Real-world assets (RWAs) include entities like gold, fine art, real estate, and anything else with some tangible or even intangible value. In 2023, these assets with real-world connections go beyond the physical space. The advent of blockchain technology has ensured that these traditional entities have a unique on-chain representation. And that brings a novel concept called the real-world asset token.

RWA-backed tokens can represent almost anything you can imagine. A real-estate project, an equity fund, a masterpiece like the “Mona Lisa,” or more! With RWA-backed tokenization, the opportunities are endless. Imagine being able to own a fragment of the “Mona Lisa” without having to put your entire wealth in line. Having a “Mona Lisa” backed real-world asset token makes that possible. This guide explores every aspect of RWA-backed tokens, including their impact on the DeFi ecosystem and the technicals behind the process.

- Unpacking the concept of tokenization

- What are RWA tokens? Understanding tokenization up close and personal

- What are real-world assets examples?

- The process of tokenization: getting your first real-world asset token

- Why tokenize real-world assets: purpose and use-cases

- How tokenized assets even work?

- Types of RWA-backed tokens

- Benefits of RWA-backed tokens

- RWA-backed tokens: use-cases

- RWA-backed tokens as a DeFi gamechanger

- Challenges of RWA-backed tokenization

- Top RWA-backed tokenization platforms

- The modern-day RWA-backed token ecosystem

- Key RWA trends and the future

- The road ahead for your real-world asset token

- Frequently asked questions

Unpacking the concept of tokenization

Before we delve deeper into RWA-backed tokens, let’s take a quick look at tokenization in general.

Even though the process of representing an asset digitally isn’t exactly novel, DLT (distributed ledger technology) and blockchain technology have pushed the envelope by adding a new dimension to the existing world of tokenization.

“Tokenization is the largest transformation of finance and markets in over 50 years.”

Simon Taylor, entrepreneur: Twitter

Tokenization bridges real-world assets and options to store, trade, and transfer them right into the digital space. The process converts the value associated with the tangible or intangible entity into a token. And you can then use the real-world asset token freely across a given DLT space. Simply put, with tokenization, you can convert any asset into a digital token, enabling seamless transfers, high liquidity, fractional ownership, and easy storage — all without intermediaries.

When backed by real-world assets, each represented token is termed a real-world asset token.

What are RWA tokens? Understanding tokenization up close and personal

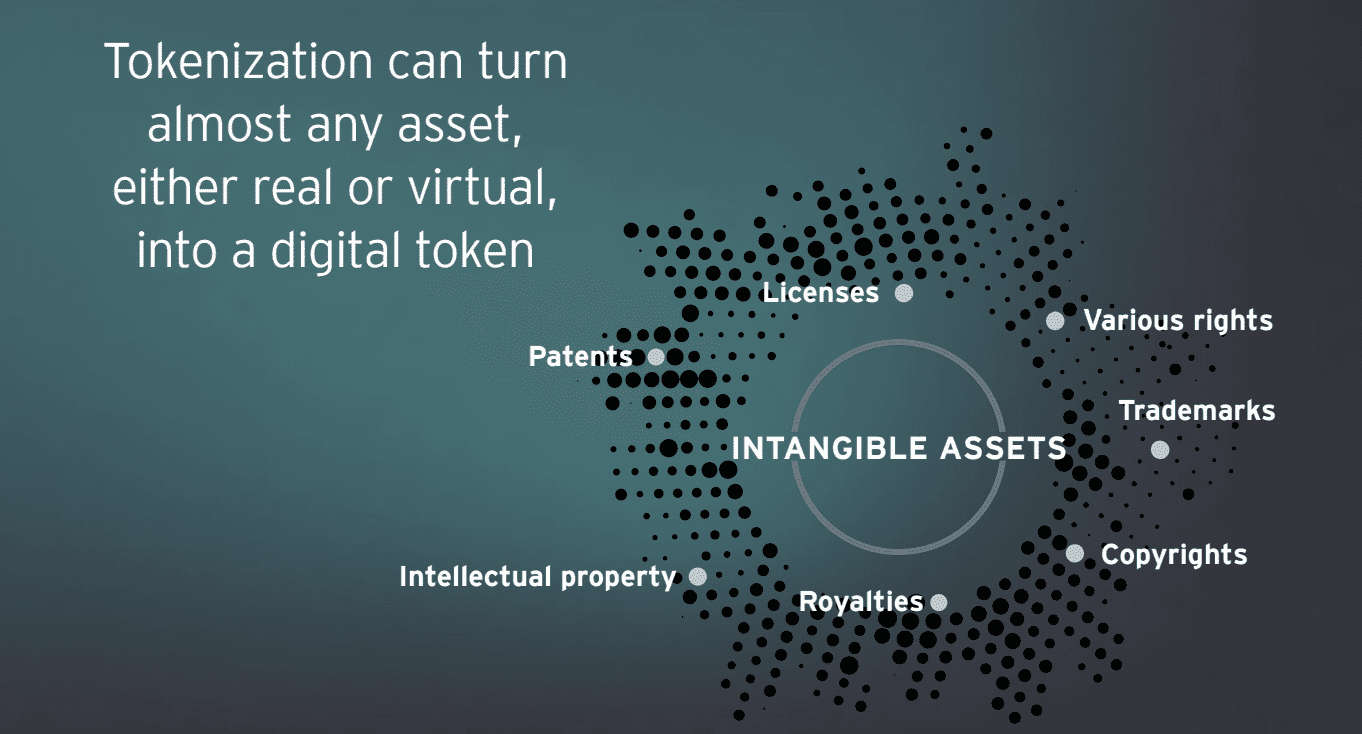

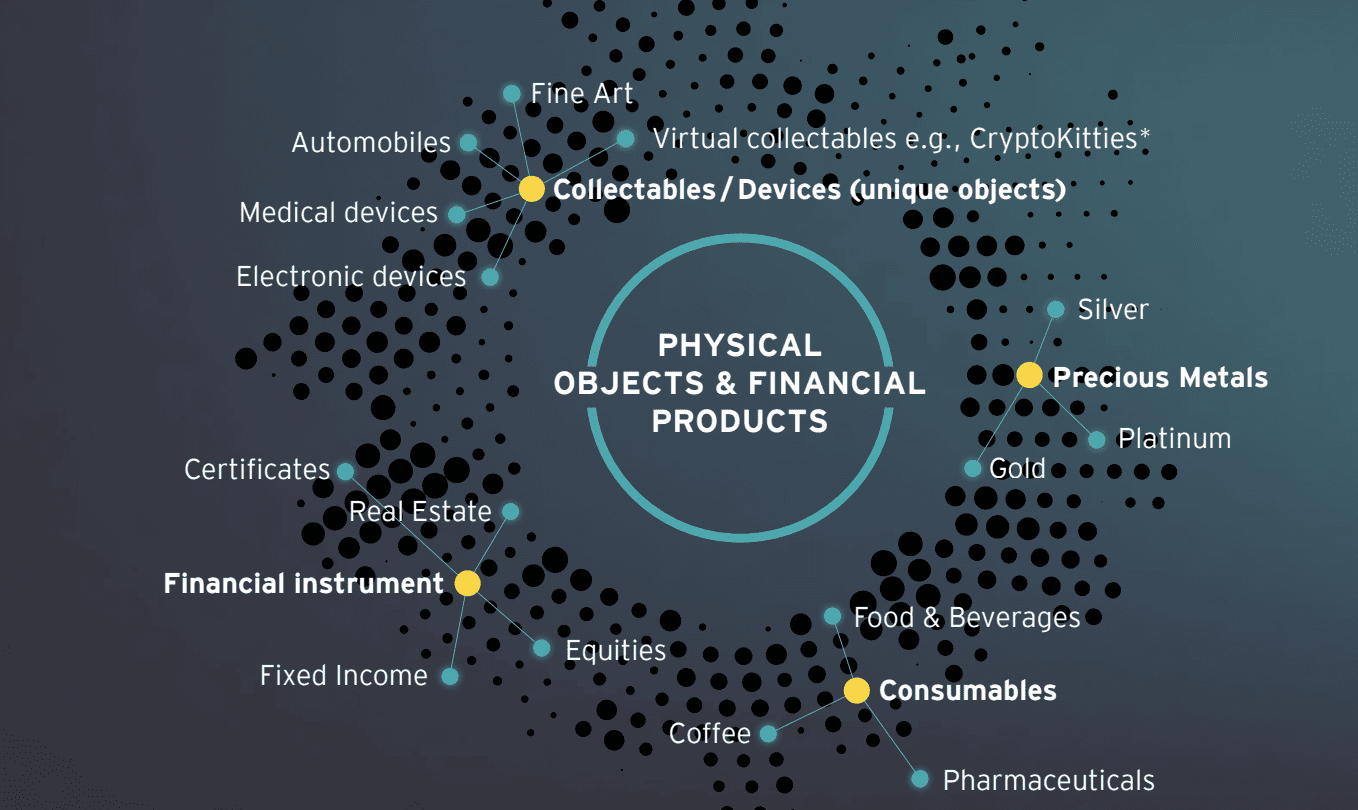

With tokenization, you can represent and interact with real-world assets on-chain. What can be transformed into RWA-backed tokens? The answer is that it can be anything — collectibles, oil, real estate, anything! Let us look at some actual examples.

