PancakeSwap is a decentralized exchange packed with features including Initial Farm Offerings (IFOs), a unique staking mechanism, and an NFT marketplace. The platform’s focus on community engagement and quick integration of new projects has also added to its popularity. Here, we explore what PancakeSwap is, its history, features, the CAKE token, and its position in the market in 2024.

KEY TAKEAWAYS

➤ PancakeSwap is a DEX on BNB Smart Chain that supports low fees and fast transactions.

➤ Users can earn CAKE tokens through yield farming, staking, and participating in Initial Farm Offerings (IFOs).

➤ PancakeSwap also includes additional features like an NFT marketplace and a lottery.

➤ PancakeSwap’s popularity is driven by its user-friendly interface, community support, and DeFi services.

What is PancakeSwap?

PancakeSwap is a decentralized exchange, or DEX, operating on the BNB Smart Chain. It leverages BNB Smart Chain’s high transaction throughput and low transaction costs to provide faster transactions and competitive fees.

The efficiency of the BNB Smart Chain and the additional features offered by PancakeSwap enhance the overall investment experience and attract a wide range of users.

PancakeSwap uses an automated market maker (AMM) model, similar to other DEXs. That means it relies on liquidity pools and rewards liquidity providers for their contributions.

History

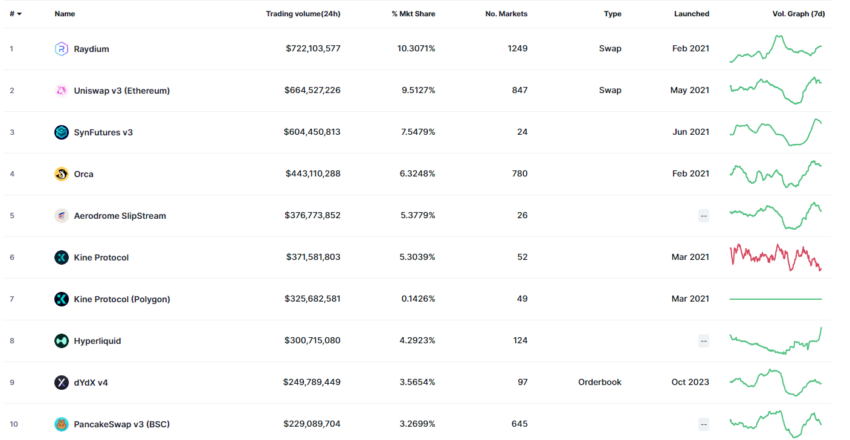

PancakeSwap is a relatively new DEX compared to some of the other established players in the market. It was launched in September 2020 but has made tremendous headway since.

Notably, the platform’s launch coincided with a period of high congestion and gas fees on the Ethereum network. The DeFi boom around the time attracted many Ethereum investors, leading to slower transactions and expensive fees.

PancakeSwap entered the scene to provide a more cost-effective solution with lower swap fees at 0.25% and a bridge to wrap non-BEP-20 tokens by allowing compatibility with Binance Smart Chain (now BNB Chain).

As a result, PancakeSwap gained significant traction and quickly became a mainstay in the DeFi ecosystem. It started attracting both novice and experienced users and within a year of its launch, PancakeSwap achieved a total trading volume of $23.1 billion.

Although it did not surpass its main rival, Uniswap, this volume reflected impressive growth for a platform that started as a new entrant to the DEX space.

PancakeSwap features

A big part of PancakeSwap’s rapid growth resulted from its innovative and practical features. These include:

