The Tezos blockchain supports various applications, spanning financial services to digital art and beyond. Like many well-known blockchain platforms, it uses a staking mechanism to maintain network security. Tezos lets you contribute directly to the network’s security and receive rewards. This guide dives into the essential information about Tezos staking. We explain what it means to stake your XTZ holding and examine the various methods available.

Methodology

We explored multiple options over several weeks to identify the top platforms for buying Tezos (XTZ). Our selection criteria focused on the core elements that make the buying/trading experience reliable and efficient. Our evaluation was largely based on key metrics such as security, fees, liquidity, ease of use, and compliance. Here’s a quick look at the reasons why we chose the following platforms:

Kraken

Kraken stands out as a goliath in the crypto space, having earned the trust of users across the world with its stringent security measures and exceptional market liquidity. The exchange deploys features like cold storage options, 2FA, and encrypted data storage to ensure that your transactions remain under lock and key. Kraken caters to new and seasoned traders by offering a giant pool of trading information and competitive transaction fees.

Coinbase

As one of the world’s largest and most popular exchanges, Coinbase commands the kind of trust you expect from your go-to crypto trading platform. It offers an intuitive interface that suits crypto newcomers particularly well. However, it is equally practical for experienced users who prefer advanced trading tools and options. Coinbase operates under strict regulatory compliance and offers sizable liquidity for multiple XTZ trading pairs.

Ledger

Ledger offers a unique proposition — it is a hardware wallet manufacturer that allows users to stake XTZ directly from the security of their device. This method is ideal for those seeking the ultimate protection for their XTZ stash, as it aims to blend the impenetrable security of cold storage with the functionality of active staking.

Exodus Wallet

Exodus Wallet is ideal for buying Tezos (XTZ) due to its integrated exchange feature, which allows users to seamlessly purchase XTZ directly within the wallet interface. This built-in functionality eliminates the need for external exchanges, streamlining the process and reducing transaction complexity. Additionally, Exodus supports a wide range of cryptocurrencies, enabling easy portfolio diversification. The wallet’s user-friendly design makes it accessible to both beginners and experienced users, facilitating an intuitive experience for managing and transacting in XTZ.

OKX

OKX stands out as a top platform for buying and staking Tezos (XTZ) due to its comprehensive suite of investment products that cater to various experience levels and risk tolerances. It offers competitive APY on cryptocurrencies and features a robust “Earn” section where users can select from a range of options, from low-risk savings accounts to high-risk, advanced dual investment products. OKX protects transactions with industry-standard encryption and secures significant digital assets using cold storage solutions. The platform also enforces multi-factor authentication and anti-phishing protocols to actively secure user accounts, making it a reliable and secure choice for managing and growing your cryptocurrency investments.

For further information and insight into BeInCrypto’s verification methodologies, click this link.

Where to buy Tezos (XTZ)

OKX

- What is Tezos?

- Tezos staking: Secure the network, earn rewards

- Embarking on your Tezos staking journey

- How to stake Tezos (XTZ)

- Benefits of Tezos staking

- Risks associated with Tezos staking

- Secure your stake: Best practices for Tezos staking

- Tezos staking: How often are rewards paid?

- Understanding Tezos staking rewards and tax

- Platforms to stake Tezos

- Is Tezos staking worth it in 2026?

- Frequently asked questions

What is Tezos?

Tezos was launched in 2018 following a record-breaking ICO. It has since become a major player in the blockchain space. Tezos facilitates the development and execution of smart contracts, which are basically self-executing agreements that power decentralized applications (DApps).

Tezos allows stakeholders to participate in the network’s security and evolution by voting on proposed upgrades to the protocol. This approach eliminates the need or scope for any disruptive hard fork, which can ultimately fracture the user base.

Notably, Tezos uses a unique proof-of-stake (PoS) consensus mechanism called liquid proof-of-stake (LPoS). Unlike many other blockchains, Tezos prioritizes formal verification, a process that enhances smart contract security by minimizing vulnerabilities. The platform also emphasizes modularity and upgradability, ensuring long-term scalability and adaptation.

