OTC, or Over-The-Counter, is off-exchange trading conducted directly between parties without an intermediary exchange. Despite its challenges, Bitcoin’s growing popularity has attracted even institutional traders who previously observed from afar. While crypto exchanges suit most investors and traders, they are unsuitable for large-volume Bitcoin purchases. In such cases, OTC brokers provide a suitable solution for buying substantial amounts of Bitcoin. Here are our top choices for OTC Bitcoin markets.

What is OTC Bitcoin?

OTC is not a crypto-specific term, as you can find an OTC desk for pretty much any asset or financial instrument, and more. But, we are interested in it in the realm of digital currencies, where it exists, as well.

Crypto OTC vs. exchange

There are several differences between using an OTC desk and trading Bitcoin on exchanges:

- One key difference is that a crypto exchange can secure liquidity, so you can just put your coins out there and wait for someone to buy them or look for an order that matches your needs.

- Exchanges can also provide transparency and ensure that you won’t pay more or less than the coins’ actual worth at the time of the transaction. This is not the case regarding OTC trades, which are often not nearly as transparent. That means that their price is not necessarily published for the public to see.

- Another big difference is that OTC trading is not for everyone. Small retail investors cannot participate, as OTC desks only work with huge volumes, meaning $100,000 and more in most cases. So, you can’t simply come with a few hundred dollars and expect to trade with the high net-worth individuals of the crypto world. Meanwhile, on the exchanges, you can start trading with only a few dollars in your wallet, meaning many more users can find their place on such platforms.

The benefits of over-the-counter Bitcoin trades

You might be wondering what benefits OTC Bitcoin trading brings, apart from simply letting traders buy large quantities of BTC? Well, there are a few additional advantages to it.

One example is carrying out large orders without moving the market too much. Moving the market is very easy with large quantities of money. If you decide to sell a huge amount of BTC, its price might drop. If you decide to buy it, its price could grow, simply because of your own order.

This is something that is often done by the so-called Bitcoin Whales, which usually trade with such large quantities that they often make headlines simply for entering a position.

This is because the crypto market is still rather small compared to the world’s financial markets. While it has hundreds of billions of dollars, this is nothing compared to the forex market or even the stock market.

As a result, it is quite easy to manipulate it, even with ‘small’ amounts of only a few million dollars.

By trading at an OTC desk and reducing the transparency of your trade, you can avoid moving the market and attracting attention. Meanwhile, you still complete your trade, regardless of whether you are selling large amounts of Bitcoin, or buying them.

Advantages of OTC Bitcoin trading:

- The lack of restrictions means that there is no maximum limit for transactions.

- Security is pretty high.

- Liquidity can get rather high, as well.

- You can buy cryptocurrencies in exchange for fiat directly, without having to go through a crypto-to-fiat exchange first.

- Your coins go directly into your wallet, where you can keep them safe, especially if you use cold storage.

Disadvantages of OTC Bitcoin trading:

- No quick way to buy or sell your coins. Such large transactions will have to wait a while until someone willing and able to buy or sell coins comes across your offer.

- You will be limited to a few coins that people are buying in massive quantities, while on exchanges, you can often trade dozens, if not hundreds of different assets, depending on the platform.

- The prices can differ, and you won’t always pay the same one as you would within exchanges that are keeping track of the coin’s current value at any given time.

- Bitcoin OTC trading is only suitable for long-term investments. This is, once again, due to the fact that you won’t be able to find a buyer/seller quickly.

Best Bitcoin OTC brokers

Several reputable OTC brokers are available to buy large amounts of Bitcoin. It’s important to research and choose one that best fits your needs. Here are our top recommendations for OTC Bitcoin brokers:

1. Coinbase Pro

One of the best Bitcoin brokers in the U.S. is undoubtedly Coinbase Pro. This is a service closely tied to the Coinbase crypto exchange, which is the US’ largest digital currency trading platform. Like Coinbase itself, Coinbase Pro offers a good deal for its users.

