Are you looking to learn how to trade Bitcoin futures and options? Understanding the foundations of crypto assets and the corresponding trading products is paramount. This guide walks you through how to buy and sell Bitcoin futures and options and explains the concepts and profit-making methods behind each.

KEY TAKEAWAYS

► Bitcoin options and futures allow traders to speculate on cryptocurrency prices or hedge against potential losses without actually owning the asset.

► Understanding the mechanics of how to trade Bitcoin options and futures is crucial, with detailed steps provided for through platforms like Bybit.

► Options offer greater flexibility by allowing traders to choose not to execute the contract, unlike futures which have a binding agreement to buy or sell.

►Before trading Bitcoin options and futures, it’s important to do your own research (DYOR) to understand the risks and legal implications.

How to buy and sell Bitcoin options: Step-by-step

You can explore how Bitcoin options work using a number of platforms. For the purpose of this demonstration, we are using one of the most trusted crypto derivatives platforms on the market – Bybit. After you sign up, you can start trading Bitcoin options in a few easy steps.

In short you must:

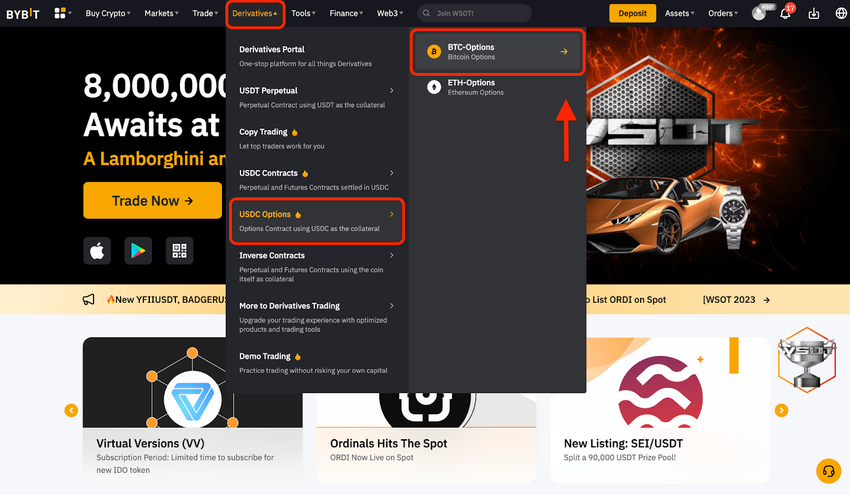

- Find the BTC options page in the “Derivatives drop-down menu.”

- Choose an options contract (Call or Put, depending on whether you are buying or selling)

- Edit the settings, including the price at which you wish to buy or sell.

- Submit the order and monitor any open positions.

- Set a limit close order if you have open options.

Now, let’s take a closer look.

Step 1. Go to the options page

Note that Bybit also offers ETH options.

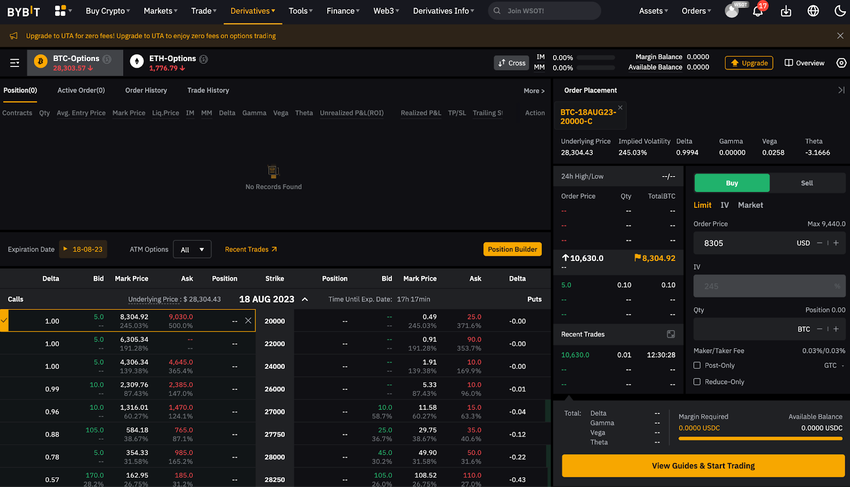

Step 2. Select options contract

You can now pick a Call or Put option. You can use the existing filter to sort these options based on their expiry date, strike price, or any of the other filters available.

Do note that the contracts are listed according to their predetermined strike price.