Tezos staking: Secure the network, earn rewards

Tezos staking allows users to participate in the network’s consensus mechanism and contribute to its security. This is achieved through “baking” or delegating XTZ, Tezos’ native cryptocurrency.

Baking vs. delegating:

- Bakers: These network validators hold a security deposit of 6,000 XTZ. They validate transactions, create new blocks, and earn rewards in the form of newly minted XTZ and transaction fees.

- Delegation: Not everyone needs to be a baker to benefit from crypto staking. XTZ holders can delegate their coins to a baker, indirectly participating in consensus and receiving a share of the baking rewards. This delegation process is secure — users retain ownership of their XTZ while allowing the baker to stake a larger amount.

The delegation process in Tezos is relatively smooth and secure. It allows XTZ holders to contribute to network security without having to invest any substantial capital. Additionally, it safeguards them from the risk of asset loss due to slashing, which is a penalty enforced in many other proof-of-stake networks. This makes Tezos staking a popular choice for users looking to earn passive income while supporting network operations.

Embarking on your Tezos staking journey

You have two options if you plan on staking on the Tezos network. You could either be a baker or delegate your tokens to a baker. Each approach has advantages and drawbacks, so understanding the nuances is key to picking the one that best suits your risk appetite and goal.

The baker’s way: Balancing authority with duty

Bakers are the lifeblood of the Tezos network. They shoulder critical tasks like validating transactions, creating new blocks, and proposing and voting on network growth changes.

However, this power comes with a hefty price tag — you must acquire a collateral of around 6,000 XTZ. This substantial financial commitment isn’t the only hurdle. As a baker, you also need specialized hardware to run the baking software and a decent amount of technical expertise to configure and manage their setups.

Furthermore, you may have to be on your toes constantly to minimize downtime. This is important because a baker’s reputation depends squarely on their ability to run node operations reliably.

That said, the rewards for bakers can be quite enticing. As a baker, you retain all block yields, ensuring a potentially lucrative return on your investment. So, to cut a long story short, bakers typically earn good returns on their investments, but baking is not a job for everyone. It demands serious commitment and comes with significant responsibility.

Delegating XTZ: A passive approach with flexibility

You could consider delegating your XTZ to a baker if active participation seems overwhelming. This approach offers a more laid-back alternative. Your XTZ remains safely stored in your wallet, and you will have peace of mind knowing you have full control over your assets. This setup allows you to passively earn rewards and maintain a consistent source of passive income without any extra effort.

While delegating offers flexibility, you have to beware of a few limitations. For instance, you can’t split your XTZ holdings across multiple bakers within the same wallet. However, you can change your delegation anytime by transferring your funds to a different wallet.

Also, carefully evaluate a baker’s track record and commitment to fair reward distribution before signing up. Bakers typically charge a fee for their services, so assessing their fee structure and historical performance is crucial.

If you are unsure whether to become a baker or a delegator, remember that it ultimately boils down to your risk tolerance, level of technical expertise, and the amount of time you can realistically dedicate to network participation.

How to stake Tezos (XTZ)

Follow these steps to start staking Tezos.

