Crypto is a narrative-driven market. One narrative that has captured the attention of Crypto Twitter and social media is that of ERC-404 hybrid tokens. But what are they, and how do they work? Find the answers to these questions and more in this comprehensive ERC-404 token guide. Here’s what you need to know about the innovative (yet unofficial) Ethereum token standard.

KEY TAKEAWAYS

► ERC-404 tokens blend fungibility and non-fungibility, combining ERC-20 and ERC-721 features to improve NFT liquidity and enable fractional ownership.

► The standard allows NFTs to be traded on decentralized exchanges, bypassing traditional auctions and enhancing price discovery and market access.

► Developed without an official Ethereum Improvement Proposal (EIP), ERC-404 tokens lack formal audit processes, which presents security risks.

► The ERC-404 sparked renewed interest in NFTs by offering a hybrid approach that could support broader web3 adoption and improve NFT functionality.

What is ERC-404?

Tokenization is an important tool for managing digital assets within the Ethereum ecosystem. Typically, this splits into two main types: fungible and non-fungible tokens (NFTs). Fungible tokens, which usually follow the ERC-20 standard, ensure each asset unit is the same as the next. This makes the ERC-20 a straightforward and efficient method for dealing with fungible assets.

On the contrary, non-fungible tokens of the ERC-721 and ERC-1155 standards are all about uniqueness. They enable users to identify digital assets individually based on their distinct characteristics.

The crypto community saw the birth of ERC-404 on the Ethereum blockchain in early February 2024. ERC-404 is a token standard that merges the fungibility of ERC-20 with the distinctiveness of ERC-721 NFTs.

The brains behind this cutting-edge token standard are two enigmatic figures known as “ctrl” and “Acme.” The pair fast-tracked the development of ERC-404, motivated by previous experience with a project that promised similar features but failed to meet expectations.

Let me start by saying that the concept behind $EMERALD itself has immense potential and I really wanted to find an opportunity to not only somehow save our immensely down bad bags but also help this guy realize what he had even made, because he has no clue…

At this point I just want to find a way to separate this bozo from the idea he somehow stumbled upon and fumbled so we resolve that my team would handle the actual work and he’d just sit and wait. So we say we’ll do everything and give people a safe contract for free.

Ctrl: X (formerly Twitter)

How do ERC-404 tokens work?

ERC-404 tokens merge the best aspects of fungible and non-fungible tokens into a streamlined solution. Within an ERC-404 contract, an NFT and a fungible token are generated together in a predetermined ratio, tying their destinies together.

The connection between the NFTs and tokens is deep and unbreakable. To put it simply, owning one token “x” means also owning its corresponding “x” NFT.

Acquiring an NFT automatically grants the owner the related token. Conversely, selling the token also means the associated NFT is transferred. Thus, transferring the NFT away means the original token moves to the new owner’s address. Here is a step-by-step example of how it works.

- Person A purchases one token from Person B.

- As a result, Person A is credited one token, and one NFT is sent to them by the contract.

- Concurrently, Person B’s balance decreases by one token and their corresponding NFT.

- Following that, Person A decides to sell half of their token (0.5) to Person C:

- Person C is then allocated half of a token.

- Person A retains the remaining half token.

Steps five and six are where things get interesting. Because NFTs are unique and non-fungible, how does someone send 0.5 units of an NFT? This logic is left entirely up to the deployer of the ERC-404 contract.

Note that this scenario also leaves room to create fractional NFTs.

Changes in the ERC-404 implementation

The latest version of the ERC-404 standard introduces a refined mechanism for managing the relationship between tokens and their associated NFTs. As stated previously, the standard was somewhat rushed. The current process for transferring ERC-20 tokens has been streamlined.

Specifically, when you transfer a certain amount of ERC-20 tokens, the equivalent number of ERC-721 tokens in your possession are directly transferred to the recipient. This eliminates the previous requirement to burn and re-mint ERC-721 tokens, making the process more straightforward and gas-efficient.

The handling of ERC-721 token IDs has also been optimized. Instead of continuously increasing the ID numbers, they are now recycled and reused in a FIFO (First In, First Out) manner. This change ensures a consistent and predictable lineup of NFT token IDs, mirroring the behavior seen in standard NFT collections.

