Kraken is a long-standing centralized exchange (CEX) that has weathered many a crypto winter. In this Kraken review, we will assess the proficiency of the leading CEX. We discover why Kraken endured while many of its peers have fallen, offering a comprehensive analysis of the global platform’s features, pros, and cons.

KEY TAKEAWAYS

• Kraken is one of the oldest crypto exchanges with a reputation for prioritizing customer security.

• The centralized exchange (CEX) boasts numerous enticing earn products, although staking service operations have been restricted in the U.S. since February 2023.

• Users should use the CEX with with care. While Kraken has a reputation for protecting user funds, operating within any decentralized ecosystem carries risk.

Kraken at a glance: Our overall rating

Kraken is a U.S.-based exchange with global reach. The platform is transparent about its commitment to security, which includes customers’ assets as well as its own data. While exchanges like Binance offer more features, Kraken comes top with security and usability.

| Features | Security | Customer support | Fees | Assets | Products | BeInCrypto Score |

| Score | 5/5 | 3/5 | 4/5 | 5/5 | 4/5 | 4.2 |

What is Kraken?

Kraken is a well-known exchange that facilitates the buying, selling, and trading of various cryptocurrencies. It was founded by Jesse Powell and Thanh Luu in 2011 and became one of the first Bitcoin exchanges to be listed on Bloomberg Terminal.

Kraken is headquartered in San Francisco, California, and is a prominent player in the U.S. cryptocurrency industry. Over the years, Kraken has expanded its services to cater to a global user base. The platform offers a wide range of cryptocurrencies for trading, as well as advanced trading features and tools.

As one of the older and more established cryptocurrency exchanges, Kraken has earned a reputation for its commitment to security and regulatory compliance.

