From the title alone, some readers may already be judging us, and rightly so, at first glance. How could we prepare a LUNA price prediction piece when the ecosystem collapsed in 2022, taking the entire crypto market down? The answer lies in the fact that this Terra (LUNA) price prediction model considers the new ecosystem, which is entirely separate and not linked to Terra USD or UST.

But how can we predict the future price relevant to the new Terra ecosystem when there isn’t enough historical data available? We have some ideas. Keep reading to learn more.

KEY TAKEAWAYS

➤ The LUNA price prediction focuses exclusively on Terra 2.0, a new ecosystem distinct from the collapsed Terra Classic and its infamous algorithmic stablecoin UST.

➤ The long-term outlook predicts significant growth, with potential highs reaching $188.62 by 2035.

➤ Terra 2.0 introduces a decentralized and developer-focused ecosystem.

Terra (LUNA’s) long-term price prediction until 2035

If you plan on going long on Terra 2.0, the table below can help you trace the path till 2035. Over time, the price hikes and drops might change depending on LUNA’s market cap, trading volume, and social chatter.

| Year | Maximum price of LUNA | Minimum price of LUNA |

| 2025 | $7.77 | $6.06 |

| 2026 | $10.49 | $6.50 |

| 2027 | $15.73 | $9.75 |

| 2028 | $21.24 | $13.17 |

| 2029 | $28.64 | $22.36 |

| 2030 | $52.92 | $33.78 |

| 2031 | $71.44 | $55.72 |

| 2032 | $92.87 | $72.43 |

| 2033 | $116.08 | $90.54 |

| 2034 | $150.90 | $117.70 |

| 2035 | $188.62 | $147.12 |

LUNA price prediction and technical analysis

Before we start with the technical analysis of LUNA, it is important to analyze the possible patterns:

Pattern identification

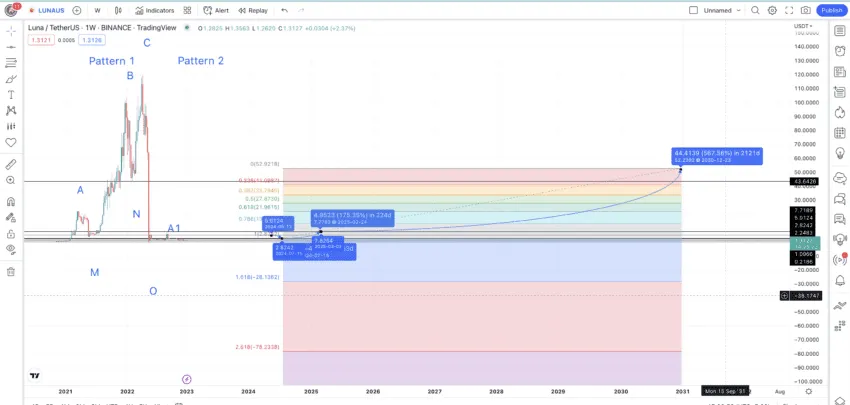

Looking at LUNA’s weekly chart, there’s a clear pattern. After a flattish trading session comes a peak followed by a bottom and two higher peaks, each peak is followed by a bottom, which we have marked for your better understanding.

Note that the crypto market conditions force the drop after the highest price (peak C). We shall exclude the drop value and instead take the average high-to-low drop percentage while calculating for the next set of points.

Therefore, the three higher highs might be the recurring pattern for the price of LUNA in the future. We have divided the long-term chart of LUNA into two segments: pattern one and pattern two.

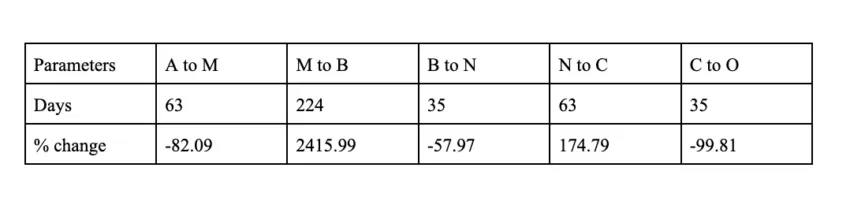

Price changes

Now, we will trace the path from A to O as part of pattern 1. Once we have the data, we will use the averages to locate the next point, M1, and even the next high, B1.

Based on the table above, the average high-to-low distance and percentage change come out at 49 days and 70.03. Do note we haven’t taken the values from C to O while calculating the average. This is because the drop can be considered an aberration and not a standard event.

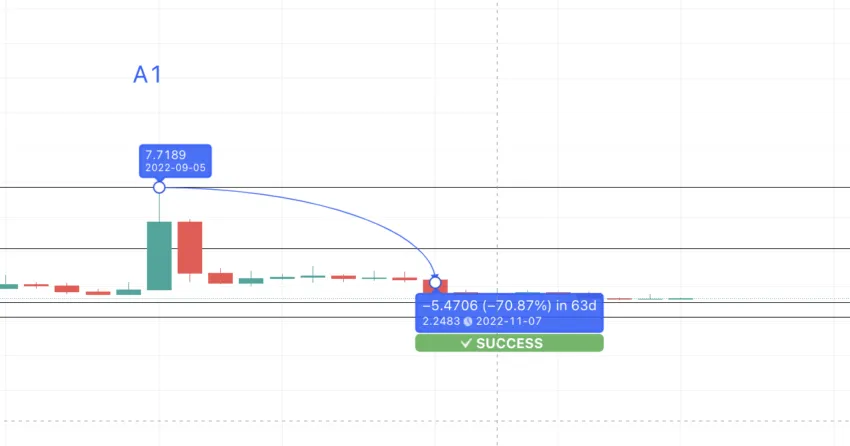

Therefore, if we consider the new high as A1, the next low from which the price of the LUNA token might rise might surface at $2.24. Here is the successful completion of the forecast, suggesting we are heading in the right direction with our Terra price prediction.

