Nexo is one of the few crypto lending platforms that has withstood multiple crypto winters. In this comprehensive Nexo review, we explore the platform’s mechanics. Here’s what you need to know about the crypto lending heavyweight in 2025.

KEY TAKEAWAYS

• Nexo is a leading platform dealing with crypto borrowing and lending.

• The trading platform provides a range of features, including spot and futures trading, margin trading, and crypto loans.

• Nexo excels in user experience and security but it lacks a proof of reserves, which offers transparency.

• The platform is globally available, but it faces regulatory restrictions in certain regions where it has ceased operations.

Nexo at a glance: Our overall rating

Nexo has stood the test of time and market conditions and is clearly a resilient platform. However, the company could do more to provide transparency and assurance of its financial standing.

| Criteria | Assets | Rates | Features | Security | User experience | BeInCrypto score |

|---|---|---|---|---|---|---|

| Score | 4/5 | 4/5 | 5/5 | 3/5 | 4/5 | 4 |

What is Nexo?

Nexo is a platform popular for its crypto-backed loans that allow users to access cash without selling their cryptocurrency assets. Users can deposit their crypto assets as collateral and then receive a loan in fiat currency or stablecoins.

In addition, the platform offers high interest rates on crypto deposits, making it attractive for those who want to earn interest on their holdings.

Antoni Trenchev, Kalin Metodiev, and Kosta Kantchev founded Nexo in 2018. The team behind Nexo has experience in financial technology, with some of its members involved in Credissimo, a European fintech group. Nexo has its origins in Europe and operates as a subsidiary of Credissimo, which is based in Sofia, Bulgaria.

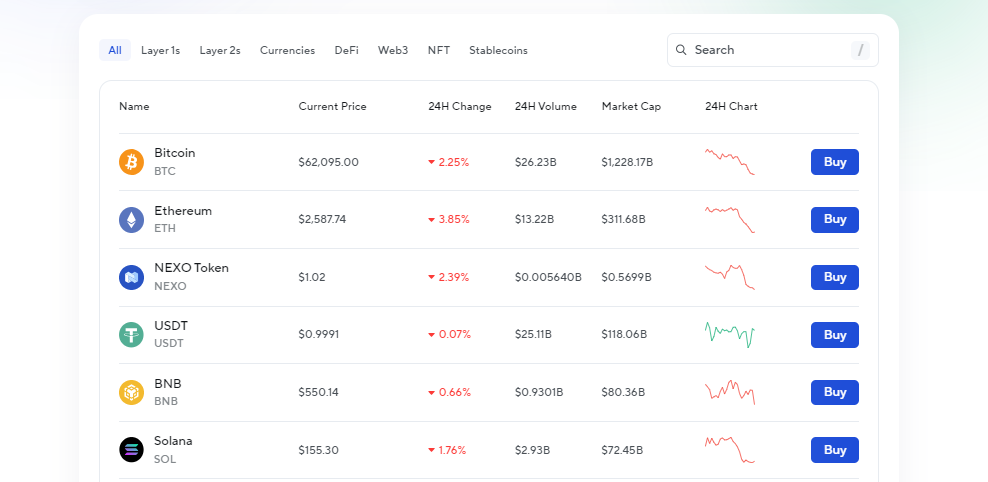

What can I trade on Nexo?

While Nexo is largely known for its crypto loans, you can also buy and trade crypto on the platform. Users can purchase over 60 digital assets swiftly using a card or direct bank transfer. This includes spots and perpetuals.

Spot trading on Nexo

There is a selection of more than 500 trading pairs. Nexo also supports unique order types, each providing specific benefits. Disregarding any specific branding or naming conventions, here are the order types:

- Advanced order on-the-spot exchange: An advanced order is akin to a stop-market order. A stop market order becomes a market order once the asset reaches a specified price. It’s essentially a trigger that, once reached, will execute a market order to buy or sell the asset.

- Trailing order: This is a trailing stop order. The trailing stop order sets a stop price at a fixed amount below the market price (for sell orders) or above the market price (for buy orders). If the market moves favorably, the stop price will adjust itself, “trailing” the market price by the specified distance.

- OCO (“One-Cancels-the-Other”) order: This is a classic OCO order. An OCO order combines a stop order with a limit order. When either the stop or limit price is reached and the order executed, the other order is automatically canceled.