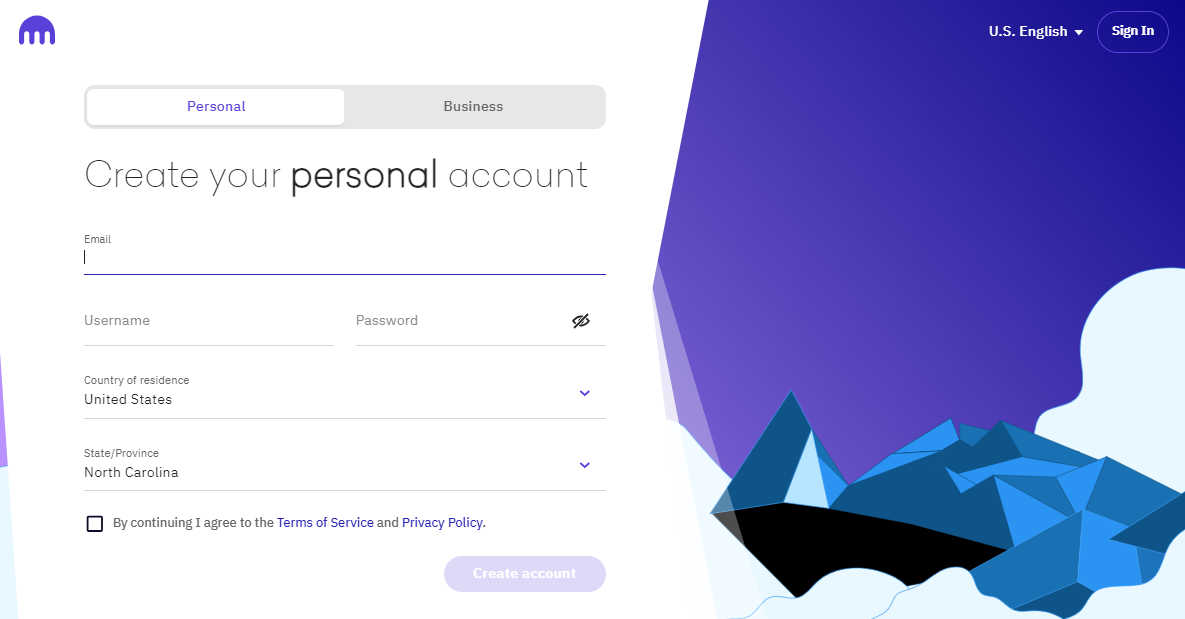

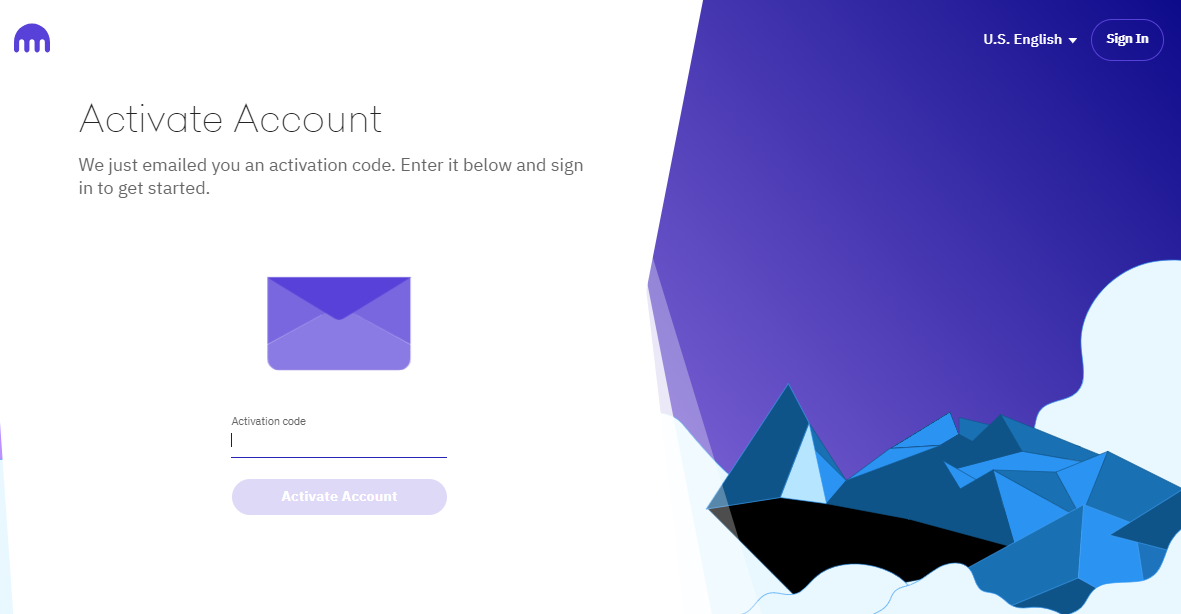

How to sign up for Kraken in 2025

1. Go to the Kraken website. Click “Sign up.”

2. After you are redirected to the following page, choose “Personal” or “Business.” Enter the necessary information and select “Create Account.”

3. Lastly, enter the activation code that you will receive in your email.

Voila! You are now an official Kraken user.

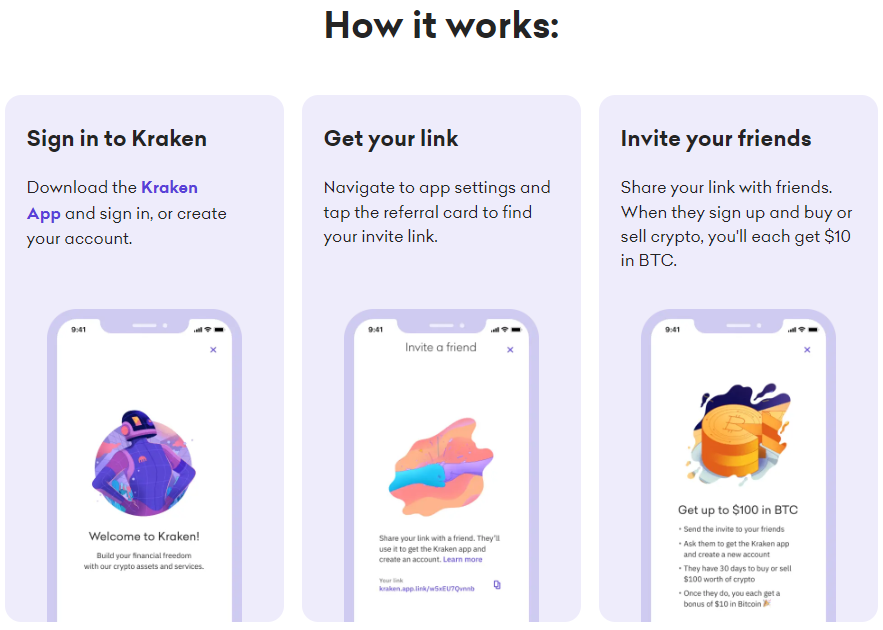

Welcome offer/bonus

When you download the Kraken app and refer a friend, you can earn BTC. Kraken’s referral program allows you to access the app and retrieve your unique referral link.

