While purchasing Bitcoin or other cryptocurrencies from an exchange is the simplest investment method, an alternative approach is to acquire new coins through crypto mining. While the coins themselves are obtained without direct cost, this mining process involves expenses for hardware investment and maintenance. So, the question arises: is crypto mining still profitable? In this article, we explore the fundamentals of crypto mining to provide insights on this topic.

KEY TAKEAWAYS

► Crypto mining profitability depends on several factors, including electricity costs, mining equipment efficiency, and the price of the cryptocurrency being mined.

► Joining a mining pool can increase the chances of earning rewards by pooling resources.

► The initial costs for mining hardware and loans can be substantial, and profitability may take time to realize, especially with high competition.

► While Bitcoin mining is often less accessible, mining less popular altcoins can still be profitable, especially with favorable electricity rates.

Is crypto mining still profitable?

Unfortunately, there is no easy way to determine if crypto mining is still profitable for all situations. Miners should research each coin and consider the cost of electricity needed to run the mining machines, equipment price, and the difficulty of mining.

Considering the volatile nature of cryptocurrency, miners should also be aware of the current crypto price. If the price of that specific crypto drops under a certain level, mining it might not be profitable anymore. That’s why many miners stop supporting the network when prices drop.

Additionally, the mining equipment used by large miners makes it difficult for solo or smaller miners to compete. To be more efficient, you can join a mining pool, but this comes with a cost and reduces your profit.

Many crypto miners choose to mine less popular currencies instead of Bitcoin. While other cryptocurrencies may not be worth much, You can convert those coins into any other crypto, including Bitcoin.

Before you start mining, try to calculate the potential profit using one of the crypto mining profitability calculators you can find online. This is a good start to learning if crypto mining is profitable for you.

Cost of electricity

You must realize that your mining rig or ASICs equipment runs extensively. This translates to expensive electricity bills. If your local power rates are high, you will spend a lot of money mining. Mining a single Bitcoin can cost a lot of electricity, even in the most affordable countries.

A less powerful rig could help you save money by mining other currencies instead of Bitcoin. Note that it may take weeks or even months to recover your initial investment and make profits.

Crypto mining difficulty

The hash rate is the way to measure the crypto mining difficulty. As more computing power works to earn the same amount of crypto, the hash rate increases. Depending on your hardware, a network with high difficulty may not be profitable for your crypto mining.

Equipment costs

The equipment and setup costs must be paid upfront. It’s an investment, and it may take some time to start making a profit.

This includes graphics cards, which can run upwards of $700 per piece, regardless of what cryptocurrency you choose to mine. However, it’s possible to build a basic mining rig suitable for mining less popular cryptocurrencies for around $3,000.

Hardware prices vary from manufacturer to manufacturer. It all depends on how much energy the machine uses and how much computing power it produces. You will mine more crypto if you have more computing power. Your monthly costs will be lower if you have lower energy consumption.

Miners must consider the machine’s longevity and profitability when choosing the right machine to invest in. Profitability is determined primarily by the machine’s cost per hash, its wattage per hash, and your hosting costs.

If hosting costs are low enough, it is a good idea to prioritize the ‘price/H’ rather than the ‘watts/H.’ Your lower operational expenses will offset the decrease in the efficiency of your machine.

Mining pool

A cryptocurrency mining pool is a group of miners that work together to mine blocks and share the reward. Individual miners can join a mining pool to compete with the mining farms. This can speed up the mining process while also lowering the difficulty of mining, making it more profitable.

Since it is becoming increasingly more difficult to mine cryptocurrency, more miners are joining pools. While the reward is less if there are more participants, mining pools have a greater chance of getting rewarded for their mining efforts. The most popular types of mining pools are:

- Proportional mining: A proportional mining payout system gives miners rewards that are proportional to their effort in finding a block. The amount of the payout depends on whether a pool finds a block. This payout method is lucrative during Bitcoin’s price explosions. The payout from Bitcoin’s rising price will guarantee that the miner makes a profit, even though the difficulty level goes up.