Traders can also choose Coinbase brokerage, where they can purchase up to $25,000 worth of Bitcoin per day and still enjoy prices that are close to the average market price. Coinbase will take 1% of the transaction in return for its service. Of course, while this doesn’t seem like much at first, it is still very expensive because large sums are exchanging hands.

On the other hand, if they choose to go with Coinbase Pro, there will be no maximum daily limits for Bitcoin purchases. When the user places their order, the algorithm will instantly calculate the market price.

The investor is considered a taker, and they will have to pay a fee which is between 0.10% and 0.15%. Meanwhile, if their order doesn’t match any existing offers within the service, they will be considered a maker. In that situation, they will not have to pay a fee for their trade.

All in all, Coinbase Pro is a pretty good place for buying large amounts of Bitcoin, and a great OTC desk for anyone looking to invest a huge amount into the world’s most popular crypto.

Pros:

- International market

- Great liquidity

- Low fees

Cons:

- Not beginner-friendly

- Customer support could be improved

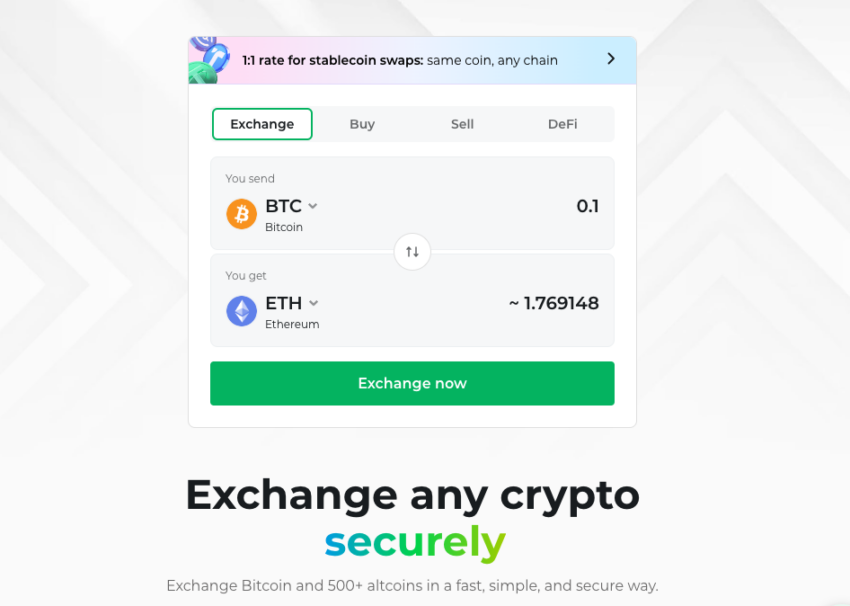

2. Changelly

Next, we have Changelly — a platform that emerged five years ago, in 2015. Since then, it’s been a well-known OTC Bitcoin market and very popular among traders.

Changelly allows users instant crypto-to-crypto and fiat-to-crypto exchange. It also supports over 200 different digital assets, so whether your goal is to buy Bitcoin or some other altcoin among the most popular ones, the chances are that you will find it on Changelly.

The exchange is also well-known for keeping the commissions at the lower end of the spectrum, meaning you will pay less to enjoy its services and keep more for yourself.

Like Coinbase Pro, Changelly also doesn’t pose a limit on crypto-to-crypto Bitcoin OTC trading.

However, it can still guarantee the safety of all transactions. As soon as your order is closed, the funds will be transferred to the credit card you linked to your trading account. Three major fiat currencies are currently supported — GBP, USD, and EUR.

Pros:

- Low fees

- No limit on crypto-to-crypto trading

- Safe transactions

- Large number of supported assets

Cons:

- Prices set by Changelly

3. Kraken

Then, there is San Francisco-based Kraken, which has been around since the early days of the crypto industry. Founded in 2011, Kraken is among the largest crypto exchanges when it comes to liquidity and volume.

