The Litecoin (LTC) price has fallen since it deviated above long-term resistance at the beginning of July.

Despite the bearish trend, the LTC price is approaching a confluence of support levels which could initiate a significant bounce.

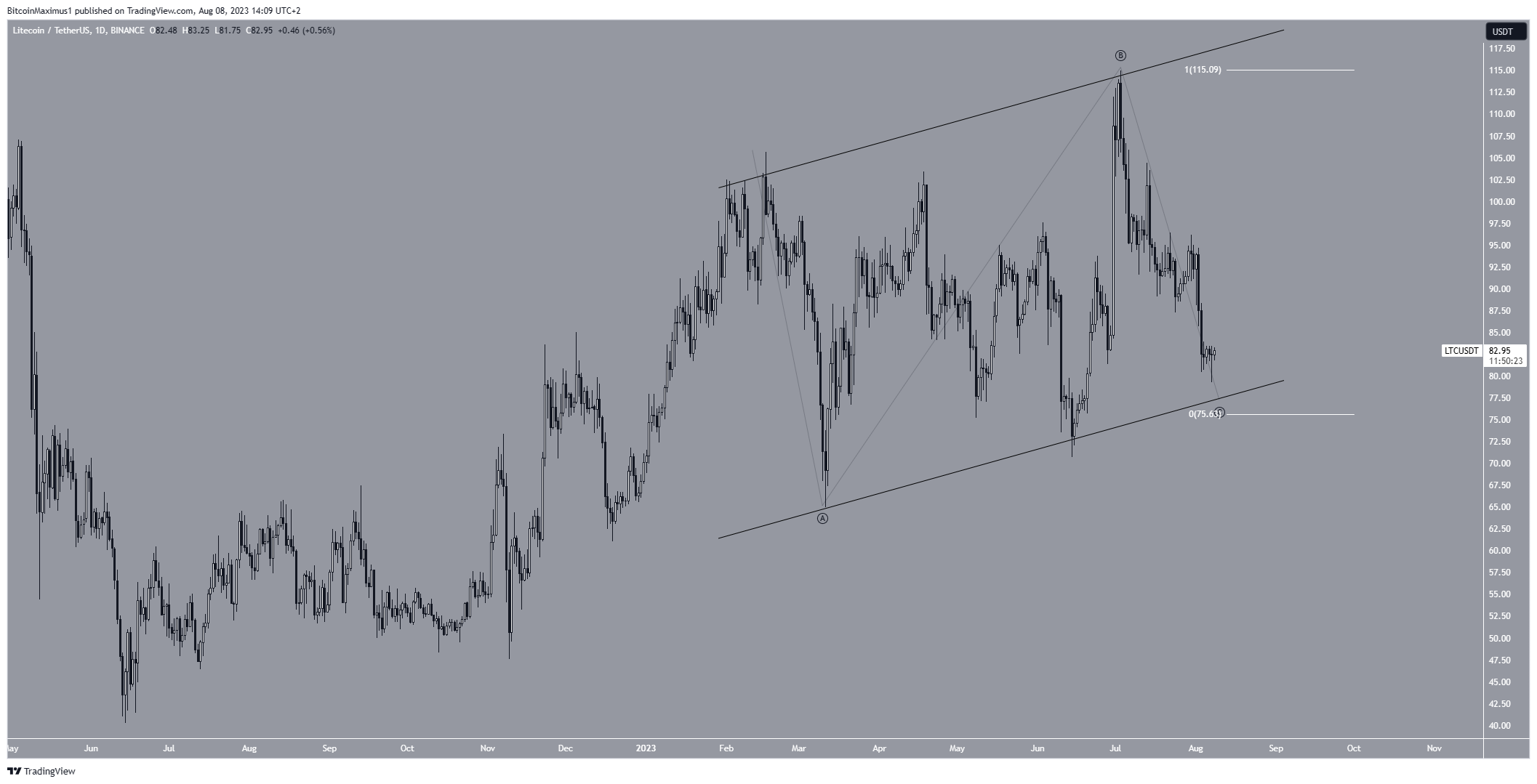

Litecoin Price Deviates and Falls Below Resistance

The analysis of the weekly timeframe for LTC suggests a pessimistic outlook due to bearish signals from both price action and the Relative Strength Index (RSI).

The price action indicates a bearish trend because of the deviation above the $100 resistance area. The LTC price temporarily exceeded the $100 mark (red circle), confirming this level as resistance. Such a deviation is typically seen as a negative signal and often precedes significant downward movements. This was the case with LTC since the price has fallen to a low of $79.29.

The LTC price is now approaching a long-term ascending support line at $76. The line has been in place since June 2022. Therefore it has measured the slope of the upward movement since then.

Crypto investing, simplified. Get LTC price predictions here.

So, the trend can be considered bullish as long as the price trades above the line. A return to the $100 resistance area would be a bounce of 20%.

On the other hand, if the price breaks down, it can fall by another 25% and reach the $64 support area.

Additionally, the weekly RSI supports the notion of a continuing downtrend. Traders use the RSI as a tool to gauge momentum and whether a market is overbought or oversold. This helps them decide whether to hold or sell an asset.

An RSI reading above 50, combined with an upward trend, usually favors bulls. Conversely, a reading below 50 indicates the opposite. The RSI has just fallen below 50 after it displayed a bearish divergence (green line) during the earlier deviation.

This occurs when a decrease in momentum accompanies a price increase. It reinforces the possibility of a bearish trend.

Read More: 6 Best Copy Trading Platforms in 2023

LTC Price Prediction: Why Did Price Fall After Halving?

Litecoin’s third halving occurred on August 2. It reduced the LTC block rewards from 15 to 6.25, increasing the scarcity of the asset. However, despite the halving being a deflationary event, the LTC price has fallen in the week since. It is possible that miners caused the sell-off.

Despite the drop, there is hope for an LTC price bounce. Litecoin has traded inside an ascending parallel channel since the beginning of February. It is currently very close to the channel’s support line, which coincides with the previously outlined long-term ascending support line. Due to this confluence, this is a very strong support area.

Moreover, the wave count supports the possibility of a local bottom. Technical analysts utilize the Elliott Wave theory to ascertain the trend’s direction by studying recurring long-term price patterns and investor psychology.

It is possible that the entire movement contained inside the channel is part of a large A-B-C corrective structure. If so, waves A:C would have an exactly 1:1 ratio. This is the most common ratio in such structures.

If the count is correct, the LTC price would bounce sharply at the channel’s support line and increase toward the $100 resistance area.

However, a breakdown from the channel would invalidate the count and likely send the price to the previously outlined $64 support.

Therefore, the LTC price prediction will determine whether the price breaks down from the long-term ascending support line or bounces. A bounce could trigger a 20% increase to $100, while a breakdown could cause a 25% drop to $64.

For BeInCrypto’s latest crypto market analysis, click here