Liquidity Provider (LP) tokens are a novel way through which crypto adopters can earn passive income. Beyond the rewards, opting to become a liquidity provider is a matter of principle for some. Liquidity providers help support decentralized exchanges and, in turn, a financial system unreliant on intermediaries.

How do LP tokens work? How can LP tokens be profitable? And, what does all this mean for the market? Let’s take an in-depth look.

A brief intro on DEXs

Liquidity provider tokens (LP tokens) are tokens that are allocated to liquidity providers on a DEX (decentralized exchange). A DEX runs on an automated market maker (AMM) protocol. But what exactly is a DEX?

Decentralized exchanges, or DEXs, are peer-to-peer platforms where transactions can be made directly between crypto traders. DEXs are a way to facilitate financial dealings that aren’t officiated or regulated by any intermediary, such as banks, brokers, and other financial institutions.

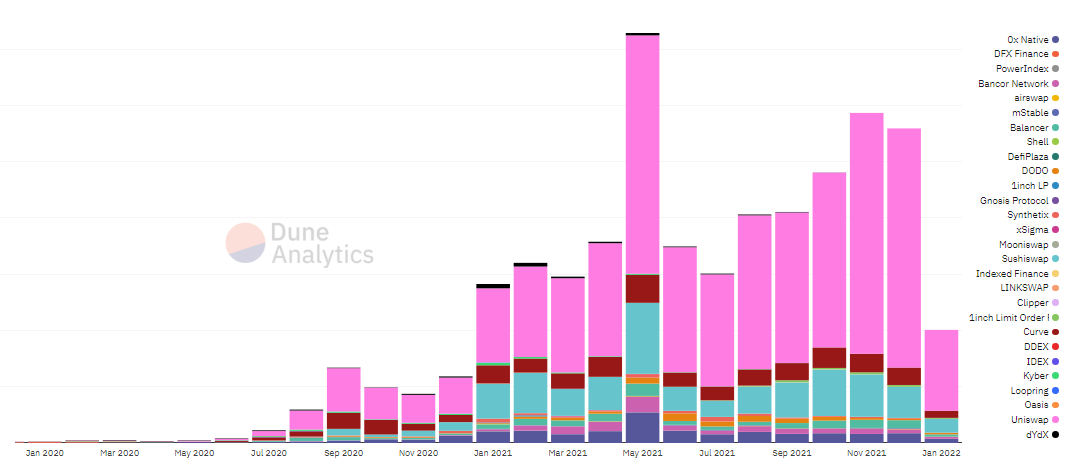

Many popular DEXs run on the Ethereum or the BSC networks, such as Uniswap, Pancakeswap and Sushiwap.

How do DEXs work

The reduction in the use of intermediaries is an essential tenet of the blockchain community. This is one of the reasons why DEXs have grown in popularity alongside traditional centralized exchanges. How do these work, and how are they different from their centralized counterparts?

The global cryptocurrency market relies on cryptocurrency exchanges to provide liquidity. These facilitate billions of dollars of trading volume every day. Leading exchange platforms are expanding to meet the growing demand for digital assets. They offer asset custody and new trading features and functionality.

A DEX provides a unique approach to the trade of digital assets. Decentralized exchanges do not require an intermediary organization to clear transactions. Instead, they rely on self-executing smart contracts to facilitate trading. This allows near-instantaneous trades. These transactions often occur at a lower price than what centralized crypto exchanges can offer.

DEXs embrace a non-custodial structure in the absence of intermediaries. This means that traders will retain custody of their cryptocurrency. They will, however, also be entirely responsible for managing their wallet and personal keys. Control then comes at a price. Private keys can be lost easily.

It’s also important to note that lack of an intermediary also means that most DEXs have limited counterparty risk. Furthermore, generally, they’re not required to follow Know-Your-Customer (KYC) or Anti-Money-Laundering (AML) regulatory standards.

In a nutshell, DEXs are a peer-to-peer marketplace where traders are able to engage in transactions without the requirement of supervision or assistance of an intermediary. These exchanges promise a higher degree of freedom, but also require a greater effort from all parties involved. One of the challenges is consistently providing liquidity. A liquidity provider on a DEX is rewarded with LP tokens.

Automated Market Maker (AMM)

