Wyre, once a major player in crypto payments, shut down in June 2023 due to challenging market conditions. Though its operations ceased, RockWallet, a self-custodial wallet, stepped in early 2024 to acquire Wyre’s customer base. This allowed the platform’s former users to transition to RockWallet’s platform, which promised to manage their digital assets without service interruption. This article explores what Wyre was and why it used to be a big name in crypto back in its heyday.

KEY TAKEAWAYS

➤ Wyre, a crypto payments provider, shut down in June 2023 due to difficult market conditions.

➤ Wyre became popular by enabling businesses to integrate customizable fiat on-ramps and streamline crypto purchases for end-users.

➤ RockWallet acquired Wyre’s customer base in February 2024 and promised users a smooth transition.

What is Wyre?

Wyre operated as a Money Service Business (MSB) licensed to transmit and convert funds. Its primary focus was to bridge the gap between fiat and cryptocurrency economies. Over the years, the platform succeeded in serving as a key facilitator for blockchain businesses needing easy and compliant fiat on-ramps.

The company’s services were tailored to individuals, businesses, and enterprises, offering:

- User-friendly dashboard: Streamlined management of crypto transactions.

- APIs for exchanges and payments: Supported seamless crypto transactions and cross-border transfers.

- On-chain compliance: Assisted businesses in meeting regulatory requirements.

- OTC desk: Catered to institutional clients needing high-volume transactions.

With multiple use cases, Wyre emerged as an attractive and powerful platform for many blockchain and crypto-focused projects.

Wyre also provided regulatory compliance tools, which attracted partnerships with high-profile platforms like MetaMask and Opera.

Wyre gained recognition for enabling fast and cost-effective international transactions by leveraging blockchain technology. Its services allowed users to bypass traditional financial systems, reducing the time and fees associated with cross-border transfers. Its approach to bridging fiat and cryptocurrency economies made Wyre an appealing choice for blockchain businesses, as well as individual users.

History and team

Wyre, based in San Francisco, was co-founded in 2013 by Michael Dunworth and Ioannis Giannaros. It was originally launched as Snapcard, a Bitcoin payment app, which soon gained popularity among merchants for promoting Bitcoin payments.

By 2015, it had already processed millions in Bitcoin transactions, particularly in the U.S. and Latin America.

However, as regulatory costs for Bitcoin payments began to rise, the company shifted its focus from consumer payments to building financial infrastructure for blockchain businesses. This pivot resulted in its rebranding as Wyre in 2016.

The company’s transition to serving blockchain businesses proved successful, with Wyre offering services for businesses to exchange, hold, and transfer digital and fiat assets.

Canceled acquisition by Bolt: In April 2022, leading checkout and shopper network, Bolt, announced that it was acquiring Wyre for $1.5 billion. However, the acquisition plan was officially dropped in September 2022 as both companies agreed to “continue their partnership as independent businesses to bring more innovation to e-commerce and crypto rather than consummating the merger.”

Wyre’s troubles and RockWallet acquisition

In early 2023, Wyre faced significant financial difficulties. The company temporarily restricted withdrawals in January 2023 due to liquidity issues, which raised serious concerns about its solvency. Although operations resumed shortly afterward, the company’s troubles weren’t entirely behind it and it had to permanently shut down.

Following its shutdown in June 2023 due to challenging market conditions, RockWallet announced on Feb. 15, 2024, that it had acquired Wyre’s entire customer base.

This transition allowed former Wyre clients to safely and easily migrate their accounts to RockWallet without needing to go through the Know Your Customer (KYC) process again.

RockWallet stated in the announcement that customers were to receive communications directly from Wyre with login details and instructions to reactivate their accounts. This way, the erstwhile stranded Wyre customers found a way to migrate to the RockWallet platform.

Former Wyre users can visit sendwyre.com for more information about reactivating their accounts. RockWallet’s app is available on both iOS and Google Play, providing users with the ability to store, send, and manage a variety of cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Tether (USDT), USD Coin (USDC), and Bitcoin SV (BSV).

Wyre’s modus operandi

Unlike conventional money transfer services, Wyre payments used blockchain technology to settle transactions. Once you signed up on the platform, you could start transferring money to any country where Wyre is licensed to run its MSB operations.

The platform connected the market on both the business-to-business (B2B), as well as the business-to-consumer (B2C) side. It enabled businesses to buy, exchange, hold, and withdraw multiple assets including BTC, ETH, DAI, AUD, USD, GBP, EUR, and HKD, among others. All you had to do as a business owner was to connect your bank account to the Wyre dashboard.

Additionally, businesses could also deploy Wyre’s API and SKD to offer users fiat on-ramps with their debit cards and bank accounts. The platform also offered an over-the-counter (OTC) trading desk to institutional clients.

Key features and services:

- Dashboard: An intuitive interface where users could manage, buy, sell, and exchange digital assets.