However, the drop was lower, and LUNA touched $1.17 a few days back. So, we will take this level and label it M1. That’s closer to the initial drop to M from A — per the table above.

Terra (LUNA) price prediction 2025

Outlook: Bullish

Based on the 2024 low of $0.28— owing to the strong weekly support lines, a low of $0.6 — close to the strong support levels — looks likely in 2025. The timeframe could be anywhere between 35 to 63 days.

The high in 2025 can surface at $7.77 — keeping the 174.79% minimum growth percentage in consideration. This way, the maximum Terra (LUNA) price prediction for 2025 can breach an important weekly resistance of $7.71.

If you look at the daily chart illustrated above, the high in 2025 could be equal to the D1 — one of the peaks made by the new LUNA token.

Projected ROI from the current level: 964%

Terra (LUNA) price prediction 2030

With the 2024 low and 2025 high to work with, we can connect the points to extrapolate the price forecast for LUNA till 2023. Tracing the same growth path, we can put the LUNA price prediction for 2030 at $52.92 per the Fibonacci extension.

However, Terra 2.0 must maintain steady ecosystem growth to reach this level and avoid negative development. If LUNA manages to hit $52.92 by 2030, it might see more aggressive growth in the next few years. For that, the drop in 2030 shouldn’t exceed $33.78 — a 38.20% drop from the high.

Projected ROI from the current level: 7149%

Terra price prediction and the fundamentals

To start, we will look at the Terra ecosystem’s fundamentals. But first, it is important to explain the rebranding.

Terra (the old blockchain ecosystem) went belly up in 2022 when its primary algorithmic stablecoin, UST, lost its peg and kept dropping. As the entire platform was hinged on the UST-LUNA (the native crypto of the old ecosystem) balance, things started to go south very quickly. The blockchain crashed, leaving UST and LUNA in shambles.

A few weeks later, Terraform Labs launched a new blockchain protocol — via a hard fork, naming it Terra (the new one) and rebranding the old platform as the Terra Classic. In came a new LUNA (for the new chain), which is active even in 2025. The old native token was rebranded to LUNC.

Did you know? Terra 2.0 or simply the new Terra is built using the proof-of-stake (PoS) consensus and currently has 130+ validators.

The new Terra

With all the confusion out of the way, we will now build a price forecasting model for Terra (LUNA) — the new ecosystem and its native crypto. Here are the features relevant to the new Terra protocol:

- A smart contract-compatible ecosystem with support for DApps.

- It is open-source and is loaded with new-gen developer tools.

- LUNA, its native crypto, is the go-to method of transacting within the new Terra network.

- A few projects are building on the ecosystem, including Arbie — a trading bot, and Coinhall — a platform with price charts.

- It is a proof-of-stake (PoS) platform built using the Cosmos SDK.

- Terra 2.0, or the new Terra, is a part of Do Kwon’s regeneration plan — something most have little faith in, at least in this bearish crypto market.

- The new protocol, or Terra 2.0, supports LUNA staking and even introduces slashing penalties to keep the supply and issuance in check.

Here is what the Terra ecosystem looks like:

Currently, Terra is still a controversial ecosystem. However, the price of Terra (LUNA) can climb once more builders come on board. The trust score is still low, which will take some time to improve.

Is the LUNA price prediction model accurate?

Our LUNA price prediction model undertakes both long-term and short-term technical analysis. It also considers the tokenomics of the current Terra 2.0 blockchain protocol. Further, we focus on the fundamentals of this controversial proof-of-stake digital asset. Finally, we zoom in on the development activity, volatility, and social chatter around Terra 2.0. This has helped us form a well-balanced, realistic, and usable LUNA price prediction.

Disclaimer: This analysis focuses on the new Terra (LUNA) ecosystem. While Terra’s restructured blockchain aims to rebuild trust and stability, its market performance remains volatile and subject to risks. Conduct thorough research (DYOR) and consult a financial advisor before making any investment decisions.

Frequently asked questions

Terra is a smart contract-compatible ecosystem that supports decentralized applications (DApps). It is open-source and equipped with new-generation developer tools, with LUNA as the native cryptocurrency used for transactions within the network. The new Terra protocol, or Terra 2.0, built using the Cosmos SDK, is a proof-of-stake (PoS) platform that supports LUNA staking and introduces slashing penalties to manage supply and issuance despite skepticism in the bearish crypto market.

LUNA and LUNC refer to tokens on two different Terra blockchains operating in parallel. The old (original) Terra network uses the renamed Luna Classic (LUNC), which includes UST tokens. In contrast, the newly launched Terra blockchain has a native token called LUNA, which is not linked to the original stablecoin.

We expect the price of LUNA to reach $7.77 by 2025. For the 2025 price prediction to hold, Terra 2.0 must aim to regain the trust of the market participants. More projects coming in and building using the new Terra protocol can help realize the 2025 high.

If all goes well for LUNA regarding development, social volumes, and fundamentals, it could reach $10 by 2026. Also, by this time, LUNA’s trading volumes should have improved. For LUNA to reach $10 by 2026, it should be able to breach the $7.5 mark by 2025.

Predicting the price of LUNA in 2030 might be difficult considering the need for adequate historical data, especially after Terra was rebranded to Terra Classic and the old LUNA became LUNC. However, if we track the growth of LUNA before the UST contagion, the growth path sets the new LUNA for a price of $52.92 by the end of 2030.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.