What are real-world assets examples?

The answer includes tangible assets like cars, collectibles, real estate, metals, silver, gold, and anything else with physical relevance. The likes of equities, carbon credits, bonds, and anything that is intangible but with a relevant physical existence also qualify.

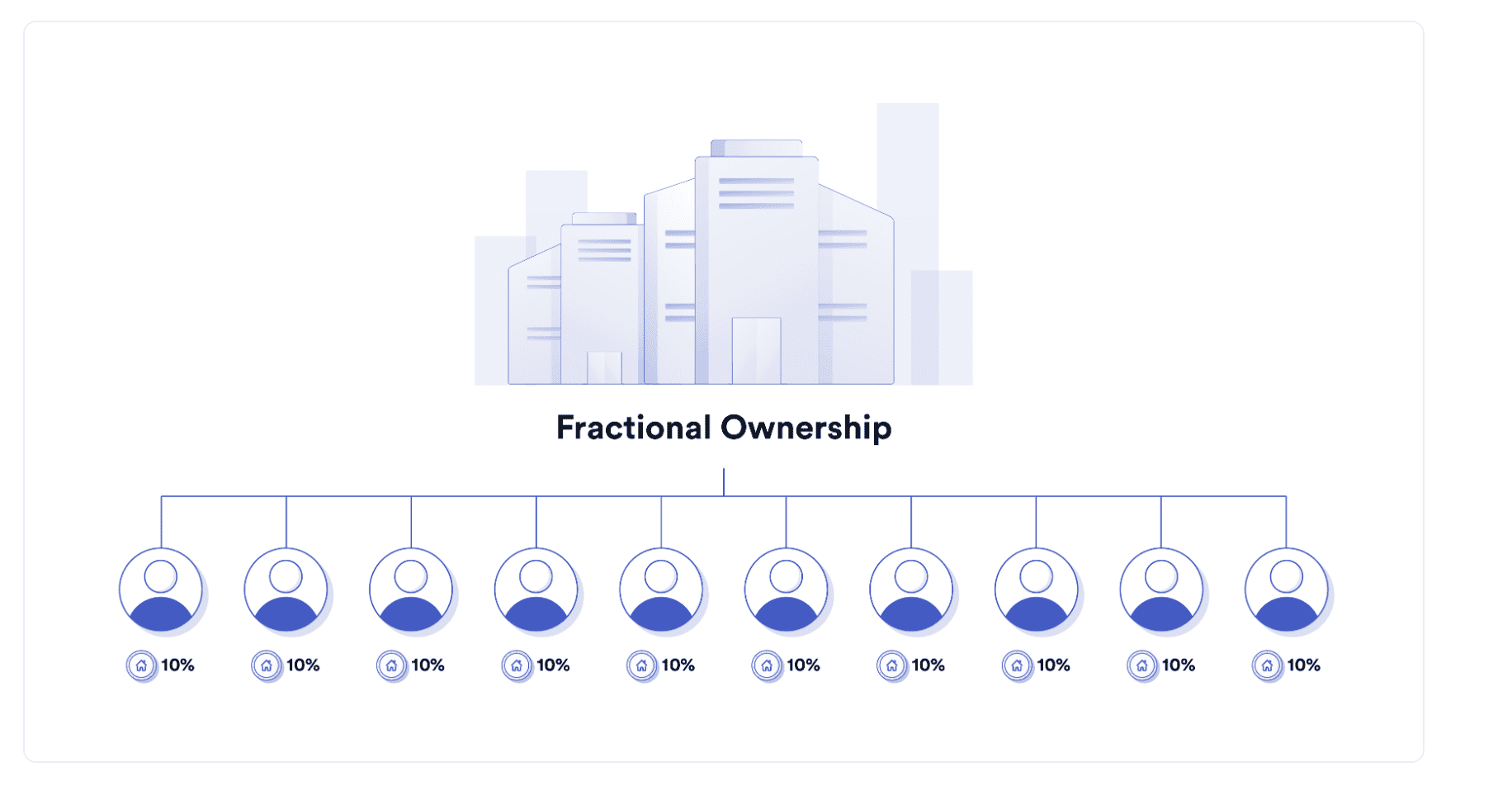

Let us take a more relatable example. Imagine you want to invest in a high-end New York property valued at over $10 million. While it might be difficult for a regular individual to get a piece of the pie, having this piece of real estate tokenized can allow fractional ownership. With RWA-backed tokens having a supply of 1 million, owning even a 0.0001% stake in the high-end property is possible — making your contribution $10.

Here is what the Ripple team is focusing on in regard to real-estate tokenization:

Even full-fledged industries, including the Maritime industry, are being tokenized, making elusive investment options available to individuals.

ShipFinex is a pioneer in this segment. Here is what their tokenization approach looks like:

How can tokenization make real-world assets accessible?

Markets concerning precious metals like palladium are relatively illiquid. There are high entry barriers, with mostly corporates and firms making trades via bilateral settlements. This, in turn, restricts price discovery and limits market access. Tokenization can help solve these issues by allowing for fractionalization.

Smaller buyers can access these exclusive markets, paving the way for enhanced liquidity. Plus, atomic swaps and smart contracts come in when these real-world assets are tokenized to the DLT premise. This allows for instant settlement and seamless multiparty trades.

As far as the process of tokenization is concerned, the most obvious approach for a real-estate asset is to shift the ownership to a legal entity. This legal entity then issues the asset-backed cryptos to represent ownership, taking care of everything else.

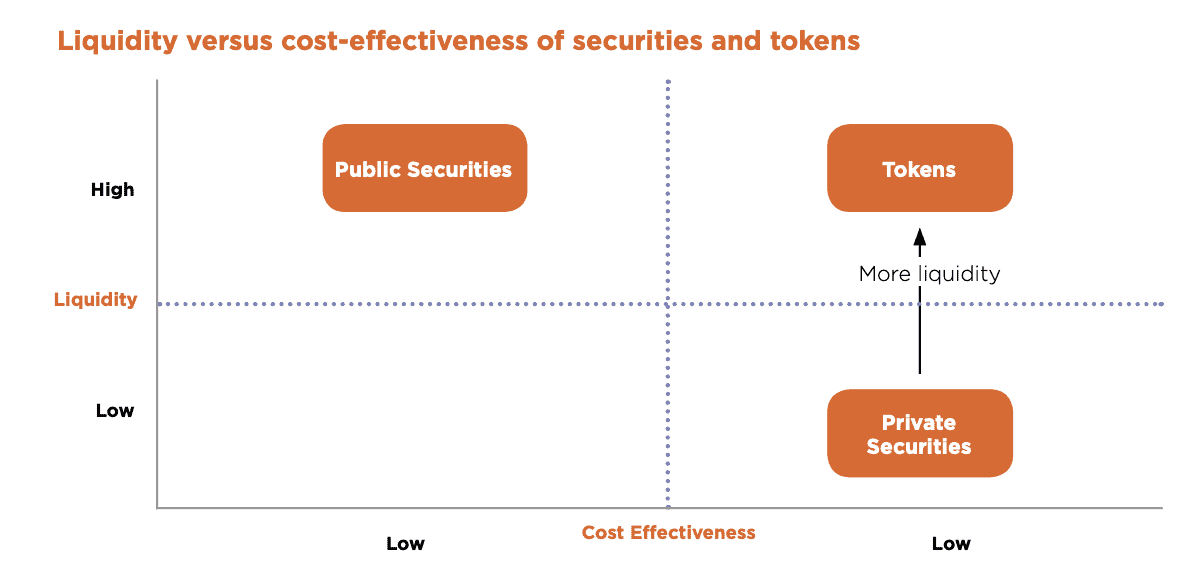

Simply put, the tokenization of real-world assets moves them from the low-liquidity and high-cost-effectiveness region to the high-liquidity and high-cost-effectiveness space. Plus, there are fewer administrative burdens to deal with when securities and other high-volatile assets are tokenized into the DLT/Blockchain space.