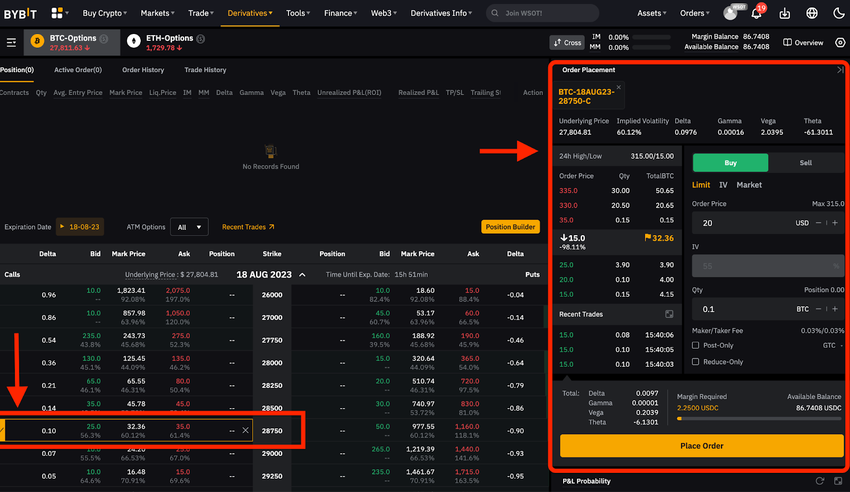

Step 3. Edit and submit an order

Then, proceed to edit your order.

To buy a Bitcoin option, select the “buy” option. If you want to sell Bitcoin options, select “Sell.”

Make sure to select your option contract carefully. You can either buy in or sell it using the limit option or instantly open the position using the market price (market option). Don’t forget to check the “Estimated P&L” dashboard, which may help you implement your trading strategy.

After you select the buying/selling price and then the quantity, place your order. It will appear under “Active orders” on your personal dashboard, above the list of option contracts.

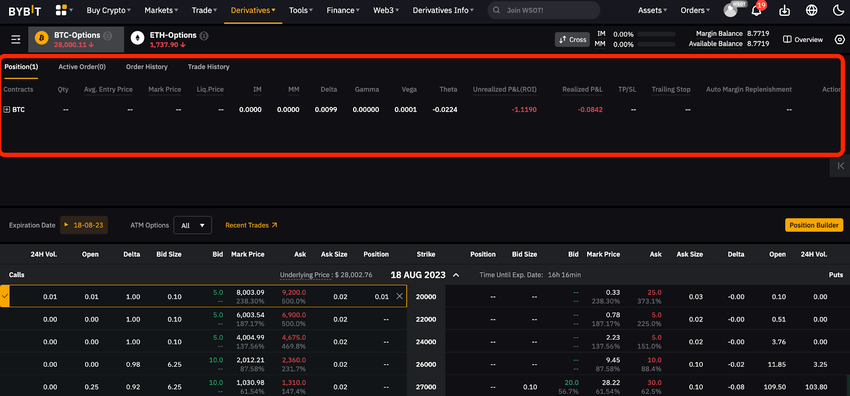

Step 4. View your open positions

You can always view the status, positions, and trade history of your orders in the USDC Derivatives account.

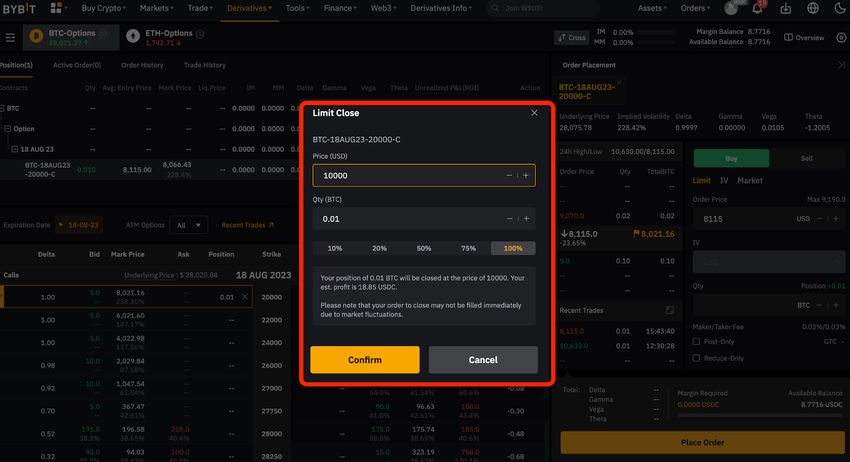

Step 5. Close Bitcoin option (or set a limit)

You can choose to close your Bitcoin option at any time. You can also set a limit close order to close your Bitcoin option position when a given price is reached.

And that’s how you can trade Bitcoin options on a dedicated crypto derivatives platform, such as Bybit.

What are crypto futures?

Once many people learn how to trade cryptocurrency, they often move into the predictive sphere of crypto futures. Cryptocurrency futures are agreements where two investors agree to buy or sell an asset at a cryptocurrency’s predetermined price at a later date.

Futures are a derivative trading instrument. It’s a way to be involved with a cryptocurrency without actually owning it. Just as you might bet on the future price of gold or stocks, you can do the same with crypto.

