A project that prioritizes transaction anonymity and secrecy, Monero strives to be entirely decentralized. But do the use cases and an undervalued price tag make XMR a good investment option? This Monero price prediction piece will help you decide. We assess the fundamentals of this PoW blockchain, followed by its tokenomics and technical analysis.

NOTE: This article contains out of date figures and information. It will be updated with fresh analysis for 2025 and beyond in the New Year. In the meantime, please see our Monero price prediction tool for the most recent, data-informed projections.

- Monero price prediction and fundamental analysis

- Monero tokenomics: does it impact the price predictions?

- Key metrics and the XMR price prediction

- Monero price prediction and technical analysis

- Monero (XMR) price prediction 2023

- Monero (XMR) price prediction 2025

- Monero (XMR) price prediction 2030

- Monero’s (XMR’s) long-term price prediction (up to 2035)

- Is the Monero price prediction model reliable?

- Frequently asked questions

Monero price prediction and fundamental analysis

Fun bits first: there are rumors that Satoshi Nakamoto (the pseudonymous Godfather of Bitcoin) is also behind Monero! Both projects are decentralized projects with a strong focus on anonymity while acting as a medium of exchange.

Aside from rumors, here are some of the traits that make Monero stand out from its PoW peers:

- Enhanced privacy with ring signatures, support for confidential transactions, and stealth addresses in play.

- Complete fungibility with one unit of XMR always equalling another unit, regardless of the state.

- A new breed of PoW consensus, also known as Adaptive PoW, facilitates greater decentralization.

- Tail emissions mean ongoing block rewards for miners even after the maximum supply has been mined. It has already taken effect now, with the circulating supply of XMR equal to its total supply. More on this in our tokenomics section.

- Dynamic block size to accommodate a greater number of transactions and avoid network congestion.

- XMR, the native coin, has several use cases related to remittances, micropayments, and more.

The last network update happened in August 2022, as mentioned in this tweet:

The price rise leading to the network update on Aug. 14, 2022, followed by a correction, acted as a classic example of “buy the news, sell the event.”

How do the Monero fundamentals look?

Monero is a key privacy-focused project with nifty enhancements to improve the entire state of crypto mining. The concept of confidential transactions courtesy of ring signatures is not a novel approach. But it certainly keeps transactions from being blacklisted, furthering the ethos of decentralization. Thus, added brownie points for Monero and its native token XMR.

The Monero roadmap also indicates that there might be a layer-2 solution in the works to improve scalability and speed further.

Monero tokenomics: does it impact the price predictions?

It is important to note that Monero is ASIC-resistant and, therefore, can be mined using your regular equipment.

The total supply is capped at 18.4 million XMR, a mark that has already been breached. Yet, despite the supply cap, tail emissions will mean that some amount of XMR will keep entering the system every minute.

If you are into specifics, the value to be added is 0.6 XMR per block. This happens to be perpetual inflation. Monero (XMR) has an annual issuance rate of 0.86% — lower than that of bitcoin, litecoin and bitcoin cash.

The miner-centric token economics model is expected to work in favor of XMR price predictions, as there will always be an incentive to secure the network.

Key metrics and the XMR price prediction

Below is a quick 4-week volatility chart paired with the price of XMR. It is clear that every time there is a drop in volatility, the price of XMR seems to surge. Right now, we can see the volatility of XMR coins rebound from a newly made bottom, which keeps the market optimistic about the up-trending prices.

Additionally, the volatility chart seems to be making lower lows. As volatility is often inversely correlated to prices, weakening momentum can bring good news for XMR.

Finally, another positive indication would be the improving market cap and trading volume associated with the XMR coin. The 3-month market cap seems to be improving, which can be taken as a good sign for the Monero predictions in the short-term and mid-term.

Monero price prediction and technical analysis

We shall start with the daily chart as our base for technical analysis to track Monero’s price predictions in the short term.