- Pay-per-share mining: This method distributes payouts according to the mining power of the entire pool. The pool shares the rewards with the pool equally so that the miner’s share of the profits, so miners earn even if the pool doesn’t find a block. This mining pool model guarantees a flat fee and is most suitable for low Bitcoin prices.

Miners need to always adapt to the constantly changing prices of cryptocurrency to make sure that crypto mining is profitable. Oftentimes, miners switch mining pools to make the most out of changing payout methods and crypto prices.

In response to the declining Bitcoin rewards, some mining pools have changed their rewards strategy and switched between the payout methods.

Profitability calculators

There are many profitability calculators available online to calculate the cost-benefit of mining. Most calculators will ask you to input the available hashing power, energy consumption, electricity cost, and the fee of the mining pool. You can find one such Bitcoin profitability calculator here.

Make sure to run your analysis multiple times with different prices to determine the cost of power and its value. You can also change the difficulty level to see the impact on the analysis. Calculate the price at which mining becomes profitable and your breakeven price.

And if you want to know more about wallets, join BeInCrypto Trading Community on Telegram with like-minded people. Here you can share your experience, discuss and read all the hottest news on crypto, Web3 and the Metaverse. Join us

What is crypto mining?

Cryptocurrency mining is the process used by proof-of-work (PoW) blockchains to validate new blocks and create new coins. Bitcoin is the most popular cryptocurrency that uses this model, but there are other cryptos.

Other popular cryptocurrencies that are created through mining are Monero, Ravencoin, Litecoin, Grin, Zcash, and Ethereum Classic. So, what is crypto mining, and who are the miners?

To “mine” cryptocurrency, one must set up a specialized computer, that uses its CPU to hande the type of computations required for cryptocurrency mining. Each blockchain may have different algorithms, and specialized miners may need to be designed with specific software.

In simple terms, a blockchain is a large, distributed network of computers all over the globe that verify and secure blockchain transactions. The miners are happy to pay for this complex hardware and set up the network as long as the cryptocurrency rewards make up for the logistic costs (hardware costs, electricity, and maintenance) and still deliver a profit.

As you see, the principle of crypto mining is simple, and it relies on the computing power of the miners to validate the blockchain and generate new coins through block rewards.

Bitcoin mining and its profitability

Bitcoin mining is the process of verifying crypto transactions on the Bitcoin blockchain and generating new Bitcoins through block rewards.

If the price of Bitcoin is higher than the cost of mining them, miners can make a profit. Recent technology developments and mining equipment have turned crypto and Bitcoin mining into a business.

Professional mining centers are now equipped with huge computing power and can make a profit. Is Bitcoin mining profitable, still? Many say yes, but the truth is that each miner has to determine that for themselves.

Many miners take out loans to bootstrap mining operations until they are profitable. However, if they are not profitable enough to pay back the loans and maintain the cost of mining, they will default on their loans. They may sell their mining equipment to pay off the debt but may also be underwater if the price of the equipment drops as well.

Miners earn through block rewards

A block reward is a specific amount of newly minted cryptocurrency. Each blockchain has a predefined period of time for each block.

For instance, the Bitcoin blockchain creates a new block roughly every ten minutes. The fastest miner to validate the new block receives the reward. In 2009, when the blockchain was created, the anonymous creator of Bitcoin, Satoshi Nakamoto, set the mining reward at 50 BTC for each block and encoded future reductions.

This payout is halved by the Bitcoin code approximately every four years. This process is called the Bitcoin halving. In 2012, the block reward was reduced to 25 BTC. Four years later, in 2016, another Bitcoin halving took place, and the reward was set at 12.5 BTC per block.

In 2020, the Bitcoin block rewards were cut in half once more, reaching 6.25 BTC. 2024 saw another reduction, which put the block reward at 3.125.