Step 1: Choose your staking platform

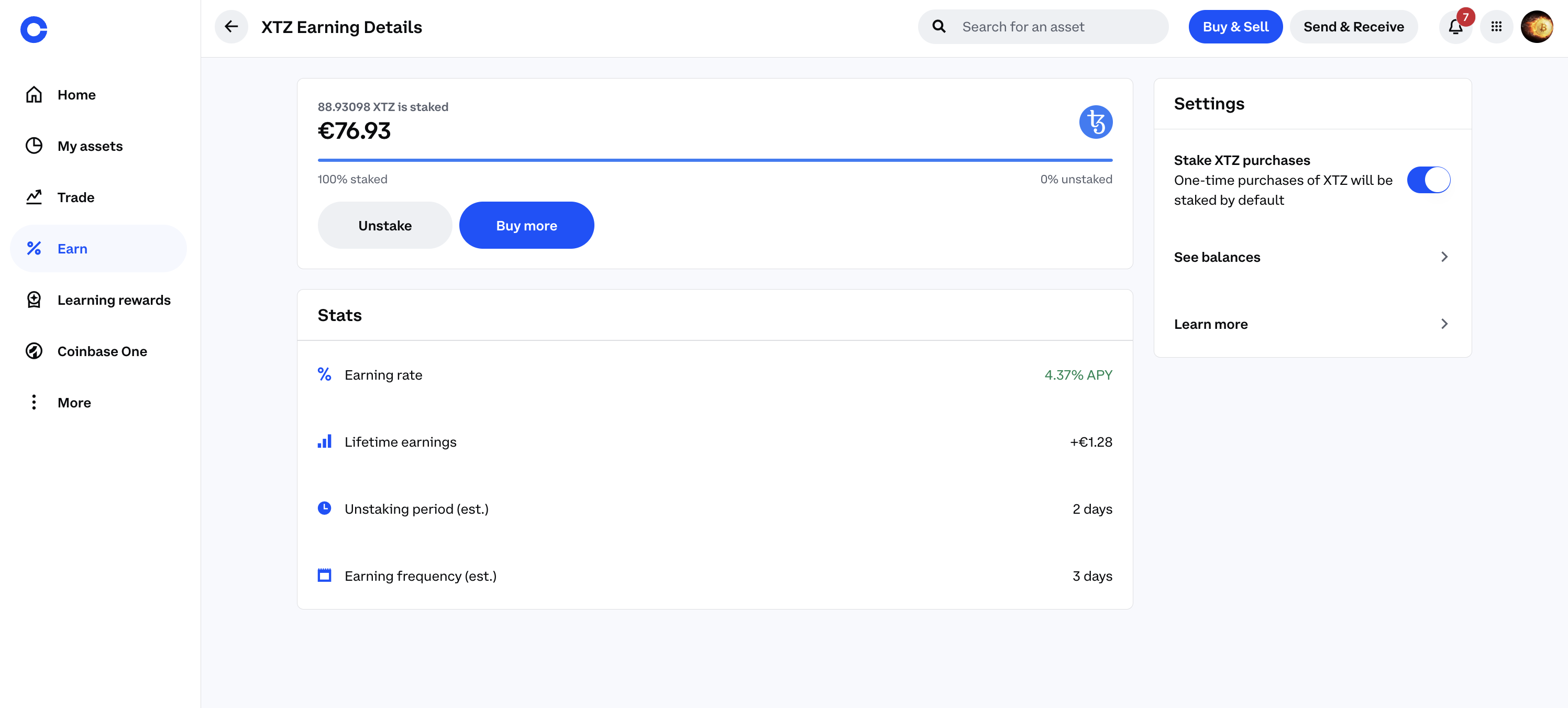

For this demonstration, we’ll use Coinbase due to its user-friendly interface. The centralized exchange combines user-friendliness and security, making it a good option for XTZ staking. Other reputable options include Binance, Kraken, and OKX.