XMR is now seen trading inside the falling wedge pattern, failing to breach the upper trendline despite the decent trading volume. The price of XMR is currently trading at $154.80 with the immediate resistance at $164.60 — which it failed to breach previously. In case the trading volumes continue to be high and XMR coin manages to break past the $164.60 mark, we can expect a move toward $180.

The only concern for the XMR holders would be the 50-day moving average line (green) falling under the 100-day moving average line (blue) in a death crossover of sorts. This might be the reason why the 7-day price of XMR was mostly in range and even dipped 0.73%.

Let us now move to the weekly chart to locate the broader pattern for the long-term Monero predictions.

Pattern identification

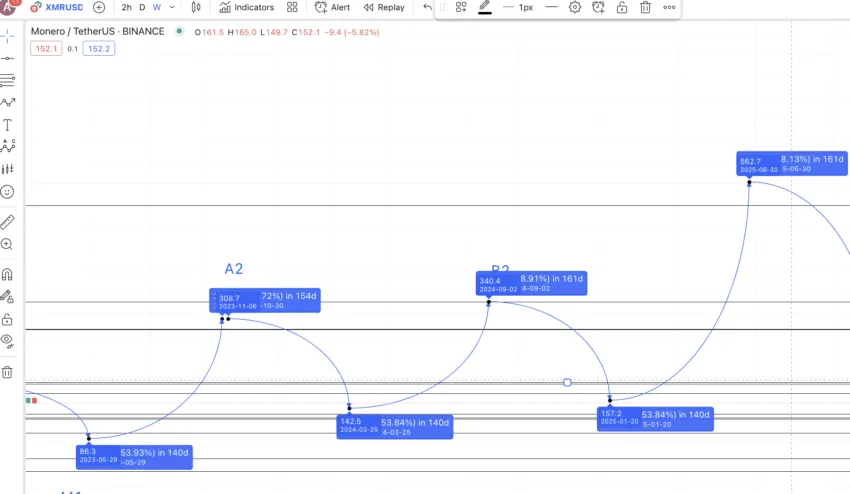

Here is the weekly chart pattern that illustrates a clear trend. XMR makes a series of highs to the peak of $517.62. From there, XMR follows a series of lows, continuing the pattern.

The weekly RSI shows a bullish divergence, which might hint toward a new peak. A rise above the last high would help kickstart a new pattern of sorts.

The chart includes every crucial high and every crucial low — all points that help us locate the average price percentages and distances between the next set of highs and lows.

Price changes

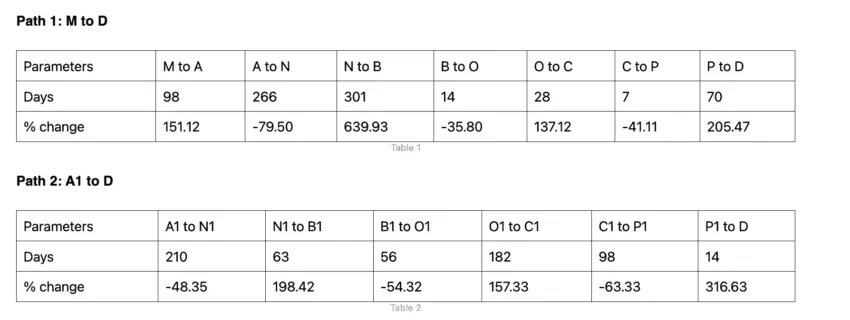

We shall now locate the price percentage levels and distance between the highs and lows corresponding to two paths: M to D and A1 to D.

We can now use the sum of non-negative column values to get the low-to-high average and the sum of negative column values to get the high-to-low average.

Low-to-high: 258% and anywhere between 14 days and 301 days.

High-to-low: 53.73% and anywhere between 7 days and 266 days.

We will now use these data sets to plot the Monero forecast levels in the short- and long-term.