The process of tokenization: getting your first real-world asset token

Tokenization has a basic idea driving its existence — using smart contracts to represent an asset virtually. However, there is a catch. Tokenization of real-world assets like gold differs from the process of tokenization associated with something intangible — like an exclusive software license or even an NFT.

“NFTs are just one sign of what’s to come next in tokenization.”

David Schwartz, CTO at Ripple: Twitter

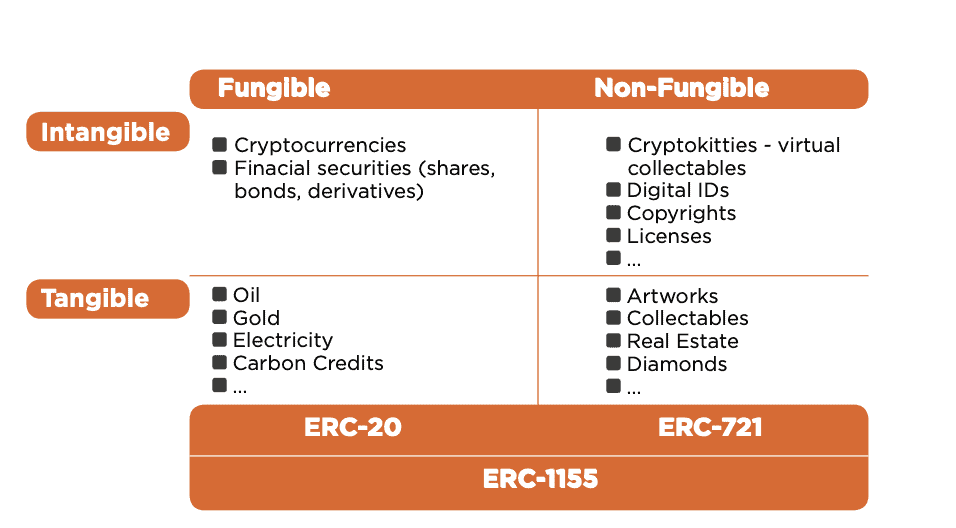

Therefore, fungible and non-fungible RWA-backed tokens exist just like in crypto. That is exactly why we often use them interchangeably with asset-backed cryptos. While fungible tokens follow the ERC-20 standard — if on Ethereum, like the gold-backed DigiX token DGX — tokenizing non-fungible tokens adheres to the ERC-721 standard.

However, a new token standard, ERC-1155, can help create contracts comprising ERC-20 and ERC-721 tokens. Therefore, if you plan to launch real-world asset buckets with real estate, stocks, gold, and other entities, you should look at the ERC-1155 or the Crypto Item token standard.

Steps to tokenization

Now with the token standards out of the way, let us look at the process, step-by-step:

- It all starts with asset selection. If you plan on launching your first real-world asset token, you must first choose the right asset — artwork, commodity, real estate, or anything else — that you would want to tokenize.

- Once done, you need to take care of the legal framework. This involves ascertaining the rights of the token holders, the status of the asset in legal terms, and mitigating disputes related to the asset, if any.

- The next step is to appraise the asset professionally. This is a crucial step, as the value of your tokens would be directly pegged to the total worth of the asset.

- Once appraised, the next step is to write and audit the smart contract(s) associated with the tokens. This is the point where you fix the supply, issuance, liquidation rules, and other guidelines associated with real-world asset token usage.

- Finally, you can initiate a token sale via a dedicated platform or even a crypto exchange, provided you adhere to the specific rules of the listing ecosystem.

Did you know? A group of companies, including Harbor, Polymath, Swarm, Factora, and TrustToken, has emerged, offering smart contract-powered tokenization platforms to users. These firms aim to provide end-to-end tokenization solutions with a focus on transparency, standardization, and amplified liquidity.

Newer tokenization standards

Each mentioned company has a specific way of dealing with tokenization’s compliance and legal aspects. For instance, Polymath has a Polymath ST-20 standard to pair regulatory requirements with the token itself. This allows selective token trading and makes everything permissioned per the issuer’s requirements.

Swarm, on the other hand, brings the Market Access Protocol or MAP into the mix. MAP takes care of the compliance and regulatory considerations associated with tokenization.

Key tokenization elements

Smart contracts and automation make the backbone of every tokenization gig. As smart contracts are programmable, you can use them to create any logic associated with your real-world asset token. From token transaction rules, vesting period, issuance automation, trading rules, and more — smart contracts take care of everything.

Smart contracts add a layer of automation to the management of RWA-backed tokens. For instance, if a real-estate property also generates rental income for the token holders, smart contracts and automation can help distribute revenue to the token holders proportionally. The smart contract might also decide the nature and type of token that can be used to transfer the passive income to the token holders.

Overall, tokenization is a highly systematic approach led by smart contracts and automation. It creates a bridge between the traditional world and the decentralized world to usher users into a new era of ownership and investment.

Why tokenize real-world assets: purpose and use-cases

So why is real-world asset tokenization crucial? For starters, RWA-backed tokens can onboard even the unversed in the DeFi ecosystem. Real-world assets fall in the Traditional Finance (TradFi) category — a realm plagued with regulations, middlemen, and whatnot. Tokenization aims to bring these assets to the decentralized world, making them a part of the ever-expanding DeFi ecosystem.

