This IoTex price prediction piece considers the potential of an EVM-compatible layer-1 chain and its native coin, IOTX. The tech-heavy blockchain is a platform for the “Internet of Trusted Things,” focusing on DApps, digital assets, and smart physical devices. So, is investing in IOTX a good option, especially when it has successfully reached our predicted price level for 2024? Let’s take a look.

- Fundamental analysis and the prices of IoTeX coins

- IoTeX price prediction and the involved tokenomics

- IOTX price prediction and key on-chain metrics

- IoTeX price forecast and technical analysis

- IoTeX (IOTX) price prediction 2023

- IoTeX (IOTX) price prediction 2024

- IoTeX (IOTX) price prediction 2025

- IoTeX (IOTX) price prediction 2030

- IoTeX (IOTX’s) long-term price prediction up to 2035

- Is the IoTeX price prediction model accurate?

- Frequently asked questions

Fundamental analysis and the prices of IoTeX coins

IoTeX belongs to a family of decentralized networking solutions with peers like Helium and NKN. However, it goes one step further with an aim to connect IoT devices using encryption and blockchain technology. Devices and users on the IoTeX blockchain can run concurrent services with interoperability in mind.

“With the addition of more and more products over the years, inherently, onboarding for new users became more difficult. Which is why I’m so proud to launch IoTeX Web Wallet. This will serve as an incredible entry point for anyone looking to get invested in IoTeX and/or DePIN.”

Aaron Basi, Head of Product at IoTeX: X

Imagine running a DApp on any smart device, which can interact with other blockchain participants via IoTeX. Like any other layer-1 blockchain, IoTeX comprises a root network and an ecosystem of sidechains to support scalability.

Other insights:

Here are some of the other descriptive features that you might want to know about:

- IoTeX blockchain is extremely efficient regarding scaling — all thanks to the delegated proof-of-stake consensus.

- Layer-2 solutions support scalability and interoperability.

- The network even supports edge computing, allowing smart devices to communicate better with each other.

- The subchains, thanks to layer-2 support, can interact with each other.

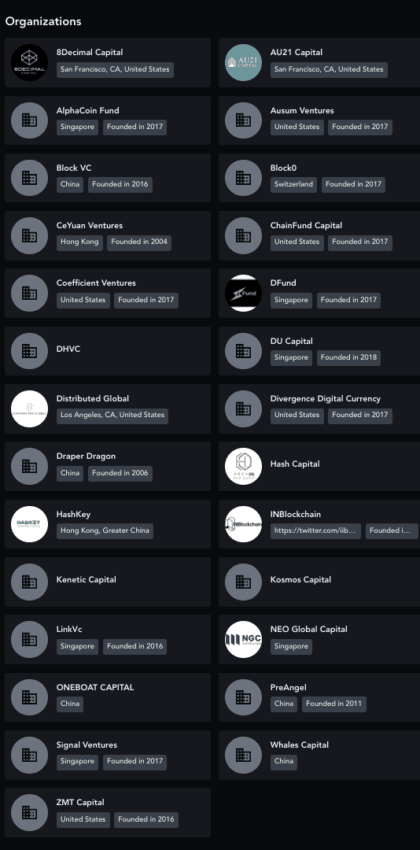

- The platform has a celebrated lineup of investors.

- The IoTeX blockchain hosts infrastructure layers that connect to the Binance Smart Chain, Ethereum, and Heco ecosystems.

- IOTX is the native coin meant for paying network usage or gas fees. Hence, its price action might depend on the network adoption and development activity.

- The native coin also supports burning, spending, and staking. It also has a vital role in managing network governance — making it a wholesome cryptocurrency.

Did you know? IoTeX boasts an in-house, proprietary hardware solution called the Pebble Tracker, which is privacy-focussed and captures climate, motion, light, location, and other real-world metrics.

And that’s more or less everything important about the IoTeX blockchain.

Overall, IoTeX is fast, scalable, and solves an important issue of making machine economics simple — for automated vehicles and smart devices.