Afterward, give it to a friend, family member, or follower. Once they sign up using your link and buy or sell $100 in crypto within 30 days of signing up, you and they will receive $10 in Bitcoin.

The maximum amount of Bitcoin that you can receive for referrals is $100. However, the referral bonus is not available for residents of Washington and New York.

History of Kraken

Kraken made history by becoming the first cryptocurrency exchange to secure a Special Purpose Depository Institution (SPDI) charter in Wyoming.

This charter empowered Kraken to serve as a bridge to the banking ecosystem, reducing its dependence on external banks for payment processing.

It’s essential to note that Kraken, despite this distinction, does not hold FDIC insurance as a traditional bank would.

This significant milestone did not shield Kraken from SEC scrutiny. In early 2022, the SEC initiated a reevaluation of cryptocurrency regulations, introducing additional operational challenges for exchanges like Kraken.

Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries must provide the proper disclosures & safeguards required by our laws.

Gary Gensler, SEC Chairperson

This intensified regulatory oversight culminated in Kraken reaching a settlement with the SEC in February 2023 concerning the company’s U.S. staking product.

An SEC enforcement action alleged that Kraken failed to register its staking-as-a-service platform appropriately, so Kraken ceased its U.S. staking service operations in February 2023.

Where is Kraken available?

Kraken operates across various continents, encompassing regions such as Africa, Asia, Europe, North America, Oceania, and South America.

Number of users and trading volume

As of August 2024, Kraken claims to have a global user base of over 10 million spanning, 190+ countries. However, it is uncertain whether Kraken’s reported user figures represent active users or merely registered accounts.

Additionally, in terms of yearly trading volume, Kraken recorded $397.76 trillion in 2022, $802.82 trillion in 2021, and $24.78 trillion in 2020, as per data sourced from Nomics.

As of Q3 2024, Kraken reports a quarterly trading volume exceeding $207 billion, though BeInCrypto has not independently verified this figure.

The company has at least 45 investors across various rounds of funding, according to Crunchbase. Some of these investors include SBI Investment, Digital Currency Group, and Blockchain Capital, among others.

Features

- Spot trading: Allows users to buy and sell a wide range of cryptocurrencies at current market prices.

- Margin trading: Enables users to borrow funds to trade larger positions than their account balance, potentially amplifying both profits and losses.

- Futures trading: Allows users to purchase and trade various crypto futures.

- NFT marketplace: Kraken offers an NFT (non-fungible token) marketplace where users can trade, buy, and sell unique digital assets.

- Earn feature: Often referred to as staking-as-a-service, users can stake their cryptocurrencies to earn rewards or interest over time.