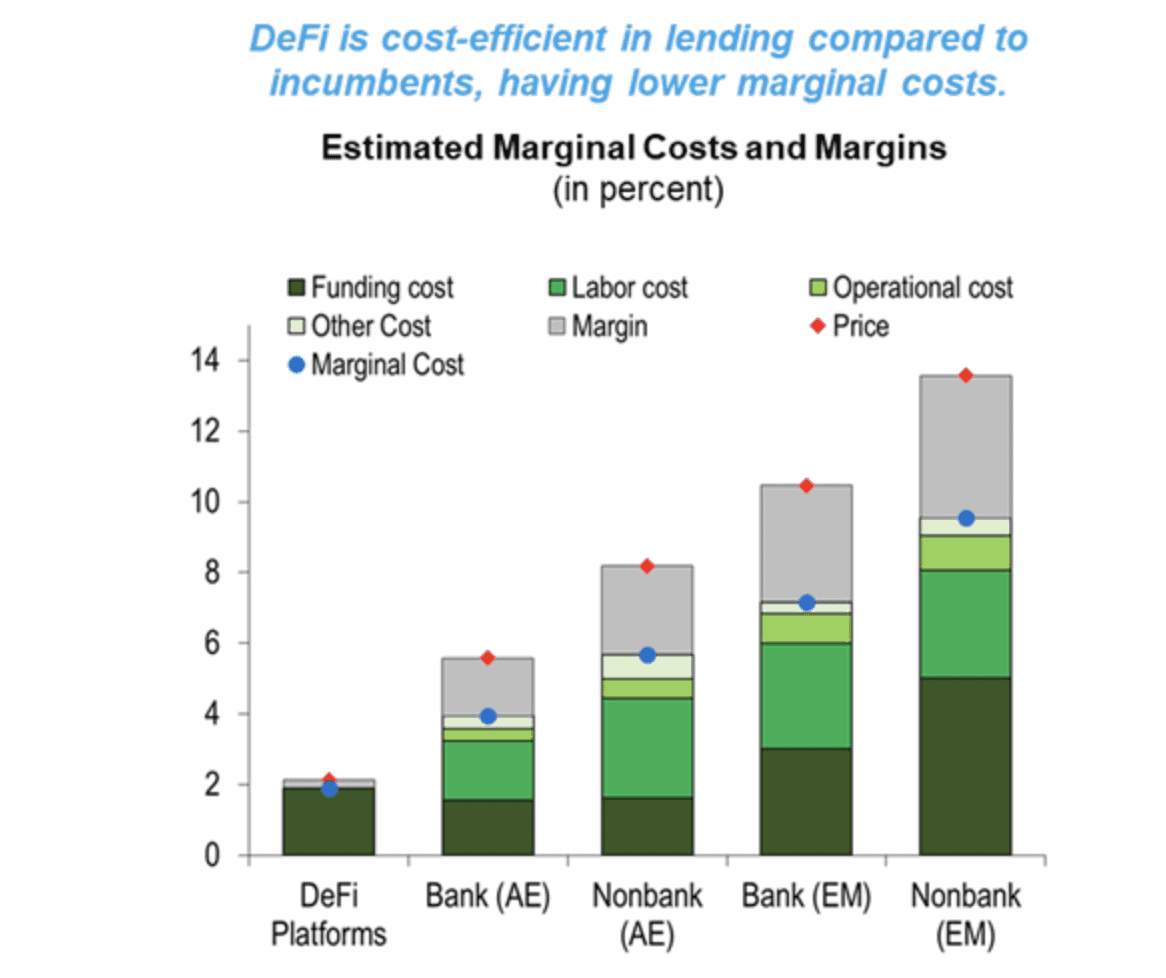

And it goes without saying that unlike banking systems and other traditional financial institutions, DeFi stands for cost savings with almost negligible margin, labor, and operational costs in play.

DeFi protocols and tools like Automated Market Makers, liquidity pools, and more allow for instantaneous transaction finality — something the TradFi realm has been missing for a while now. With RWA-backed tokens, it becomes possible to pair the advantages and accessibility of legacy real-world assets with the innovative aspects of DeFi.

How tokenized assets even work?

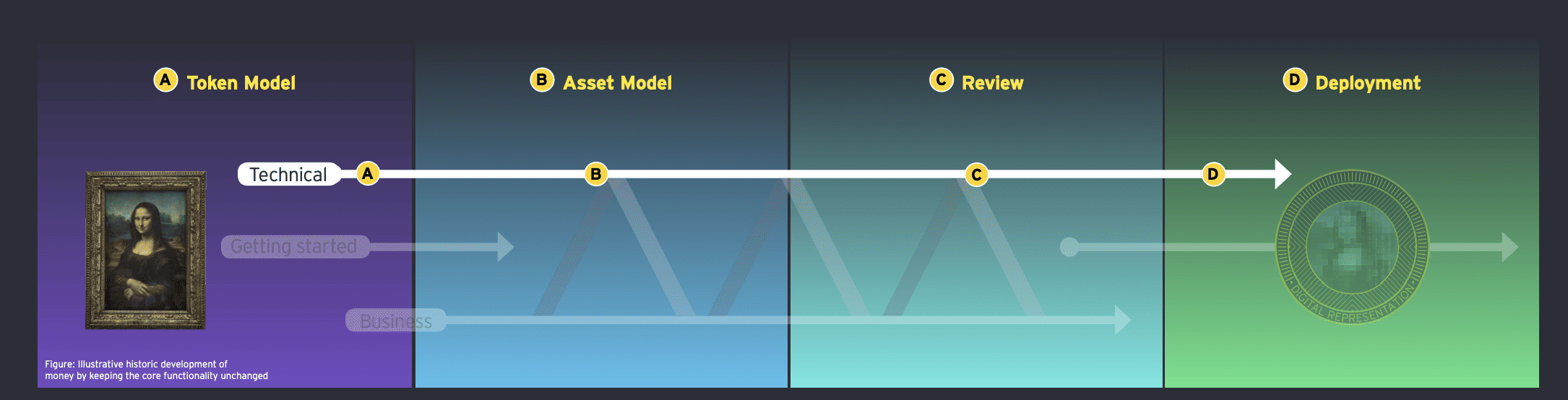

While we discussed how the tokenization process works, moving an actual real-world asset on-chain is much more technical. Here is an easier representation of how things actually work. The entire process can be segregated into three phases:

External asset legitimization

Also termed off-chain formalization, asset legitimization involves taking care of all the compliance-related, legal, and administrative processes. This helps validate the existence of the asset against which the tokens would be pegged.

Digital-physical integration

This segment involves encoding the financial and legal aspects of the token-based transactions into the tokens via smart contracts. These contracts are responsible for enforcing obligations, ensuring compliance, and handling ownership. This process is also called information bridging, and at this point, oracles sourcing off-chain data also come into the mix.

Also, at this point, choosing the model that will best represent your token is necessary. You can start with ERC-20 token standards or can consider the likes of ERC-721 for unique goods, ERC-3643 for securities and encoded compliance and regulatory considerations, ERC-2222 for dividend-bearing assets, ERC-4626 for yield-bearing assets, ERC-1400 for security tokens, and more.

In some cases, the token model is selected before off-chain asset formalization.

Tokenized asset market dynamics and management

This phase involves bringing the tokens to the market, all while setting the dynamics of demand and supply. At this point, the liquidity and valuation of the tokens are tested. Also, based on where the tokens are listed, it is necessary to ensure that they adhere to the Anti-Money Laundering (AML) and Know-your-Customer (KYC) regulations, if applicable.

Another way of understanding the process of tokenization or how a real-world asset token works is by looking at this flowchart:

How to create a real-world asset token: EY

Do note that bringing an RWA-backed token to the market involves a sophisticated blend of technical, legal, regulatory, and economic considerations.

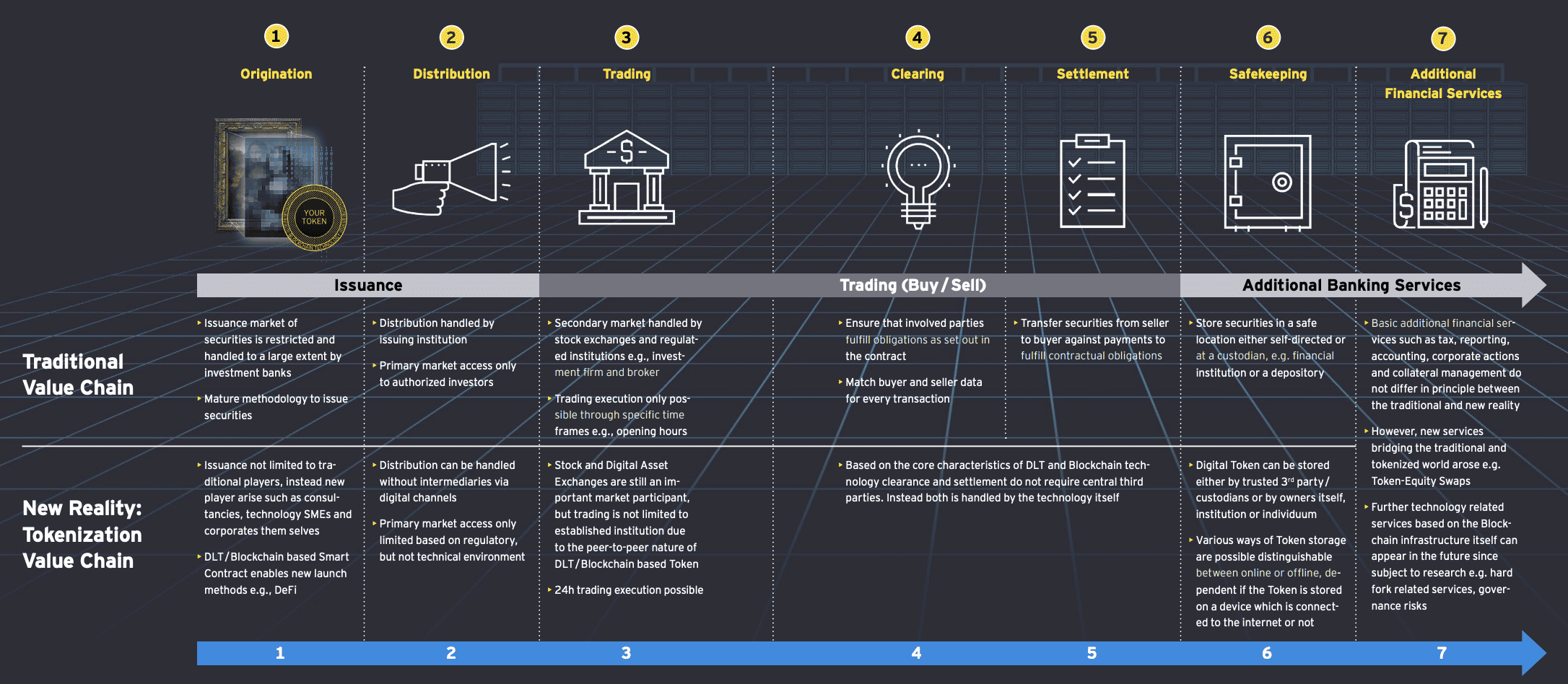

However, regardless of how sophisticated the process is, the entire flow starts with the idea to tokenize and moves all the way to safekeeping and infusion of additional financial services, if needed. And if that looks similar to a traditional value chain, the below infographic demonstrates the difference, all thanks to the elimination of the middlemen.