IoTeX price prediction and the involved tokenomics

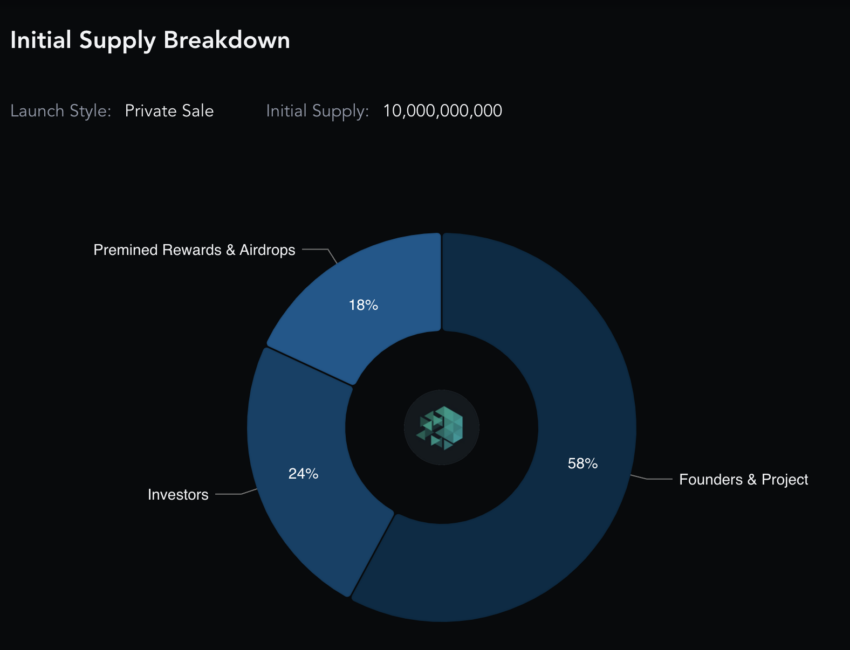

The token economics of IoTeX, involving its native coin, IOTX, is pretty straightforward. The overall supply is capped at 10 billion, out of which almost 94% makes up the circulating supply. During the initial supply distribution, 24% went to the investors participating in the private sale. What’s disconcerting is that founders — including the project — hold 58% of the total supply.

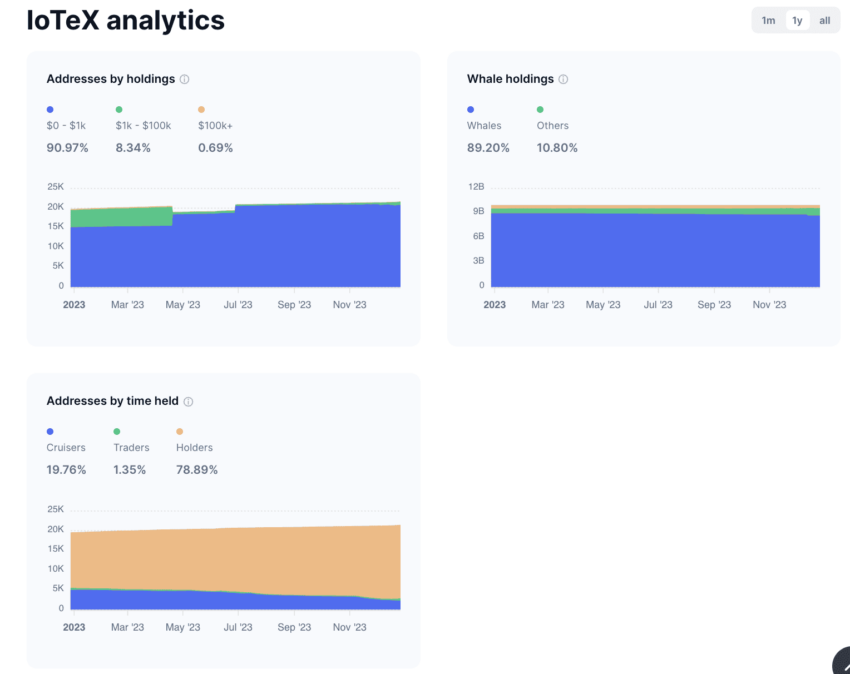

This becomes a concern if the project starts dumping IOTX tokens during a market-wide sell-off. The holder statistics, as of early 2023, revealed that the top 100 IOTX holders controlled 98.78% of the supply. That didn’t look well for the IOTX price predictions, especially when the crypto market slipped into a bear cycle.