- Stop loss and take profit orders: A stop-loss order is a type of order placed to sell an asset once it reaches a particular price, and it’s commonly used to limit a potential loss. A take-profit order is used to lock in a profit when trading. It closes the trade once the market moves in your favor to a specified level.

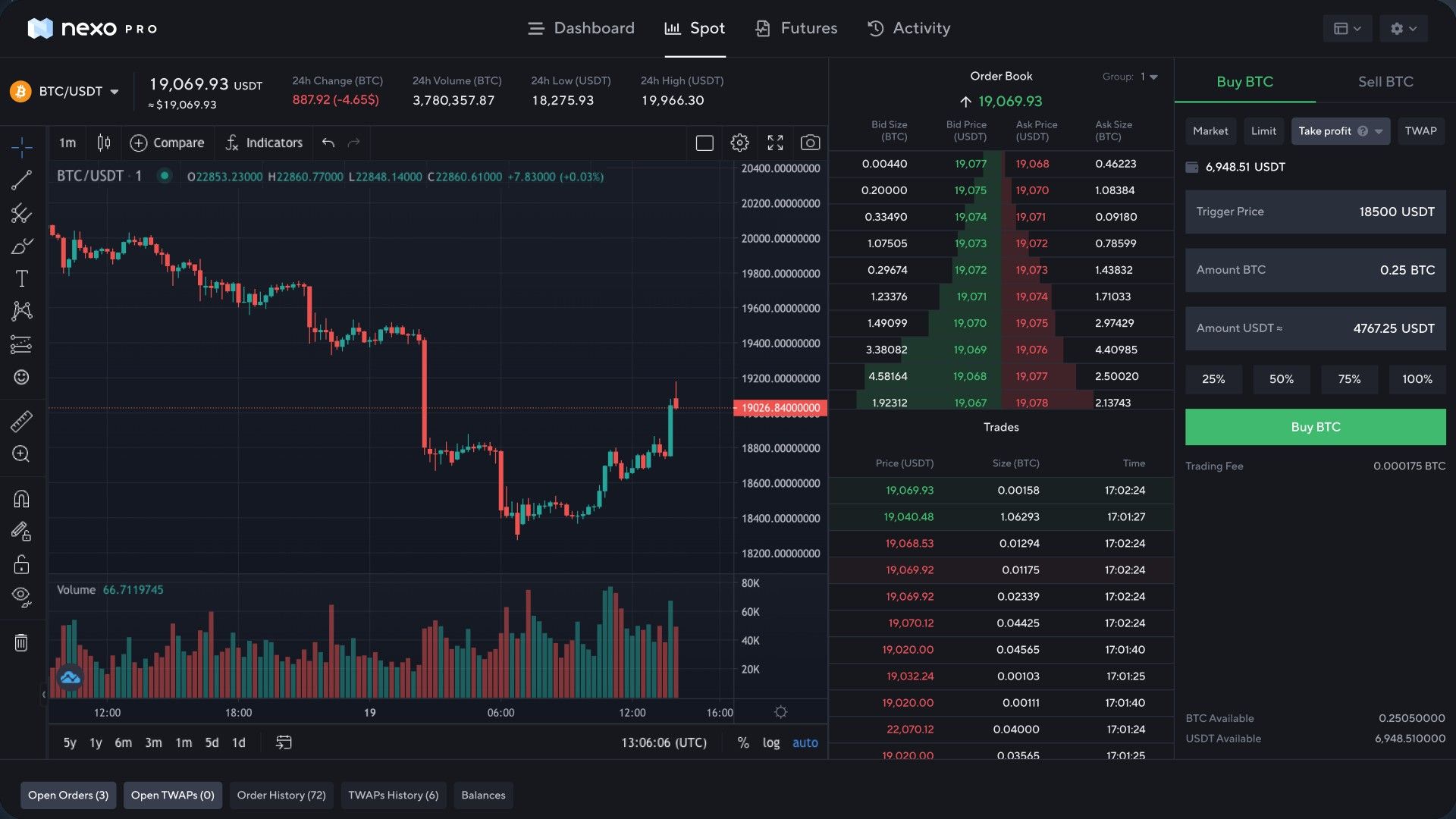

Futures trading on Nexo

Nexo also offers perpetual futures trading. With this feature, users can trade futures contracts that are settled in USDT (Tether).

Traders can leverage their positions up to 2x, meaning they can trade with double the amount of their actual deposit.