Types of RWA-backed tokens

While quite a few types of RWA-backed tokens exist, we shall now look at the most common types.

Real-estate tokens

These tokens represent fractional ownership in a real-estate-backed asset. The tokens can be pegged to land, commercial properties, or anything that you can think of. As the tokens are supposed to adhere to federal regulations, the token model needs to be selected carefully. These are also termed security tokens as they derive their value from another underlying asset.

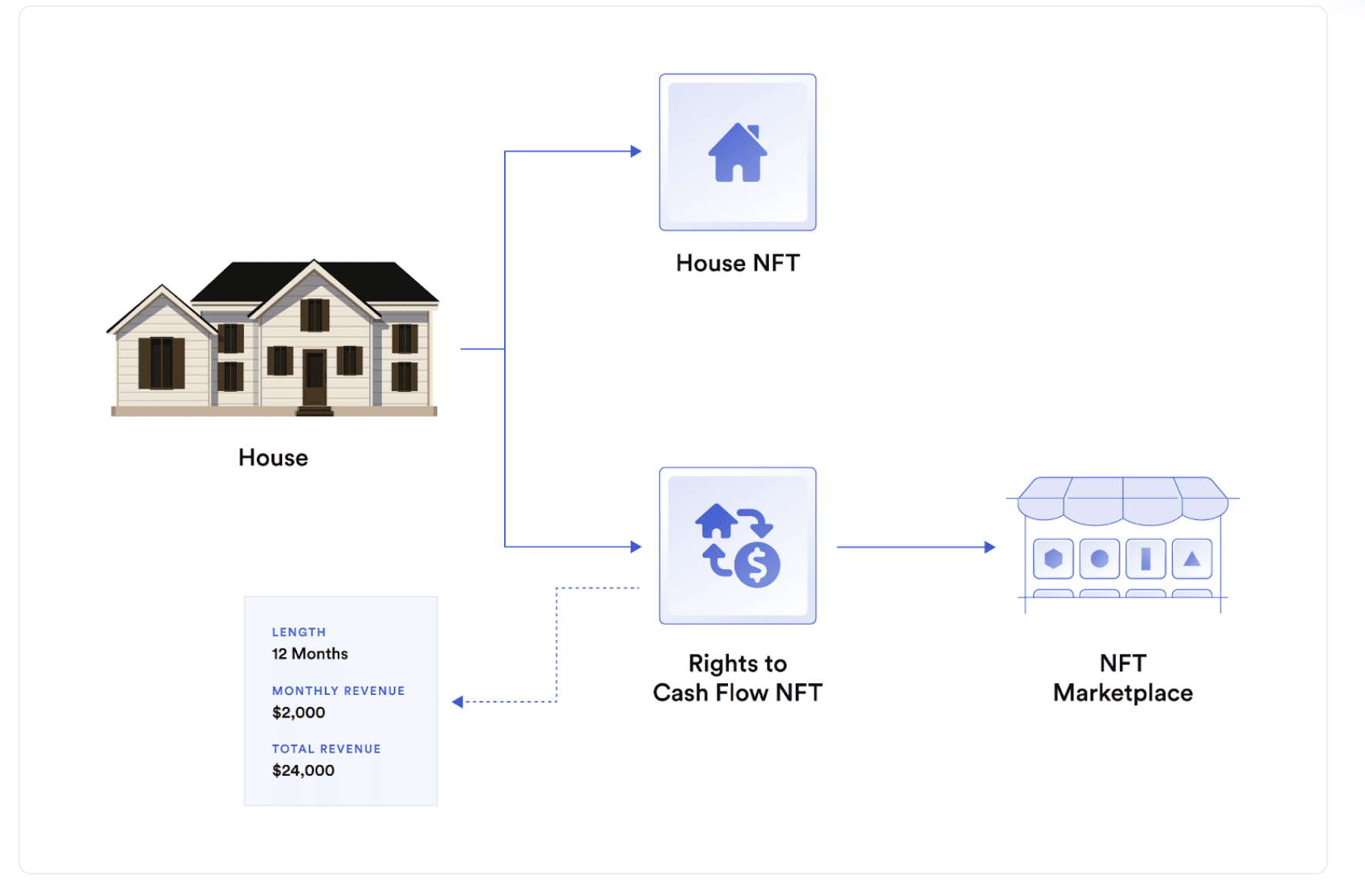

Real-estate tokenization comes with a wide range of possibilities. You can perceive real-estate tokens as NFTs —dynamic NFTs to ensure that they automatically update their data based on the housing conditions. Or, they can be mere fractions of a larger property, allowing regular users to get hold of something exclusive. Real-estate tokens can also be used to generate regular cash flow or passive income. Investors can lend or stake house-based NFTs to others for a rent-based income or royalty.

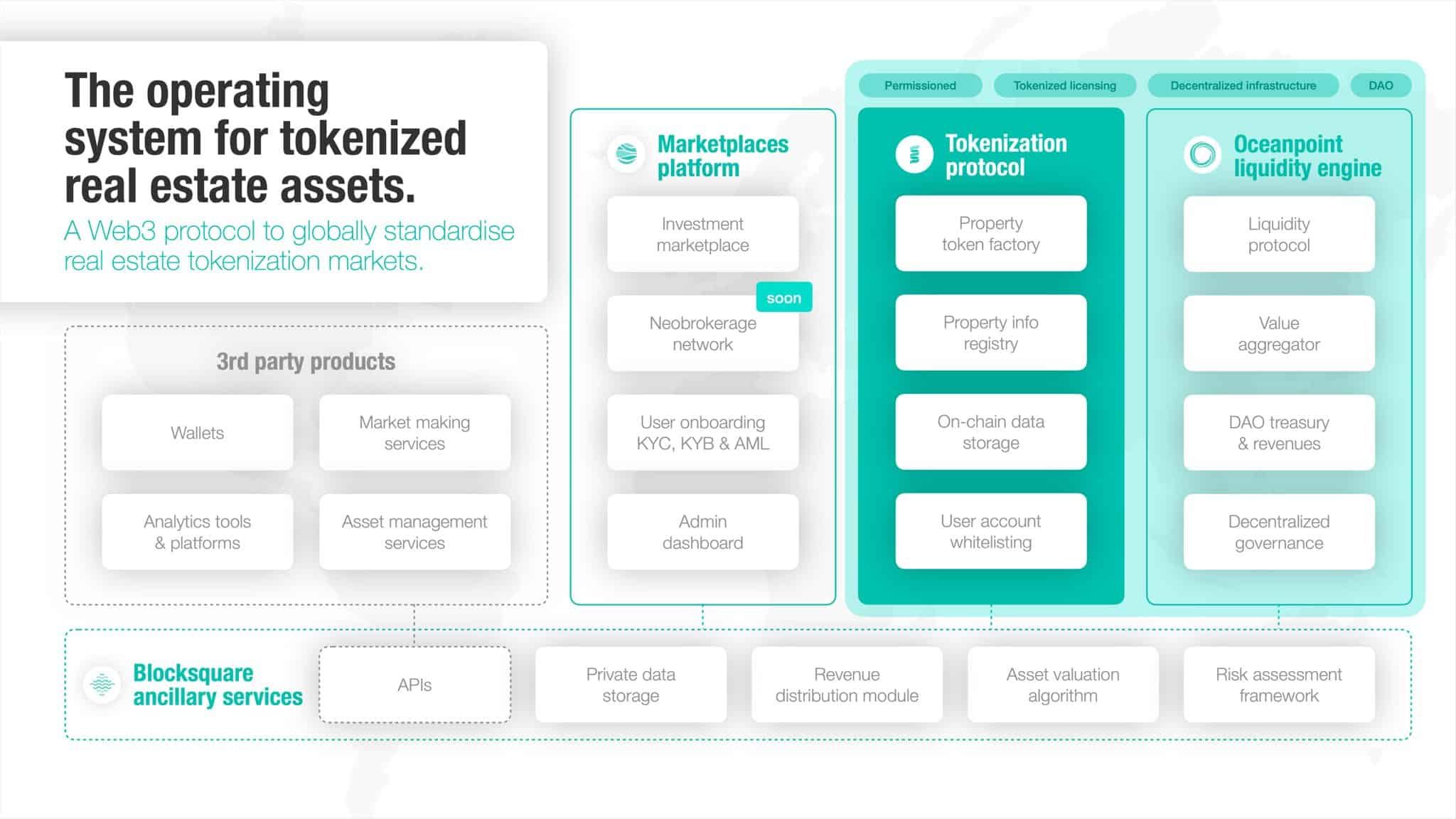

Here is a sneak peek into the operating system preferred for tokenizing real-estate assets:

These are mere possibilities. Real-estate tokens can have tons of other utilities, including lower costs, reduced instances of fraud, better discovery of prices, and more.