Yet, things changed a bit by the end of 2023, as IOTX whales now only control 89% of the supply.

There is another silver lining. The IoTeX blockchain implements a burn-drop mechanism, eventually making the circulating supply net deflationary over time.

IOTX price prediction and key on-chain metrics

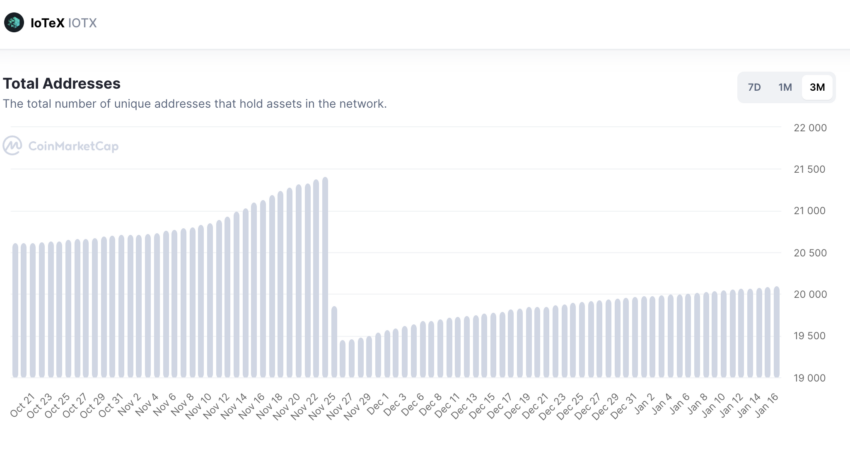

The short-term IOTX price predictions didn’t look robust due to the “total addresses” metric. Over the last three months, as of early 2023, the number of addresses holding IOTX dipped considerably.

