DeFi has grown significantly in recent years. This sector includes blockchain-based protocols and assets, with diverse services from peer-to-peer financial solutions to activities like trading, lending, and borrowing. Kava is one project that has attracted attention for its innovative approach to decentralized lending. This guide explores the Kava cryptocurrency, how it works, and what sets it apart within the evolving DeFi space.

Do you want to buy KAVA? Use and test these exchanges

Best for beginners

Best for security

Methodology: How did we choose the best platforms for buying and holding Kava?

This detailed Kava explainer feels complete with a list of the best exchanges and platforms to buy this layer-1 token. After testing over ten exchanges for a period of six months, here are the picks— evaluated for KAVA-based liquidity, trading volume, ease of making a purchase, and other metrics.

Coinbase for buying and holding KAVA

The KAVA/USD pair on Coinbase comprises 1.41% of the global trading volume for this layer-1 cryptocurrency, per data from CoinMarketCap. There are other traits to look at, which include:

•A decent liquidity score of 432, according to CoinMarketCap, hinting at quick trade executions.

•Offers real-time KAVA to USD conversion update

•Has a decent-to-high KAVA holding time of 73 days to date, which is relatively long-term

•Offers detailed Kava buying and staking guides

•Competitive fees that can go as low as 0.5%

Kraken for holding KAVA securely

Kraken is known for its enhanced security posture. The same holds even for KAVA trades. Here are the traits to consider while choosing Kraken for buying and holding KAVA:

•Trading fees for KAVA and other cryptos can vary from 0.05% to 0%

•Offers multiple KAVA trading pairs — KAVA/USD, KAVA/EUR, KAVA/XBT, and KAVA/ETH

•Kraken’s KAVA/USD pair comprises almost 2% of global KAVA trading volume

•For almost every KAVA trading pair, Kraken has a high liquidity score, per CoinMarketcap, with KAVA/USD liquidity being the highest at 528 to date.

•Advanced security implementations like SSL encryption and two-factor authentication

Both Coinbase and Kraken come across as notable platforms for trading KAVA. In addition to the mentioned features, we have also taken the Kava-centric educational resources, speed of trade execution, and availability of advanced trading charts while picking these.

To know more about BeInCrypto’s methodology verification , click on the link.

What is Kava?

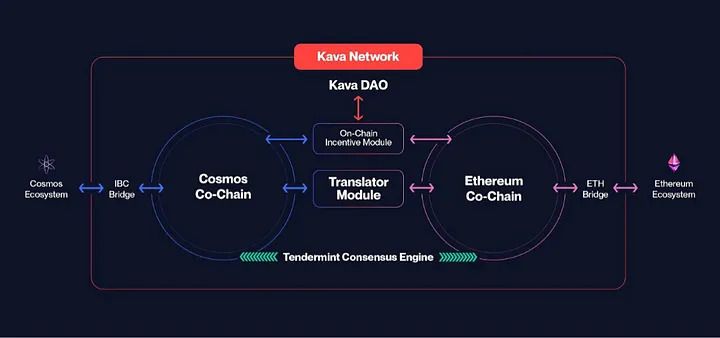

Kava is a layer-1 blockchain that offers collateralized decentralized loans to its users. Its primary goal is to become a leading DeFi hub by providing users with a lending platform that supports various crypto assets, including Bitcoin, Binance Coin (BNB), XRP, and others. The chain uses Cosmos-SDK, an open-source framework for building public proof-of-stake blockchains. It combines the interoperability of Cosmos with the strong development capabilities of Ethereum, creating cross-chain capabilities for both blockchains.

The Kava ecosystem comprises three primary facets designed to meet different financial needs:

- Kava Mint allows users to use their cryptocurrencies as collateral to obtain loans. Kava’s stablecoin, USDX, backs this system.

- Kava Lend (formerly known as Hard Protocol) gives users access to various assets for borrowing.

- KavaSwap, an Automated Market Maker (AMM), facilitates liquidity exchange across blockchains, including Ethereum and Binance Smart Chain.

History of Kava

In 2021, Scott Stuart took the helm as CEO of Kava Labs, guiding the network into a pivotal role in the blockchain space. Under Stuart’s leadership, the network introduced an Ethereum Virtual Machine (EVM) compatible chain to draw Solidity developers and establish ties with Ethereum’s developer community.

The year 2022 marked further advancements for Kava. The “Kava 9 Minute” upgrade was rolled out early in the year, incorporating the Cosmos IBC protocol into the network and connecting Kava to the expansive Cosmos ecosystem. This integration enhanced Kava’s interoperability, which, thanks to its foundation on the Cosmos SDK, allowed for smooth interactions with a wide range of external crypto wallets, custodians, and other blockchain services.

Following this, the network underwent the “Kava 10” upgrade, introducing EVM support. This significant development, carried out with assistance from the Ethermint team, effectively bridged the gap between Cosmos and Ethereum, facilitating the deployment of EVM-compatible applications on Kava.

In July 2023, the Kava network witnessed the launch of the “Kava 14” upgrade. This update was a landmark event, introducing an internal bridge that enabled the secure conversion of ERC-20 tokens into IBC-20 tokens. It also marked the native issuance of USDT on Cosmos, a significant milestone in the evolution of the Kava Chain.

How does Kava work?

