VeUSD is the first native, USD-backed stablecoin on the VeChain blockchain. Stablecoins are useful assets that help investors, traders, and anyone involved in the cryptocurrency market avoid the market’s volatility. Here’s all you need to know about VeUSD.

KEY TAKEAWAYS

► VeUSD is a USD-backed stablecoin native to the VeChain blockchain, designed to facilitate fast, low-cost cross-border payments.

► VeUSD is fully collateralized and redeemable at a 1:1 ratio, with the collateral managed by Prime Trust.

► Unlike algorithmic stablecoins, VeUSD’s value is maintained through collateralization, making it less prone to risks such as volatility or loss of its peg.

► Despite its potential uses, VeUSD remains underutilized in 2024, with limited network activity on the VeChain blockchain.

What is VeUSD?

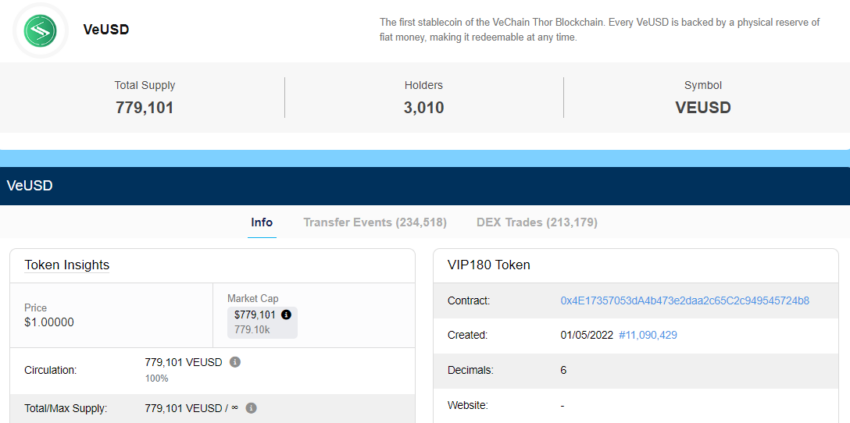

VeUSD is a U.S. dollar-pegged stablecoin, fully backed and redeemable for USD at a 1:1 ratio. The collateral USD for VeUSD is held in a trust account managed by Prime Trust, a financial infrastructure company for fintech apps. The Vechain stablecoin was launched in May 2022.

VeUSD is the first stablecoin native to the VeChainThor chain, developed by the VeChain Foundation, in collaboration with Stably, a U.S.-based asset tokenization infrastructure provider.

VeUSD is a VIP-180 token, which is a subset of the ERC-20 standard. While VeUSD isn’t subject to price volatility (which is conversely characteristic of the entire crypto market), it benefits from many cryptocurrency particularities.

For instance, it can be used for fast cross-border payments and low-cost transactions. The stablecoin enables users to make transactions without incurring high fees from money transfer companies or credit card processors. You can find all VeUSD blockchain transactions on the VeChainThor block explorer.

The VeChainThor blockchain has a growing ecosystem and needs VeUSD as a medium of exchange. Vexchange, an automated liquidity protocol on the VeChainThor blockchain, is the first platform to integrate VeUSD.

Vexchange users can trade VeUSD and withdraw the funds for cash via Stably Prime. Other centralized and decentralized exchanges will probably list VeUSD as well.

You can join BeInCrypto’s Telegram channel for crypto trading signals.

Is VeUSD regulated?

Stably created VeUSD, an asset tokenization infrastructure provider based in the U.S. Stably partners with regulated financial institutions to launch stablecoins or tokenized assets compliantly.

You can redeem VeUSD and other fiat-backed stablecoins at a 1:1 ratio. This means for every 1 VeUSD, you will receive $1 in exchange.

The creators of VeUSD chose Stably to create VeUSD due to their strict compliance with U.S. regulatory authorities and international ones. The VeChain Foundation believes that cryptocurrency’s mass adoption is dependent on compliance. The team are also closely working with key channel partners as well as global authorities, DNV, and PwC.

Stably Prime’s platform offers many benefits, including the ability to quickly and easily mint or burn the stablecoin. After creating an account on Stably Prime, users can deposit USD to quickly convert it into VeUSD.

You can also deposit other stablecoins on Stably Prime and convert them into USD. Then, you can convert the balances to the stablecoin.

VeUSD will always be pegged to the U.S. dollar

Stablecoins are a specific type of cryptocurrency that maintains a fixed value over time, typically to a specific fiat currency, often the U.S. Dollar. This means that one unit of cryptocurrency is equal to one unit of real currency.

Fiat money backs each Vechain stablecoin because each user has to deposit collateral to mint new VeUSD stablecoins. You can redeem your tokens from this reserve at any time at a 1:1 ratio.

How does VeUSD work?

According to the VeChain team, users and enterprises can create and burn USD-backed stablecoins. As a result, this opens VeChain up for DeFi and web3 activities.