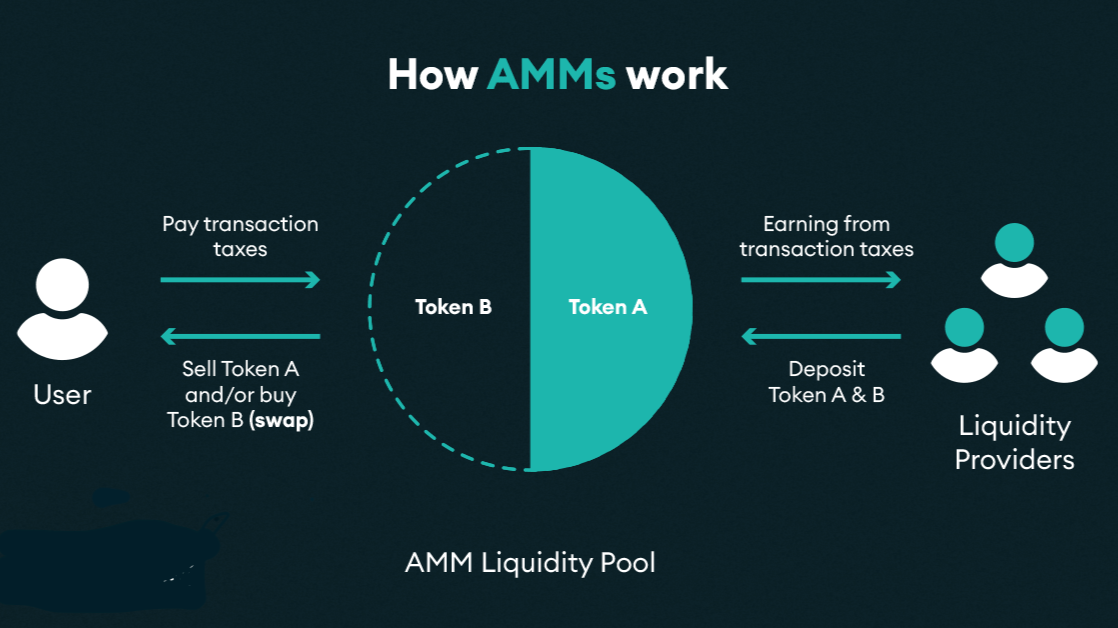

An automated market maker (AMM) is a type of decentralized exchange protocol that uses a mathematical formula for pricing assets. Essentially, assets are priced using a pricing algorithm, rather than an order book as a traditional exchange.

How exactly does this work?

Each protocol may have a different formula. Let’s take an example. Uniswap uses a formula of x * y = k. In this equation, x represents the amount of one token in the utility pool, while y is the amount of the other token. The total liquidity of the pool, which must remain constant, is represented in this instance by k.

Different AMMs may use other formulas. All of them, however, will make use of an algorithm as the method of determining prices. This may seem to be a difficult process. What issue does it help solve?

Before the creation of LP tokens, all assets used in the Ethereum ecosystem were inaccessible during their usage. Tokens are usually locked up when they have to be staked. This is normally part of a governance system. When it comes to DeFi, this concern can be solved by creating easily convertible assets in AMMs using LP tokens.

The LP tokens allow the use of the same tokens multiple times regardless of whether they are staked in a platform governance scheme or invested in a DeFi product. The indirect form of staking that LP tokens allow can help solve the problem of limited crypto liquidity pool. This method prioritizes the proof of ownership rather than staking LP tokens themselves.

What is a liquidity pool and a liquidity provider?

Liquidity providers (LPs) are those people who add funds to a crypto liquidity pool. A liquidity pool is a large amount of money that traders can trade against. In exchange for providing liquidity to the protocol, LPs receive fees from trades that occur within their pool.

How does a liquidity pool work?

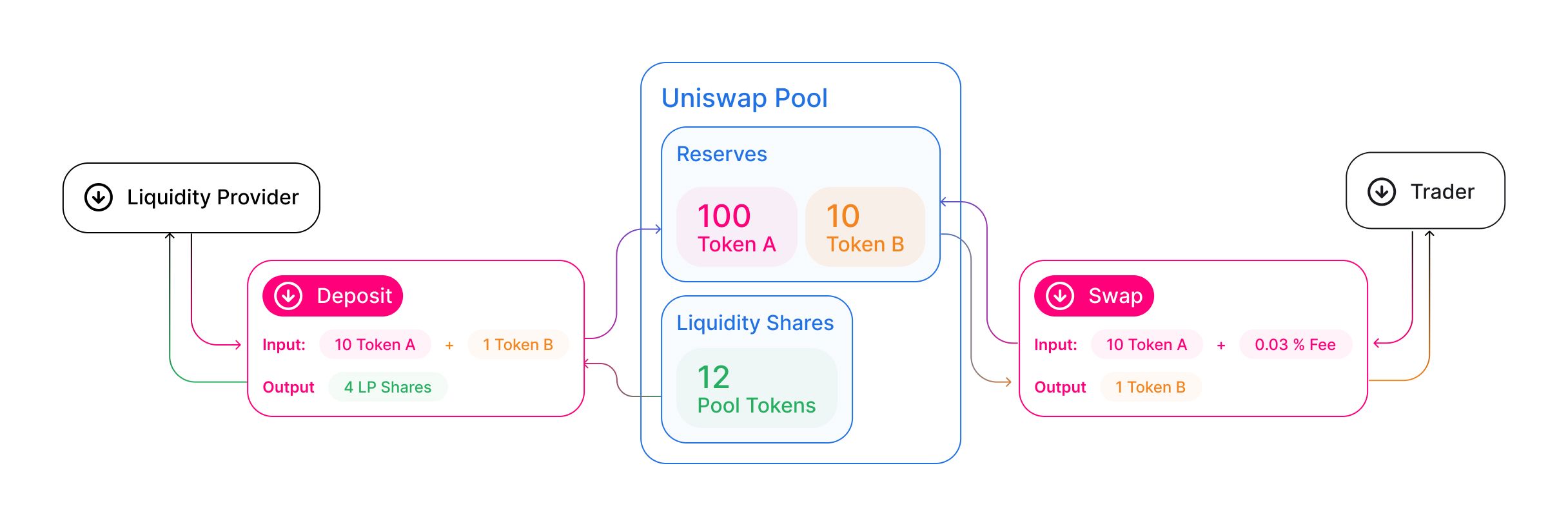

For instance, in the case of Uniswap, for a pool of two coins A and B, providers must deposit 50% of coin A and 50% of coin B. Their deposit helps the exchange work.

