KuCoin, a prominent global exchange, was charged under anti-money laundering laws by the U.S. Department of Justice (DOJ) in late March 2024. Many users are subsequently taking matters into their own hands and exploring KuCoin exchange replacements. In this article, we shed light on the top KuCoin alternatives users can turn to in 2025.

KEY TAKEAWAYS

• KuCoin’s legal issues escalated in 2024 with a DOJ indictment for violating U.S. regulations.

• KuCoin’s CEO downplayed the legal challenges saying the exchange was committed to compliance and would work to address any concerns raised by regulators.

• The exchange has a history of skirting regulatory boundaries in several regions.

• Top KuCoin alternatives in 2025 include YouHodler, Coinbase, Bybit, OKX, Kraken, Gate.io, and Binance.

- The top KuCoin exchange replacements

- 1. YouHodler

- 2. Coinbase

- 3. Bybit

- 4. OKX

- 5. Kraken

- 6. Gate.io

- 7. Binance

- KuCoin’s exchange replacements compared

- What happened to KuCoin?

- KuCoin’s response

- Why look for a KuCoin exchange replacement?

- Which KuCoin exchange alternative is right for you?

- Frequently asked questions

The top KuCoin exchange replacements

1. YouHodler

In addition to serving as a crypto swap and trading platform, YouHodler also provides crypto-backed loans with competitive loan-to-value rates. This approach enables users to gain liquidity without having to sell their cryptocurrencies.

Users can also earn interest by depositing their crypto into a YouHodler Interest Account, where funds are held in cold storage. Supported stablecoins offer interest rates of around 12%, while over 50 other tokens provide rates ranging from 2.5% to 11%.

YouHodler’s other strengths include its competitive and transparent fee structure and user-friendly interface.

- Investment tools like Multi HODL suits to different investment strategies and liquidity needs

- Competitive interest rates

- Wide support for cryptocurrencies

- Lack of global reach in several countries, including the U.S.

2. Coinbase

Coinbase is a top alternative to KuCoin, especially for new traders who prefer a user-friendly experience. With its straightforward interface and extensive educational resources, Coinbase makes it easy for beginners to adjust to the inherent complexities associated with crypto trading.

The platform supports over 240 cryptocurrencies and is available in over 200 countries. Additionally, Coinbase offers stringent security features, including insurance for digital assets and FDIC-insured USD balances.

- Robust security

- User-friendly interface ideal for beginners

- Offers a rewards program for earning crypto

- Mandatory KYC

3. Bybit

Bybit is a leading crypto derivatives exchange with a user-friendly interface and advanced charting tools. It provides high liquidity and fast order execution, which minimizes slippage and provides traders with optimal trading conditions.

Bybit also prioritizes security with strict measures, such as multi-signature cold wallets, a 100% proof-of-reserves (PoR) policy, and advanced protocols like 2FA and encryption.

- Educational learning sources

- Up to 100x leverage on cypto

- Advanced tools

- Not available in the U.S.

4. OKX

OKX makes a strong KuCoin alternative for advanced traders looking for a comprehensive trading experience. The platform supports over 320 cryptocurrencies and is known for its high liquidity, which ensures smooth order execution and efficient trading.

Its monthly proof-of-reserves reports provide transparency and build trust. At the same time, the platform’s reliable trading app and extensive ecosystem make it a top choice for those looking for a reliable KuCoin alternative.

- High liquidity

- Reliable trading app

- Extensive ecosystem

- Not accessible in the U.S. and Canada

- May be challenging to navigate

5. Kraken

Kraken stands out for its top-notch security, competitively low trading fees, and substantial selection of crypto, which serves newcomers and seasoned traders alike.

Kraken Pro’s advanced trading platform offers competitive fees and access to a broad array of crypto trading markets. The fee structure decreases as trading volumes increase, thus making it an appealing option for seasoned traders.