Finally, the update has improved transaction transparency through the emission of predictable events. These events clearly indicate the actions performed, whether they pertain to ERC-20 or ERC-721 tokens, enhancing clarity and traceability for all operations within the standard.

How does ERC-404 differ from ERC-20 tokens?

ERC-404 and ERC-20 tokens differ in scope and utility. In reality, an ERC-404 is just a smart contract that generates an ERC-20 contract and a complementary ERC-721 contract.

On the contrary, the ERC-20 creates tokens and some logic for maintaining a ledger for said tokens. The major differences between the two can be found in the NFTs. The hybrid token concept allows NFTs to trade on NFT and token markets. In other words, ERC-404 can trade on marketplaces like Uniswap and OpenSea. Additionally, ERC-404s allow for native fractionalization of NFTs.

ERC-20 tokens trade on decentralized exchanges like Uniswap, while ERC-721 typically trade on OpenSea and similar platforms. The ERC-404 combines the best of both worlds, which allows for a better developer experience.

History of hybrid tokens

The evolution of the ERC-404 standard marked a notable shift in the realm of digital tokens, beginning with the launch of $PANDORA. This groundbreaking project combined NFT boxes of various colors with the PANDORA token, rapidly achieving a market cap exceeding $100 million since its inception by the pseudonymous duo “ctrl” and “Acme” in early 2024.

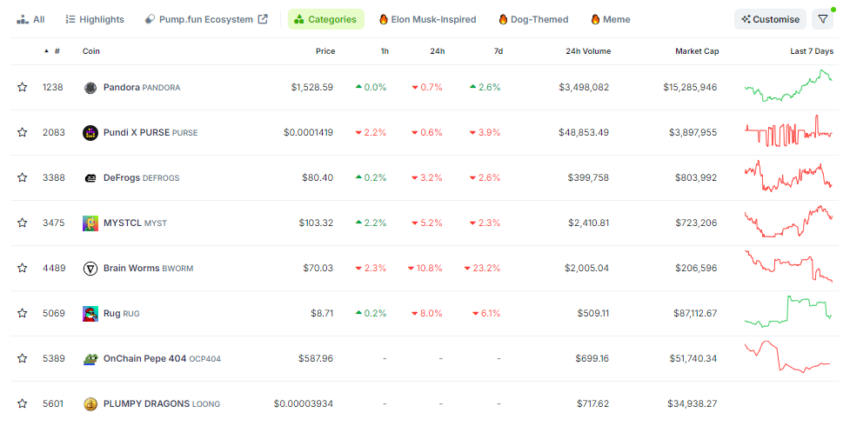

The landscape further expanded with the emergence of new ventures such as Defrogs, Rug, and Monarch, all tapping into the potential of hybrid token technology.

Yet, it’s crucial to note that ERC-404 didn’t pioneer the concept of hybrid tokens. Various attempts have been made to blend token functionalities, each contributing to the ongoing evolution of token standards.

Among these precursors, ERC-3525 introduced a model for semi-fungible tokens, revolutionizing transfer and approval methods to suit their semi-fungible nature. It distinguished itself by decoupling a token’s value from an address, instead associating it directly with a token owned by an address.

In early February 2024, an amateur developer known as Serec Thunderson created a unique token named EMERALD, setting the stage for the ERC-404. Despite EMERALD’s downfall due to a critical flaw, it sparked interest among other developers who polished the idea into what became ERC-404 at the month’s start.

Benefits of ERC-404

Incorporating ERC-404 tokens into a project introduces a significant enhancement, especially in terms of liquidity and market dynamics, as seen by the launch of $PANDORA.

Incorporating ERC-404 tokens solves many challenges with limited NFT liquidity and market access. Traditional NFTs usually require auctions for sales, which can be slow and unpredictable.

By contrast, ERC-404 tokens enable the creation of liquidity pools for NFTs. This means NFTs can be bought and sold instantly, similar to trading regular crypto tokens, without the delays or uncertainties of auctions.

Here are a few of the challenges that ERC-404 solves:

- Barriers for sellers:Traditional auctions are a gamble—if few buyers show up, sellers may get low bids or fail to sell at all. ERC-404 liquidity pools let sellers exchange tokens instantly, giving more control over sales.