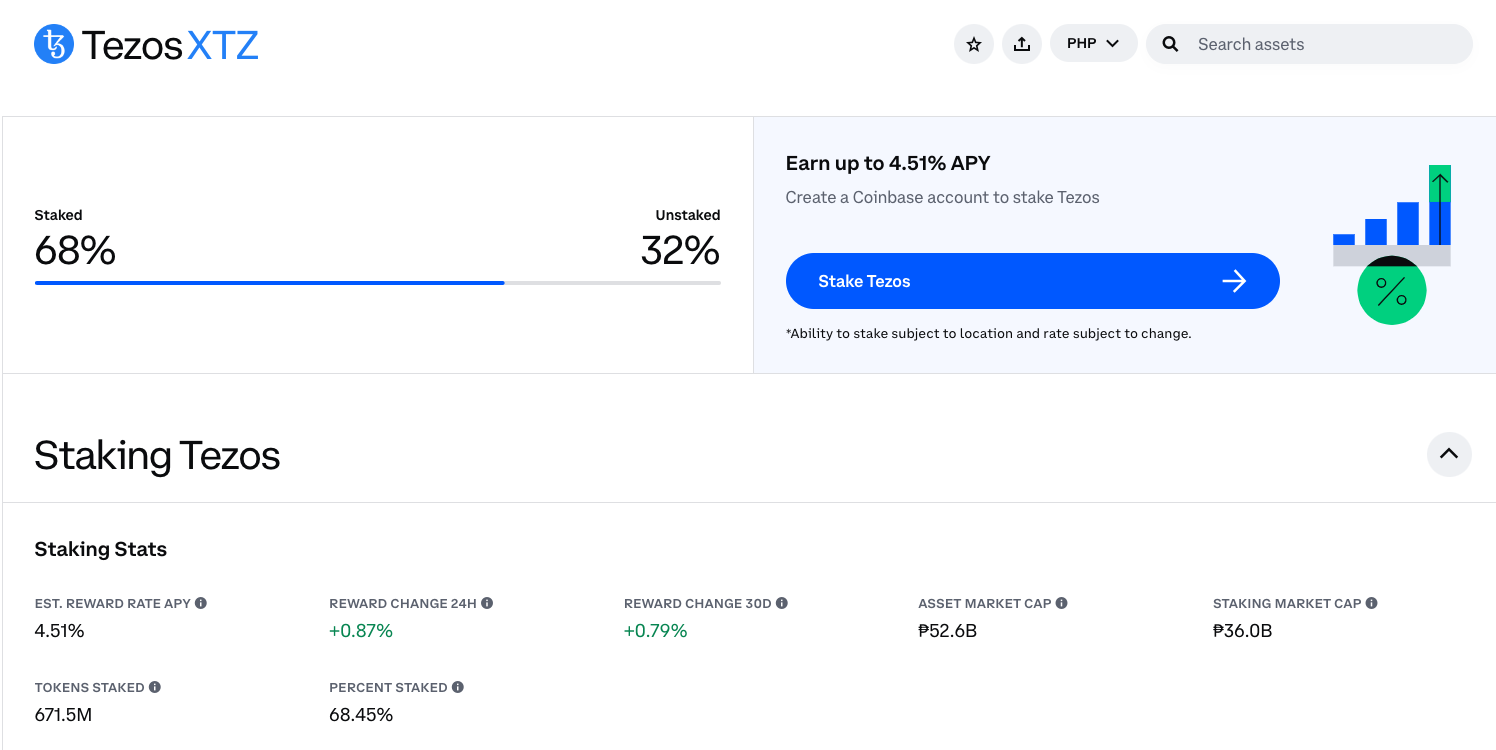

The ideal platform depends on your priorities. Consider factors like security measures, ease of use, fees associated with staking, and the estimated annual yield (APY) offered. These factors can significantly impact your experience and the rewards you earn. Coinbase offers an APY of 4.51% on XTZ staking as of May 8, 2024.

Step 2: Fuel your stake

After choosing Coinbase as your staking platform, ensure you have Tezos (XTZ) in your account. You can purchase XTZ directly using fiat currency (USD or EUR) on Coinbase or transfer it from another wallet if you already own some. However, before proceeding any further, check your platform’s minimum staking amount requirement. Coinbase doesn’t have any minimum amount requirement, meaning you can start staking with 1 XTZ.

Step 3: Delegate to a baker

Go to the staking section and choose from a list of available bakers or validators. Bakers are responsible for validating transactions and creating new blocks on the Tezos network. Evaluate each baker’s performance, reputation, and fees to find the best match that meets your expectations.