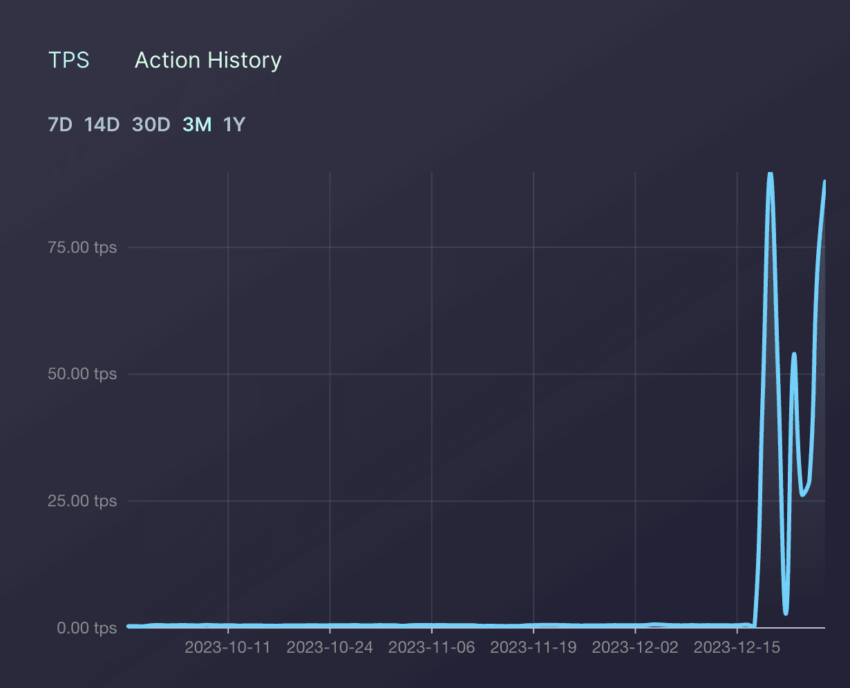

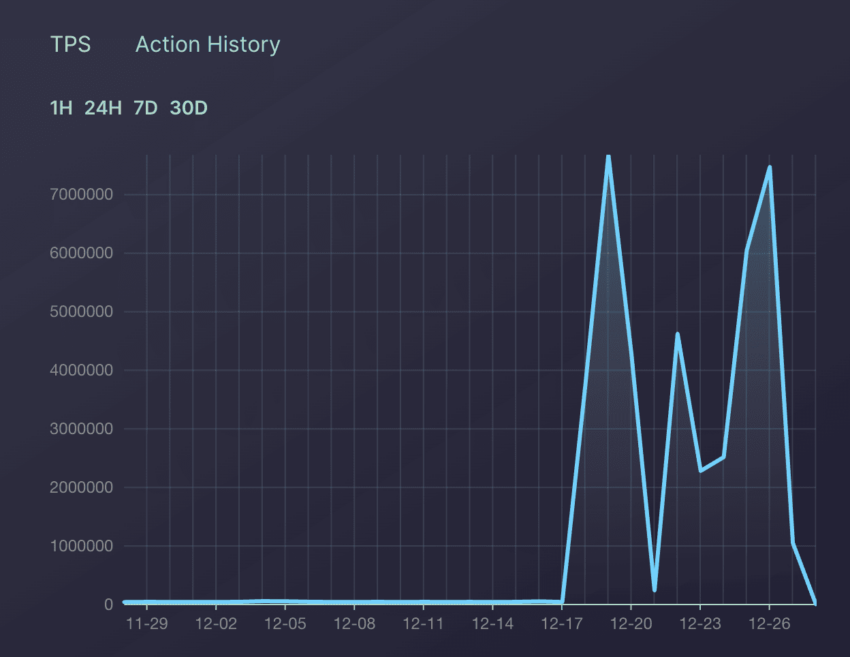

Yet, what worked for IOTX towards the end of 2023 is the increase in the number of network-led transactions and even the action history over the last 30 days or so.

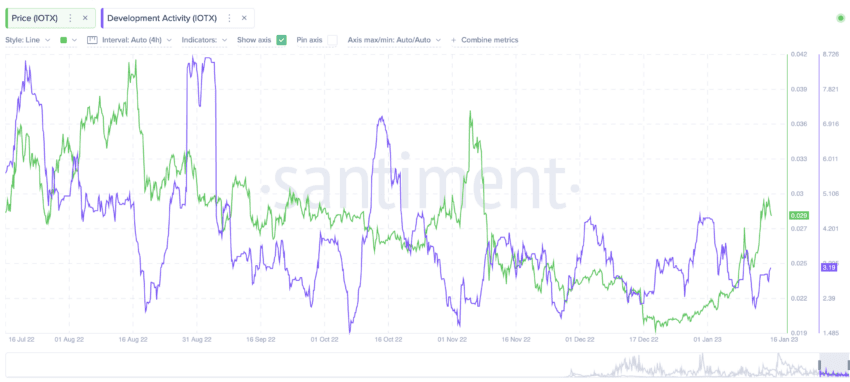

The development activity was at its peak in August-September 2022. And the decline started pushing the prices down. There was another lower high in October, which did make the prices surge for a brief period.

The prices are now increasing in response to the overall development activity trying to break above its previous high, made in November 2023.

Also, there is a reason why the relief rally across the crypto market might not impact IOTX that positively. Look at the 4-week price volatility, which seems to be approaching a peak. The volatility at IOTX’s counter might need to drop for the prices to respond positively to the existing levels. More addresses starting to hold IOTX can be a good way to achieve the same. However per the December 2023 volatility chart, a quick price correction could be incoming.

IoTeX price forecast and technical analysis

Before we get to the broader charts, let us quickly analyze IOTX’s potential now, as of December 2023.

