The Litecoin (LTC) mining hashrate in Binance’s pool has fallen from 69 terahashes/second (TH/s) in January to 28 TH/s as miners face the imminent halving of block rewards.

The pool has fallen from its dominant perch in January to become the seventh-largest LTC producer.

Cause of Lower LTC Production Uncertain

As a result, Binance Pool now only accounts for 3.6% of the LTC hashrate despite connections with the namesake exchange, which is the largest by trading volume. At the same time, Binance’s share has been absorbed by Poolin, F2Pool, and viaBTC, all of whom have seen their shares of hashrate rise since the start of 2023.

ViaBTC currently controls 33% of all Litecoin production. F2Pool and Antpool offer the network just under a third of the computing power for confirming transactions.

So far, the reasons for the decline in Binance Pool’s share remain unclear. However, legal action in several countries, including the United States of America, may have caused miners to flee. The US Securities and Exchange Commission (SEC) recently accused Binance and its CEO, Changpeng Zhao, of violating securities laws.

Litecoin Halving Could Force Miners to Upgrade

Presently, Litecoin’s hashrate is approximately 780 TH/s, with miners earning about 7,200 LTC per mined transaction block. However, the imminent third Litecoin halving will reduce Litecoin’s block reward to 3,600 LTC.

Read more about Litecoin mining here.

The lower reward may encourage miners to upgrade equipment to models offering a higher hashrate to improve their chances of earning the reward.

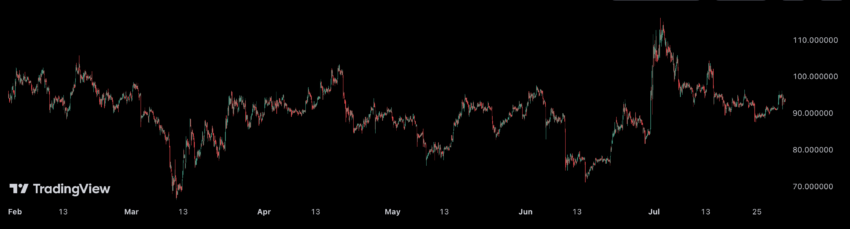

Additionally, analysts say Litecoin’s price has already reached a local maximum and is unlikely to breakout above a $115 resistance level after the halving. The asset is currently trading at roughly $93.

The halving will take place on Aug. 3, 2023.

Got something to say about the Binance mining pool losing its dominant LTC hashrate or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.