The total value locked (TVL) in liquid staking protocols is up 292% since last year’s mid-year crypto slump. The amount locked in liquid staking protocols like Ethereum’s Rocket Pool and Lido rose to $20 billion, slightly under April 2022’s peak of $21 billion.

The rise in TVL came after developers switched the consensus mechanism of the Ethereum blockchain from proof-of-work to proof-of-stake. Instead of miners, special node operators called validators earn about 4% of annual ETH issuance for validating transaction blocks.

Ethereum Decentralized Staking Worth $15 Billion

Ethereum developers boosted the TVL further after completing the so-called Shapella upgrade in April. Further improvements, including cheaper transaction blocks will help Ethereum scale to handle more transactions per second.

Interested in finding out more about the Shapella upgrade? Read more here.

Staking protocols give customers the benefit of locking ETH to earn rewards. Additionally, they can hold this value in a derivative token they can use to profit in decentralized finance (DeFI) protocols.

Without staking protocols, ETH investors would need to purchase expensive hardware to validate Ethereum transactions. Staking pools do most of the heavy lifting on behalf of investors.

Lido accounts for one-third, or eight million, of all staked ETH, worth about $14 billion, while Rocket Pool holds about $1.3 billion.

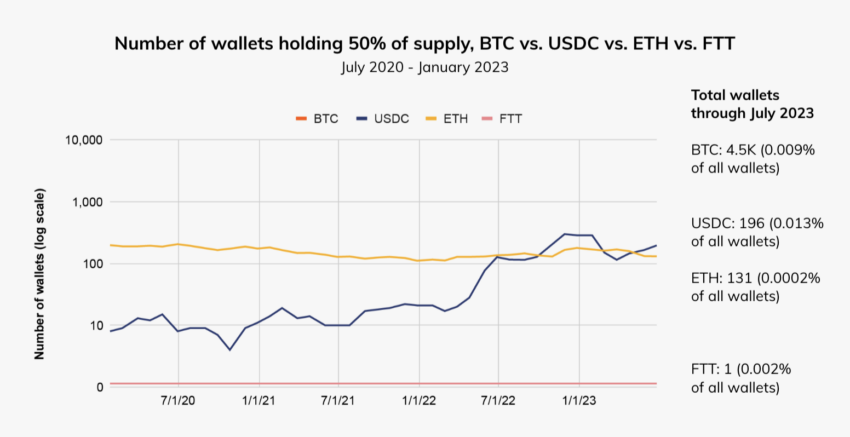

Concentration Concerns May Be Overcooked, Says Chainalysis

The large percentage of ETH held by Lido has raised concerns since it poses a single point of failure. Last month, Curve Finance, arguably one of the most trustworthy decentralized protocols, was hacked by black hats for about $50 million.

Read more about the benefits of ETH staking here.

Last month, a report from analytics firm Chainalysis said the problem may be less severe upon closer inspection. While liquid staking wallets contain large ETH balances, they can be removed by stakers at any time, lowering concentration risk.

Got something to say about Ethereum liquid staking or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.