Our December 2023 analysis: short-term

The daily IOTX/USD chart shows that the prices, to date, have been trading within the wedge pattern. A breach past the upper trendline, or rather the $0.65 mark, can push the prices higher, even towards the $0.07 mark. Yet, the RSI isn’t sending out the most bullish signs as a bearish divergence is forming, which might lead to a quick correction.

While fundamentals and on-chain metrics help with long-term crypto price predictions, we must rely on technical analysis to identify patterns. For IOTX, the native coin of IoTeX, here is the quick weekly chart as of January 2023:

Notice that the weekly chart starts with a standard high, bottoms out, and leads to a price peak— the maximum price for IOTX. The swing high formation is clear from the peak, with IOTX making lower highs. This might also suggest a persisting downtrend at IOTX’s counter.

This pattern could continue in two ways:

- With IOTX breaking out and finally making a new high, That way, we could establish a foldback pattern where the right side of the chart looks like a mirror image of the left side of the chart.

- The correction continues, delaying the foldback pattern formation. That might mean we might see some additional lower highs in the short term.

Which of the two possibilities transpires will be decided by the short-term IOTX price predictions. Let us now track the early 2023 analysis in which we expected the prices to hit crucial resistance levels of $0.03571 and then $0.03818.

Short-term price prediction of IoTeX (IOTX)

The daily chart reveals an interesting formation. The falling channel at IOTX’s counter is noticeable. And the price action is slowly moving toward the upper trendline. At present, the price of IoTeX (IOTX) is at $0.02863. If the upper trendline is clearly breached with high volumes, we can expect the price to hit $0.03571 and then $0.03818.

The RSI is in the overbought zone, but it is not all bad. If it moves up a bit, it might be able to complete a bullish divergence — making a higher high compared to the peak it made in early November. Moving above the encircled region might move the prices of IoTeX higher.

The moving average lines mostly trade in parallel. For a short-term, clear rally, the red line (50-day MA) might have to cross above the green line (100-day moving average). Or even the green line crossing above the blue line (200-day moving average) can help. Overall, it seems the short-term crypto price of IOTX is waiting to increase. All that is needed is some buying pressure, and the peaking volume pillars might help.

Pattern identification

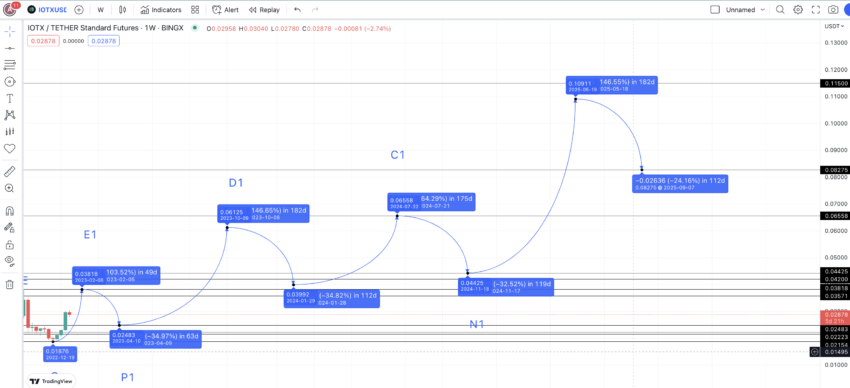

The short-term price prediction shows that an uptrend might be in order. This way, IOTX would be able to realize the foldback pattern real soon. Assuming that the mirror image of the left-sided pattern might continue, here is the weekly chart with all the crucial points marked.

While the lows and highs are marked on the chart, the mentioned points aren’t simply for reference. Instead, they work as important support and resistance lines and might play a role depending on the condition of the broader crypto market.