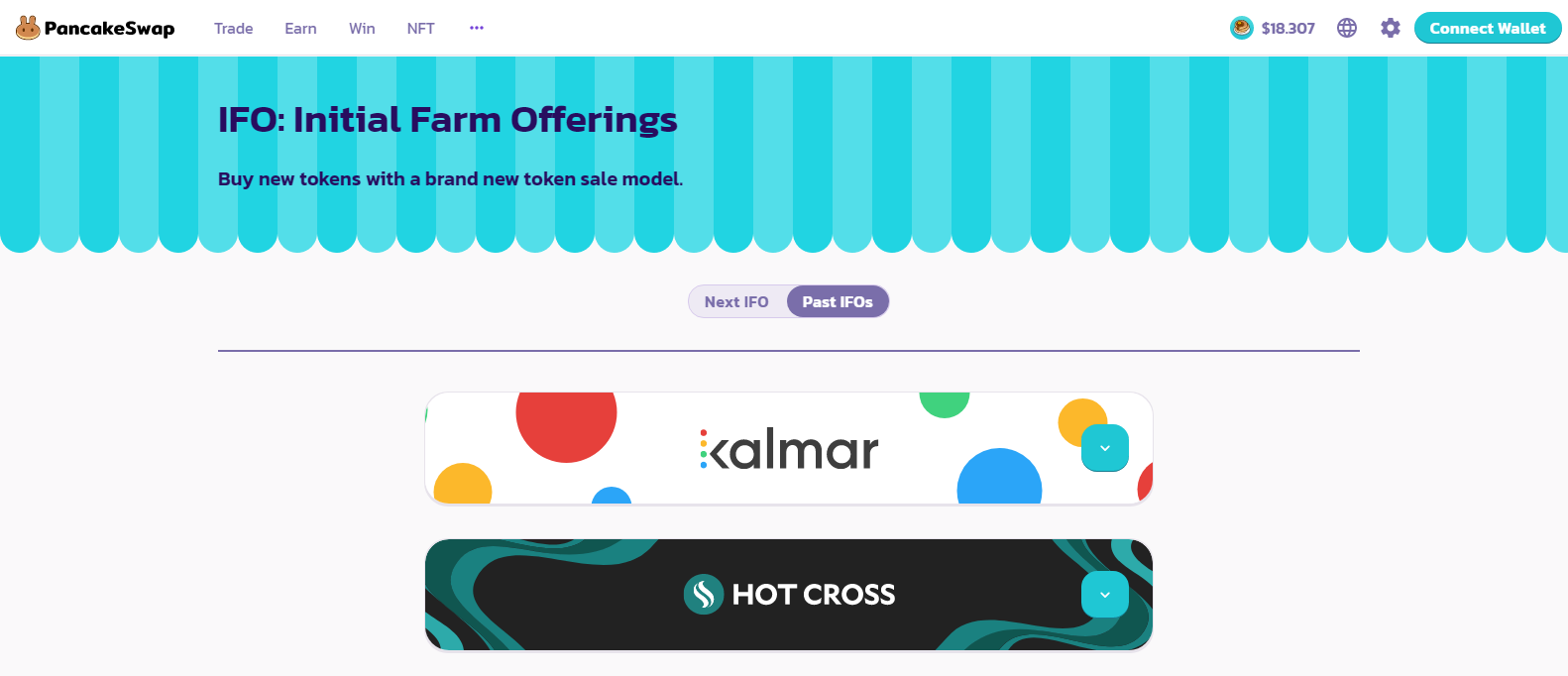

Initial Farm Offerings (IFOs)

PancakeSwap’s IFOs offer a decentralized fundraising model that allows users to participate in the pre-sale of vetted projects using LP tokens.

The projects are vetted by the Binance team to mitigate risks for investors. The novel nature of IFOs appeals to investors seeking unique investment opportunities within a secure ecosystem.

Yield farming

PancakeSwap users can earn CAKE tokens by staking their LP tokens in yield farms, which makes it a popular choice for those looking to generate passive income. Staking LP tokens rewards users with both CAKE tokens and LP rewards for providing liquidity.

PancakeSwap lottery

The PancakeSwap lottery is a unique feature where users can purchase tickets to participate in two draws held daily.

Matching all six numbers on a ticket awards the winner 40% of the prize pool. At its peak, the prize pool has exceeded $1.1 million. To ensure fairness, PancakeSwap employs Chainlink’s Verifiable Random Function (VRF) for impartial selection of winners.