Art and collectible tokens

These tokens are linked to the collectible space. They can also be seen as utility tokens — because they are primarily associated with a product or a service. Several platforms, including Masterworks.io, have been actively tokenizing pieces of high-value artwork from the likes of Banksy, Warhol, and more — offering the flexibility of fractional investment to individuals.

Commodity tokens

If the asset baking the released tokens represent ownership in physical and tangible products, including gold, agricultural products, oil, or anything else, the tokens can be backed as commodity tokens. In some way, even stablecoins pegged to gold or even tangible fiat can be termed commodity tokens.

One of the latest examples of commodity tokens, or rather tokenization, is the HYFI blockchain tokenizing whisky fractions, allowing for round-the-clock trading across the globe.

Apart from the mentioned varieties, Central Bank Digital Currencies (CBDCs), despite being officially issued entities, can also be termed RWA-backed assets in a given capacity. While some might disagree, CBDCs are like a tokenized form of payment option, with Central Bank funds serving as the underlying asset.

Benefits of RWA-backed tokens

RWA-backed tokens come with a host of benefits, including:

- Improved liquidity as a large number of tokens is usually more accessible compared to a high-value tangible or intangible asset.

- Democratized investment with a heavy focus on liquidity and fractional ownership, which in turn allows a greater number of individuals to participate.

- Improved market efficiency with better pricing-related security and transparency followed by round-the-clock trading opportunities.

- Better traceability as blockchain’s immutability ensures that the records are free of disputes and fraud.

- Built-in compliance as specific legal requirements can be coded into the token itself, provided you choose the right token model and smart contracts.

- Programmability, as from the distribution of dividends and yields, everything can be transformed into a trustless affair.

- Lower costs and entry barriers as tokenization aims to eliminate brokers and middlemen.

There are also a number of other secondary and tertiary benefits of pushing traditional assets on the blockchain and tokenizing them.

RWA-backed tokens: use-cases

A real-world asset token comes with a host of use cases, with a few mentioned as follows:

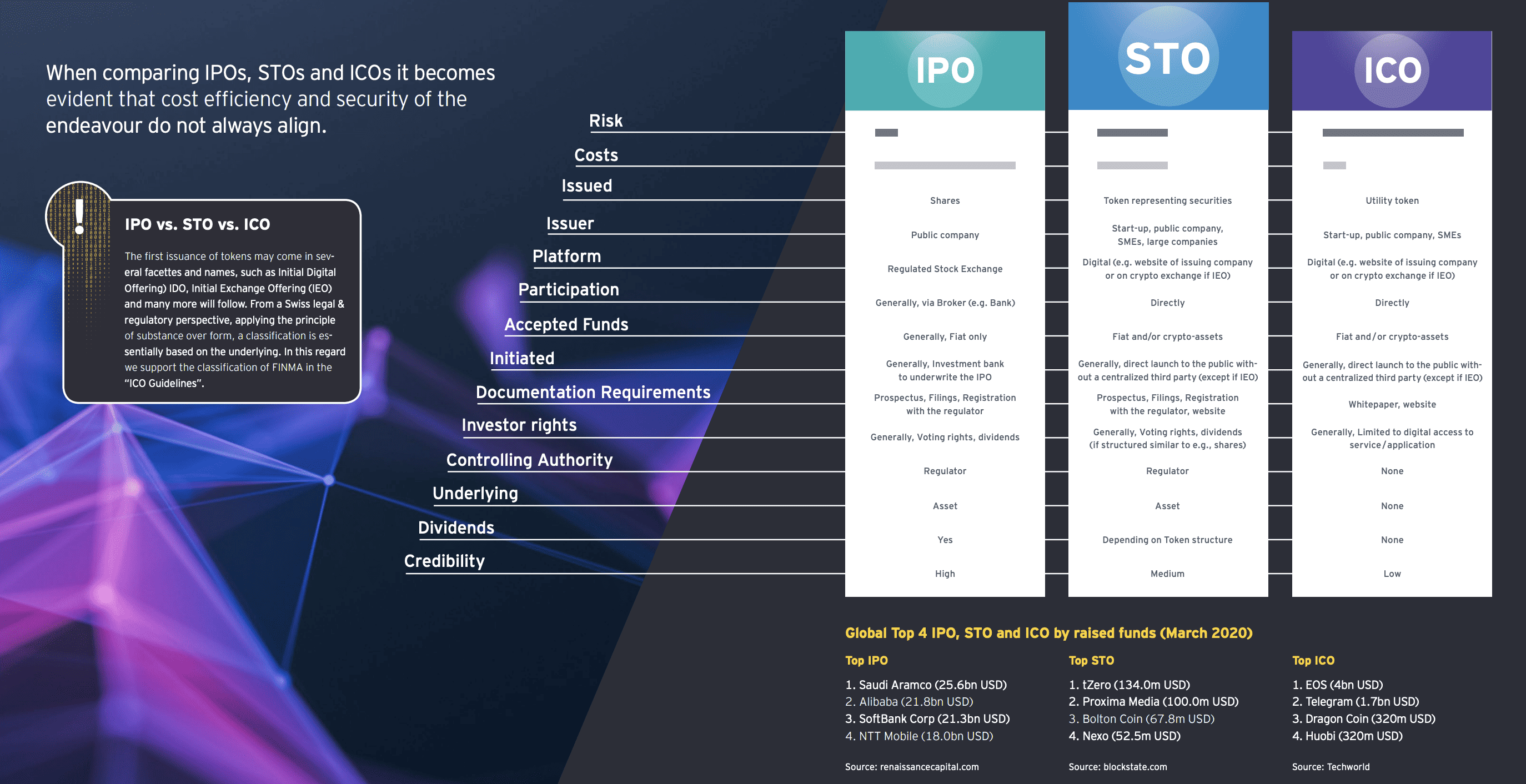

- Fundraising, mostly in the form of an STO or Security Token Offering, allows investors to enjoy the perks of liquidity and fractional investing.

Here is how standard ICOs and IPOs fare against STOs, considering factors like risk, costs and credibility.

- Real-estate investments focusing on fractional entries reduce the barrier for small-time investors.

- Easier access to fine arts and collectibles

- Supply chain financing with RWA tokens unlocks the value stuck within organization supply chains and gives firms access to working capital.

- Debt tokenization with the focus on tokenizing the rights associated with debt instruments like loans, any mortgage-backed security, or more — moving the same to blockchain and turning them into tradable assets.

- Commodity tokenization, where assets like oil, gold, and other tangible entities can be tokenized.

- Tokenization of payment options in the form of CBDCs and stablecoins.

- A better way to offer and sell fractions of intellectual property rights, making life easier and better for content creators.

- Tokenization of the insurance space, making policies more accessible and cost-effective.

- A better way to fund infrastructure-based projects, allowing passive income-generating investments.

- Tokenization of venture capital portfolios, allowing investors to purchase stakes in startup firms.

- Opening up new royalty streams for NFT artists, courtesy of programmed utility tokens.

Here is a thread explaining which companies are best equipped to initiate an STO:

RWA-backed tokens as a DeFi gamechanger

One of the major reasons why RWA-backed tokens are gaining popularity is that they are expected to render DeFI functional and compatible even with external markets. The driving force is the belief that in the long term, DeFi will unveil market efficiencies and unique opportunities to these asset holders — something that is amiss in TradFi.