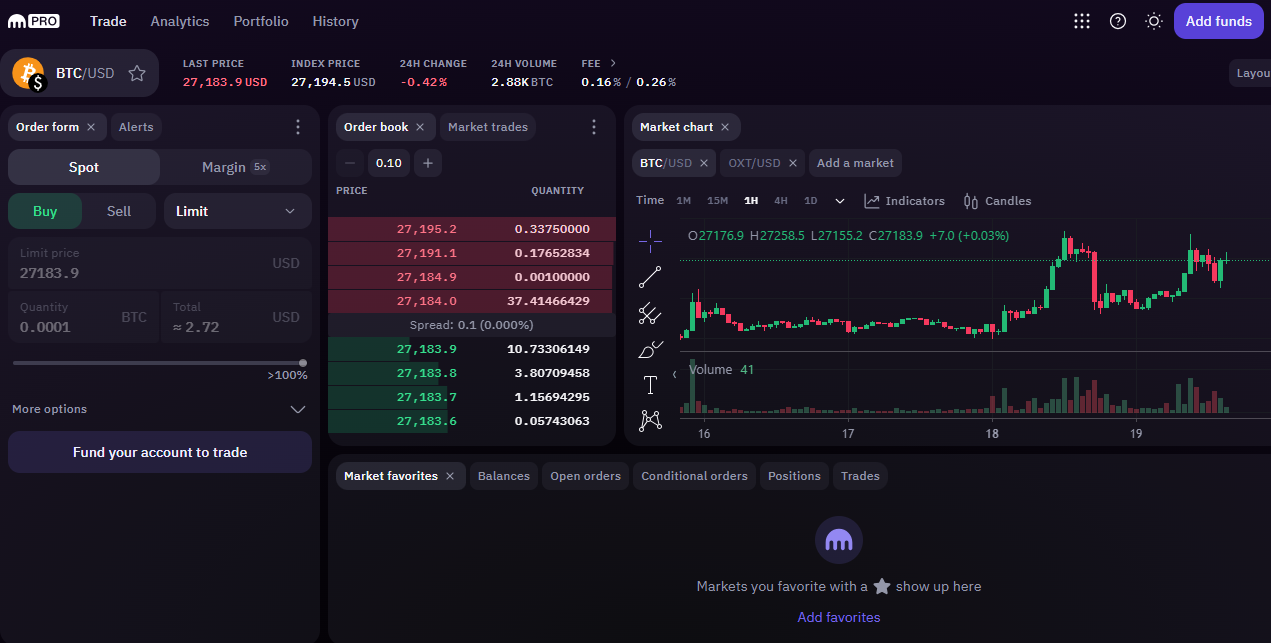

- Advanced trading interface: Kraken provides an advanced trading interface equipped with various tools and features like chart analysis, multiple order types, and customizable trading layouts to cater to the needs of experienced traders.

Security

Kraken emphasizes user security. The platform offers multiple layers of protection, including strong password options and multi-factor authentication. Users can also secure their accounts with FIDO2 devices, and extra approval is required for new device access.

Sensitive client data is kept offline, encrypted, and tightly controlled. Access to this data demands access to highly secure systems, ensuring data confidentiality. Kraken’s fund security offers advanced cold storage and hot wallet solutions. Consequently, the crypto infrastructure is physically secured in monitored, guarded cages.

In 2014, Kraken passed the world’s first cryptographic proof of reserves (PoR) audit, and in 2022, it reemphasized its commitment to transparency, announcing the “implementation of next-generation auditing standards designed to let clients prove their bitcoin and ether balances are backed by real assets held in our custody.”

Kraken’s $3 million “hack”

On June 9, Kraken’s chief security officer, Nick Percoco, disclosed that a security researcher had reported a vulnerability in Kraken’s system. The vulnerability allowed users to artificially inflate their balances.

Kraken quickly fixed the bug, ensuring no user funds were affected. However, the situation escalated when the researcher who discovered the bug allegedly shared it with two others, who then exploited it to withdraw $3 million from Kraken’s treasury.

When Kraken requested details, the researchers refused and instead demanded a discussion with Kraken’s business team. They also refused to return the funds until a financial settlement was reached. Kraken saw this as extortion rather than ethical hacking.

The exchange did not identify the researchers involved, but Certik, a blockchain security firm, later revealed that it had uncovered several vulnerabilities in Kraken’s system. The relationship between Kraken and Certik soured over repayment disputes.

Kraken refused to pay the bounty, citing non-compliance with their bug bounty program rules. It also sought intervention by law enforcement agencies to recover the stolen funds.

CertiK eventually returned all the funds while maintaining that it didn’t stray from its whitehat operations. However, the incident clearly highlighted the difficulties in maintaining ethical standards in security research — especially in the cryptocurrency industry.

Fees

Kraken’s fee schedule is based on the trading volume a user conducts over a rolling 30-day period. For spot trading, where users exchange cryptocurrencies directly, there are two categories: makers and takers.

Makers, who provide liquidity by placing orders that don’t immediately fill, incur a fee of 0.16% for trading volumes up to $50,000, while takers, who remove liquidity by matching existing orders, pay a fee of 0.26%. However, as trading volume increases, fees decrease significantly. For instance, users trading more than $500,000,000 enjoy a fee of 0.00% for makers and 0.04% for takers, encouraging higher-volume traders to use the platform.

Kraken also offers futures trading, with fees structured similarly. For trading volumes up to $100,000, users pay a maker fee of 0.0200% and a taker fee of 0.0500%. As the trading volume surpasses $100,000,001, the maker fee becomes 0.0000%, while the taker fee reduces to 0.0100%. This sliding fee scale incentivizes both smaller and larger traders to participate in futures markets.

Margin trading fees on Kraken vary by the specific cryptocurrency being traded. Users are charged an opening fee ranging from 0.015% to 0.02%, and there are rollover fees, typically within the range of 0.01% to 0.02%, applicable over a 4-hour period.

Again, the fees for stablecoins pegged tokens, and FX pairs are based on trading volume. For volumes between $0 and $50,000, makers and takers pay 0.20%. However, for those trading over $100,000,000, makers enjoy a fee of 0.00%, while takers pay a minimal fee of 0.001%.