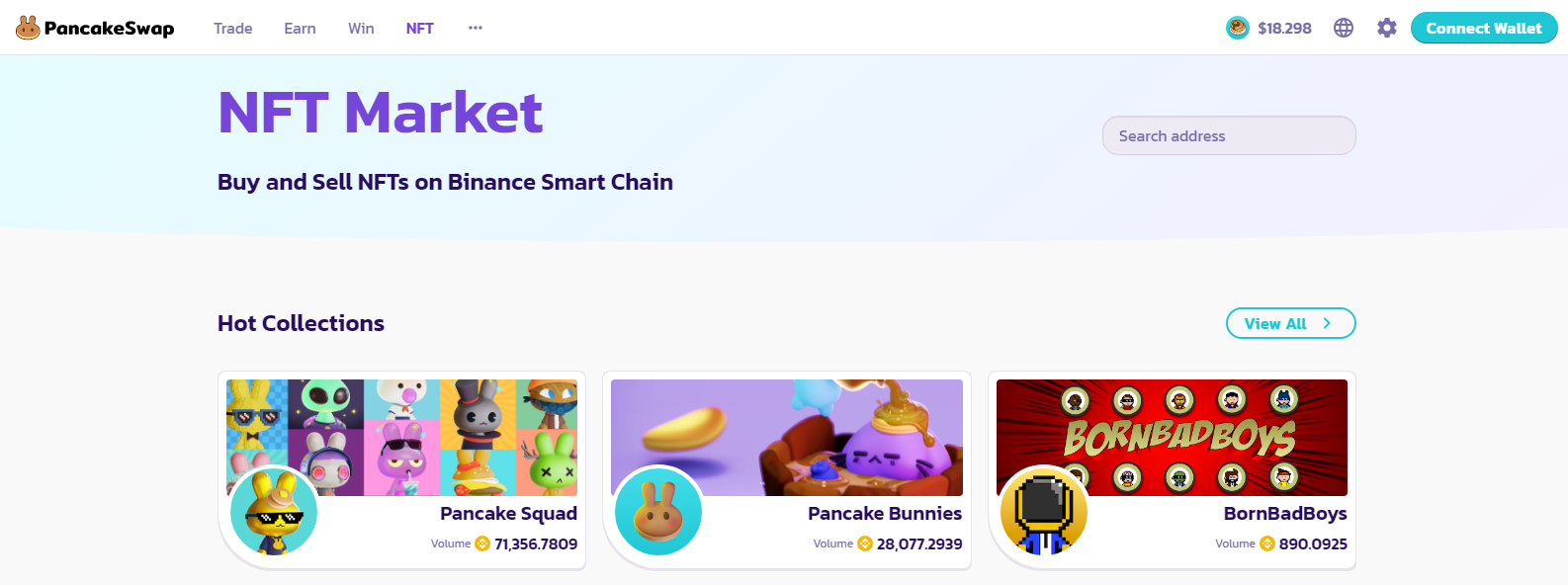

NFT marketplace

With the growing popularity of NFTs, PancakeSwap launched its NFT marketplace in September 2021. This marked its expansion into the digital collectibles space and was met with a positive response.

On its first day, the marketplace generated over $3.6 million in trading volume. PancakeSwap commemorated the launch with a special collection called PancakeSquad.

How does PancakeSwap work?

PancakeSwap operates on the BNB Chain and uses BEP-20 tokens. However, the exchange also supports bridging, which means it allows users to bring in non-native assets from other blockchains.

The platform also offers auto-compounding features and the Syrup Pools, which are designed for users to earn additional tokens.

Syrup Pools are among the simplest ways to earn free tokens on PancakeSwap, as users can stake CAKE and receive other tokens in return. Several cryptocurrencies are supported on these pools, with auto-compounding options to optimize returns.

Overall, PancakeSwap provides a trading experience similar to Uniswap’s, while benefiting from BNB Chain’s lower costs and faster transactions.