One of the unique aspects of Nexo’s Perpetual Futures is the ability to trade contracts even on assets that are not available on their spot trading platform or the regular Nexo Exchange. Examples include GMT, ALGO, WAVES, XTZ, and several others.

However, Nexo’s trading features are restricted geographically. Specifically, the Nexo Pro platform, which is Nexo’s advanced trading interface, is not accessible to clients who reside in the U.S., Canada, or the United Kingdom. Additionally, neither margin trading nor futures exchange is available for Australian residents.

Margin trading on Nexo

Nexo offers a margin trading feature that allows users to amplify their trading positions. With this feature, traders can go either long (betting the price will rise) or short (betting the price will fall) with up to 5x leverage.

This means that traders can trade with up to five times the amount of their actual deposit. To facilitate this, the cryptocurrency assets held in the user’s Nexo portfolio serve as collateral.

In other words, these assets are used to secure the borrowed funds required for margin trading. Users can repay these borrowed amounts at their discretion.

On the Nexo Pro dashboard, traders are provided with an overview of their margin trading activities. This includes insights into their outstanding loan amount, current margin level, and the margin call threshold. The margin call threshold is a critical value; if a trader’s margin level drops to this point due to adverse market movements, they are required to add more collateral to their account to maintain their position.

If this threshold is reached, Nexo sends automated reminders to the trader, prompting them to top up their collateral to prevent their positions from being liquidated.

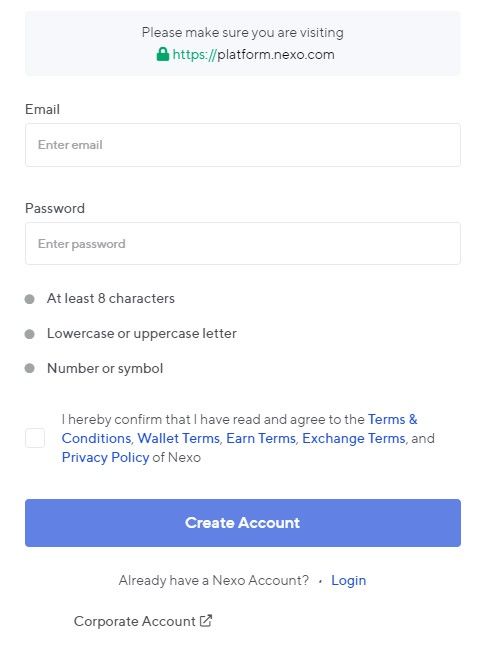

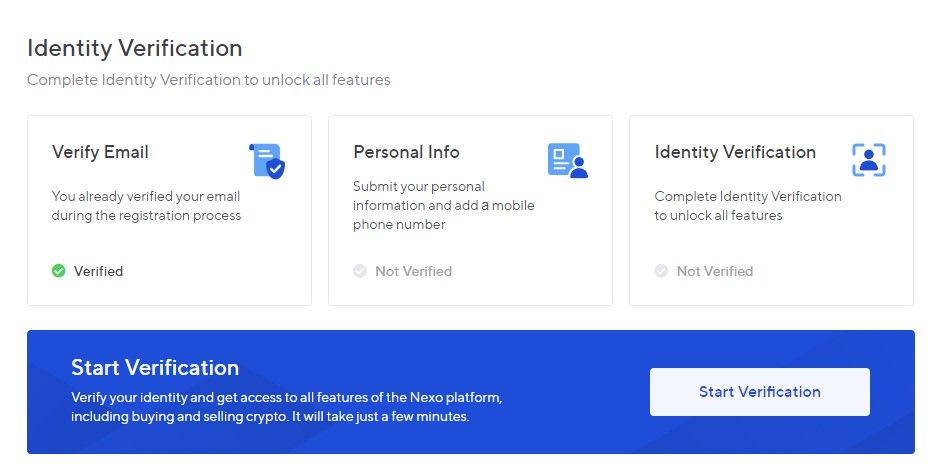

How to sign up for Nexo in October 2025

1. Firstly, go to the main Nexo website and select “Get Started.” You will be brought to the following page. Simply enter the requested information.