In essence, liquidity providers are traders who place their crypto tokens on DEXs to earn transaction fees. This is often called liquidity mining or market-making.

Transaction fees are usually expressed in interest rates. The interest rate varies depending on how much liquidity is available and how many transactions are in the liquidity pool.

Using liquidity mining

It is generally easy to add funds into a liquidity pool. The protocol determines the value of the rewards. For example, Uniswap v2 charges traders 0.3%, which goes directly to LPs. To attract liquidity providers to their pools, other platforms and forks might charge lower fees.

But, how important is it to attract liquidity? AMMs work in a way that reduces slippage for large orders. This may lead to more volume on the platform.

Slippage issues can vary between AMM designs. Pricing, as we mentioned earlier, is determined by an algorithm. In a nutshell, the price is determined by how the ratio between the two tokens in the pool has been affected after a trade. Slippage will occur if the ratio changes significantly.

Yield farming

To recap, unlike staking, yield farming does not involve locking crypto assets when validating transactions on the protocol. Yield farming allows someone to invest in liquidity pools of various protocols. In other words, LPs are lending their crypto and looking to receive interest for it.

Let’s look at a simple example of how to generate this kind of passive income. When adding liquidity to a pool on Uniswap, Pancakeswap, or a different DEX, both the coins in the pool must be present in our wallet. Farmers will choose these pools based on Annual Percentage Yields (APY) and the level of impermanent loss which is affected by a coin price’s volatility.

Once you have made your decision and have the two coins available in the wallet, you will need to go to the DEX and “supply liquidity.” As soon as you have made the transaction, you will receive liquidity provider tokens. The LPs measure the percentage of your ownership of the pool.

You can remove liquidity at any time. Various websites provide information on the yield farms that offer the highest value, at the lowest risk, at any given time.

What are LP tokens?

As mentioned previously, LP tokens are the rewards provided to someone that has assisted a DEX in creating liquidity. Essentially, LP tokens represent the share of the pool owned by a liquidity provider. The liquidity provider retains complete control over the tokens. Furthermore, the LP tokens can be withdrawn from a pool at any time.

LP tokens help solve a potentially vital issue for DEXs, that of liquidity. Essentially these decentralized exchanges are paying users because they require liquidity in order for trades to go ahead unaffected. When providing liquidity, users interact with the yield farm’s smart contracts. These determine how much of a contribution was made by someone, and how much they need to be rewarded.

How LP tokens work

Let’s look at a simple example. If you have contributed crypto assets that are worth $100 to a pool that is worth $1000, you own 10% of the liquidity pool. Because of this, you are entitled to 10% of the LP tokens of that liquidity pool.

Your LP tokens can, essentially, be farmed for rewards provided by the DEX as a way to repay you for solving a liquidity issue. The rewards are proportional to how many LPs you own. LP tokens can be transferred and staked on other protocols. However, DEXs will look to persuade users against doing this. One strategy, for example, is to introduce auto-compounding farms where the aforementioned rewards will be reinvested into liquidity pools.

Farming with LP tokens

Yield farming works in the same way as one would deposit money into a bank with the purpose of receiving interest on their deposit. A DeFi project will require users to temporarily send in their crypto assets to improve liquidity.

For example, when contributing to a liquidity pool of ETH/USDT, the crypto owner will provide both ETH and USDT. In exchange for them staking their crypto assets, they will receive a yield. Yield farming can have a low average APY but can, also, sometimes reach 1,000% to 3,000% if one joins in the early stages.

Generally speaking, farming LP tokens is more profitable than participating in liquidity pools. However, the former carries more risks.

Crypto owners will receive LP tokens when they contribute an equal amount of tokens to a pool. These tokens represent their stake in that pool. These LP tokens will be minted when adding funds to the pool. They are then burned when removing the funds. This ensures that the number of LP tokens owned always corresponds to the percentage of total pool ownership. There is no risk of permanent loss.

Farming involves using LP tokens in order to stake them on a farm. Owners simply execute a smart contract to let the LP tokens be farmed. In this case, users will usually receive rewards in the form of another token. This process involves a higher degree of trust from the owner, as issues with the smart contract could put the deal in peril.

Now you know how LP tokens work

Liquidity pools can be both an effective way for a crypto investor to earn passive income, and to contribute to a financial system that cuts out the middleman. DEXs depends on the liquidity contribution of the provider.

In exchange for helping maintain the consistency of a liquidity pool, and allowing trades to occur, the provider will be rewarded. LP tokens show how much a provider has contributed to a pool. APY shows what rewards the provider will receive throughout one year of contribution.