Litecoin’s latest halving has become a central topic of discussion in the cryptocurrency market. With the upcoming halving event, miners will receive half the reward they used to for producing blocks.

This phenomenon is not new, as Bitcoin undergoes similar halvings every four years. However, the implications of the halving on Litecoin’s future bear significance as it could take miners out of business.

A Closer Look at Litecoin Halving

Understanding the Litecoin halving process is essential to grasp the core of the issue.

Litecoin miners receive a certain number of LTC when they produce a block. This reward, initiated at 50 LTC per block, undergoes a 50% reduction after every 840,000 blocks mined, approximately every four years.

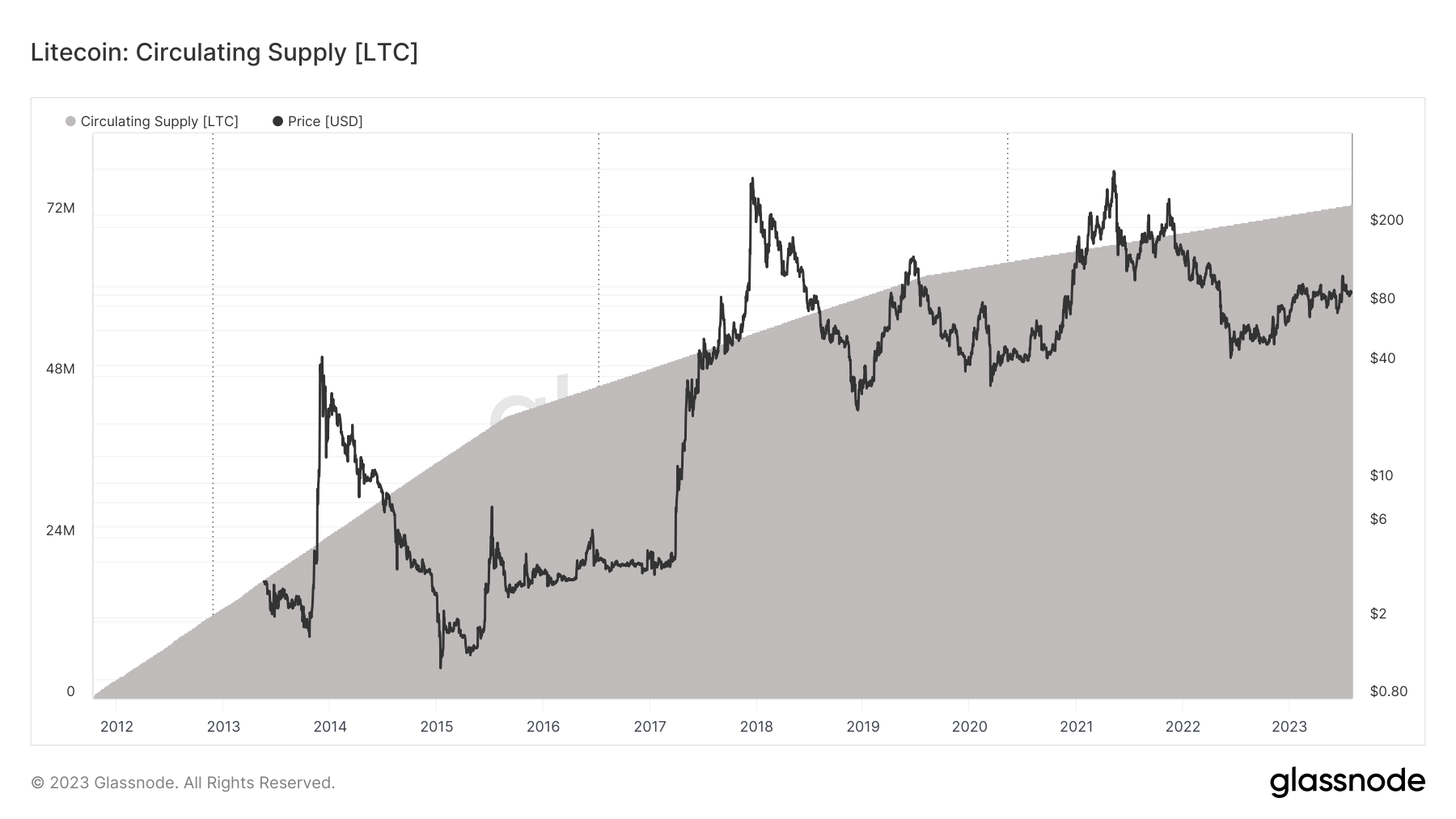

The mining reward is poised to drop from 12.5 LTC to 6.25 LTC soon. This mechanism is designed to keep the supply of LTC in check, with a hard cap of 84 million LTC. Currently, nearly 87% of this total supply is already in circulation.