- Barriers for buyers: Auctions limit participation since only interested buyers who are aware of the auction and willing to wait can join. Liquidity pools open up the market, making it accessible to anyone ready to buy.

- Price discovery: Auctions can set prices, but often inefficiently, especially with few buyers. With ERC-404 liquidity pools, NFT values adjust in real-time, giving a clearer, fairer market price.

What are the risks and limitations of ERC-404?

ERC-404 tokens attract their fair share of critics. Some criticisms are aimed at the current hype, others at the token itself. Due to the informal standard and rush to production, many have hypothesized a coming wave of fake projects, rug pulls, and other malicious behavior.

In other words, many projects will behave unintendedly, and some may rush into a project unaware of how it should work because ERC-404 tokens are not standardized.

Another criticism is aimed at the use of token signatures in the smart contract. Specifically, when someone purchases a token, an NFT is transferred with it. If you transfer 0.5 units of a token, for example, you do not receive an NFT.

However, if you acquire enough units that equal a single token, then an NFT is minted. This could potentially lead to some instances where users can “steal” NFTs when an ERC-404 token is deposited into a protocol.

What are the top ERC-404 projects?

1. Pandora

Pandora is the inaugural project to utilize ERC-404 tokens. It uniquely combines NFT boxes in various colors with the PANDORA token itself. Since its introduction, PANDORA has witnessed remarkable growth.

Reaching a market cap. of over $250 million, it has since settled to just above $150 million. It was crafted by pseudonymous developers “ctrl” and “Acme.”

2. DeFrogs

DeFrogs is the second most popular token that uses a slight modification of the ERC-404 token implementation. It features a collection of 10,000 tokens with PEPE-inspired memes.

The market cap is currently above $6 million, and the project has a maximum supply of 10,000 tokens. You can find DEFROGS listed on marketplaces like Uniswap and OpenSea.

3. Pundi X

Pundi X provides blockchain-based payment solutions for brick-and-mortar businesses through its proprietary XPOS system to enable crypto transactions.

This platform allows stores to accept cryptocurrency and fiat payments, use loyalty programs, and manage customer interactions. Pundi X’s adoption of the ERC-404 token standard is primarily aimed at creating versatility for its PURSE tokens by blending features of both fungible and non-fungible tokens.

Why the hype over ERC-404 tokens?

As stated previously, ERC-404 is solving a liquidity problem inherent to NFTs — illiquid markets. Naturally, such an innovation is bound to draw a few eyes and copycats, too. As a result, many projects have forked or built upon this idea altogether.

However, ERC-404s have also drawn some attention due to the fact that they are not actual ERCs. You can not find the ERC-404 standard in the official registry for Ethereum proposals.

Throughout its life cycle, an EIP must be clearly and thoroughly documented, including its motivation, specification, rationale, and, if applicable, technical implementation details. The process is designed to ensure that any changes to the Ethereum protocol are carefully considered, widely discussed, and agreed upon by the community.

An ERC, which stands for Ethereum Request for Comment, is a type of standardization document within the Ethereum ecosystem that outlines specific rules issuing changes on the Ethereum blockchain.

These standards are proposed by members of the Ethereum community through the Ethereum Improvement Proposal (EIP) process. Once a proposal gains enough support, it can be adopted as an ERC.

ERCs serve various purposes, including defining new token standards, specifying new functionality, or proposing improvements to the Ethereum platform.

Unlike standard Ethereum tokens that follow formal Ethereum Improvement Proposals (EIPs), ERC-404s have been introduced without undergoing the official EIP process. This means they haven’t been subject to the same scrutiny, including audits, that official standards receive.

Because they are not official ERCs, it’s crucial for users to approach ERC-404 tokens with an added layer of caution.

The future of ERC-404 tokens and hybrid token standards

As the ERC-404 is still rather new, there are still opportunities to improve. Given some time, it could have the potential to bring some newfound interest in crypto. Hybrid tokens, such as the ERC-404, are simply another innovation with the potential to improve the web3 experience.