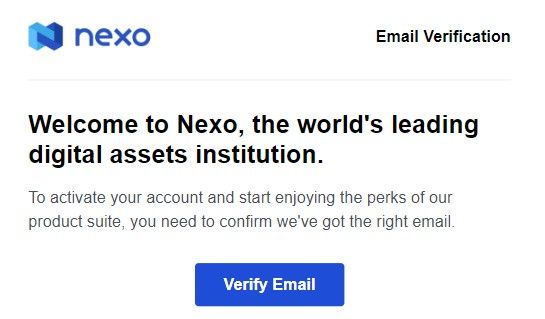

2. Secondly, you will have to verify your email.

3. After you verify your email, you are redirected to the customer dashboard.

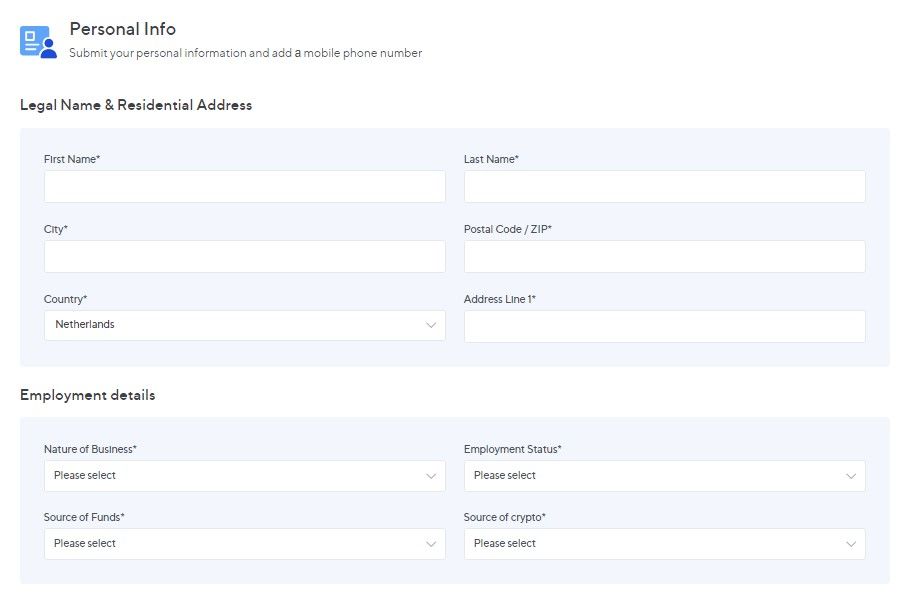

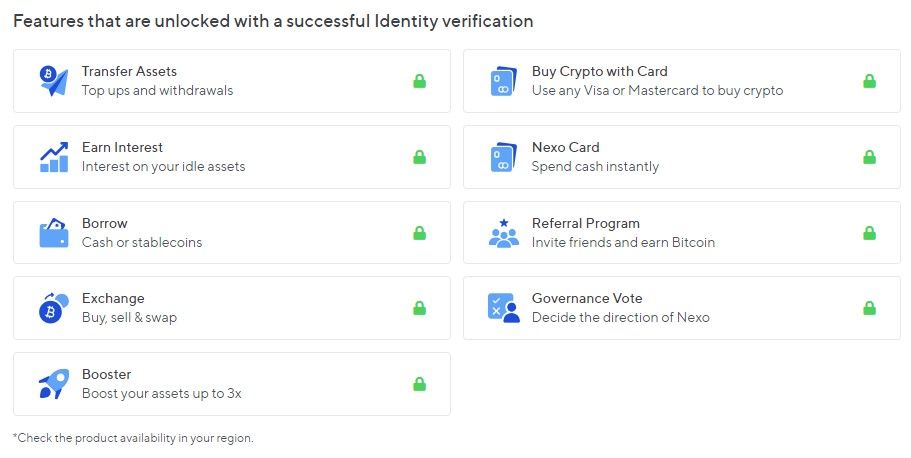

4. You will have to KYC to deposit, purchase, and engage in most activities on Nexo.

5. Simply fill out the form provided below to complete KYC.

Welcome offer / bonus

When you sign up for Nexo, you will have the opportunity to refer friends to earn rewards. You and a friend can earn $25 in Bitcoin when you refer someone and they deposit at least $100. Once your referral is verified, you will receive payouts within 30 days.