These contracts are electronically traded and settled in cash or crypto, using set rates to determine Bitcoin and other values. When trading crypto futures, the trader commits to buying the asset when the contract expires. In simpler terms, a futures contract is a bet on the price of something in the future. Each contract has specific details, like how many units are involved, the price, and how it will be settled.

For example, if you bought two BTC futures contracts for a total value of $50,000 when Bitcoin was $25,000 each, you’d need to deposit half that amount, $25,000, upfront. This deposit is called a margin. The rest of the payment is borrowed or “leveraged.”

The value of your contract will change with BTC’s price. Depending on the price movement, you can keep the contract, sell it, or, when it ends, get a new one or cash in.

To start trading Bitcoin futures, you simply need to set up an account on one crypto futures trading platform. Your trading experience and funding determine how much you can borrow or “leverage” for trades. Regulated platforms have set limits on this leverage.

Leverage and margin increase the possibility of increased profits and losses while trading cryptocurrency futures and options. Because of this, it’s important to focus on using efficient risk management techniques, including stop-losses, to mitigate the inherent volatility of cryptocurrency markets.

What are crypto options?

Similar to crypto futures, an option is a contract letting you buy or sell a digital asset at a fixed price later on. The main difference between futures and options is that crypto options remove the obligation to buy the asset when the contract expires. You don’t have to use it, but you can if you want.

Crypto options trading is a more affordable and often safer way to trade digital currencies than futures. There are two crypto options types :

- Call option = Right to buy

- Put option = Right to sell

Depending on where you trade, you can either get cash or actual crypto like Bitcoin when the option ends. For instance, OKX will give you BTC if your BTC option is successful at expiration. Other platforms may pay you in cash.

Types of crypto options available on crypto option trading platforms:

- American-style options let you use the contract anytime before it ends.

- European-style options can only be used when they end. But you can sell them or end them early if you want.

How to trade Bitcoin options

- An option creator creates calls and puts. These options have an end date and a set price (called the strike price).

- The premium is the price you pay for an option. It acts like insurance, letting you secure a price.

- Premium costs depend on the time left, the expected volatility of the price swings, current interest rates, and the current asset price.

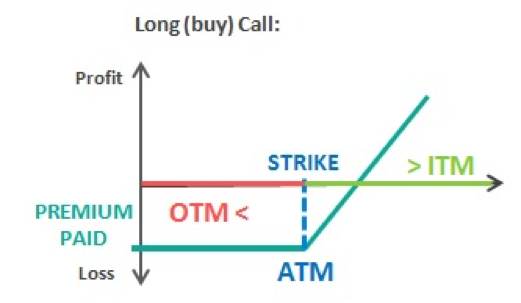

- This is how option prices work:

- In The Money (ITM): You’re making a profit from the start.

- At The Money (ATM): The strike price is the same as the current price.

- Out of The Money (OTM): You’d make a loss if you used the option now.

Expiration date

Crypto options contracts are essentially promises to trade digital assets in the future. Each comes with an “expiry” date, marking when the contract can be acted upon. European options can only be exercised on this expiry date, while American ones offer flexibility to be exercised anytime before the expiry.

Take, for instance, a European call option to purchase BTC at $20,000, set for a certain date. On that specific date, you can buy Bitcoin for $20,000, irrespective of its market value, according to your options contract and value.

Strike price

The “strike price” of an option is a predetermined price at which the crypto can be traded in the future. A call option lets you buy at this price, whereas a put option enables selling. For instance, a call option might give you the right to buy Bitcoin at $30,000 by Christmas Day. Conversely, a put option might grant the right to sell it at that same price.

Note that if you have a call option, you may not choose to buy, but if you have a put option, the buyer might choose to exercise his right to buy, and you must comply.

Option calls explained

Buying a call means paying a premium for the potential to buy an asset like Bitcoin at a future price. While you start with an initial cost, profits arise if the asset’s price at expiration surpasses the strike price plus the premium.

Selling a call, on the other hand, grants you an immediate premium but ties you to potentially selling the asset at an unfavorable rate if the market surges.

Option puts explained

When buying a put, you pay a premium for a potential future selling price. Profits occur if the market price drops significantly. Selling a put earns you a premium but commits you to potentially buying the asset at an unfavorable rate.

Consider selling a Bitcoin put option at $20,000. If BTC’s value drops drastically, you’re contractually obligated to buy at a price higher than the market rate, resulting in a potential loss.

Making a profit with crypto options trading

For example, selling a Bitcoin put option with a $30,000 strike price that expires on a certain date can help you make a profit. You will earn an immediate premium when selling this option. If Bitcoin’s value rises to $34,000 by that date, the option expires unused (because the option’s buyer will not sell their BTC to you when the market price is higher and, therefore, grants them a profit), and you retain your premium.