Let us understand the scope of RWA-backed tokens in the DeFi space better and why the same could be a potential gamechanger in the years to come:

Firstly, RWA-backed tokens can help with collateral diversifications, stealing some limelight from more volatile cryptos. This would mean that, in time, DeFi participants might be able to use debt instruments, real estate, and even commodities as collateral for indulging in a diverse range of DeFi activities.

Did you know? MakerDAO partnered with New Silver in 2021 to mint real-estate-backed DROP tokens, allowing holders to use them as collateral to mint DAI — MakerDAO’s native stablecoin.

While this is just one example, the bridge between RWA-backed tokens and DeFi is expected to unlock massive liquidity by boosting up the TVL of the supporting DeFi protocols. Plus, the focus is also on promoting financial inclusion, allowing those most familiar with TradFi to explore the middlemen-free features of decentralized finance.

Challenges of RWA-backed tokenization

Despite being one of the more forward-looking concepts, RWA-backed tokens do come with their share of risks and challenges. These include:

- Legal and regulatory challenges

- Complexities related to asset verification and due diligence

- Asset-token linking concerns via the right kind of information bridging

- Asset and custody management, which primarily happens off-chain

- Standardization of the procedure

- Subpar market adoption

We expect these challenges to fizzle out over time once adoption picks up.

Top RWA-backed tokenization platforms

Several market participants have willingly onboarded the RWA-backed token bandwagon, allowing seamless bridging of TradFi and DeFi. Here are some of the most prominent names in the given space:

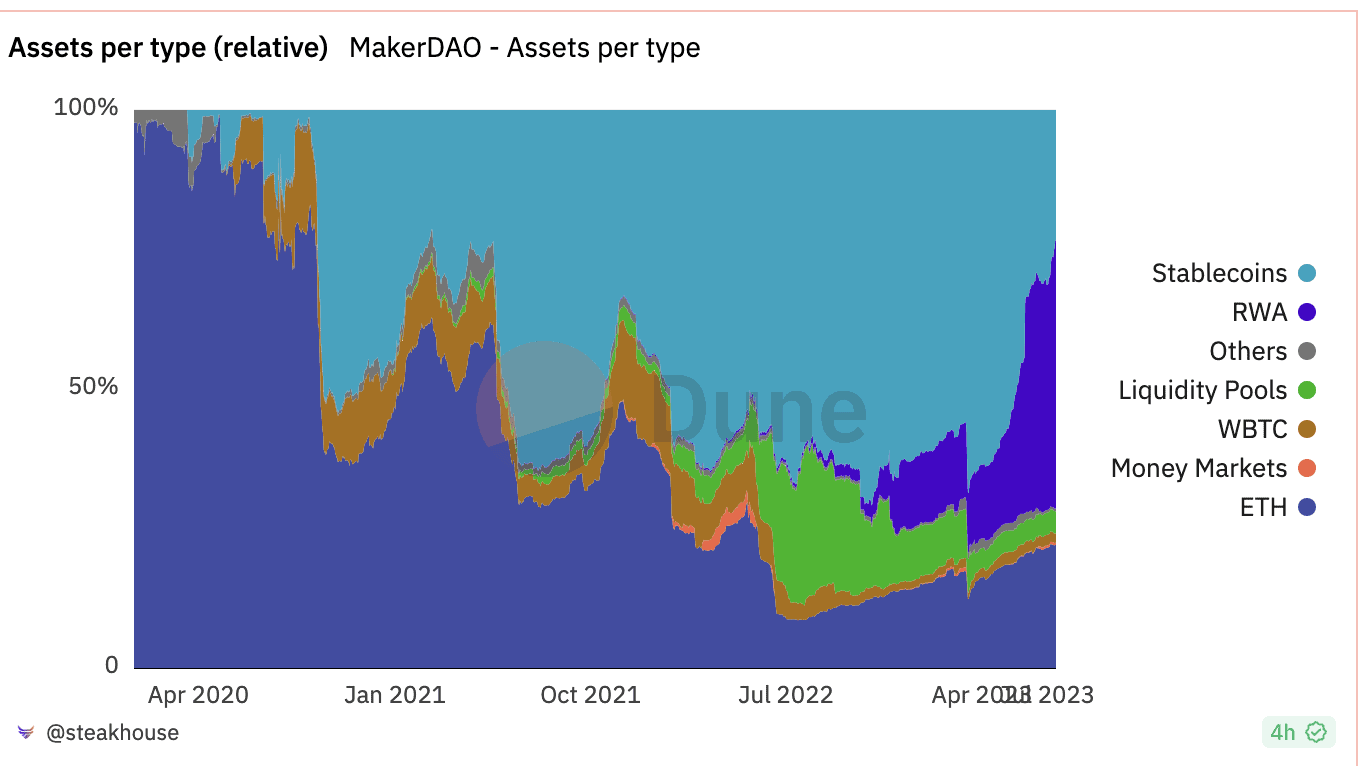

MakerDAO

Essentially a debt platform sitting atop Ethereum, MakerDAO has been like an early RWA adopter. If you scroll up, you can see how it partnered with New Silver to ensure that real estate can be used to mint DAI tokens. MakerDAO has specific vaults powered by smart contracts.