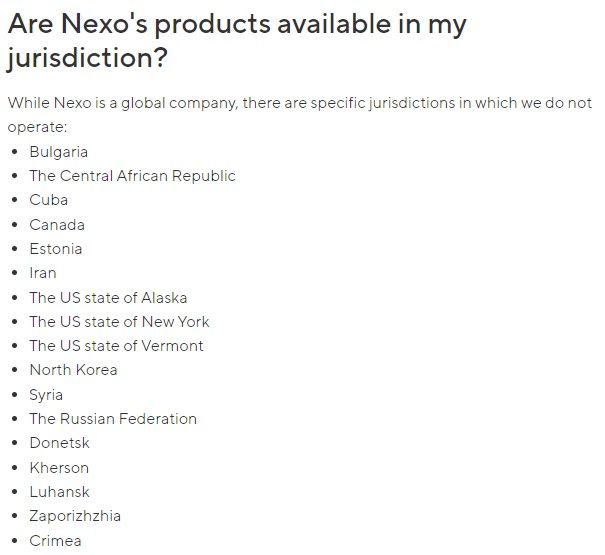

Where is Nexo available?

Nexo is a global platform; however, there are a few places where the platform is unavailable, or its services are limited. Most notably, Nexo made headlines when the company pulled out of U.S. markets on the heels of an SEC lawsuit. For further clarity on restricted countries, it is best to refer to the Nexo website.

Deposit and withdrawals

Unlike most exchanges that have experienced difficulty with payment processing services in recent years, Nexo provides a variety of deposit and withdrawal methods. Payment methods accepted by Nexo include:

- Visa and Mastercard: Nexo supports traditional payment methods, allowing users to make swift transactions using their credit or debit cards. This convenience ensures that users can complete their purchases in mere seconds.

- Apple Pay and Google Pay: Embracing the shift towards digital wallets, Nexo integrates with both Apple Pay and Google Pay. This feature lets users fund their accounts effortlessly with just a single tap, streamlining the process and enhancing user experience.

- Personal EUR bank account: Nexo provides a personal EUR bank account feature for users who transact in euros. With this, users can send and receive EUR via SEPA Instant. Moreover, by possessing a personal IBAN on Nexo, users can facilitate smooth EUR transfers between their bank accounts, greatly reducing the chances of encountering delayed transfers.

- Instant GBP transfers: Nexo recognizes the importance of rapid transactions for its U.K. user base. As such, it offers the Faster Payment Service (FPS), enabling users to top up and withdraw GBP instantly.

- USD wire transfers: For those dealing in U.S. Dollars, Nexo offers a straightforward method of sending and receiving funds through wire transfers. This method is reliable and commonly used for larger transactions.

- On-chain crypto transfers: Lastly, for the crypto-savvy users, Nexo facilitates on-chain cryptocurrency transfers. Users can deposit or send cryptocurrency via popular networks. Notably, they can also bridge their assets across various chains without incurring gas fees, making cross-chain transactions both feasible and cost-effective.

How does Nexo compare to others?

| Platform | Assets (borrow) | Rates (borrow) | Loan-to-value | Earn | Terms |

|---|---|---|---|---|---|

| Nexo | 30+ | 0%-15.9% | 20% | Up to 16% | N/A |

| YouHodler | 50+ | Up to 26% | Up to 90% | Up to 15% | Up to 365 days |

| Coinloan | 200+ | 1% | 20%-70% | Up to 9.2% | 1-12 months |

| Salt Lending | 9 | 7.5%-12.5% | 20%-70% | N/A | 12-60 months |

Nexo

Nexo supports borrowing against more than 30 different assets. Its borrowing rates range from 0% to 15.9%. The loan-to-value ratio on Nexo is fixed at 20%.

Additionally, users have the opportunity to earn interest up to 16% on their assets, although the terms for this interest aren’t specified in the chart.

YouHodler

YouHodler allows its users to borrow against over 50 assets. The borrowing rates can reach up to 26%, and the platform offers a wide loan-to-value ratio that goes up to 90%. Users can earn interest rates up to 15% and the loan terms can extend up to 365 days.

Coinloan

Coinloan supports borrowing against over 200 assets. The borrowing rates begin at a mere 1%. It offers a variable loan-to-value ratio ranging between 20% and 70%. Additionally, users can earn interest up to 9.2%, with loan terms that span from one to 12 months.

Salt Lending

Lastly, Salt Lending provides borrowing options for nine assets with rates ranging from 7.5% to 12.5%. Its loan-to-value ratios are similar to Coinloan’s, varying from 20% to 70%.

