The real-world asset (RWA) crypto market is booming in 2026, with tokens such as ONDO, POLYX, and LAND leading the charge. With an increasing number of enticing projects emerging in quick succession, the fear of missing out (FOMO) is palpable. That said, we would advise that you don’t dive in blind. This guide teaches you how to invest in RWA crypto assets without complexities and while staying safe. Here’s what to know and how to buy real-world crypto assets.

KEY TAKEAWAYS

• Real-world asset (RWA) tokens represent digital ownership of physical assets like real estate, commodities, and securities.

• RWA tokens use blockchain technology to offer enhanced liquidity, security, and the ability to own fractional shares of physical assets.

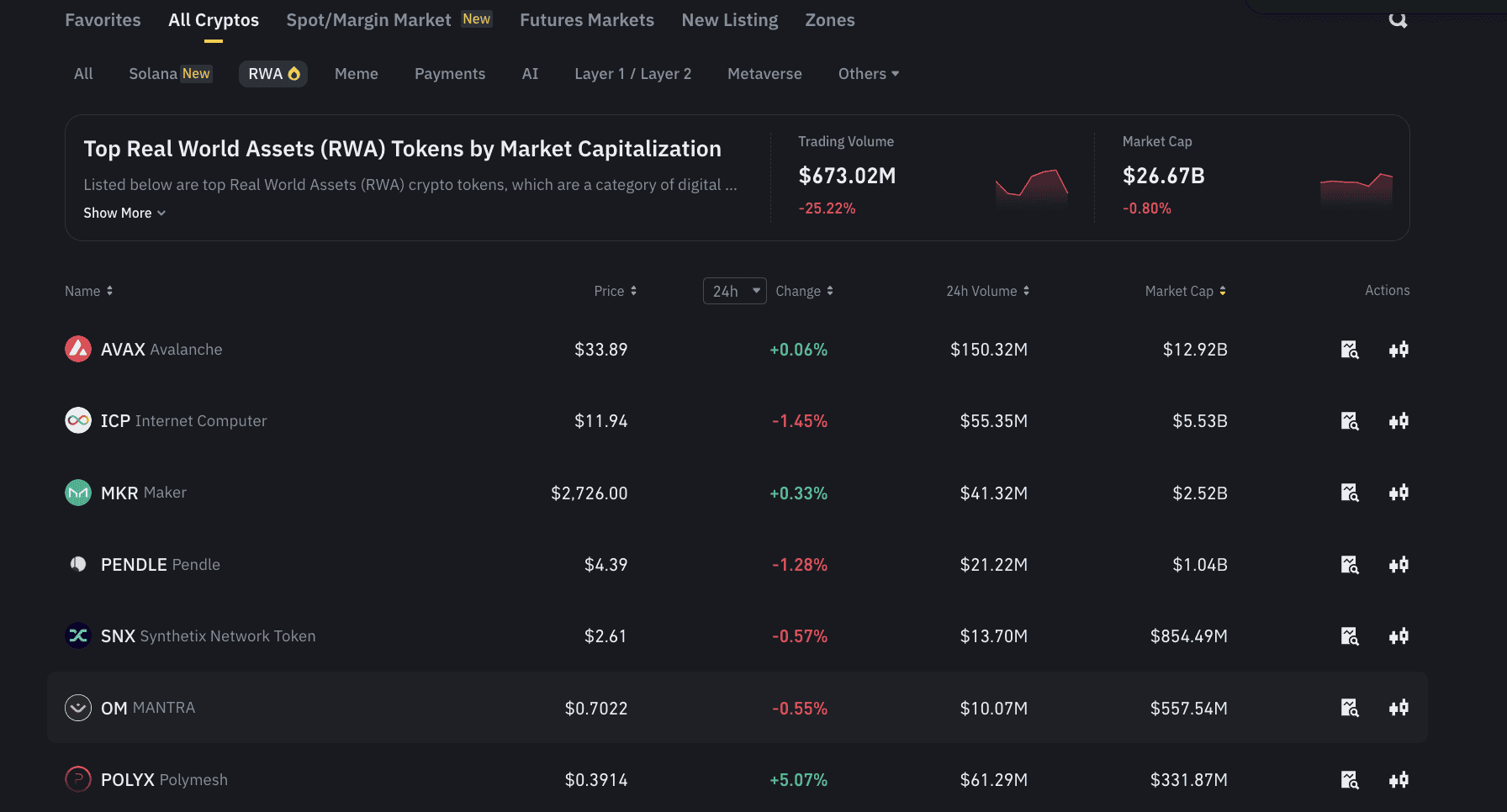

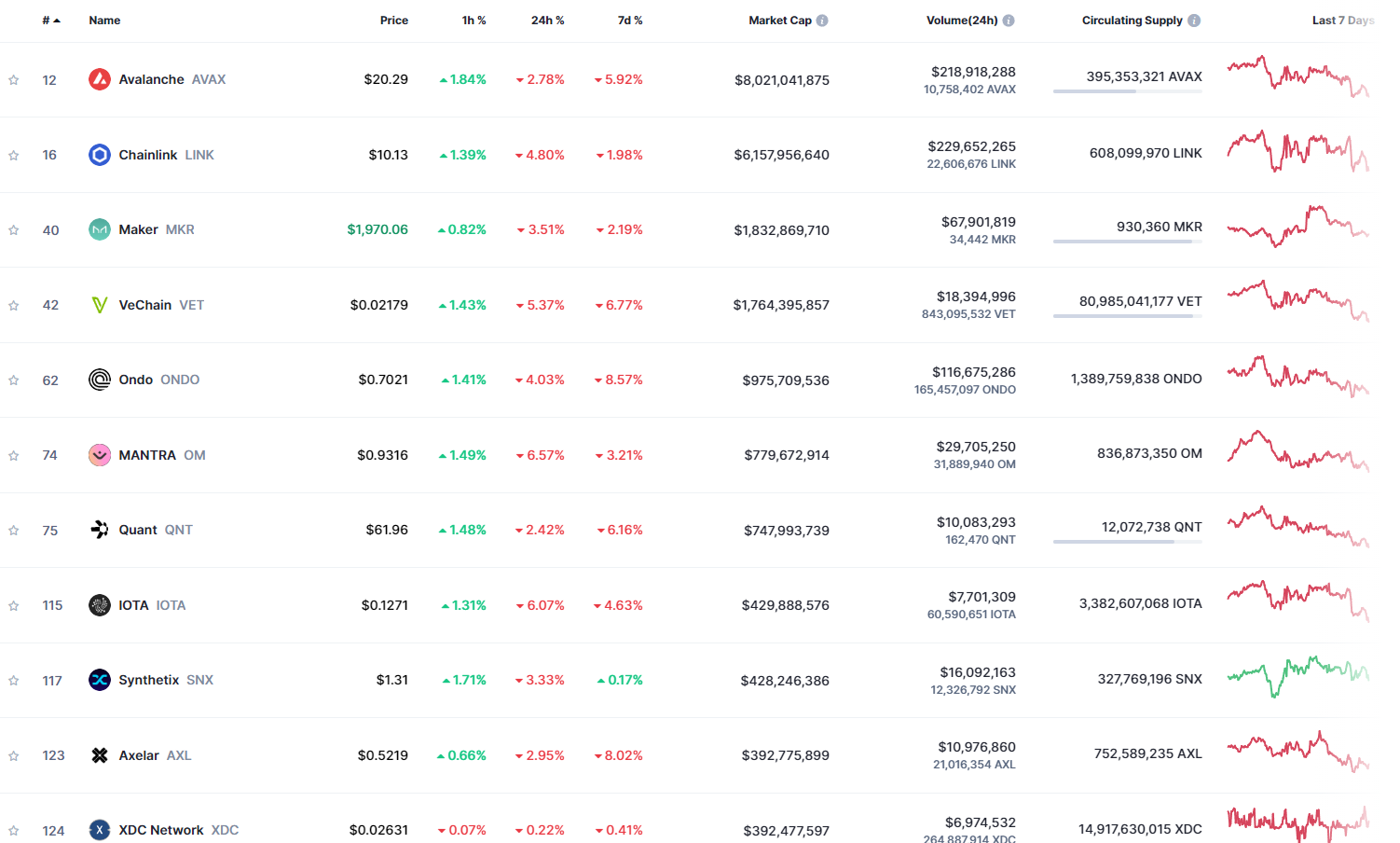

• Popular RWA tokens include Polymesh, Ondo, MANTRA, Synthetix, etc.

