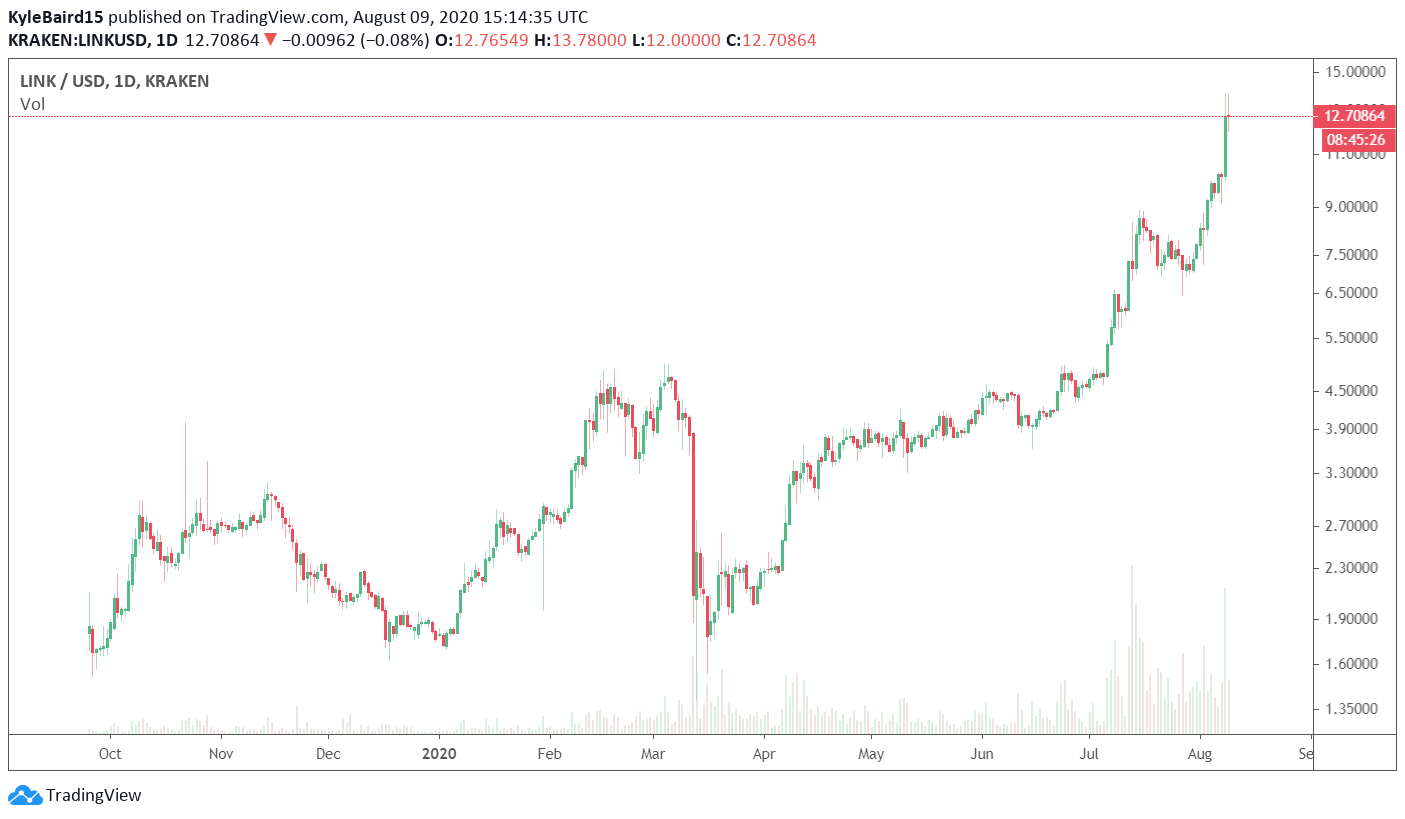

LINK keeps surprising the cryptocurrency space. After several weeks of an uptrend, the oracle network entered a new phase of price discovery.

After several attempts of creating FUD from a fraudulent Zeus Capital, LINK continues on its way up. The token is already ranked sixth in market capitalization on CoinMarketCap.

Today, LINK’s trading volume surpassed Bitcoin’s on Coinbase, and it’s also coming close to passing BTC on Binance.

LINK Keeps Climbing

Chainlink is, without a doubt, one of the frontrunners in this current market uptrend. In just the past 30 days, LINK’s price has gone from $6 to $13 at the time of press.

The King of Trading Volume

Seemingly unaffected by the FUD, LINK keeps rising both in price and trading volume. On Aug 9, LINK’s trading volume surpassed Bitcoin’s on Coinbase:

It’s Oracle Time

Chainlink is in price discovery territory. It currently passed Litecoin in market capitalization and is now challenging Bitcoin Cash for a place in the top-5. Oracles seem to be one of crypto’s hottest potatoes. Not only is LINK going up, but also its direct competitor—Band Protocol ($BAND).

Comparisons are constantly coming up between the two projects. On a long-form Medium post, Smart Content does a deep analysis of both projects. Its report states:1/ Band Protocol ($BAND) will be listed on

— Band Protocol (@BandProtocol) August 5, 2020

@CoinbasePro

, the leading licensed US-based digital asset trading platform, and begin trading on Tuesday, August 11.

Coinbase users will be able to buy, sell, convert, send, receive, or store BAND.https://t.co/FIYIBdoHsK

When fully compared, Band Protocol is going for a blockchain-based approach to solving the oracle problem by using monolithic consensus, which enforces standardization of nodes and has upper limits to its decentralization.It follows:

This rigid model is why Band will struggle to support authenticated APIs in a scalable manner, as it’s near impossible for all nodes to support credentialed data in their framework without redesigning the whole data industry from the ground up.Although the post could be accused of being biased towards LINK, it seems that BAND is still far away from LINK in customer adoption and real-world usage. This raises questions about how solid the current bull run is if projects without much real use can gather millions of dollars in a matter of days.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Tony Toro

Tony has worked for several financial companies in London during the last seven years, gaining experience in traditional finances and trading. Passionate about direct democracy, digital rights and privacy, he has been involved with cryptocurrency since 2013.

Tony has worked for several financial companies in London during the last seven years, gaining experience in traditional finances and trading. Passionate about direct democracy, digital rights and privacy, he has been involved with cryptocurrency since 2013.

READ FULL BIO

Sponsored

Sponsored