Options often offer more creative ways to trade than futures. Both can be used to predict or safeguard against cryptocurrency price changes, but options give traders more choices in how they trade.

Advantages of trading futures and options

Why are traders choosing to engage in Bitcoin options and futures?

- Regulated trading: Trading Bitcoin options and futures allows traders to be involved in cryptocurrency overseen by a regulatory body, which can give them more confidence.

- Attracts institutional investors: Big investors or firms prefer such regulated methods because they are more trustworthy and have a safety net.

- Simplicity: You don’t need to deal with the hassles of owning BTC. That means no need for a Bitcoin wallet or worrying about how to store your coins safely.

- There are no actual ownership risks: Since the contracts are settled in cash, you won’t have the risks tied to owning the actual cryptocurrency, which can be very volatile.

- Safer option: Bitcoin futures can be less risky than owning Bitcoin. With set positions and price limits, you can limit potential losses.

- Position limits: Different platforms have different rules about how many contracts you can have. Most crypto platforms allow adjustments based on your trading history and deposited funds.

Are crypto options risky?

As with all financial instruments, Bitcoin futures and options are risky investments. Here’s what you should know before you start trading options and futures:

- Higher risks with options: Trading Bitcoin options can be more risky than simply buying or selling Bitcoin. For instance, if you purchase an option at a certain price and Bitcoin doesn’t reach that price by the expiry date, you lose the amount you paid for the option.

- Options are complicated: Unlike just buying or selling Bitcoin, with options, many factors influence their value. A major factor is time decay. As the expiry date gets closer, the option’s value can decrease because there’s less time left to act on it.

- Young market for Bitcoin options: Bitcoin options are relatively new. Therefore, they don’t have the same deep market as more established options. This can affect price stability and make trading in longer-term options more unpredictable.

- Different trading processes: To trade Bitcoin options, you can’t just use a regular Bitcoin trading account. You need to sign up on an exchange that specifically supports crypto derivatives.

| Pros | Cons |

|---|---|

| Typically regulated | Can be more complex than holding |

| Attract institutional investors/liquidity | Steep learning curve |

| No custodial risks | Amplified profits and losses |

| Exposure to BTC w/o holding |

Is crypto options trading legal?

Whether crypto options trading is legal depends on the rules of the country you’re in. It’s vital to understand the laws in your area before starting crypto options trading. As with any other financial instrument, to ensure you are not doing anything illegal, you must research crypto option taxation laws in your country.

While there’s still some debate about how some cryptocurrencies should be taxed, profits from crypto options are typically seen as capital gains. As an individual trader, you’ll be taxed on your profit when you close a trade, not when you open it. Only at the trade’s closure will you need to consider whether you owe capital gains tax or can claim a capital loss.

DYOR before trading Bitcoin options and futures

While many trade crypto directly by buying or delving into crypto futures, trading platforms increasingly facilitate those looking to trade options. This guide demonstrates that learning how to trade Bitcoin options and futures is relatively simple.

Crypto options and futures trading offer traders a unique instrument in the crypto markets. Most traders aim to buy a call option or hedge against potential market downturns. You should be familiar with crypto trading patterns before you start trading. Remember that crypto derivatives can be even riskier than owning the underlying asset. Ensure you thoroughly research how crypto futures and options work before engaging in this type of trading.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Trading futures carries significant risks and profits are not guaranteed.

Frequently asked questions

Both OKX and Bybit are widely recognized as leading platforms for crypto options trading due to their high liquidity and range of offerings. However, the best platform can vary based on individual needs, regional accessibility, and changes in the market. It’s essential to do up-to-date research and consider factors like fees, supported assets, and user experience before choosing a platform.

The cost of BTC options varies based on factors like the strike price, expiration date, and market volatility. It’s best to check specific trading platforms for current pricing and the options premium for the contract you’re interested in.

Yes, OKX offers options trading for various cryptocurrencies, including Bitcoin (BTC). Always make sure to familiarise yourself with the platform’s trading terms and conditions before engaging in options trading.

Professional traders often employ various strategies to manage risk when trading Bitcoin futures and options. They might use hedging to offset potential losses by taking an opposite position in a related asset. Spread trading is another technique whereby the company simultaneously buys and sells futures contracts to capitalize on the price difference. Moreover, setting stop-loss orders to automatically sell at a predetermined price can limit potential losses. Professionals also often diversify their investment portfolios to spread risk and regularly conduct technical and fundamental analyses to inform their trading decisions.

For professional traders, staying up-to-date of regulatory changes is crucial. Regulatory shifts can dramatically impact market dynamics, influencing liquidity, the range of available trading instruments, and compliance requirements. Professionals must be informed about various jurisdictions’ regulations, especially if they trade on international platforms.