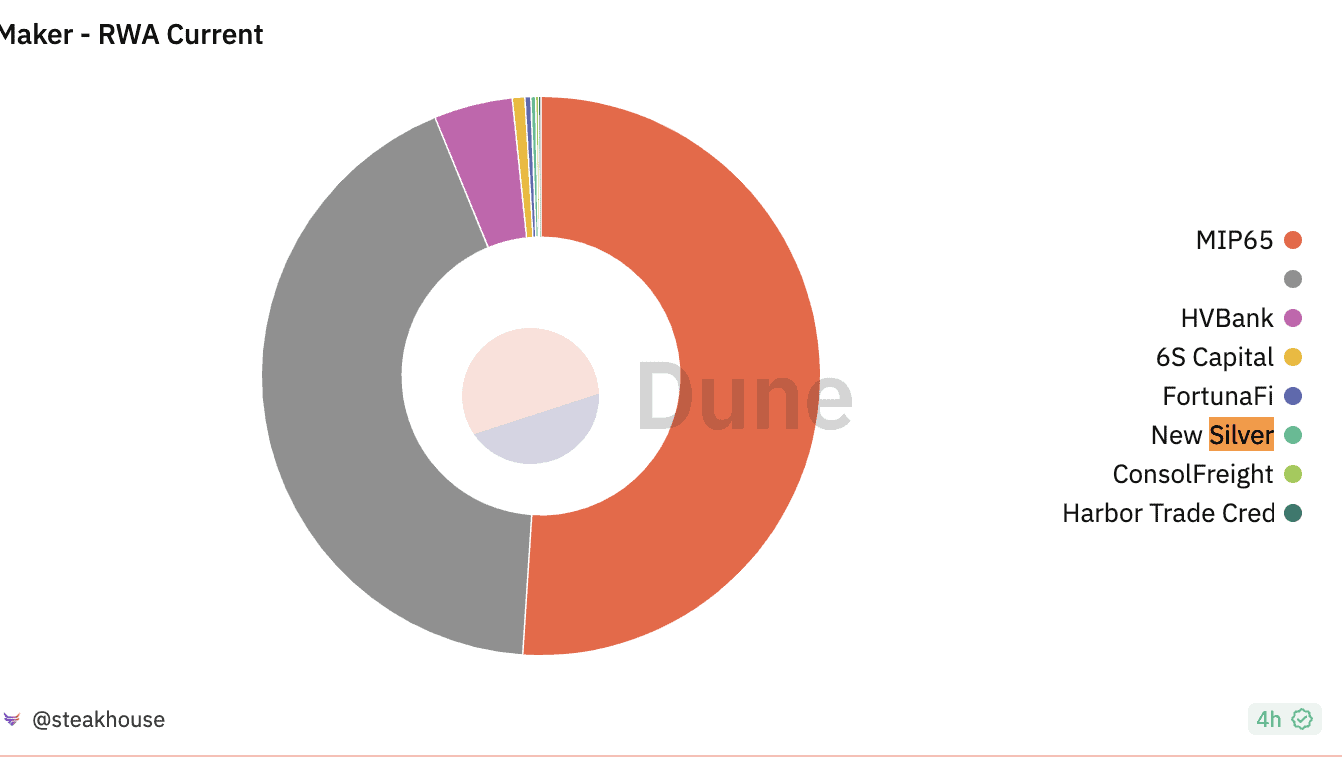

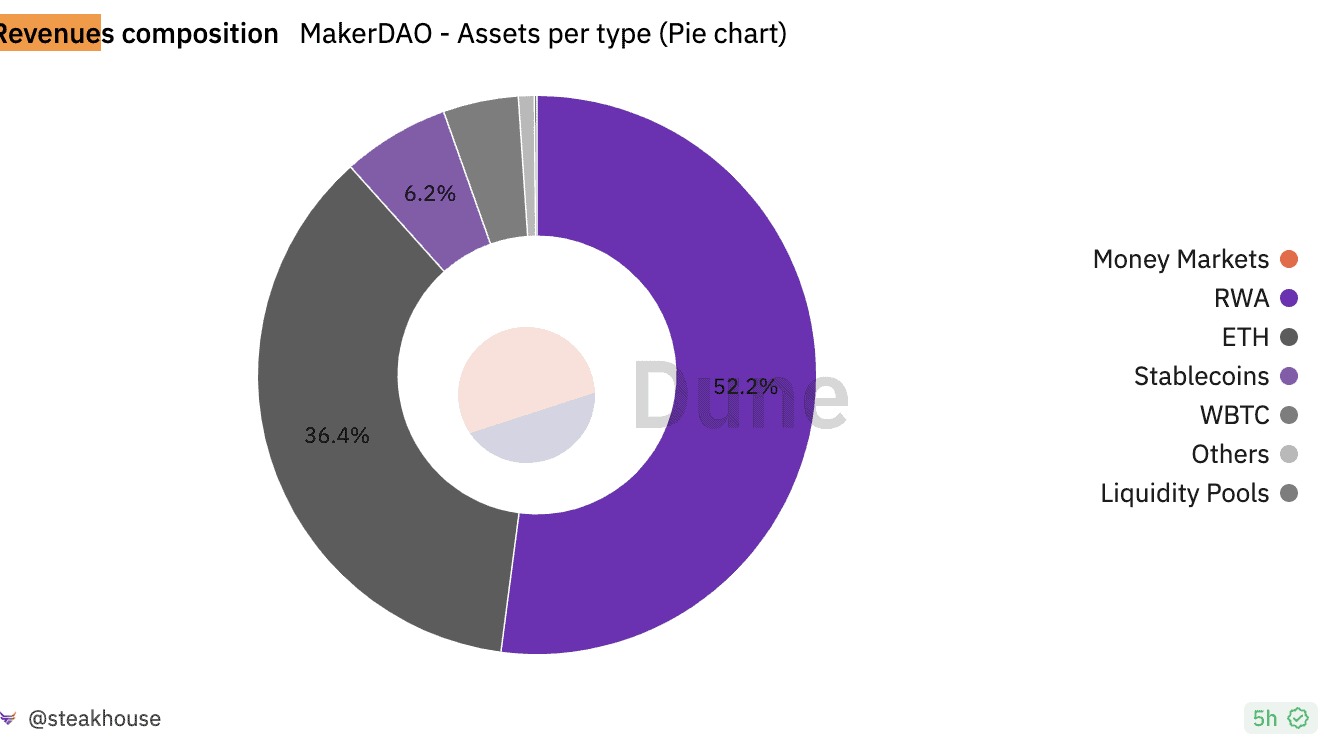

Here is a chart showing that a massive chunk of MakerDAO’s asset base comprises RWA tokens.

If you delve deeper into the vaults, a number of RWA players on MakerDAO are contributing to the size of the vaults.

Also, if you look at MakerDAO’s revenue composition, RWA-backed tokens comprise more than half of the same.

Goldfinch

This protocol assists businesses in accessing DeFi features like crypto lending without having to supply crypto collateral. Any business can hop onto Goldfinch and acquire crypto loans. The protocol has a unique approach to vetting businesses, courtesy of a chain of auditors.

Centrifuge

Centrifuge, without a doubt, is one of the leading RWA-backed token players, connecting TradFi and DeFi seamlessly. Here is how Centrifuge works:

Imagine you can invest in assets like invoices, housing loans, and even houses via the internet, using crypto-specific avenues. This is where Centrifuge is handy, working as a bank (not that centralized, though) and allowing users to access crypto loans using real-world assets.

Centrifuge even allows TradFi users to explore the high-risk, high-yield benefits of DeFi, courtesy of a feature called tranching. This is where users can choose their level of risk and the subsequent rewards, to invest and work with crypto using real-world assets.

Maple

Here comes a borrowing-lending protocol that focuses on uncollateralized dealings. Maple has pool delegates instead of Goldfinch’s community-focused vetting support, allowing the protocol to validate the creditworthiness of people interested in using RWA-backed tokens to get crypto loans.

If you delve deeper into how Maple Finance even works, you will see the involvement of multiple parties involving Institutional borrowers, pool delegates, and lenders. And as a credit market protocol, Maple Finance even promises APYs up to 8.31% for select lenders.

Ondo Finance

Ondo Finance is yet another public credit player in the RWA-backed token space. It aims to bring institutional-grade and real-world financial products to the DeFi world via “Fund tokens” — Ondo Finance’s version of real-world asset tokens.

Ondo boasts several products, including the OUSG (a short-term U.S. government fund), OHYG (a high-yield corporate bond fund), and more. Ondo tokenizes assets like these, labels them as fund tokens, and allows users to buy, sell, and trade the same once the AML and KYC processes are over. You can use these fund tokens across DeFi protocols for staking, earning yields, and more.

Apart from the mentioned platforms, other popular RWA players in the space include the likes of STASIS, which deals in tokenized fiat, RealityBits, which deals in tokenized real estate; and Harbor, which offers a wide range of assets.

As for the top RWA tokens, the following names are considered established:

- DROP and TIN tokens from Centrifuge

- CFG tokens that are native to Centrifuge

- RealT Tokens, which adhere to the ERC-20 standards

- MakerDAO DAI

- Blockchain Capital’s BCAP tokens

- Blocksquare’s BST

While these are some of the top RWA tokens, you can even consider the native tokens of the RWA platforms, including TrueFi’s TRU, Goldfinch’s GFI, and more, as part of the analysis.

The modern-day RWA-backed token ecosystem

In 2023, the RWA-backed token ecosystem primarily comprises equity-based, real-asset-based, and fixed-income-based players across the DeFi markets. Per the nomenclature, equity-based DeFi markets deal in company stocks and other intangible yet real-world financial resources. Real-asset-based DeFi markets mainly deal in collectibles, real estate, and commodities. Synthetix and Backed Finance are the leading players in this category.

As for the fixed-income DeFi markets, any bond, treasury bill, or TradFi asset qualifies for collateral, allowing you to use the same in a “tokenized” form. The markets include private and public credit players like Centrifuge, Ondo, and GoldFinch.

Key RWA trends and the future

What does the future hold for real-world assets and tokenization? Here are the key RWA trends to look forward to.

The emergence of custodians

Even though blockchain will keep intermediaries out, there might be a surge in the number of custodians. This would involve taking care of the physical, real-world assets.

Increased diversification

Over time, we expect other asset classes to come into the RWA-backed space. While fine art, precious metals, and more are already there, the tokenization of whisky fractions, for example, is a step toward novelty.

Growth of layer-1 chains

Most of the RWA protocols are built atop permissionless L1 chains. However, it is a matter of time that dedicated layer one solutions with built-in KYC solutions. There will be several permissioned layer-1 solutions in focus, including the likes of Avalanche-based Inatian Markets.

These are some of the key trends. Over time, we also expect to see advances in identity verification, data security and transparency, and highly improved legal frameworks for tokenization needs.

For tracking other tokenization trends through 2030, check this tweet out:

The road ahead for your real-world asset token

Tokenization offers a fresh perspective regarding interacting with traditional finance and asset classes in a pro-crypto space. It readily bridges the gap between DeFi and TradFi by moving traditional assets on the blockchain. That said, anyone looking to launch their own real-world asset token should consider compliance, evolving market trends, interoperability, risk management, reputable partnerships, and trustless enforcement. All of these factors are crucial for redefining business models and aligning them with the decentralized world.