Market volatility makes it difficult for investors to use crypto as a store of value or a means of exchange. As such, other types of tokens have a role to play in helping mitigate this issue. Rebase tokens, for example, were created to provide the same solution as stablecoins. Yet, instead of relying on another asset’s value, the price of a rebase token is directly aligned with its circulating supply.

This article reviews the mechanism behind these tokens and delves into some of the most popular supply elastic tokens on the market today.

What are rebase tokens?

Rebase tokens are cryptos that maintain price stability by adjusting supply. Contrary to traditional cryptos, a fixed supply is not pre-determined for rebase types. This process of adjusting a token’s circulating supply rate is referred to as a “rebase mechanism.” This means the supply is automatically modified based on a pre-determined formula and triggered at regular intervals.

Essentially, when the demand for a rebase token increases, so does its supply. This works the same for the reverse when there’s low demand and low supply. Rebase tokens are also referred to as elastic supply tokens since they are “price elastic.”

The need for price-stabilizing tokens is in high demand. The demand isn’t just for rebase tokens but also stablecoins in general, which continue to be crucial to the crypto ecosystem despite depegging and stability crises rocking the boat in both 2022 and 2023.

How do rebase tokens work?

Rebase tokens have an elastic supply. It means that supply is directly proportional to supply and demand without changing its value in users’ wallets. In other words, the amount of tokens in the wallets will increase or decrease accordingly. However, the total wallet value does not change. To understand how this works, these types of tokens are built on smart contracts, which allow for the automation of specific processes, in this example, the automation of the circulating supply adjustment.

In addition, the entire mechanism is based on a predetermined routine, as mentioned before. If, for example, the rebase mechanism is set to a 24-hour interval with a $1 target price, the circulating supply increases once the price passes this target. As a result, this reduces the value of that particular token.

So, if one rebase token doubles in value from $1 to $2, the supply inflates during the rebase period. Basically, the supply of the token would increase, bringing the price back down to $1.

Do rebase tokens make money?

Investors can substantially increase their rebase holdings if the price of the token increases. This means they are not only benefiting from the higher price but also the greater number of tokens when the supply adjusts. Yet, for rebase tokens to be profitable, an expansion within the protocol’s treasury must exist. If an increase is not backed by any substantial growth in the treasury, this can lead to a dilution.

Popular rebase tokens

As of late June 2023, the rebase tokens’ market capitalization is $339 million, with a 24-hour trading volume of $421,851. The largest gainer is Ampleforth, while the one that is trending the most is Olympus. Below are a few of the most popular rebase tokens in circulation.

Ampleforth (AMPL)

The Ampleforth (AMPL) token was among the first to use the elastic supply mechanism. It runs on Ethereum using the Chainlink software. Ampleforth’s price target is $1 with a 24-hour interval. The token’s supply is adjusted every 24 hours, with the goal of keeping the price at this value. Therefore, when AMPL’s price increases by more than a few cents, extra tokens are reflected in user wallets proportionate to their holdings. Ampleforth has the same commodity asset class properties as bitcoin but differentiates itself from the original crypto with its rebase mechanism.

The number of active addresses for AMPL is shown in the chart below.

RMPL

RMPL is a crypto forked from Ampleforth. It is a decentralized token that uses the elastic supply protocol. It employs randomized, not fixed, rebasing. Since volatility is in the token supply rather than the price, it eventually always finds a supply-price equilibrium. There is no general market data on CoinMarketCap for RMPL, as it is listed as untracked. However, according to GeckoTerminal, a price of $0.316 is listed against WETH on Uniswap V2 with a market capitalization of $506.69K.