However, the platform does not provide features for earning interest on assets. Salt Lending offers loan terms ranging from 12 to 60 months.

Features and tools from Nexo

Buy crypto

Nexo provides its users with a seamless experience when it comes to purchasing cryptocurrency. Users can instantly complete their crypto acquisitions using credit or debit cards.

Exchange crypto

The platform boasts a wide array of trading opportunities, offering over 500 market pairs. This broad selection provides users with flexibility and a plethora of choices when exchanging cryptocurrencies.

Nexo card

The Nexo card allows users to earn interest of up to 9% annually, with payouts made daily. It operates in both credit and debit modes, providing users with versatility in their transactions.

Nexo Pro

Nexo Pro is a professional trading interface tailored for advanced traders and offers a comprehensive range of tools and features to enhance the trading experience.

Earn interest

Nexo incentivizes users by offering interest earnings of up to 16% on a range of assets, including BTC, USDT, USDC, and over 37 other assets. Notably, the interest is compounded daily, allowing assets to grow faster over time.

Nexo Booster

For those looking to increase their cryptocurrency holdings, Nexo Booster permits users to borrow funds, enabling them to purchase up to three times more cryptocurrency.

Nexo Wallet

This digital wallet solution by Nexo allows users to safely store, manage, and transact with their cryptocurrency assets, all from the comfort of their mobile phone.

Perpetual futures

Nexo introduces perpetual futures trading, enabling traders to enter futures contracts to speculate on the future price movements of cryptocurrency assets.

Borrow funds

One of Nexo’s standout features is the ability for users to borrow funds without selling their cryptocurrency. Offering rates as low as 0% and devoid of hidden charges, users can choose from over 30 fiat currencies or borrow instantly using USDT or USDC.

Additionally, users aren’t limited to borrowing against one cryptocurrency; they can leverage their entire digital asset portfolio.

Nexo Loyalty Program

The Nexo Loyalty program is designed to reward dedicated users. It operates on a tiered system, with the ratio of NEXO tokens held in a user’s account determining their tier.

The tiers include Base, Silver, Gold, and Platinum, each requiring 0%, 1%, 5%, and 10% of a user’s portfolio to be in NEXO tokens, respectively.

The rewards grow with each tier, allowing users to benefit from increased yields with the Earn on Crypto & FIATx suite, lower borrowing rates for the Instant Crypto Credit Lines, and other benefits.

Security and payment processing

Nexo prioritizes security through stringent over-collateralization policies, ensuring loans are only issued to borrowers who meet strict collateral requirements. This risk management approach includes market-neutral strategies that ensure liquidity and growth.

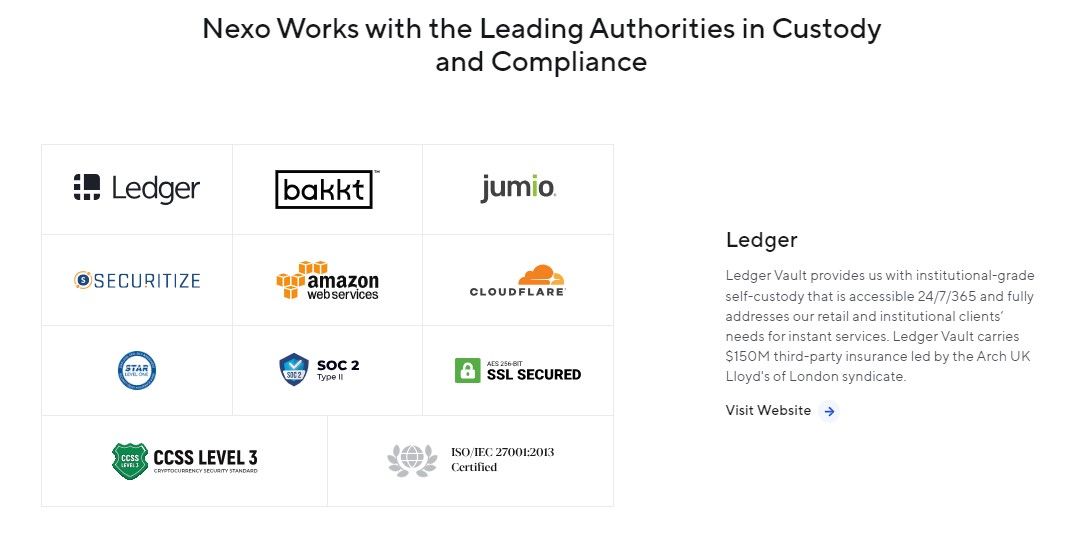

Nexo uses a network of custody and insurance providers, like Ledger Vault and Bakkt, which offer protection through premier underwriters such as Lloyd’s of London. Ledger Vault facilitates 24/7 institutional-grade self-custody with $150M insurance.