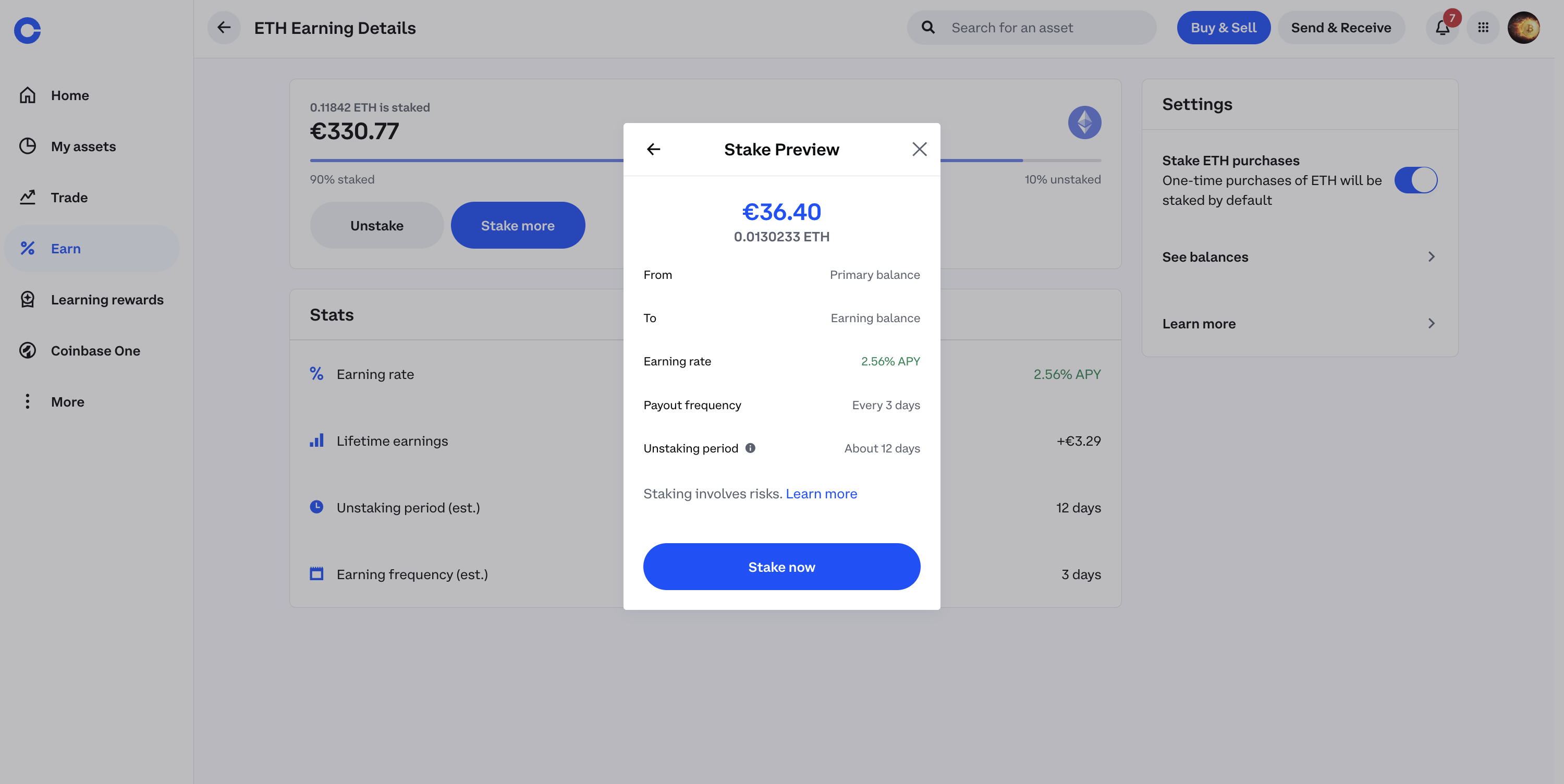

Step 4: Confirm and start earning

Once you’ve selected a baker, specify the amount of XTZ you wish to delegate and confirm the transaction. You might need to verify the transaction using your password, PIN, or a security device, depending on your security settings. You will see a stake preview window.