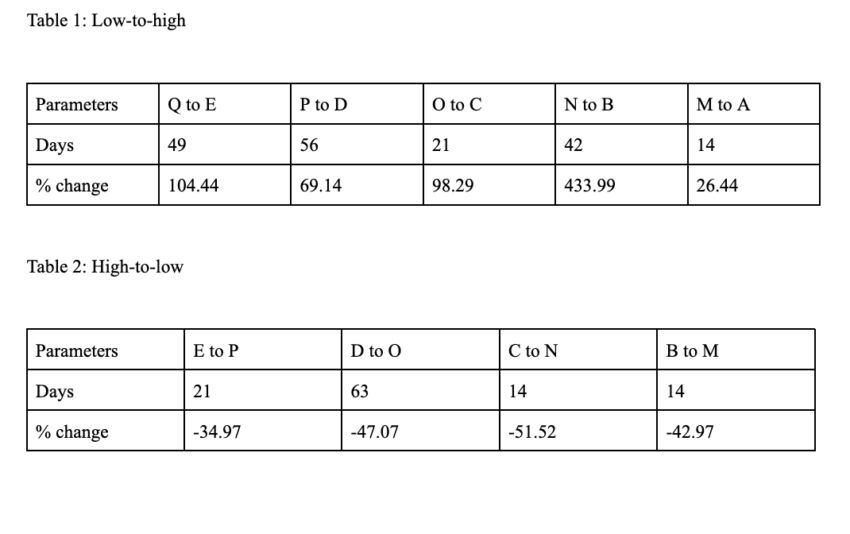

Price changes

We expect the path from A to Q to recur, but as a mirror image, we will trace the price change percentages and distances from Q to A. We will have Table 1 with all low-to-high values and Table 2 with all high-to-low values.

The low-to-high average price percentage and distance is 146.46% and 36 days, approximately. The maximum distance can go as high as 49 days. The minimum percentage growth can be 26.44% — the worst-case scenario during bearish market conditions. Also, depending on the market conditions, the maximum price hike can be anywhere from 26.44% to even 433.99%.

Table 2 puts the high-to-low price dip and distance at 44.13% and 28 days. The maximum price drop distance is 63 days, and the minimum price drop percentage is 34.97% — the best-case scenario during strong market conditions.

We will now use the data to plot the crypto price prediction points.

IoTeX (IOTX) price prediction 2023

We predicted a level of $0.06125 for IOTX in 2023. And it almost succeeded, hitting last December 2023. Now that Q is the last low for IOTX, the next high, or rather E1, can use the low-to-high average values of 146.46% and 36 days, respectively. However, the market is still in the bearish phase, and we might not get the maximum price hike of 146.46%.

Using the short-term price chart from earlier, we can put the next high in line with the E — from the left-sided part of the chart. The level surfaces at 0.03818. We can mark this point as E1.

The next low can be anywhere till 63 days. Also, if the high goes to 0.03818, we can expect the drop to 34.97% — the minimum drop percentage from Table 2. Therefore, this low P1 can also coincide with the left-sided P low, surfacing at $0.02483. T

If P1 surfaces at $0.02483, we can assume the selling strength is less. Therefore, we might see the next high surfacing at 146.46% in 49 days. Note that the days might vary as the left side of the chart was during the bull market, and currently, the crypto market conditions aren’t that strong.

Therefore, the price growth of 146.46% can take 180 days to realize — the sum of all the distance points from low to high. This puts the highest price prediction for 2023 at $0.06125 towards the end of 2023.

Projected ROI from the current level: 112.60%

IoTeX (IOTX) price prediction 2024

Outlook: Bullish

At D1, the highest price of IOTX in 2023 is already higher than the older D from the left side of the chart. Therefore, assuming the market conditions are strong, the low might take 112 days — the sum of all high-to-low distances. The drop could be a minimal 34.97%, using data from Table 2.

This level, or O1, is at $0.03992 and somewhere in early 2024. IOTX should be in an uptrend, making $0.03992 the minimum price prediction for 2024. As per the market conditions, the next high could be in 180 days, and resistance might be found at $0.0658. This equals a high of 64.29% and aligns with our 69.14% high from Table 1. We can mark this C1.

Notably, we are hinting that IOTX might not surge a lot in 2024, considering the cyclical nature of its price action. However, we won’t be surprised if it manages to cross past the resistance of $0.0658 and scale the 8-cent mark with ease.