Pros and cons

Kraken offers a range of features and services in the cryptocurrency trading space, but like any platform, it has its strengths and weaknesses. Let’s explore some of the notable pros and cons of using Kraken as a cryptocurrency exchange.

| Criteria | Pros | Cons |

| Regulatory compliance | Kraken’s compliance efforts and transparency contribute to its trustworthiness. | Regulatory agencies like the SEC and CFTC have pursued legal actions against crypto exchanges, posing risks. |

| Trading options | Offers a variety of trading options, including spot, margin, and futures trading. | Nil |

| Advanced trading tools | Provides advanced tools and customizable interfaces, suitable for experienced traders. | Nil |

| Security | Strong security commitment with multi-factor authentication, cold storage, and continuous monitoring. | Nil |

| NFT marketplace | Zero gas fees for NFT transactions, making it cost-effective for users. | Nil |

| Geographical restrictions | Nil | Services not available in Washington, New York, and staking not available to U.S. customers. |

| Customer support | Nil | Mixed reviews, with issues like delayed withdrawals and abrupt account closures. |

How does Kraken compare to others?

How does Kraken hold up against its competitors? In terms of features, we’ve already covered that the exchange offers a range of trading services, including spot, margin, and futures trading.

While Coinbase primarily focuses on spot trading and does not directly offer futures, Binance provides an extensive array of options, including spot, futures, and margin trading. Robinhood, on the other hand, primarily focuses on spot trading and margin trading for crypto and stocks.

Kraken offers an “Earn” feature, which includes staking services that allow users to earn rewards on their crypto holdings.

In contrast, Coinbase does not directly offer an “Earn” feature. Binance offers a similar “Earn” feature, making it competitive with Kraken in this regard. Robinhood, on the other hand, does not provide staking or earnings on cryptocurrencies. In terms of advanced features, Binance slightly edges Kraken’s offerings.

Kraken boasts a diverse range of supported assets, with over 230 cryptocurrencies and trading pairs available. Coinbase offers more than 250 cryptocurrencies, while Binance again leads the pack with over 500 cryptocurrencies and trading pairs.

In contrast, Robinhood supports a relatively limited selection of cryptocurrencies, numbering around 15. Instead, Robinhood offers a much larger selection of stocks.

| Features | Kraken | Coinbase | Binance | Robinhood |

| Trading services | Spot, margin, futures | Spot trading (Does not directly offer futures) | Spot, futures, margin | Spot trading & margin trading |

| Earn | Yes | No | Yes | No |

| Assets | 230+ | 250+ | 500+ | 15 (not including stocks, ETFs, etc.) |

| Mobile app | Yes | Yes | Yes | Yes |

| Unique features | Zero gas fees for NFTs, staking services | Coinbase Pro | Binance Smart Chain, Launchpad, staking pools | Commission-free stock and cryptocurrency trading, fractional shares |

Customer support

Based on publicly accessible reviews, Kraken‘s customer support appears to have received mostly negative feedback. Many users have expressed frustration and dissatisfaction with their experiences, citing issues such as delayed withdrawals, demands for additional KYC (Know Your Customer) verification, and abrupt account closures.

However, there are also some positive comments, with users acknowledging improvements in the platform’s user interface with the introduction of Kraken Pro.

Overall, it appears that while some users have had satisfactory experiences with Kraken’s customer support and the platform in general, more have encountered significant frustrations and difficulties, particularly related to withdrawals.

Regulatory compliance

To cater to clients within the United States, Kraken holds a registration as a Money Services Business with FinCEN through its entity ‘Payward Ventures, Inc.’

Kraken Bank also operates under the oversight of the Wyoming Division of Banking, operating under a Special Purpose Depository Institution (SPDI) charter.

For clients in Canada, Kraken maintains its status as a Money Services Business, regulated by FINTRAC through Payward Canada, Inc. Additionally, Kraken has secured licenses to operate in the UK, Italy, APAC, and the Middle East.

Invest responsibly

This Kraken review does not constitute an official Kraken endorsement; it is solely for informational and entertainment purposes only. Readers should always do their own research and consider their personal goals and financial obligations when making investment decisions.

Survival of the fittest

Overall, this Kraken review finds that the exchange has elements it must improve upon, particularly around customer support and experience. Yet, the platform has garnered a solid reputation in the industry with an excellent overall product.

The company has also demonstrated transparency, a genuine commitment to compliance, and responsible fund management. Consequently, Kraken has survived everything that has been thrown at it over the years and still stands tall in 2025