And that’s it! You have officially started earning rewards through Tezos staking.

Benefits of Tezos staking

Tezos staking is beneficial for the staker and the network. Some of the key benefits of staking on Tezos include:

- Earn passive income: Tezos staking allows you to generate a steady income stream without actively trading. You essentially participate in the network’s block creation process and, in turn, earn rewards for your contribution.

- Secure the network: Once you start staking on Tezos, you become an active participant in securing the network. Your participation helps validate transactions and contributes to the overall health and stability of the network. Additionally, staking grants you a voice in the network’s governance.

- Retain control of your assets: Tezos staking doesn’t require you to surrender your XTZ stash to a third party. You maintain full rights and control over your funds even when you delegate your tokens to a validator (baker). This allows you to earn rewards while simultaneously keeping your XTZ within reach.

- Simple and accessible process: Numerous platforms and wallets offer Tezos staking services with minimal or no fees and low minimum staking requirements. These platforms usually offer additional functionalities, including buying, selling, or trading your XTZ directly within their interface.

Risks associated with Tezos staking

While staking Tezos can earn you sizable profits, it’s important to understand the potential drawbacks:

- Validator performance risk: A poorly performing baker can impact your rewards. Be extra careful while choosing your validator.

- Validator misconduct risk: Dishonest or negligent baker behavior could affect your rewards or service reliability. Opt for validators with a decent track record.

- Regulatory risk: Crypto regulations vary by location. So, it’s important that you stay informed about how changing regulations might impact staking or taxes on rewards.

- Technical risk: Bugs in the Tezos protocol, baker software, or staking wallets could pose a risk to your XTZ stash.

- Network health: Low network participation or uneven baker distribution can impact Tezos’ decentralization and security. A healthy network is generally more secure and potentially more valuable.

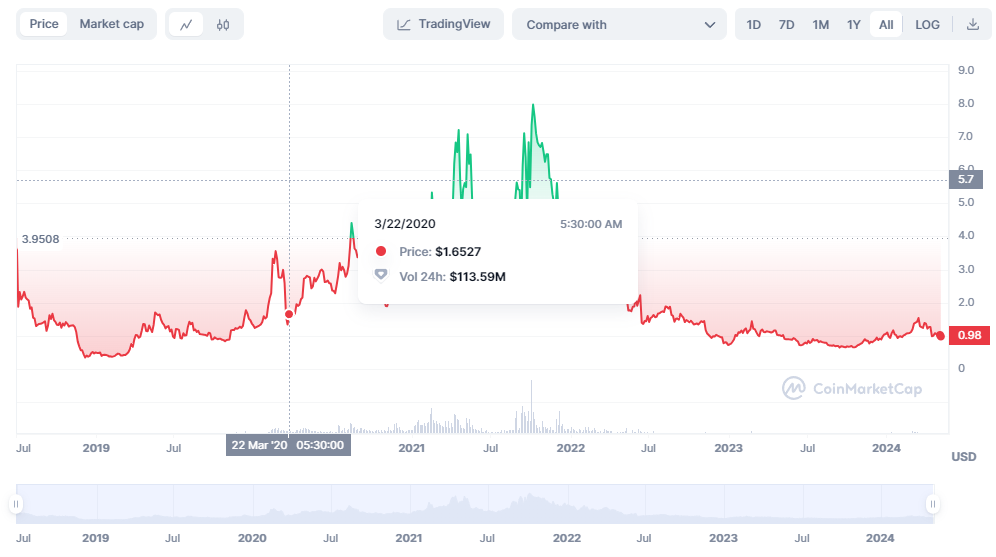

- Market volatility: XTZ price fluctuations impact the fiat value of your staking rewards. Consider this when evaluating potential returns.