- Relatively low Bitcoin (BTC) withdrawal fees

- Advanced trading features are suitable for experienced traders

- 24/7 customer support availability

- Unavailable in all U.S. states

- No futures trading in Canada

6. Gate.io

Gate.io supports trading for 1,400+ cryptocurrencies and offers a variety of trading options, including spot, margin, futures, and options. The platform provides advanced financial services such as lending, staking, and liquidity mining.

Additionally, Gate.io hosts an NFT marketplace for trading and investing in digital collectibles. The platform offers 24/7 customer support to address user inquiries grievances promptly. Its mobile app, available on iOS and Android, makes it easy to trade-on-the-move.

- Spot trading

- Margin trading

- NFT trading and minting

- Trading bots

- Limited fiat currency support

7. Binance

Binance, the largest crypto exchange by trading volume, offers an extensive range of cryptocurrencies and low trading fees. The platform’s deep liquidity ensures fast and efficient trades, while its clear fee structure appeals to cost-sensitive users.

Binance also prioritizes security with features like 2FA, withdrawal address whitelisting, and a Secure Asset Fund for Users (SAFU) that provides an extra layer of protection.

- Multiple trading options

- Low fees

- The U.S. version is more limited

KuCoin’s exchange replacements compared

| Exchanges | Availability | Cryptos | Payment methods |

| YouHodler | 110+ | 60 | Visa, Mastercard, SEPA, and Swift bank transfers |

| Binance | 100+ | 600+ | Bank transfer, debit card, credit card, in-person cash payments, etc. |

| Kraken | 190 | 220+ | Apple pay, Google pay, Visa, Mastercard |

| Coinbase | 200+ | 240+ | Apple Pay, Google Pay, Visa, SEPA Transfer, PayPal, etc. |

| Gate.io | 100+ | 1,400+ | Visa, Mastercard, Apple Pay or Google Pay |

| OKX | 100+ | 320+ | Visa, Mastercard debit and credit cards |

| Bybit | 160+ | 100+ | Visa, Mastercard and Google Pay payments are supported |

What happened to KuCoin?

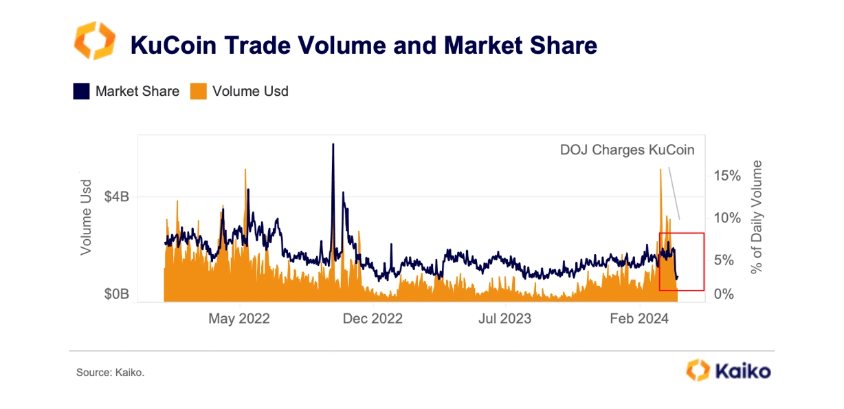

On March 26, a U.S. federal prosecutor charged two KuCoin founders, Chun Gan and Ke Tang, with violating anti-money laundering (AML) laws. Specifically, the charges claim the company misled at least one investor about its operations in the U.S.

Furthermore, the platform is accused of failing to register with U.S. government entities or to maintain a sufficient anti-money laundering program. The DoJ claims the platform did not implement procedures to verify the identities of its clients, as required by U.S. law.

KuCoin’s response

KuCoin’s CEO, Johnny Lyu, quickly responded to the DOJ’s allegations. He promptly downplayed all legal and regulatory issues, saying that the charges were growing pains in a fast-growing industry.

Citing the exchange’s registration with India’s Financial Intelligence Unit as an example, Lyu added that KuCoin was committed to regulatory compliance. He also assured users that all funds were safe.