Kava’s lending system revolves around collateralized debt positions (CDPs). A CDP is a smart contract that holds the cryptocurrency collateral and adjusts based on redemptions or issuances. Here’s a step-by-step breakdown of how Kava’s lending process works:

- Depositing collateral: Users start by depositing their desired crypto assets into the Kava platform. This is done through a web portal by connecting their wallet to the platform.

- Locking collateral: Kava locks the cryptocurrency once deposited. This makes it available as collateral for a CDP. This is a crucial step in initiating a loan.

- Issuing stablecoins: In exchange for the locked collateral, the user receives the equivalent amount in Kava’s stablecoin, USD X. This stablecoin can be used for various purposes, including paying bills or as collateral for other investments.

- Liquidation: Kava has a CDP auction similar to a margin call if the collateral value falls below a specific debt ratio threshold. Kava will automatically liquidate the collateral and close the loan to protect the ecosystem.

- Repaying the debt: Users can repay the debt at any time with a stability fee. This fee is distributed to the validators who run the Kava nodes and are paid in the native Kava coin.

- CDP closure: When the debt is fully repaid, the CDP closes, prompting Kava to burn the stablecoins and return the collateral to the user.

The primary benefit of this system is that it allows users to unlock the dollar value of their cryptocurrency without selling their holdings.

Consensus mechanism

Kava is built on the Cosmos network, using the Tendermint consensus mechanism. Tendermint uses a Practical Byzantine Fault Tolerance (PBFT) consensus mechanism for proof-of-stake cryptos. This consensus method allows for faster block generation, with transactions confirmed in a matter of seconds. Additionally, it offers high throughput, with estimates of up to 10,000 transactions per second.

One key advantage of Tendermint is its finality. This eliminates the possibility of reversible transactions, which is a significant concern in blockchain networks like Bitcoin, where transactions can take longer to finalize. As a consensus mechanism for Kava, Tendermint provides a secure and scalable blockchain, ensuring the platform’s reliability and efficiency.

The unique features of Kava:

- Collateral coin support: Unlike other DeFi projects that accept collateral in only one or two cryptocurrencies, Kava allows users to use a broader range of assets as collateral. This flexibility simplifies the loan process.

- Hedging with interest: Kava allows users to hedge their positions with interest. This feature can benefit those looking to manage risk in their crypto holdings.

- Growing asset support: Kava continually expands its support for new crypto assets, including derivative products and synthetics. This ensures that the platform remains relevant and adapts to changing market dynamics.

- Cross-chain capabilities: A translator module connects the Ethereum Co-Chain, which supports EVM smart contracts, with the Cosmos Co-Chain using Tendermint consensus and IBC.

Kava cryptocurrency (KAVA)

KAVA cryptocurrency recorded an all-time high (ATH) value of $9.12 back in 2019, marking a huge 516% increase compared to its performance in the preceding year. In 2023, KAVA rose to 121.38% but is down almost 87% from its all-time high (ATH) of $9.12 hit in August 2021. Here are some key aspects of KAVA:

- Proof-of-stake: KAVA is a proof-of-stake coin. Holders can stake their KAVA to earn rewards. The annual percentage rate (APR) for staking KAVA can vary, depending on the amount staked in the network.

- Inflation and burning: KAVA’s protocol has a target rate of 7% inflation, which helps maintain network security and incentivize staking. KAVA has mechanisms for burning coins, reducing the overall supply.

- Lender of last resort: Kava’s emergency mechanism, known as the “lender of last resort,” can mint KAVA to address under-collateralized CDPs.

- Staking: Staking KAVA involves delegating coins to a validator node. Validators can charge a commission, and the returns on staked KAVA can vary based on the level of staking activity.

Tokenomics

In October 2019, Kava raised $3 million BNB in exchange for 6.52 million KAVA via an Initial Exchange Offering (IEO) on Binance Launchpad. The network later secured an additional $1.2 million through subsequent funding rounds.

The $KAVA distribution is divided as follows:

- Private sale 1: 30.05% of the total supply

- Treasury: 28.48% of the total supply

- Kava Labs shareholders: 25% of the total supply

- Binance launchpad sale: 6.52% of the total supply

- Private sale 2: 5.02% of the total supply

- Private sale 3: 4.93% of the total supply

KAVA wallet

Wallet options include mobile, desktop, and hardware wallets, providing flexibility for KAVA holders. When selecting a Kava wallet, it’s crucial to weigh factors like security, user-friendliness, features, and fees.

Several options stand out: Trust Wallet, Atomic Wallet, Math Wallet, and hardware wallets like Ledger and SafePal are all prime choices for storing KAVA.

Kava’s promising path in DeFi

Kava is a promising DeFi project, showcasing potential through its support for multiple collateral types, attractive staking returns, and partnerships with Cosmos and Ripple. However, being a relatively new venture, it carries higher risks, and its success depends critically on continued development and community adoption. Importantly, conducting thorough research and risk assessment is essential before engaging with it. As Kava expands, it positions itself to become a significant player in the DeFi revolution.

Frequently asked questions

How can I participate in Kava’s governance?

Can I stake KAVA for rewards?

What upcoming innovations can we expect from Kava?

Is Kava a good crypto?

Who is behind Kava crypto?

Is Kava a stablecoin?

Is Kava a good long-term investment?

How does Kava make money?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.