• You can invest in RWA tokens through CEXs for better security or through DEXs for greater flexibility.

How to invest in RWA crypto tokens?

You can invest in RWA tokens through a centralized exchange (CEX) — which tends to be safer — or a decentralized exchange (DEX), should you want to enjoy the perks of early listings.

Using CEXs

Using CEXs like Binance, Coinbase, or Kraken offers a straightforward way to invest in RWA crypto tokens. These platforms often have dedicated sections or tags for real-world assets (RWA), making it easier to identify and invest in them. Here’s what to do:

- Research and select a CEX: Choose a reliable CEX that lists RWA tokens.

- Create an account: Sign up on the chosen platform and complete the verification process.

- Fund your account: Deposit funds into your account using your preferred method, such as a bank transfer, crypto transfer, or credit card.

- Select RWA tokens: Search for RWA tokens such as Landshare (LAND), Polymesh (POLYX), or Ondo (ONDO). Review their performance and market potential.

- Make the purchase: Follow the platform’s instructions or choose from the existing listings to buy your selected RWA tokens. Be mindful of the trading pair you wish to work with.

- Secure your investment: To protect your tokens from potential hacks, transfer them to a secure wallet, preferably a hardware option.

Using DEXs

Decentralized exchanges list tokens early. To locate RWA tokens, you can track them via websites like CoinMarketCap, or analyze them more deeply using tools like DEXScreener. Once you have conducted sufficient research and have a solid investment and risk management strategy in place, you can head over to DEXs like Uniswap or SushiSwap.

Here are the steps to follow:

- Connect your wallet: Use a crypto wallet like MetaMask to connect to the DEX.

- Fund your wallet: Ensure your wallet has sufficient funds. Ethereum (ETH) is often required, although this is dependent on the DEX.

- Select RWA tokens: Search for RWA tokens on your chosen DEX. The best approach is to locate a token on CoinMarketCap and then move to the exchange.

- Make the purchase: Execute the trade directly from your wallet. Confirm the transaction and pay any required gas fees.

- Monitor listings on CEXs: Sometimes, RWA tokens initially listed on DEXs are later listed on CEXs.

Did you know? ELYSIA (EL) Token is an example of a real-world asset (RWA) token that was first listed on a decentralized exchange (DEX) and later on a centralized exchange (CEX). Initially, ELYSIA was traded on DEXs, leveraging the flexibility and reach of decentralized finance (DeFi). Later, ELYSIA partnered with BKEX, a global crypto exchange, to launch the world’s first RWA money pool on a CEX, significantly expanding its accessibility and investor base.

Holding RWAs on DEXs also allows traders to work with liquidity pools and earn passive income, although this comes with significant risk.

What are RWA tokens?

Real-world asset (RWA) tokens digitally represent ownership of physical assets such as real estate, commodities, and securities. These tokens leverage blockchain technology to provide liquidity, security, and fractional ownership.

Investing in RWA tokens can come with a host of benefits. These include the scope to diversify your portfolio and enhance transparency while dealing in real-life investment items (for example, art, fine wine, or real estate).

Polymesh (POLYX) is one example of an RWA blockchain. Designed for regulatory-compliant trading of security tokens, the altchain offers a secure platform for tokenized securities.

Note that investing in RWA tokens also carries risk. The value of the underlying assets can be volatile, and the liquidity of these tokens may not always match that of traditional markets.

How to stay safe while investing in RWA crypto?

To invest in RWA crypto while staying safe and avoiding crypto scams, ensure to:

- Choose reputable platforms

- Enable two-factor authentication (2FA)

- Use secure wallets

- Verify smart contracts

- Diversify your investments

- Stay informed

- Beware of scams

- Legal and regulatory compliance

- Use DEXScreener and similar tools

- Backup your wallet

Real-world crypto or real-world opportunities?

Overall, whether through tokenized real estate, commodities, or securities, integrating RWA tokens into your portfolio can provide demonstrable benefits and opportunities in 2026. You can take advantage of the tokenization drive and opportunities in this emerging market by following the steps outlined above.

When learning how to invest in RWA crypto, it’s crucial to prioritize security every step of the way. Make sure to use reputable platforms and a secure wallet, and only interact with verified smart contracts. Never invest more than you can afford to lose. Remember, the crypto market is volatile, and profits are never guaranteed.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.