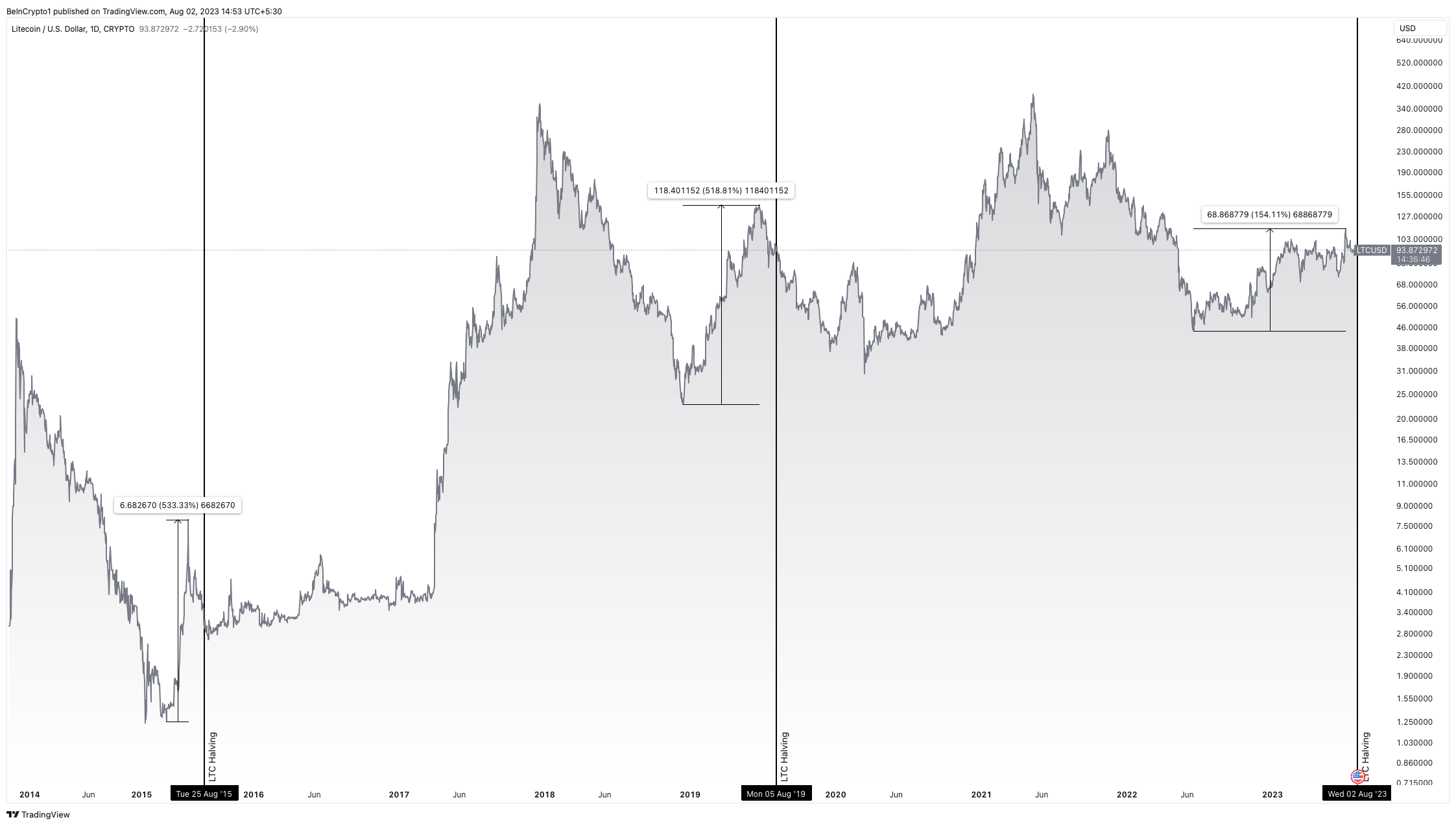

Litecoin’s price dynamics seem to sway with its halving events. BeInCrypto’s senior analyst Valdrin Tahiri observed that the price of LTC skyrocketed by 533% before the 2015 Litecoin halving and jumped 519% in 2019.

