Crypto enthusiasts and investors are eager to know when altcoin season will kick off.

Top analysts offer varied perspectives on the timing and indicators that signal this shift.

Not an Altcoin Bull Market Yet

Crypto analyst Miles Deutscher recently shared insights, emphasizing that the market is far from an altcoin bull run. He explained that although Bitcoin has reached new all-time highs and meme coins are trending, altcoins have significantly underperformed.

“Most retail doesn’t hold large amounts of Bitcoin – they’re in altcoins. And altcoins have been significantly underperforming thus far this cycle,” he noted.

Deutscher highlighted several critical data points:

- The OTHERS/BTC ratio is lower than it was in October 2023, indicating altcoins’ weak performance.

- Only eight altcoins have broken their previous all-time highs against Bitcoin since the collapse of FTX.

- YouTube views for Bitcoin are disproportionately low compared to its price surge, suggesting retail disinterest.

- Altcoins are still 70% away from their previous all-time highs, while Bitcoin reached a new peak in March.

- Since Bitcoin’s price increase from $27,000 in October 2023, altcoins have not had a sustained rally yet.

Read more: Which Are the Best Altcoins To Invest in June 2024?

Deutscher attributed the market’s behavior to a Bitcoin-led cycle driven by the spot exchange-traded fund (ETF) narrative and strong inflows.

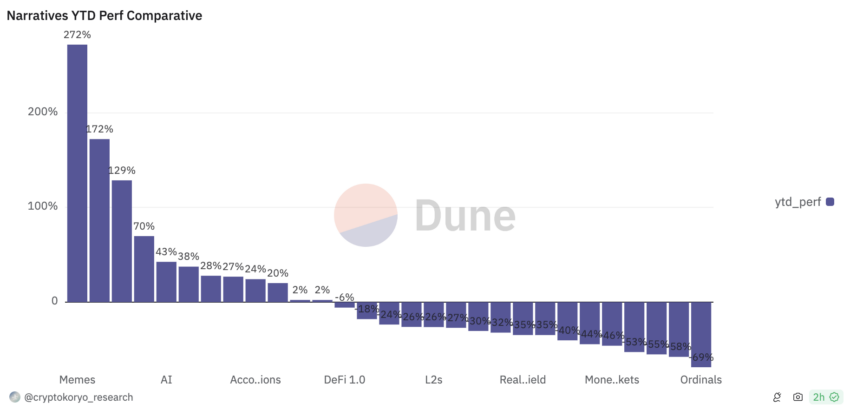

“This has been a Bitcoin-narrative led cycle… Specific narratives have significantly outperformed (with majors lagging). Memes, AI, and RWA have been the clear leaders so far this cycle,” he added.

Altcoin Season Is Coming Soon

Despite the current scenario, crypto investor Layah Heilpern pointed to several bullish factors for crypto, including Bitcoin and Ethereum ETF approvals and endorsements from high-profile figures. She argued that the market has shaken out weak hands and is poised for the next big move.

“Imagine not being bullish on crypto right now. The Winklevoss twins donated $2 million to Donald Trump. Bitcoin and Ethereum ETFs approved. Trump endorsed crypto. The halving is done. Ethereum is not a security,” Heilpern said.

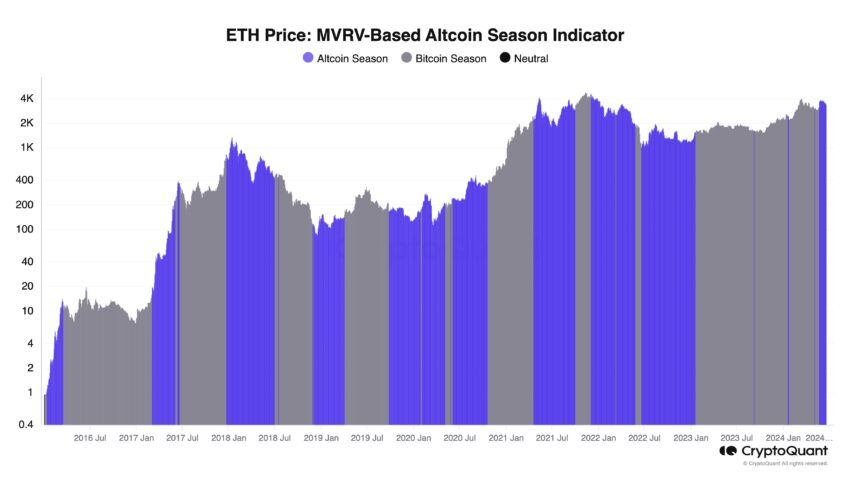

Meanwhile, Ki Young Ju, CEO of CryptoQuant, and technical analyst Mister Crypto are seeing signs of an early altcoin season. Ju observed that Ethereum’s MVRV ratio is rising faster than Bitcoin’s, indicating that Ethereum is heating up relative to its on-chain fundamentals.

This could suggest an Ethereum-led altcoin season, especially given the current ETF situation.

“Given the current ETF situation, this might be an ETH-only season. Historically, when ETH surges, other alts tend to follow,” Ju wrote.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Given the potential for an altcoins season, Michaël van de Poppe explained he is bullish on Chainlink (LINK), citing historical patterns and expecting a significant rally in the second half of the year. He noted that LINK has formed a solid weekly candle on its cycle low, similar to patterns seen in previous years that led to substantial gains.

“LINK makes a very decent weekly candle on the cycle low… A similar price pattern occurred in previous years, resulting in a 150% rally. I’m expecting the same,” van de Poppe said.

Meanwhile, Rekt Finance highlighted Polkadot’s entry into the AI race as a bullish indicator. With projects like OriginTrail and PhalaNetwork leveraging Polkadot’s technology for AI, Polkadot could become a central hub for AI projects, potentially boosting its value.

Read more: 10 Best Altcoin Exchanges In 2024

While analysts diverge on the exact timing, the consensus remains that altcoin season is on the horizon. Investors should stay informed and consider market trends and expert insights.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.