come out on top?

Litecoin (LTC) has delivered a sideways performance this week as two blocs of stakeholders begin to take opposing positions. The on-chain analysis provides a data-driven insight into the possible LTC price action ahead of the halving.

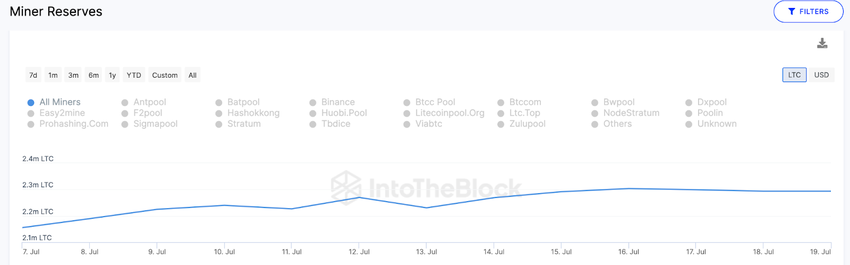

LTC Miners Are Stacking Up Their Reserves

The upcoming Halving event will see the block rewards allocated to Litecoin miners cut in half from 12.5 LTC to 6.25 LTC. It’s no surprise that ahead of the August 2 Halving date, Miners have been accumulating more of their 12.5 LTC rewards.

On-chain data compiled by IntoTheBlock shows that the LTC miners began stacking up their reserves in June 2023, when they added 310,000 LTC, worth approximately $30 million.

Interestingly, between July 7 and July 20, they added another 140,000 LTC, bringing their total reserves to 2.29 million LTC.

The Miners Reserves data track real-time changes in the wallet balances of recognized miners and mining pools. When it rises, it signifies that the miners are accumulating more block rewards than selling.

With their block rewards due to be halved to 6.25 LTC in two weeks, it appears that the miners are looking to accumulate as much of their current 12.5 LTC earnings as possible.

Evidently, this 140,000 LTC (~$13 million) reserve accumulation has considerably reduced market supply this week and put some upward pressure on Litecoin’s price.

However, things could take an entirely different turn as the halving date draws closer. The miners may start selling to get ahead of a possible post-halving LTC price crash.

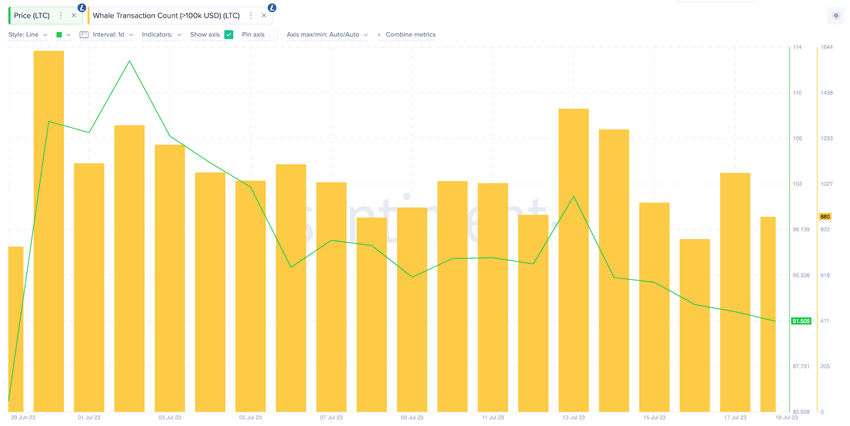

Whales Have Been Reducing Their Trading Activity

Halving events typically create uncertainty and speculation in the cryptocurrency market, causing significant price volatility. Litecoin whale investors have been gradually cutting down on their trading activity to mitigate these risks.

The chart below illustrates how LTC Whale Transaction Count (100k) has reduced from 1,628 whale transactions recorded on June 30 to just 880 transactions at the close of July 19.

Whale Transaction Count tracks the trading activity of large institutional investors by summing up daily transactions exceeding $100,000.

The chart above depicts a whopping 46% drop in whales’ trading activity. Due to their financial power and strategic influence, the drop in whale demand puts systemic downward pressure on LTC prices.

Notably, this shows that the Litecoin whales and miners are now placing opposite bets on LTC price action ahead of the halving. The whales take a mild-bearish position, while the miners take a more optimistic outlook.

Hence, the $90 support could be the critical deciding factor for both factions in the coming weeks.

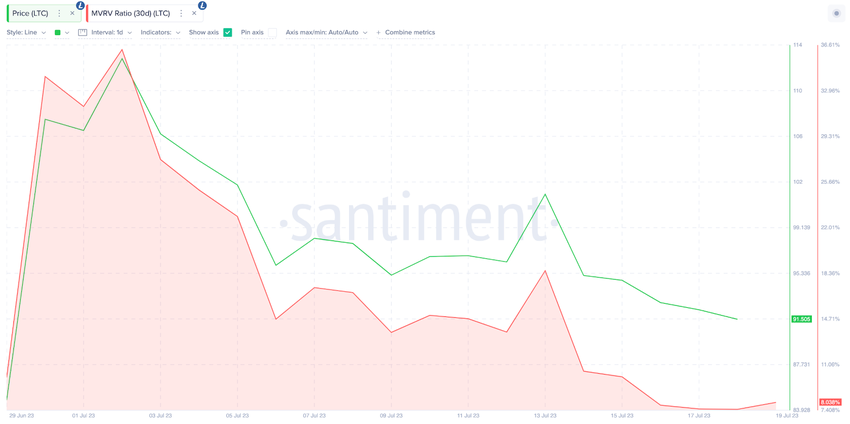

LTC Price Prediction: The $90 Support Level Could Be The Deciding Factor

If LTC loses the $90 support level, the miners’ could panic and attempt to offload their reserves before prices drop lower. That panic sell-off could drive the LTC price as low as $80.

This view is validated by the MVRV ratio, which gauges the net financial position of current LTC holders. The chart below shows that the majority of investors that bought Litecoin in the last 30 days are holding 8% profits

Given the neutral market sentiment, the bulls will likely offer support once profits drop to 5%, around $90.

However, if the miners panic, the selling pressure could spill over that $90 buy wall. In that case, Litecoin’s price could rapidly decline toward $80.

Conversely, the Litecoin whales and miners can join forces to force a rally if the LTC price can scale the $100 resistance. However, the bearish miners looking to book profits could start to sell once the price approaches the 15% profit zone at $99.

But if that resistance cannot hold, the LTC price could rise toward $110.

Read More: Best Upcoming Airdrops in 2023