Additionally, Nexo adheres to the Cryptocurrency Security Standard Level 3, necessitating multiple verification steps for critical actions. All personal and sensitive data is safeguarded using encryption and Secure Socket Layer (SSL) technology.

However, Nexo does not have a proof-of-reserves (PoR) system. It ended its relationship with its auditor, Armanino, as the latter no longer does audits. The platform looked positioned to reinstate their PoR with Moore, but this never came to fruition.

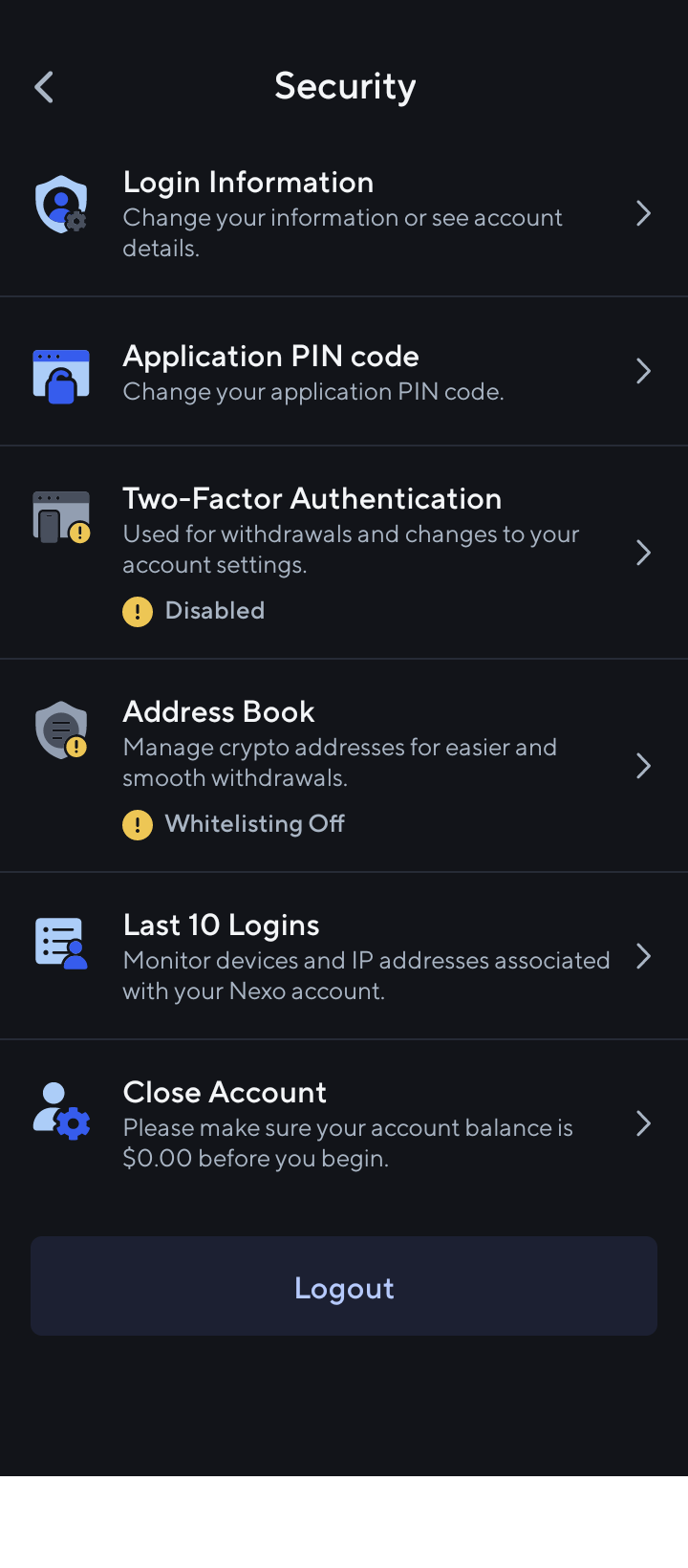

For the security of your personal account, you have several options. Firstly, you will have to establish a PIN code when you log into the Nexo app.

