“Very, very simple DeFi trading for all!” That’s what VVS Finance promises to stand for — to help make DeFi accessible to billions around the world, including the average Joe. Hence, the name VVS (very, very simple) Finance.

The platform offers a one-stop venue for users to swap tokens and earn high yields with ease. It is a decentralized exchange (DEX) built on the Cronos chain. However, there’s more to VVS Finance than meets the eye. Here’s what to know.

KEY TAKEAWAYS

► VVS Finance simplifies DeFi trading with an automated market maker (AMM) model on the Cronos chain.

► The platform emphasizes a fun, gamified experience to attract users of varying expertise levels.

► VVS Finance leverages the Cronos blockchain’s capabilities and has significant total value locked (TVL), benefiting from strategic partnerships within the Crypto.com ecosystem.

► With a high initial token supply that reduces yearly, VVS’s tokenomics present a potentially inflationary scenario.

What is VVS Finance?

As an AMM DEX, VVS Finance facilitates trading without requiring any middlemen or order books. It deploys a smart contract that leverages liquidity and assets provided by liquidity providers.

The platform focuses on enabling users to swap tokens and earn yields “while having fun.” The platform emphasizes the “fun” part to make DeFi easily accessible to beginners.

Through gamification and an easy-to-use interface, it aims to offer a novel user experience that appeals to users of all expertise and experience levels.

In addition to liquidity pools and staking opportunities, VVS Finance also enables users to discover new projects with its initial gem offering (IGO) program.

Built on the Cronos Chain

Crypto.com is well recognizable; the exchange and wallet app spends generously on marketing with high-profile advertising campaigns starring the likes of Matt Damon and LeBron James.

However, unbeknownst to many, it is also the company behind Cronos, an EVM-compatible blockchain known for its low fees and high speed.

Shortly after its launch in Nov. 2021, Cronos quickly emerged as a hit in the DeFi space, with $4 billion in total value locked (TVL) by April 2022. Nearly 60% of the TVL at the time came via VVS Finance.

The team behind VVS Finance

Not much is known about the VVS Finance team except that they:

- Like to call themselves “Craftsmen.”

- Come from a “deep product design background.”

- Want to bring the best DeFi protocols to the masses

The anonymity aspect aside, VVS Finance has managed to forge several high-value alliances with important strategic partners, including the Crypto.org and Crypto.com ecosystems. It was also a part of the Particle B Incubation program, which focuses on up-and-coming DeFi projects.

How does VVS Finance work?

VVS Finance focuses mainly on proven and audited protocols. It also offers a rewarding and inventive program powered by the VVS Finance token ($VVS), the project’s native asset.

The DEX features liquidity pools, with each pool consisting of a pair of tokens. Liquidity oroviders deposit tokens into the pool while traders swap between the tokens.

The protocol is based on a constant product formula. To elaborate, the product of the quantities of both tokens in a pool remains the same after a swap is executed. The price slippage from the swap may vary depending on the overall quantity and ratio of the tokens in the pool.

The following infographic from the project’s litepaper paints a clear picture of the underlying mechanism powering the DEX.

The underlying mechanisms are configured so that different stakeholders can benefit in multiple ways. For example:

- Liquidity providers: Two-thirds of the swap fees collected from a pool are distributed among the liquidity providers. On top of that, those staking eligible LP tokens in the “Crystal Farm” category will receive additional rewards in $VVS.

- $VVS stakers: You could also stake $VVS in “Glitter Mine” to earn $VVS or partner tokens as rewards.

- Trading incentives: Traders also stand a chance to earn sizable rewards by simply swapping tokens.

- Referral rewards: VVS Finance has its own referral program that incentivizes users to invite new users to trade on the platform.

What makes VVS Finance unique?

A number of key features help the platform offer a unique service to its users. Some of these include:

Bling Swap

This feature allows users to instantly swap tokens for a tiny fee (as opposed to what most of us are used to with centralized exchanges with traditional order books). Users pay a trading fee of 0.3%, which then goes to liquidity providers and the platform.

Liquidity provision

Any user on the VVS platform can opt to become a Liquidity Provider (LP). In return, they earn 2/3 of the swap fees in that pool (in proportion to the volume of tokens they provided).

Crystal Farming

With Crystal Farming, LP token holders can earn even more in rewards by simply staking their tokens. The rewards are usually a lot higher than those normally seen in traditional centralized yield accounts.

Glitter Mines

This rather simple feature allows users to stake and earn rewards. There are three ways to go about Glitter Mining:

- Auto VVS, which automatically compounds the $VVS you stake, so you earn even more $VVS.

- Manual VVS, where you will require manually harvesting your rewards and compounding them back into the mine.

- Partnered Mines, where you need to stake the xVVS governance token and earn tokens of VVS Finance’s partners within the mine opening period. Note that you will have to harvest your rewards manually.

Initial Gem Offerings (IGOs)

VVS Finance users get early access to exclusive sales of new tokens from promising projects launching on the Cronos ecosystem.