VeChain is a distributed platform for launching business services that use blockchain technology. It enables small and large businesses to track all necessary processes thanks to blockchain technology.

Stably allows users to redeem and mint VeUSD stablecoin tokens. Users can buy and sell VeUSD for cash via the stablecoin platform, Stably Prime. To start using Stably, you will need to sign up and then enable trading on your account by verifying your identity.

Here are the main steps for using Stably:

- Sign up for an account on Stably.

- Secondly, verify your identity.

- Thirdly, send funds to stably (USD Fedwire transfer and ACH, by sending ERC-20 USDC or USDT, using USDC on Stellar).

- You can also deposit cryptos such as Bitcoin or Ethereum.

- Finally, mint and withdraw VeUSD to the VeChainThor wallet.

If you need extra help on how to use the Stably app, you can use these easy-to-follow tutorials. To create (mint) VeUSD stablecoins, you will need to deposit USD or other assets accepted by the platform.

How does Stably work?

Former bankers and Amazon software engineers founded Stably, a fintech company based in Seattle, in April 2018. Stably Prime is a self-directed custodial account from Prime Trust through Stably. Prime Trust is a Nevada state trust company that offers custody, processing, and compliance services.

Stably’s mission — through its borderless digital money platform powered with blockchain, stablecoins, and open banking APIs — is to make financial transactions more efficient, faster, and cheaper. Users can trade VeUSD on Vexchange and then use Stably Prime to withdraw it directly to their bank account.

Stably aims to deliver the infrastructure and services necessary for the emerging financial industry, which connects cryptocurrencies and blockchain to the traditional system. Its services are transparent and fast and offer low fees. It is functional across all national and institutional borders.

VeUSD vs. algorithmic stablecoins

Some stablecoins are 100% collateralized, some are partially collateralized, and some are algorithmic. In other words, algorithmic stablecoins maintain a pegged value via algorithms. One of the most infamous algorithmic stablecoins is Terra’s UST.

Algorithmic stablecoins like UST can be pegged to other assets’ value via smart contracts. These smart contracts increase or decrease the supply based on current market values.

An algorithmic stablecoin has several ways of maintaining a peg. If they trade higher than the value of its peg, the protocol can mint new coins, which lowers its value. The protocol can also burn coins that trade below their peg, increasing the price.

Similarly, collateralized stablecoins can be minted or burnt when assets are deposited into the reserve. For collateralized stablecoins that are pegged to US dollars, such as VeUSD, users mint one token for each $1 USD deposit and burn one Vechain stablecoin token for each $1 USD withdrawal.

When assessing stablecoins, the most important thing to look at is their ability to keep their pegs. Collateralized stablecoins are liquid assets that can quickly be traded to respond to fluctuations in demand and supply. Algorithmic stablecoins do not require collateral and rely on smart contracts for theoretically unlimited liquidity.

Algorithmic stablecoins do come with risks

Three key factors, however, can easily destabilize an algorithmic stablecoin’s peg.

- The exchange rate fluctuations can affect algorithmic stablecoins, temporarily disrupting payments and transfers.

- Algorithmic stablecoins rely on external data (exchange rates) to regulate total supply and maintain their pegs. Data errors, reporting delays, and poor data quality can all lead to instability for algorithmic stablecoins.

- There is always the hacking risk for the smart contracts that can lead to disastrous consequences and investors losing their money.

Overall, collateralized stablecoins such as VeUSD have a much lower chance of losing their peg than algorithmic ones.

VeUSD has a liquid collateral (USD) that can be transferred faster than other assets, and this is the ideal case for stablecoins. In any case, cash collateral allows stablecoin supplies to resist rapid inflation or deflation. Investors can withdraw their funds at any given time.

| VeUSD | Algorithmic stablecoins |

|---|---|

| Collateralized | Uncollateralized |

| Can withdraw the collateral asset from the custodian on a 1:1 basis | Cannot withdraw any assets because there is no collateral |

| Subject to counterparty risk | Subject to the death spiral phenomenon |

| Maintains its peg through withdrawals | Can maintain its peg through minting and burning new tokens |

The state of VeUSD in 2025

As of July 2025, the VeUSD stablecoin is underutilized. Though it received a lot of support at launch, the network activity has slowly dwindled to just a few transfers between a few thousand holders.

Stablecoins are a good indicator of the popularity of a blockchain when the stablecoin is popular. On the other hand, blockchain projects must cultivate robust ecosystems to increase the popularity of stablecoins.

What’s the future of the VeUSD stablecoin?

Collateralized stablecoins such as VeUSD are backed up by USD, which makes them liquid stables. These are the most popular types of stablecoins. However, it would seem that VeUSD has not inherited this popularity.

Although VeUSD has a wide range of uses, such as decentralized finance (DeFi) applications and supply chain systems and settlements, it must play a great part in the economics of the VeChain network to gain usage.

Frequently asked questions

What are the different types of stablecoins?

What type of stablecoin is VeUSD?

Why are algorithmic stablecoins risky?

Who issues VeUSD?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.