The platform also announced a $10 million token airdrop in an attempt to retain customers and hold on to any goodwill.

To express our profound gratitude for your support and patience KuCoin will launch a special airdrop event totaling 10 million USD in KCS and BTC. We hope that through this initiative, we can express our gratitude for the support of our loyal users.

– Johnny Lyu, KuCoin CEO: KuCoin

This airdrop earmarked $8.95 million for those who experienced withdrawal congestion between March 26, 22:00, and March 28, 00:00 (UTC+8) amidst the challenges unique to decentralized platforms. The allocation amounts, ranging from 5-200 USDT, depend on the duration of the withdrawal delay.

The exchange also issued token vouchers to the recipients, exchangeable on a 1:1 basis for BTC/KCS within a week.

Why look for a KuCoin exchange replacement?

The allegations against KuCoin highlight the need for platforms with strong security and transparency. Following the news, many users sought alternatives immediately to protect their assets.

It was evident from reports that the exchange witnessed a whopping 284% drop in daily trading volume and a 50% decline in market share by April 3, 2024.

The DOJ indictment is not the first instance of KuCoin facing the music over legal and regulatory issues. Regulators in several other major markets have also cracked the whip on the platform for allegedly violating compliance standards. For further insights, read our guide on KuCoin’s legal status.

Which KuCoin exchange alternative is right for you?

When searching for a KuCoin alternative, you’ll find that many platforms have diverse offerings and cater to different needs in the crypto market. The KuCoin competitors listed in this guide provide everything from innovative financial solutions to enhanced security, ensuring that every trader and investor can find a match that suits their priorities.

As you explore these possibilities, ensure you pick the option that meets your personal requirements.

Frequently asked questions

Binance, Coinbase, Kraken, Bybit, OKX, and Gate.io are some examples of KuCoin contenders, each offering unique features and services. Binance and OKX attract users with their high liquidity and wide range of trading pairs. Coinbase is preferred for its user-friendly platform and strong regulatory stance, making it a safe choice for U.S. traders. Kraken, known for its security and extensive fiat currency support, along with Bybit and Gate.io, offers competitive trading options and financial products.

Choosing between KuCoin and Binance depends on your trading needs and preferences. Binance offers a broader range of cryptocurrencies and trading options, making it suitable for people seeking variety and high liquidity. Its advanced features and competitive fees make it a preferred choice for novice and experienced traders. KuCoin, while providing a wide selection of assets and services, might appeal to those looking for specific altcoins or unique financial products unavailable on Binance.

Yes, you can still use KuCoi. KuCoin’s user-friendly platform and community-focused approach make it a favorable option for many. However, it’s essential to consider the regulatory environment in your country as this may affect access to certain features or services on the platform.

Binance typically offers some of the lowest trading fees among the mentioned exchanges. Its fee structure is designed to benefit users with higher trading volumes and those holding its native BNB coin. Bybit and OKX also offer competitive fee schedules, especially for futures trading. However, fee structures can vary based on the type of trading activity, so reviewing each platform’s fees regarding trading is vital.

Choosing a secure cryptocurrency exchange involves researching and comparing the security measures and regulatory compliance of platforms like Coinbase, Kraken, and Binance. Coinbase and Kraken are known for their strict adherence to regulatory standards and robust security protocols, making them highly trusted among users. It’s essential to look for features such as two-factor authentication, cold storage for funds, and insurance policies. Reading reviews and checking the exchange’s history regarding security breaches can also provide valuable insights.

Decentralized exchanges (DEXs) offer benefits such as increased privacy, reduced risk of hacking, and autonomy over one’s funds. DEXs operate without a central authority, giving users control over their private keys and, consequently, their assets. They also provide access to a broader range of tokens, including early-stage projects not listed on centralized exchanges. However, DEXs might need more liquidity, user-friendly interfaces, and customer support that centralized platforms provide.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.