Meanwhile, project owners can partner with the VVS platform and launch their projects in the leading DEX on Cronos.

$VVS tokenomics

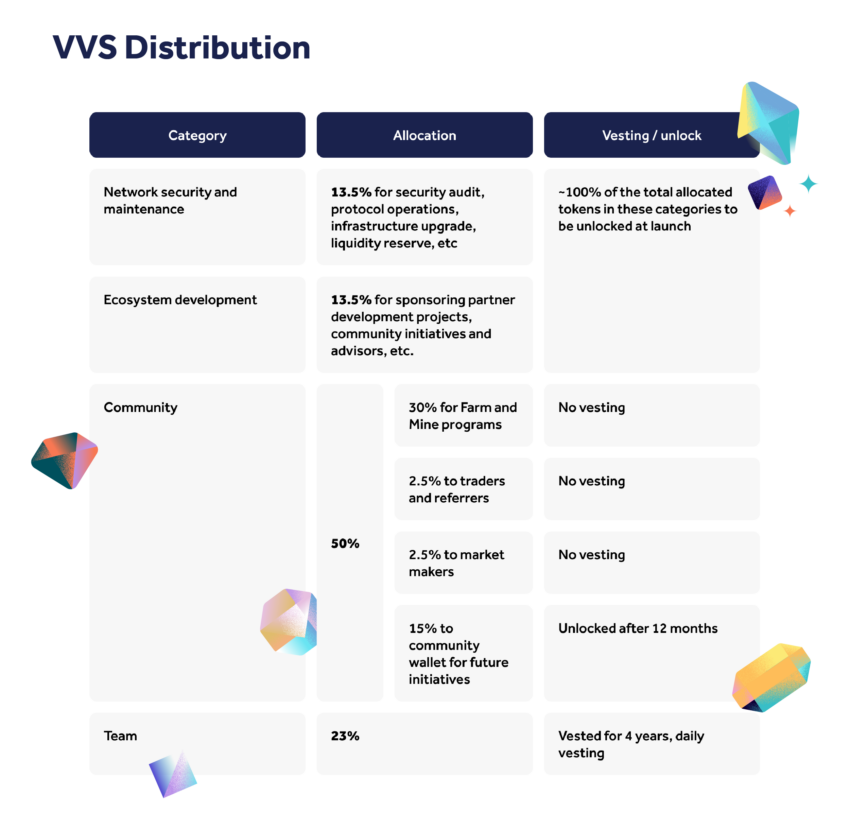

VVS Finance (VVS) token serves as the platform’s utility, governance, and reward token. The token follows the emission model, per which the VVS Finance team will mint 50 trillion tokens in the first year and halve each year thereafter.

This way, a total of (50 ÷ 2 =) 25 trillion tokens will enter circulation in the second year, (25 ÷ 2 =) 12.5 trillion tokens in the third year, and so on. The distribution of the token is as follows:

- Farms and liquidity mining: 30%

- Team: 23%

- Community reserve for future initiatives: 15%

- Maintenance and network security: 13.5%

- Ecosystem development: 13.5%

- Traders and referrers: 2.5%

- Market makers: 2.5%

Is VVS Finance a good investment?

For starters, VVS Finance’s tokenomics does raise some questions. It already has a circulating supply of more than 21 trillion VVS tokens; over ten years, the total supply of 100 trillion will be reached.

In comparison, other leading DEX tokens have a lower circulating supply. For example, SushiSwap has a circulating supply of about 192 million. Similarly, the corresponding figure for the PancakeSwap token is just over 284 million.

So, by and large, $VVS seems to be a DEX token that is (relatively) inflationary. Although, it does have a maximum total supply of 100 trillion (which the likes of CAKE don’t have despite having certain deflationary mechanisms). Keep this in mind if you are considering whether to invest in VVS Finance.

That said, the total supply of a coin/token is not necessarily a reliable indicator of the quality of the underlying project. For perspective, even ETH has an infinite total supply.

Overall, the market cap of $VVS has shown a healthy growth rate. In the first couple of months, it rose from $20 million to $170 million. It has maintained steady support, upwards of $100 million, ever since.

All factors considered, it is probably safe to say that if VVS Finance can retain its dominant position in the Cronos ecosystem, and if Cronos continues to grow in adoption and activity, $VVS may be solid in the medium to long run.

The road ahead for VVS Finance

VVS Finance is a DEX built on the Cronos blockchain aimed at simplifying DeFi for a broad user base. It has various ways for users to earn rewards through features like token swapping, liquidity pools, and staking. The platform’s $VVS token serves multiple purposes, from governance to rewards, but its high initial supply and inflationary schedule may be a concern for holders.

Despite the tokenomics, VVS Finance benefits from its affiliation with Crypto.com. Therefore, it could hold long-term growth potential for users and investors of the Cronos blockchain.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Crypto is highly volatile and investing in any decentralized asset carries significant risk.

Frequently asked questions

What does VVS finance do?

Is VVS finance a good investment?

How many VVS Finance tokens are there?

Who is the owner of VVS finance?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.