Projected ROI from the current level: 26%

IoTeX (IOTX) price prediction 2025

Outlook: Bullish

From C1, the next drop could be in 112 days (reason mentioned above) and till the strong support level of $0.04425. This translates to a drop of 32.52% and is in line with the lowest drop percentage of 34.97% from Table two.

In 2025, we can expect a hike of 146.46% from the last low of $0.04425. This puts the 2025 IOTX price prediction/forecast at $0.10911. The low in 2025 can take support at $0.08275 — a drop of 24.18%.

Projected ROI from the current level: 109%

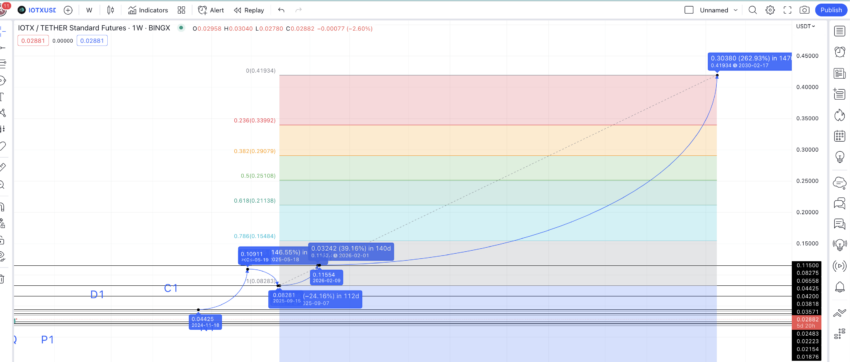

IoTeX (IOTX) price prediction 2030

Outlook: Bullish

Now that we have the highest price of IOTX in 2025 and even 2025 low at $0.08275, we need to identify the prices of IoTeX in 2026 for long-term crypto price predictions. We can expect the price of IOTX to reach and surface at $0.115 in 2026 — which coincides with the older support level or B. Notice that A1 is higher than B1, unlike the left-sided pattern where A is lower than B.

We now have 2026 high and 2025 low at our disposal. Connecting the points using Fibonacci levels makes it possible to extrapolate the path till 2030.

If we trace the same path till 2030, we can expect the highest price of IoTeX to settle at $0.4193. However, for this level to hold, we might expect IOTX to reach its previous all-time high price of $0.26 by mid-2029.

Projected ROI from the current level: 706%

IoTeX (IOTX’s) long-term price prediction up to 2035

By now, we have the IOTX crypto price predictions till 2030. However, if you plan to go longer in IOTX, regardless of the changing trading volume and market cap, here is a table to help trace the path till 2035.

You can easily convert your IOTX to USD here

| Year | | Maximum price of IOTX | | Minimum price of IOTX |

| 2023 | $0.06058 | $0.01349 |

| 2024 | $0.0658 | $0.03992 |

| 2025 | $0.10911 | $0.08275 |

| 2026 | $0.115 | $0.0897 |

| 2027 | $0.1725 | $0.1345 |

| 2028 | $0.2156 | $0.168 |

| 2029 | $0.26 | $0.203 |

| 2030 | $0.4193 | $0.32 |

| 2031 | $0.524 | $0.408 |

| 2032 | $0.68 | $0.53 |

| 2033 | $1.022 | $0.79 |

| 2034 | $1.328 | $1.03 |

| 2035 | $1.727 | $1.34 |

Do note the price of IoTeX (IOTX) each year will depend on the market cap at the time, the state of on-chain metrics, and even the network growth. Therefore, it is better to focus on the average price of the IOTX in any year rather than the maximum and minimum prices.

Is the IoTeX price prediction model accurate?

This IoTeX price prediction model doesn’t jump straight to conclusions. Instead, it first establishes the short-term technical analysis pattern before moving to long-term price predictions. Apart from the technical analysis, we also take the fundamentals, on-chain, and social metrics into account. As such, this model is both practical and realistic.

Frequently asked questions

What is IOTX all time high?

How old is IOTX coin?

Who owns IoTeX?

Is IoTeX a good investment?

What is IoTeX used for?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.