As such, it also serves as an OTC desk. Kraken acquired Circle Trade in 2019, expanding its OTC services. It offers such services for higher volumes, including $100,000 and more. For traders dealing with this kind of money, Kraken offers a 1-on-1 service.

Not only that but traders who trade such high amounts frequently also receive their own dedicated account manager. The manager will be there for them to take care of all their trading needs.

It supports multiple fiat currencies that traders can use to purchase Bitcoin, such as US dollars, Canadian dollars, Japanese yen, and, of course, euros.

The exchange also sets up a chat on WhatsApp for its OTD desk users for security reasons. However, while WhatsApp is preferable, Skype or Telegram are also supported.

Trading via these messengers is easier than ever, as traders can use them to ask for live quotes and say “done” if they agree with the prices or say “pass” if they wish to decline an offer.

However, Kraken insists that there are no discounts on the pricing. The exchange will always bid below and offer above the market. Even so, it notes that the quotes generally stay inside the spread of the order book. It also charges no additional fees, and the quoted prices are all-in.

Pros:

- Great security

- High liquidity

- Low fees

- User-friendly

- Plenty of supported coins

- Global availability

Cons:

- No discounts on pricing

- Slow connection

4. HitBTC

Another good option worth exploring is HitBTC, which was established back in 2013. The exchange offers dedicated OTC services, once again, only for traders who can dedicate a necessary minimum of 10 USDT.

This exchange also charges trading fees, although only 0.1% per transaction, which is not too bad, considering some of its competitors.

However, it should also be noted that HitBTC does not manage its OTC desk itself. Instead, that is the responsibility of one of its partners, Trustedvolumes.com.

Outsourcing this responsibility to a third party has made many in the crypto community skeptical. The skepticism is also increased by the fact that the exchange is not transparent when it comes to its business. However, it is still a major market, and as such, it is worth exploring, although there are better options if you have concerns about it.

Pros:

- Intuitive interface

- A good number of supported coins

- Low fees

- Good security

- Multi-language chat

Cons:

- Lack of transparency

- It doesn’t manage its OTC desk itself

5. Binance OTC

Last but not least, we have Binance OTC. Now, Binance is one of the world’s largest exchanges, and maybe even the best-known crypto business around the world these days.

In only a few years, it developed its exchange, blockchain, DEX, multiple fiat-to-crypto exchanges around the world, it started the IEO trend, and that’s still only scratching the surface of what Binance does.

So, naturally, it also has its own OTC desk, where you can trade Bitcoins in large volumes with others looking for the same type of deal. It launched its OTC in January 2019.

Binance has a minimum trade of $200,000. However, Binance always tried to be the best it could, and definitely to provide a better deal than competitors whenever and wherever possible.

This is why its Binance OTC brought some extra advantages, such as access to over 80 cryptos listed on the exchange. Next, it offers quick pricing and fast, simple settlements for the users’ convenience. And, of course, it is a platform with millions and millions of users, which means that there is quite a lot of action going on on the exchange and its services.

In order for users to create an account, they need to fulfill two requirements:

- Owning a VIP Level 1 (verified) account or above

- A trade order of at least $200,00 BTC

Pros:

- Part of Binance’s ecosystem

- Low fees

- Excellent selection of supported coins

- Quick pricing and simple settlements

- Excellent liquidity

Cons:

- Higher minimum admission

Develop a strategy for Bitcoin OTC trading

With that, we would end our list of the best Bitcoin OTC brokers. There are many more out there, but these are some of the industry’s best-known and most trustworthy OTC Bitcoin markets. We highly recommend that you should still look deeper into each of these and research every aspect of their services before you start dealing with them. After all, there are significant amounts of money involved with trades on these services, and that should not be taken lightly.

Frequently asked questions

What is OTC trading?

How does OTC trading differ from traditional exchange trading?

What are the advantages of OTC trading?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.