Secure your stake: Best practices for Tezos staking

While it’s true that Tezos staking offers some exciting opportunities, just like with any other investment, there are certain risks. Here’s how you can avoid some of the common staking mistakes.

- Only pick reliable bakers: Try to find bakers with a proven track record. Ideally, you should look for consistent performance, high uptime, and positive community feedback. These bakers are more likely to deliver steady returns and prioritize security.

- Spread your stake: If you hold a significant amount of XTZ, consider delegating to multiple well-regarded bakers. This diversification strategy minimizes risks associated with a single baker’s performance or any other potential issues.

- Know the fees: Before delegating, thoroughly understand the baker’s fees and service terms. Fees can vary significantly and directly impact your staking profits.

- Control your keys: Never give up control of your private keys. Ideally, you should use a secure wallet such as a hardware wallet for top-tier security — more so if you are dealing with large XTZ holdings.

- Stay updated: Keep tabs on the changes and updates in the Tezos protocol and crypto regulations. This awareness helps you adapt to evolving conditions affecting staking rewards or requirements.

- Monitor and adapt: Regularly review the performance of your baker. If a baker consistently underperforms or adjusts fees unfavorably, consider switching to a different one.

- Plan for liquidity: While Tezos allows undelegation anytime, you could benefit from planning your liquidity needs beforehand. Try to ensure you are comfortable with the staked XTZ amount and maintain sufficient liquidity for other eventualities.

- Estimate rewards: Use online staking calculators to estimate potential returns based on current network conditions and baker performance. This information makes it easy for you to make informed decisions about where to delegate your XTZ.

- Prioritize security: Regularly update your software, use strong, unique passwords, and enable two-factor authentication whenever possible.

Tezos staking: How often are rewards paid?

Tezos rewards are shelled out periodically, with payouts happening after each cycle. These cycles clock in at roughly three days each. That said, there is a catch for those new to the staking game: an initial waiting period stands between you and your first Tezos payout. You may have to exercise patience for a few weeks after delegating your XTZ to a baker. This delay is necessary for the network to integrate your new delegation and ensure that your baking and endorsing rights are accurately factored in.

Understanding Tezos staking rewards and tax

As a Tezos staker, you may enjoy substantial rewards. Remember that staking rewards are taxable income in many jurisdictions, and Tezos staking is no exception. The exact tax implications may vary dramatically depending on your region. As a general rule of thumb, tax authorities expect individuals to report their staking rewards as income. This means you’ll be taxed on the fair market value of the XTZ you receive at the time of distribution. Keep in mind that it is not a matter of how much you paid for the original XTZ you staked. Rather, you will be paying taxes on the value of the newly minted XTZ rewards.

You may also be subject to capital gains tax if you decide to sell your hard-earned staking rewards. This applies if the value of XTZ has climbed since you received it as a reward. We highly recommend users keep meticulous records of the dates and values when they receive and sell their XTZ. This is a must if you want to ensure you comply with tax regulations accurately.

Platforms to stake Tezos

1. Kraken

Kraken is a leading Tezos staking platform thanks to its superior security and commitment to user experience. Security-conscious users will appreciate Kraken’s industry-leading protective measures, such as comprehensive cold storage solutions and mandatory two-factor authentication.

The platform offers a diverse range of staking options and competitive fees, positioning it as a versatile choice for seasoned users. Users also benefit from Kraken’s consistent uptime and stringent adherence to regulatory standards.

- Top-notch security measures protect your XTZ with cold storage and 2FA

- Deep liquidity ensures smooth buying and selling of XTZ

- Competitive fees keep staking costs manageable

- Wide selection of staking options for different user preferences

- Established exchange with a proven track record

- Less beginner-friendly than competitors

- Staking features may be less extensive than dedicated staking platforms

2. Coinbase

Coinbase serves as an ideal entry point for beginners with its user-friendly interface and intuitive staking process. Being a regulated entity, Coinbase prioritizes user safety by maintaining a secure trading environment. Additionally, the platform allows for the direct purchase of XTZ using fiat currencies, facilitating an easy process to buy and stake Tezos without the need for an intermediary service.