In addition to a PIN code, you can set up two-factor authentication (2FA). Moreover, you can whitelist addresses (Address Book), which adds another level of security.

Nexo also supports biometric identification using fingerprinting or face recognition. Lastly, you can set up real-time alerts to monitor your account activity.

Customer support

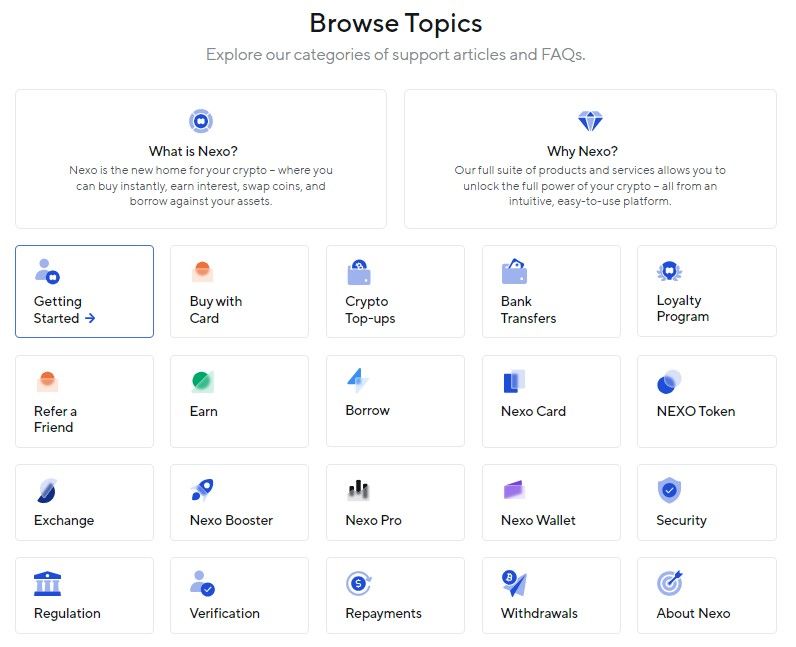

Nexo offers two customer support options. Users can refer to the help center, which has a library of common issues, or open a ticket.

Nexo responds to customer tickets rather quickly; you will most likely receive an automated response. However, we tested Nexo’s support personally and received a real human response in less than an hour.

In the case of customer reviews, Nexo has over 12,000 reviews on Trustpilot. The majority of customer experiences, according to Trustpilot, are overwhelmingly positive.

Regulatory compliance and safety

Nexo has obtained licenses and registrations in several countries. Nexo Capital Inc. is recognized as a Foreign Company by the Australian Securities and Investment Commission.

In Canada, two entities of Nexo, namely Nexo Capital Inc. and Nexo Financial Services Inc., are both registered as Money Service Businesses with the Financial Transactions and Reports Analysis Centre and the Financial Transactions and Reports Analysis Centre of Canada, respectively.

In Hong Kong, the Companies Registry has licensed Nexo Finance Limited as a Trust or Company Service Provider. Over in Italy, Nexo Services S.r.l. has been identified as a Virtual Currency Operator by the Organismo Agenti e Mediatori.

In Lithuania, the Financial Crime Investigation Service has approved Nexo Services UAB to operate both as a Virtual Currency Exchange Operator and a Virtual Currency Wallets Operator.

Additionally, in Poland, Nexo Services Sp. z o.o. is registered for activities in the field of virtual currencies by the Ministry of Finance. Lastly, in Seychelles, Nexo Markets Ltd holds a Securities Dealer License granted by the Financial Services Authority Seychelles. Nexo

Invest responsibly

Investing involves inherent risks, and past performance is not indicative of future results. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Only invest what you can afford to lose, and remember that the value of investments can go up as well as down. Make informed choices and prioritize your financial well-being.

Nexo review: Good, but could be great

It is very difficult to create a profitable exchange, let alone a lending platform for cryptocurrency. Nexo, however, has achieved this. Note that this does not mean that the platform is perfect. The company scores high marks in most categories and is clearly user-friendly. However, it could stand to benefit from issuing regular financial statements and reinstating its proof-of-reserves system.