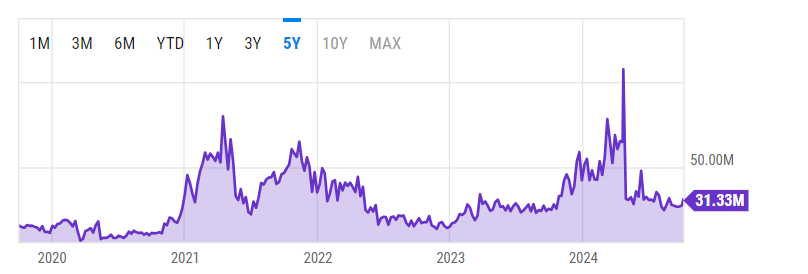

What is hashrate?

Hashrate is a key metric to assess the strength and security of a blockchain network. A higher hash rate means that there are lower chances of disrupting the blockchain by malicious actors. Hashrate is a great measure when determining if crypto mining is profitable for you.

Effectively, hash rate measures the total computing power that is used to verify and validate blockchain transactions — it measures how fast the block puzzle can be solved. The difficulty of the mathematical puzzle increases as more miners join the crypto-mining process, which adds more computing power to the network.

In 2009, the hashrate was measured in hash per minute (H/m). However, due to the rapid growth of cryptocurrency mining, H/s (hash per second) became more commonly prefixed with the following SI units:

- Kilohash – KH/s (thousands of Hashes/second)

- Megahash – MH/s (millions of Hashes/second)

- Gigahash – GH/s (billions of Hashes/second)

- Terahash – TH/s (trillions of Hashes/second)

- Petahash – PH/s (quadrillions of Hashes/second)

While Bitcoin’s exact hashrate is not known, it can be estimated based on the block difficulty and the number of blocks that have been mined.

Bitcoin mining hardware

As mentioned already, crypto mining requires special equipment. It’s important to research the different types of mining algorithms before you start investing in any equipment. High barriers to entry in terms of cost tend to be a stumbling block for those looking to make crypto mining profitable.

Bitcoin, for instance, requires specialized computers called ASICs — Application Specific Integrated Circuit. There are many brands of this kind of equipment, each with different levels of energy efficiency.

While newer machines are more efficient and produce more Bitcoin per unit of electricity, they tend to be more costly than older machines. But this is up to each individual Bitcoin miner.

Hardware is an upfront, expensive investment. Before purchasing an ASIC miner, it is important to consider the potential profit of mining. That’s why many individual miners are now asking themselves: Is crypto mining still profitable?

Is it profitable to mine altcoins?

Since there are many altcoins available for mining, you can predict the cryptocurrency mining profitability using a calculator such as WhatToMine. The website shows several coins that can generate revenues of around $2–3/day. While this is not a great return on capital investment, you might get coins that might appreciate in value over time.

In this scenario, the risks same considerations still apply. Crypto mining altcoins may be profitable depending on your setup. A powerful GPU or ASIC system can make it more lucrative. If you have cheap or free electricity, crypto mining can still be profitable. The inflation rate and the increased competition for the Bitcoin “prize” are two other factors.

When choosing a profitable altcoin to mine, you should also consider:

- The number of crypto exchanges that support the altcoin

- Ensure it’s a legit cryptocurrency

- Evaluate the long-term use of the mining equipment

- The possibility of withdrawing that altcoin to fiat

Is crypto mining profitable in 2025?

Mining was a lucrative activity in the early days of Bitcoin and cryptocurrency. The mining industry has changed dramatically over the years, with increased difficulty levels and large institutional players entering.

Individual miners should perform a cost-benefit analysis, taking into account variables — electricity costs, efficiency, and Bitcoin price — before committing to the activity. At the same time, you may also consider mining other PoW cryptocurrencies that might have a lower mining difficulty and need less expensive equipment.