- User-friendly interface that simplifies the staking process for beginners

- Strong security measures, including 2FA and insurance against platform breaches

- Established reliability as one of the largest and most well-known cryptocurrency exchanges

- Quick liquidity options that allow users to easily buy, sell, and trade XTZ on the platform

- Comprehensive educational resources to help users understand XTZ staking

- Some staking features may not be available in all locations due to regulatory constraints

3. Ledger Wallet

Ledger is one of our top platforms for staking Tezos (XTZ), renowned for prioritizing security to ensure the safest staking experience. Its hardware wallet technology is engineered to provide the highest protection possible. When you stake XTZ using a Ledger Wallet, you retain complete control over your private keys, which are stored offline, offering you ultimate peace of mind. This setup secures your Tezos assets from online threats while empowering you with direct management of your assets without intermediary risks.

- Unmatched security with offline storage and cold wallet functionality

- Stake XTZ directly from the secure confines of your hardware wallet

- Supports a wide range of cryptocurrencies for consolidated asset management

- Ledger Live software simplifies interaction with your hardware wallet

- Highly regarded brand known for its commitment to security

- Requires purchasing a separate hardware wallet, adding an initial investment

- The interface can be less intuitive for beginners compared to software wallets

4. Exodus Wallet

Exodus Wallet is a leading platform for staking XTZ as it expertly balances security with ease of use. The wallet is designed with a straightforward, intuitive interface and includes integrated staking functionality directly within the software, allowing for straightforward management of XTZ holdings.

This makes it an outstanding choice for newcomers and experienced users who value a hassle-free and secure staking process. Additionally, Exodus supports many other cryptocurrencies, offering users the flexibility to manage multiple assets within a single platform, further enhancing its appeal as a comprehensive digital asset solution.

- User-friendly interface with built-in staking features, simplifying the staking process

- Supports a variety of cryptos beyond just XTZ, offering diversification options

- Secure software wallet with built-in safeguards to protect your XTZ

- Convenient and readily accessible from your computer or mobile device

- Regular updates and feature additions

- Not as secure as a hardware walle

- Staking rewards might be lower compared to some exchange

Is Tezos staking worth it in 2026?

If you’re interested in earning substantial passive income, Tezos (XTZ) presents a compelling opportunity. According to the Tezos block explorer TzStats, the staking rate exceeds 67% as of May 8. 2024, indicating that over two-thirds of all circulating XTZ tokens are actively staked. This high participation rate highlights the continued demand for Tezos staking. Furthermore, by staking XTZ, you can reap financial rewards and contribute to shaping the future of Tezos through your active involvement in its development. Remember that profits are never guaranteed, and the value of your holdings can fluctuate according to market sentiment and demand.

Frequently asked questions

Tezos staking remains an attractive option in 2024. With well over 67% of all XTZ tokens staked as of May 8, 2024, you can join a sizable community of active stakers earning passive income while contributing to network security. Beyond the financial rewards, staking also allows you to influence Tezos’ future by participating in its ongoing development.

The exact APY for Tezos staking can fluctuate depending on various factors. These may include the platform you are using, the current staking rate, and network inflation. Tezos staking typically offers a competitive APY compared to other staking opportunities. For example, Coinbase offers an APY of around 4.51% for XTZ staking, whereas the corresponding figure for Ledger Wallet can go as high as almost 6%.

You have multiple options to choose from. Popular choices include hardware wallets like Ledger, which offer a secure and user-friendly experience. You can also stake through cryptocurrency exchanges like Coinbase or other dedicated staking platforms. Ideally, researching different options would help you find one that aligns with your security preferences and staking goals.