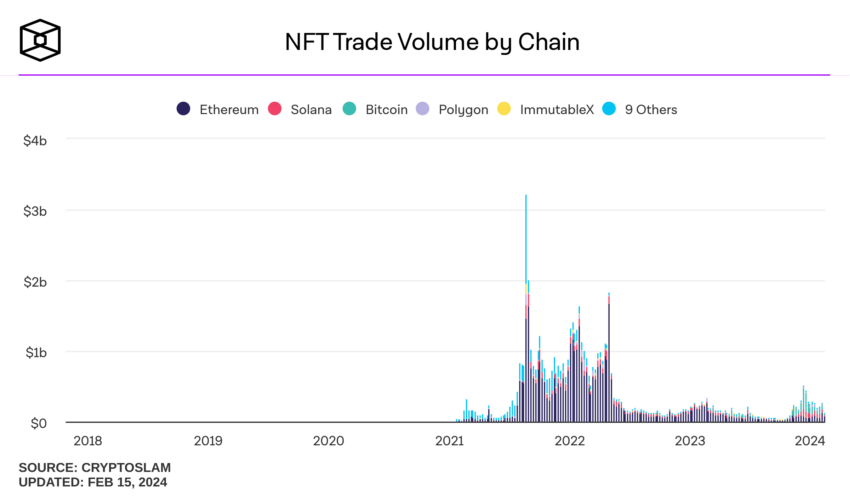

In addition to the difficult web3 experience, NFTs have also faced a decline in transaction volume since the highs of the 2021 bull market. Taking into account further criticism of NFTs and a lack of actual utility in the vast majority, one could see this particular sector as the underdog of web3.

However, the ERC-404 shows that there are still developers who believe in this sector. The hybrid token model stands to create a new experience that could potentially bring in further use cases down the line.

All eyes on NFTs again?

Thanks to ERC-404 tokens, early 2024 saw all eyes back on NFTs yet again. This hybrid token standard emerged as a rapid catalyst for new projects and improvements, kicking off the year with an innovation-driven bang. Whether this momentum will continue in the long term — and lead to new capital searching for a home in web3 — remains to be seen. However, with the ice of crypto winter seemingly thawed, ERC-404 tokens could be one element of a longer term kickstart for an NFT revival.

Disclaimer: This article is for informational purposes only and should not be considered investment advice.

Frequently asked questions

ERC-404 tokens are a hybrid token standard on the Ethereum blockchain. They blend the characteristics of fungible and non-fungible tokens (NFTs). However, despite their name suggesting an Ethereum Improvement Proposal (EIP) lineage, ERC-404s were developed outside the official EIP process.

The ERC-404 token standard was created by the pseudonymous developers known as “ctrl” and “Acme.” This standard, which did not follow the formal Ethereum Improvement Proposal (EIP) process, combines the fungibility of ERC-20 tokens with the uniqueness of ERC-721 NFTs. The original concept for the hybrid token was developed from the failed EMERALD project.

Hybrid tokens, such as ERC-404s, address several key issues. Firstly, they tackle the liquidity challenges faced by NFT collections that rely on auction-based trading. Additionally, they offer a more flexible and accessible market structure. This blend of fungibility and uniqueness in ERC-404 tokens ties the features of ERC-20 and ERC-721 tokens.

Within the Ethereum ecosystem, an ERC, or Ethereum Request for Comment, is a sort of standards document that describes guidelines for publishing modifications on the Ethereum network. This includes application-level conventions and standards. ERCs are not exclusively related to tokens. Contract standards like name registries, URI schemes, library/package formats, and wallet formats might all fall under this category.

The most popular ERC standard is arguably the ERC-20 token standard. The ERC-20 is a smart contract that allows for the simple creation, deployment, and maintenance of logic when creating new tokens. This allows for easy integration of tokens into decentralized exchanges, transfers, and wallet implementation for developers.

While ERC standards are not exclusive to token creation, there are a few ERC token standards that have become very popular. The ERC-20, ERC-721, and ERC-1155 are some of the most widely used token standards. The ERC-20 creates fungible tokens, while the ERC-721 and ERC-1155 create non-fungible tokens.

The ERC-20 token is a fungible token. This means that these tokens are interchangeable with one another. In the same way that you can pay a tab using a dollar, $5, or a $20 bill, you can use each ERC-20 token unit interchangeably. With non-fungible tokens, the individual token units are unique and do not hold equal properties; therefore, they are not interchangeable.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.