These percentages point to an underlying trend where Litecoin’s price tends to peak just before the halvings.

Read more: Litecoin (LTC) Price Prediction

This pattern is termed by BeInCrypto’s Global Head of News, Ali Martinez, as a “buy the rumor, sell the news” event, hinting that the market anticipates the supply shock before it happens, which Litecoin creator Charlie Lee acknowledged.

“A lot of the price action is a self-fulfilling prophecy… For Bitcoin and Litecoin, sometimes the price went up before [the halving], sometimes it runs up afterwards. Sometimes it doesn’t really have too much of an effect. It all depends on how the market reacts to the halving,” said Lee.

The Significance of Litecoin Halving

Tone Vays, the founder of Financial Summit, weighed in on this event, drawing parallels between Bitcoin and Litecoin halvings. He highlighted that this event, just like the Bitcoin halving, effectively cuts by half the reward Litecoin miners receive for producing blocks.

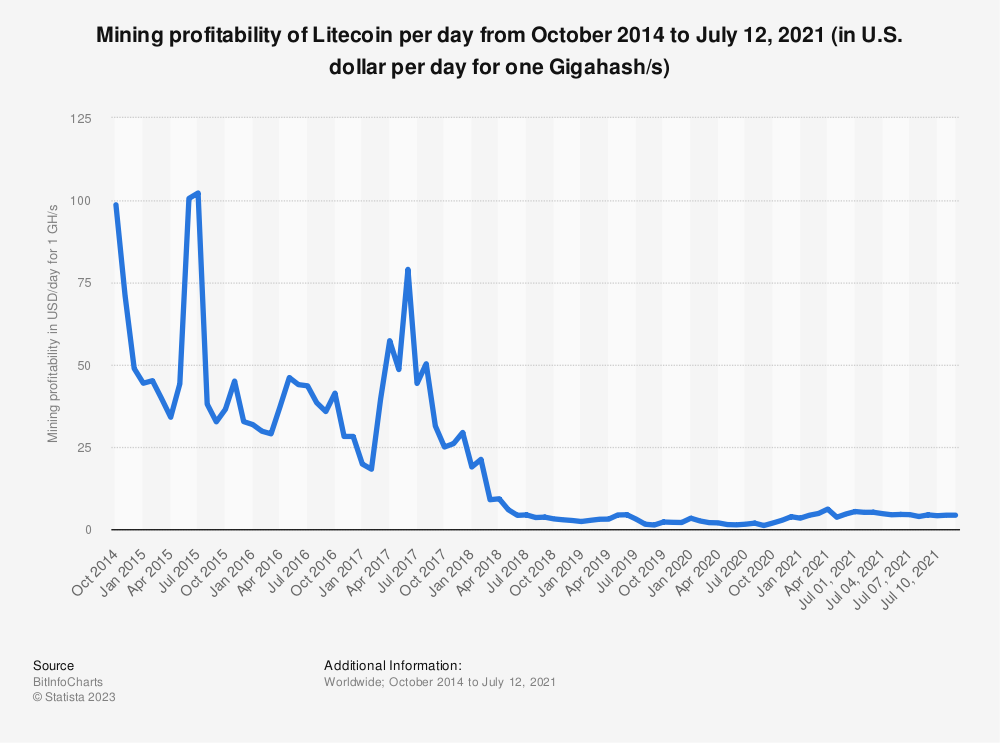

Still, for miners to remain interested, the value of the cryptocurrency should ideally double every four years.

“Litecoin needs to double in value at a minimum every four years. Otherwise, no one would want to mine it any further, making the Litecoin network less secure, which it could lead to a death spiral,” Vays told BeInCrypto.

Read more: Best Cloud Mining Sites 2023: A Beginners Guide

The underlying concern is that a drop in mining activity could render the Litecoin network vulnerable, especially regarding security. Fewer miners could make the network more susceptible to 51% attacks, wherein a single entity might control most of the network’s mining power, compromising its integrity.

Vays expressed skepticism about the long-term profitability of Litecoin mining. Especially with the current halving, suggesting that LTC might face challenges in the future.

