The Bitcoin Lightning Network was developed to address some of Bitcoin’s limitations. As a result, many users require secure Lightning Network-compatible wallets. This guide lists a number of the top Bitcoin Lightning wallets in 2025.

KEY TAKEAWAYS

► The best Bitcoin Lightning Network wallets are Joule, Éclair, Strike, Spark, Mutiny Wallet, and Wallet of Satoshi.

► The Lightning Network is a Bitcoin layer-2 that allows for quicker and cheaper transactions.

► Bitcoin’s scalability issues led to the development of the Lightning Network.

► Despite its benefits, the Lightning Network faces challenges like potential fee spikes and constant internet access.

Best Bitcoin Lightning Network wallets in 2025

Lightning Network wallets are normal Bitcoin wallets that allow users to open payment channels on the network. Here are some of the best Bitcoin Lightning Network wallet desktop and mobile wallets on the market in 2025.

Joule was launched in 2018. It is a browser extension for the Lightning Network. Users can effectively control their lightning nodes, where they can send and receive assets easily. The most significant benefit of Joule is its ease of use. It supports four operating systems and is very user-friendly. However, a disadvantage of this wallet is that it doesn’t provide custodial wallet features.

Éclair

Éclair was the first mobile Bitcoin Lightning Network wallet to be launched. ACINQ built it in 2017 and it remains one of the best Lightning wallets on the market today.

Just like Joule, Éclair features a seamless user interface, and you’ll find that setting it up doesn’t require any previous knowledge or expertise. The app also allows users to keep tabs on the node count on the Lightning Network directly from its platform. However, the wallet is still a tad limited in its functionality.

Strike (owned by Zap)

Zap was undoubtedly one of the most popular Lightning Network wallets. It entered the market in October 2017 and was built by Jack Mallers.

Zap is a multi-platform wallet that it features an attractive interface and simple installation. It’s also available on both desktop and mobile versions. However, the Zap wallet is no longer actively maintained. While the Zap wallet is non-custodial and open-source, Strike is a custodial, regulated, and proprietary solution developed by Zap Solutions Inc., that allows users to make Lightning payments with their bank account.

Spark

Spark is primarily a Bitcoin wallet, but with integrated support for the Lightning Network. It works with the C-Lightning coding platform and provides a great user experience. It provides personalized themes and near-zero configuration, and functionalities for sending and receiving digital assets. Currently, Spark provides a fully validating Bitcoin node, a c-lightning node, and a Spark Graphic User Interface (GUI).

Mutiny Wallet

Mutiny wallet is a browser first Bitcoin wallet that supports the Lightning Network. The wallet is open-source, so you can host your own copy of Mutiny. The wallet is also integrated with features that allow you to connect with the Nostr app for zapping.

Wallet of Satoshi

The Wallet of Satoshi is a full custodial wallet that comes with a practical and simple user experience. Users can directly buy Bitcoin from here without having to leave the wallet platform. As far as ease of operation goes, there’s little chance you could beat that. The app also has a location integration feature through Google Maps that allows users to find merchants close to them who also use Lightning wallets.

The above wallets were selected for their Lightning Network compatability, range of security features, reputations, and ease of use.

Lightning Network wallets compared

| Wallet | Launched | Custody | Platform |

|---|---|---|---|

| Joule | 2018 | Non-custodial | Chrome, Firefox, Opera, Brave |

| Éclair | 2017 | Non-custodial | Android & desktop |

| Strike | 2017 | Custodial | Android & iOS |

| Spark | 2018 | Non-custodial | Android & iOS |

| Mutiny Wallet | 2023 | Non-custodial | PWA |

| Wallet of Satoshi | 2019 | Custodial | Android & iOS |

What is the Bitcoin Lightning Network (LN)?

The Lightning Network (LN) is a payment channel built on top of the Bitcoin blockchain, which makes transactions faster and cheaper. Thaddeus Dryja and Joseph Poon first described it in a whitepaper in 2015.

The goal was to create a protocol that allows Bitcoin users to send and receive instant payments. To function, LN requires channels transacting parties to open channels between each other.

These channels would be used to send and receive payments instantly between the parties with zero to no fees. Once the transactions are complete, the channels are closed, and the details are recorded on the blockchain.

Lightning Payments result in instant payments because transactions do not require approval by the nodes before being confirmed. Lightning has gained some prominence in the crypto sector, but more work must be done before it gains mass appeal.

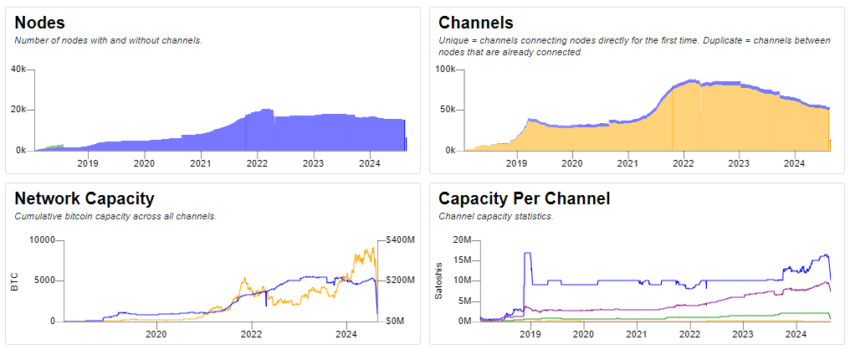

As of July 2025, the network has over 6,000 nodes and 12,000 channels with a network capacity of 965 Bitcoin (around $57 million).

How does scalability affect adoption?

Bitcoin’s limited capacity of processing only seven transactions per second has been a point of criticism, especially as its popularity has increased. Initially, this wasn’t a significant issue, but as more people began using Bitcoin for everyday payments, network congestion became a major problem.

This led to situations where users, for instance, might end up waiting hours at a coffee shop for their transaction to be confirmed by miners.

VISA, one of the most popular payment processors in the world, can process 24,000 transactions in a second (and 50,000 at peak capacity). PayPal, another top payment processor, runs about 17,000 transactions a second. For Bitcoin to replace the conventional financial system, it has to match its performance.

Drawbacks of the Lightning Network

The Lightning Network brings significant benefits to Bitcoin, enabling it to surpass VISA and other card processors with SegWit and third-layer scaling. However, it also has drawbacks.

One major concern is the potential increase in transaction fees, which could deter adoption. The Lightning Network has two primary costs: the fee for opening and closing a channel and the routing fee for payment transfers.

A rise in overall Bitcoin transaction fees might undermine the Lightning Network’s utility. For instance, when there are more Bitcoin transactions, the network congests, making it difficult or expensive to open a channel.

Additionally, LN payments don’t support offline transactions, limiting accessibility for users without constant internet access, such as those with hardware wallets. Despite these challenges, the Lightning Network has grown since its 2018 implementation.

Which Bitcoin Lightning Network wallet is best?

Choosing the right Bitcoin Lightning Network wallet depends on your individual needs. The Wallet of Satoshi provides a user-friendly interface for simple transactions for beginners. Spark’s straightforward approach may appeal to those valuing privacy and security. Strike, developed by Zap, is ideal for seamless integration with traditional finance, facilitating easy Bitcoin-to-fiat conversions.

Finally, it is important to carefully consider factors like security, usability, and transaction needs. Before investing, always conduct thorough due diligence to ensure the wallet aligns with your specific requirements.

Frequently asked questions

What is the Lightning network?

How does the Lightning Network work?

What are the benefits of using the Lightning Network?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.