Monero (XMR) price prediction 2023

Outlook: Bullish

The last discernible level on the price chart is A1. As it is high, we can use the high-to-low average to plot the next low or M1, which could also be the M2 for the next pattern. This level coincides with $86.30 — and can be considered the Monero price forecast low for 2023. We have taken the average of the low and high timelines to locate the period as 137 days.

From this level or M1, we can expect the new high (start of a new pattern) or A2 to move higher by 258% (data from earlier). This theory puts A2 or the Monero price high for 2023 at $308.70. The time taken could be an average of 14 days and 301 days — 157 days, give or take.

Projected ROI from the current level: 102%

Monero (XMR) price prediction 2025

Outlook: Bullish

From A2 or the high in 2023, we can expect the next low to show up at a drop of 53.73%. We can still assume the drop to take 137 days (approximately). Hence, the next low or N2 could surface at $142.50 and by early 2024.

The next high, in 2024, could surface anywhere between 14 days and 301 days — from data posted earlier. We can assume the time taken to be 157 days, approximately. Keeping this in mind, the next high, in 2024, could surface at a high of 258% (average from the earlier calculations). This puts B2 or 2024 high at $509.90. However, the actual B2 could surface at $340.1 — which is an important resistance level that coincides with C1 (from the older pattern).

Hence, if you are looking for some realistic Monero predictions, the true 2024 high could surface at $340.1. Considering this level and the average drop of 53.73%, we can expect the Monero forecast for 2025 to settle at a low of $157.20.

From this low, we can expect the next high to follow the average growth of 258%. This puts the Monero price prediction high for 2025 at $562.80, which will then make a new high for its native XMR coin.

Yet, for this price rise to hold, Monero will need to see some serious user adoption. The arrival of an expected layer-2 solution and other developments might help.

Projected ROI from the current level: 269.77%

Monero (XMR) price prediction 2030

Outlook: Very bullish

From the high in 2025, we can expect the price of XMR to drop as low as $260.70 (keeping the average high-to-low dip of 53.73% into consideration). Per the timeline, this could be another dip in 2025 itself. And from this low, the peak or D2 in 2026 can surface at $933.50.

Note that this price prediction is the best-case scenario and might change depending on the state of the broader crypto market.

Now that we have 2025 low and 2026 high into consideration, we can connect the points to extrapolate the Monero forecast to 2030. This would not be accurate and might be subject to change, depending on the broader market sentiments.

The expected Monero price forecast for 2030 would therefore surface at $3756.90. Just to reiterate, this would be the best-case scenario for Monero going to 2030.

Projected ROI from the current level: 2345%

Monero’s (XMR’s) long-term price prediction (up to 2035)

Outlook: Bullish

Now that we have the Monero price forecast till 2030, we can extrapolate the projections to locate the prices of XMR through 2035. Below is a table to refer to.

You can easily convert your XMR to USD here

| Year | | Maximum price of XMR | | Minimum price of XMR |

| 2023 | $308.70 | $86.30 |

| 2024 | $340.10 | $142.50 |

| 2025 | $562.80 | $157.20 |

| 2026 | $933.50 | $466.75 |

| 2027 | $1166.87 | $723.46 |

| 2028 | $1458.60 | $904.33 |

| 2029 | $2187.90 | $1706.56 |

| 2030 | $3756.90 | $2392.28 |

| 2031 | $5635.35 | $3493.92 |

| 2032 | $6762.42 | $5274.68 |

| 2033 | $7438.66 | $5802.15 |

| 2034 | $8926.39 | $6962.58 |

| 2035 | $9819.03 | $7658.84 |

Is the Monero price prediction model reliable?

This Monero price prediction model is packed with fundamental and technical analysis. While we have discussed the chart-specific indicators to offer short-term and long-term price projections, it is advisable to focus on the average price of XMR for every discussed year. That will offer the most give a more realistic view of the expected prices.

Frequently asked questions

Does Monero have a future?

Is Monero a good buy?

What will the XMR price be in 2030?

Why is Monero not popular?

Is Monero good for the long term?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.