“I don’t see any way for Litecoin to be useful unless Bitcoin’s Lightning Network fails. As long as Bitcoin’s Lightning Network succeeds, there is no need for LTC because BTC scales to small transactions. This is the same way there is no more need for silver as money because no one will ever be exchanging pieces of gold with each other,” added Vays.

This sentiment stems from Vays’ belief that Bitcoin has a far greater adoption rate and real-world utility than Litecoin. As such, the ripple effect of a Bitcoin halving is felt more acutely across the cryptocurrency market than a Litecoin halving.

Dogecoin and Litecoin Dual-Mining

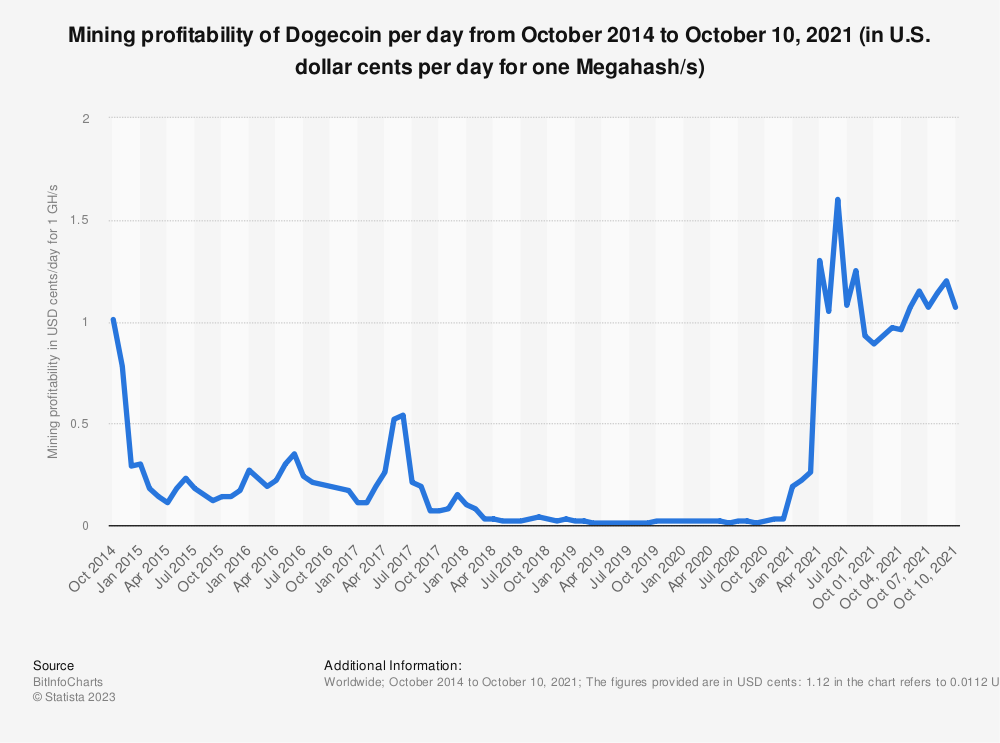

However, the situation is not entirely bleak for Litecoin miners. As block rewards for Litecoin decrease, it could naturally mean decreased profitability for miners. Yet, a critical factor might provide some relief. Litecoin has a dual-mining mechanism with Dogecoin.

Youwei Yang, chief economist at BIT Mining, highlighted this unique aspect. He noted that while Litecoin’s block reward would halve, Dogecoin’s remains unchanged. This dual-mining mechanism could somewhat offset the reduced profitability from Litecoin’s halving.

“Litecoin machines have the capability of also mining Dogecoin…. We believe that Litecoin is very stable, and Dogecoin has the potential to attract young generations. Dogecoin has enough sound and solid technology that will help the network and, at the same time, attract billions of interest and millions of users. So the combination of technology can help [Litecoin and Dogecoin] survive and get adopted,” said Yang.

Read more: Crypto Telegram Groups To Join in 2023

Due to the dual mining technology, Litecoin halving’s impact on miner profitability might be cushioned. Still, Yang added that current market dynamics, including the low volatility in the crypto market, might mean that the halving does not significantly impact the Litecoin price as previous ones did.

Regardless, Vays remains bearish on Litecoin’s prospects, especially in light of the halving. He foresees that Litecoin developers would have to decide between shifting to a proof-of-stake (PoS) model or adopting the SHA 256 algorithm and merging mining with Bitcoin.