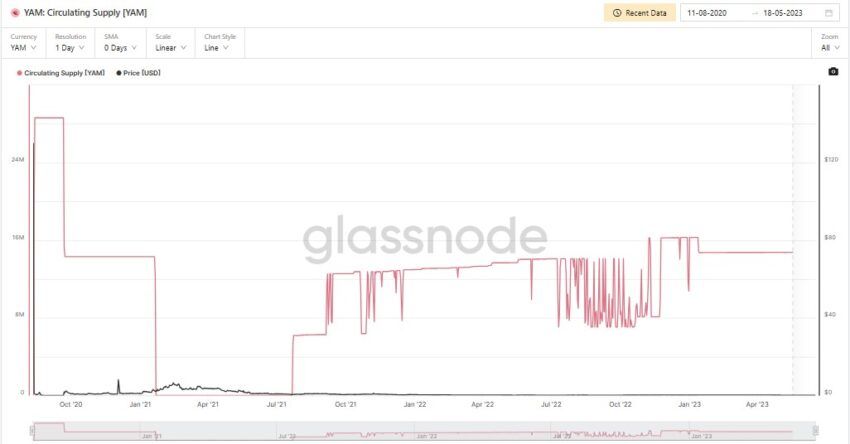

Yam V3 (YAM)

Yam Finance is a DeFi yield farming platform, another rebase crypto that works similarly to Ampleforth. The platform’s token YAM incorporates staking into its mechanism as well as a fair launch. And just as with Ampleforth, YAM strives to stay at $1 per token. Since YAM is community-owned, there was no pre-sale or founder allocation. This means that the project was distributed via liquidity mining. All members were given equal opportunities to acquire tokens through a yield farming scheme.

Did you know? At one point, the Yam project suffered a bug in its rebasing mechanism which caused more supply than was needed to be minted. This eventually led to a relaunch of the project on a new token contract.

Olympus

The OlympusDAO (OHM) finance project is building a “decentralized and censorship-resistant reserve currency that is asset-backed, deeply liquid, and used widely across web3,” as per its official site.

The project is community-owned and offers both staking and bonding protocols. Users can stake their OHM and benefit from a network that grows in line with the token’s emissions. This means the rebase mechanism uses staking for a reward to earn them eligibility to navigate the network. The OHM token’s live price as of late June 2023 is $10.68, with a market capitalization of $196.2M.

What are the benefits of rebase tokens?

The main benefit of using rebase tokens is to provide price stability in a market that is highly volatile. The token controls its price by algorithmically adjusting its circulating supply. This is especially beneficial for those who need crypto as a means of exchange or store of value.

Another benefit is the usability as a distribution method for some projects. Here, investors stake their tokens and receive a representative token that accumulates the rebases.

Pros and cons of rebase tokens

Although these tokens provide a clear benefit to the market, it’s always best to consider both the pros and cons before investing your money.

Pros

- Stable price: By automatically adjusting the supply proportionate to demand, rebase tokens keep their price relatively stable, even in volatile market conditions.

- Decentralized: Rebase tokens are decentralized, making them less vulnerable to manipulation and more resistant to censorship.

- Growth potential: Since their price stability attracts merchants and consumers, this may lead to increased adoptions which may drive demand even higher.

Cons

- Volatility: Despite providing price stability, rebase tokens are still prone to volatility and fluctuations due to the constant readjustments of supply.

- Risk of failure: They are also not immune to security vulnerabilities, technical issues, or low adoption.

- Complexity: Since they provide a relatively new underlying technology to crypto, the process may still be too complex for less advanced users.

Remember the tax burden on rebase token protocols

Before investing in rebase tokens, you should consider the applicable tax laws associated. Of course, this will depend on the type of transaction you make. Since many of these tokens are available on DEXs, you are required to swap crypto for elastic supply tokens which are taxable in most countries; you’ll have to pay taxes on any gain after that. For just selling tokens, you will have to pay capital gains tax. In addition, taxes in the form of income taxes are applied if there is a token reward payout. Of course, how you report your crypto taxes depends on where you live, so always do your own research.

Frequently asked questions

What is the most popular rebase token?

What is the first rebase token?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.