- APIs for crypto exchanges and payments: Wyre’s APIs allowed businesses to provide crypto buying options for their users.

- Cross-border payments: Wyre’s platform supported international transactions across multiple fiat and cryptocurrency options, including BTC, ETH, DAI, USD, EUR, and GBP.

- On-chain compliance: Wyre provided compliance tools to meet regulatory standards across jurisdictions.

- OTC desk: Wyre’s Over-the-Counter (OTC) desk catered to institutional clients needing high-volume crypto transactions.

Wyre fiat on-ramp

Businesses previously used Wyre’s fiat on-ramps by integrating its API and SDK, which enabled users to buy cryptocurrency directly within the business’s platform. The platform’s widget provided a customizable experience, allowing businesses to set parameters and manage transaction options for their users.

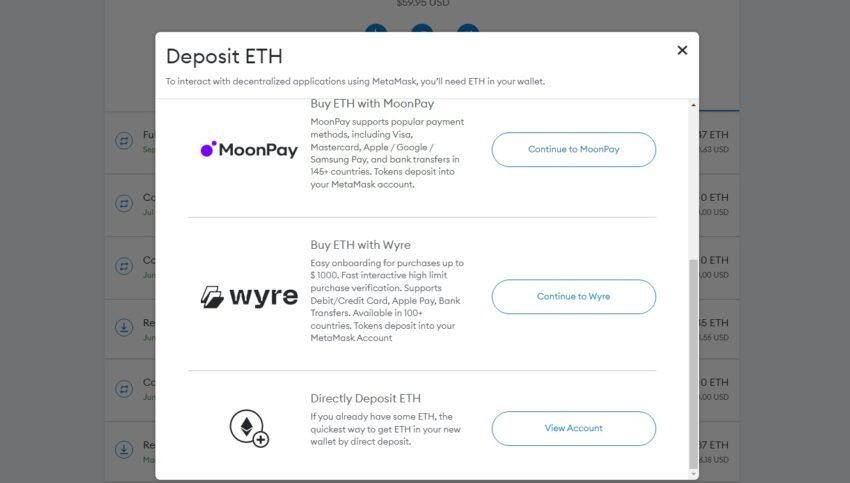

For instance, its integration with MetaMask once allowed users to purchase Ethereum (ETH) directly within the MetaMask wallet. Users would select their desired ETH amount, complete the checkout process by entering their card and personal information, and have the purchased ETH sent to their MetaMask wallet.

The platform advertised a simple integration process for businesses, requiring only a small amount of code to deploy the widget. The customization, designed to be completed in around a day, saved businesses significant development time that would otherwise take months to build in-house.

Another key selling point for the company was its competitive transaction fees. It displayed all fees transparently, charging 3.9% + $0.30 per transaction with international debit cards, while ACH network payments incurred fees of less than 1%.

API solution for global payments

Wyre’s API supported quick international transactions, often settling within hours compared to the days it would take for standard cross-border bank transfers.

Additionally, the API solution offered virtual bank accounts for non-U.S. businesses to facilitate cross-border payments efficiently.

Types of money transfer

Wyre supported both cross-currency and same-currency transfers:

- Cross-currency transfers: Involved currency exchange, with a 0.75% processing fee (or a minimum fee based on the payout currency). The platform utilized the Real Exchange Rate, ensuring users benefitted from transparent and competitive fees.

- Same-currency transfers: Involved no currency exchange and carried a 0.20% processing fee per transaction (or a minimum fee based on the payout currency).

It also introduced Live Currency Exchange Rates to minimize fees for its users, further enhancing its appeal for global transactions.

Benefits for users:

- Quick transfers: Wyre facilitated international transfers within 6–24 hours, often faster than traditional banks.

- Free domestic transfers: Transfers between Wyre users were free, making internal transactions cost-effective.

- Low international fees: Charged as low as 0.75% for international transfers, significantly undercutting typical bank rates.

- No transfer limits: Allowed transfers with no minimum or maximum limits, suitable for any transaction size.

- Recurring payments: Supported scheduling of regular transfers, useful for both personal and business automation needs.

How RockWallet serves Wyre’s former clients

Overall, Wyre enabled businesses to streamline their onboarding flows with customizable fiat on-ramps. The platform provided a valuable service by facilitating faster and cheaper transfers.

After RockWallet took over the now-defunct platform’s customer base, the company promised to uphold similar values for former Wyre users. RockWallet’s Co-Founder and COO, Steve Bailey, emphasized a commitment to building long-term trust with Wyre’s former clients and promised to offer a platform that supports their digital asset needs, including secure p2p and global remittance options. As of 2024, those operations are running as planned.

Frequently asked questions

What is Wyre used for?

Is Wyre legitimate?

Is Wyre a crypto exchange?

Does Wyre offer phone transfers?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.