The CAKE token

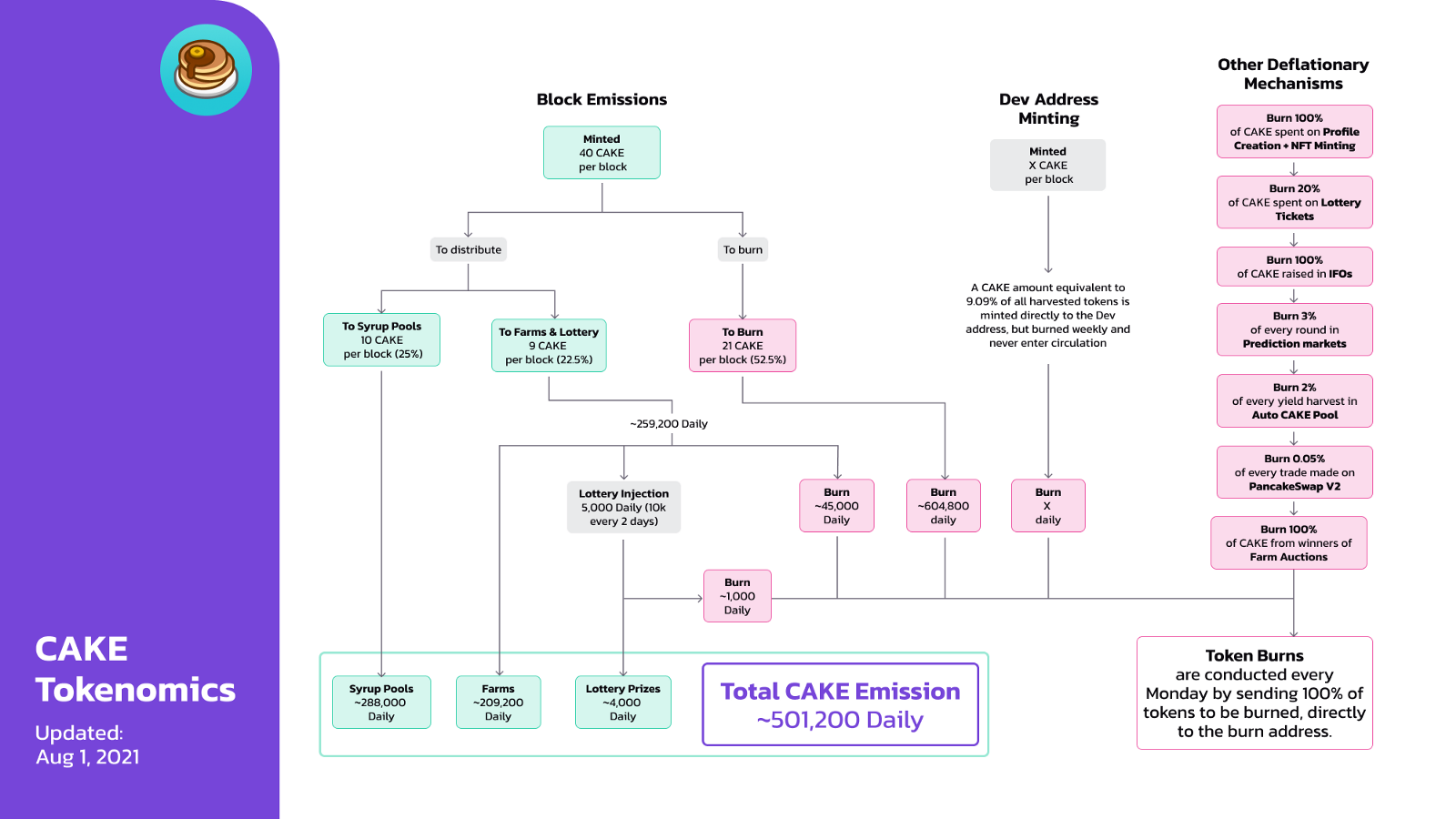

The CAKE token is central to PancakeSwap’s ecosystem. It is used for rewards, staking, and governance. The token is inflationary, meaning newly minted CAKE tokens are regularly added to the supply.

CAKE’s distribution is divided as follows: 75% goes to liquidity providers, while 25% goes to Syrup token holders.

The CAKE tokenomics include a liquidity mining program that distributes 40 CAKE per block, or roughly 501,200 CAKE per day. This structure supports liquidity provision while incentivizing user participation.

Farming and staking on PancakeSwap

Farming and staking services are popular features on PancakeSwap because of the speed and affordability of Binance Smart Chain.

After acquiring LP tokens, users can head to the “Farms” tab to choose a staking pool. With a few clicks, users can stake their LP tokens and start earning rewards. PancakeSwap’s intuitive interface and clear instructions make this process accessible even for beginners.

PancakeSwap vs. Uniswap vs. SushiSwap

| Feature | PancakeSwap | Uniswap | SushiSwap |

|---|---|---|---|

| Blockchain | BNB Smart Chain | Ethereum, Arbitrum, Optimism, Polygon | Ethereum, Arbitrum, Polygon, Fantom |

| Transaction fees | Low (0.25%) | High (variable gas fees on Ethereum) | High (variable gas fees on Ethereum) |

| Speed | Fast (BNB Smart Chain’s low latency) | Slower (dependent on Ethereum’s network speed) | Slower (dependent on Ethereum’s network speed) |

| Native token | CAKE | UNI | SUSHI |

| Yield farming | Yes | No | Yes |

| NFT marketplace | Yes | No | No |

| Initial offerings | Initial Farm Offerings (IFOs) | No | SushiBar |

| Staking options | CAKE staking in Syrup Pools | No | xSUSHI staking for rewards |

| Governance | CAKE holders can vote on proposals | UNI holders can vote on protocol changes | SUSHI holders can vote on protocol changes |

| Unique features | Lottery, NFT marketplace, IFOs, auto-compounding | Direct token swaps and liquidity pools | SushiBar, Onsen Program, lending and borrowing |

| Transaction volume | High on BNB Smart Chain | High on Ethereum and layer-2 chains | Moderate across supported chains |

Is PancakeSwap worth considering in 2024?

Despite entering the market later than some of its major competitors, PancakeSwap’s unique offerings and efficient platform have attracted a broad user base. The addition of NFT services and other financial products further expanded PancakeSwap’s appeal. Overall, PancakeSwap’s features, affordability, and speed make it a strong option for those looking for a reliable DEX in 2024. Remember that trading on decentralized exchanges carries risk. Be aware of slippage, prioritise your security, and never invest more than you can afford to lose.

Frequently asked questions

Is PancakeSwap legit?

What is PancakeSwap used for?

What is PancakeSwap crypto?

What is slippage on PancakeSwap?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.