The Flow blockchain is the brainchild of the start-up generator behind the Crypto Kitties NFT game. Dissatisfied with Ethereum’s scalability struggles, Axiom Zen built its own permissionless, layer-1 altchain. So far, Flow has focused on delivering n array of decentralized applications (DApps). Early success suggests the altchain could be one of the decade’s key contributors to web3, building a vibrant consumer-focused ecosystem. Here’s everything you need to know about the Flow blockchain and the FLOW crypto that powers it.

If you want to use Flow Blockchain, here are a few exchanges where you can buy FLOW tokens:

Best for altcoins trading

Best for futures trading

Best for spot trading

What is the Flow blockchain?

Flow is a proof-of-stake chain designed specifically for NFT-based applications and games. Rather than attracting a crypto fanbase, Flow aims to bring web3 technology to a mainstream audience.

The history of flow

Crypto Kitties NFTs

In 2017, Axiom Zen launched Crypto Kitties, a cartoon cat breeding game, on the Ethereum blockchain. The game quickly exploded in popularity. But as NFT trading within the game spiked, so did congestion on the Ethereum network. As a result, gas fees increased, and transaction delays worsened.

Crypto Kitties was one of the original successful applications of cryptographic technology beyond the creation of cryptocurrencies. But it exposed a weakness in the architecture of traditional blockchains: scalability.

The Flow blockchain arrives

In response to these problems, Axiom Zen created a new crypto company: Dapper Labs. Instead of attempting to navigate existing networks, the new company would create a new blockchain.

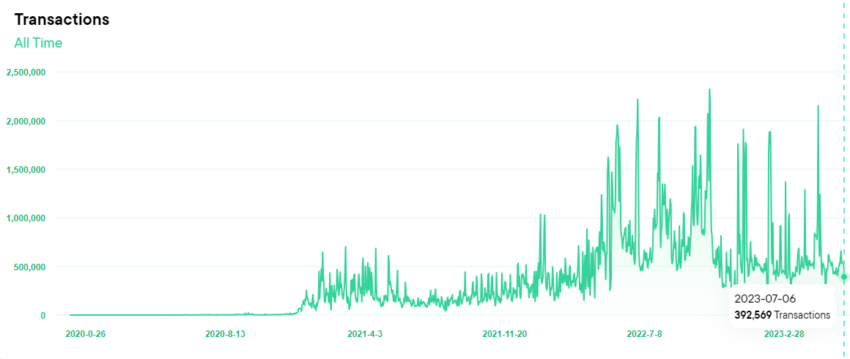

Dapper Labs released a white paper in 2019, and the beta version of the Flow blockchain launched in 2020. By early 2021, the Flow chain was processing over 500,000 transactions per day.

As of July 2023, the Flow blockchain holds over 22 million accounts.

The Flow team

Dapper Labs was co-founded by Roham Gharegozlou, who serves as CEO, and Mikhael Naayem, who serves as President. Roham founded Axiom Zen back in 2012. Naayem has served on Axiom Zen’s board since its creation. Another key team member is Dieter Shirley; he’s been Dapper Labs’ CTO and Lead Architect at Flow since 2018. Before this, Dieter was the Chief Software Architect at Axiom Zen.

How does flow work?

Flow uses a multi-node variation of proof-of-stake validation to secure its network. In traditional blockchains, every node stores the entire blockchain history and performs all tasks required to process new blocks. Flow compares this as being analogous to a single worker building an entire car.

Instead, Flow separates the jobs of its validator nodes into four distinct roles.

“This separation of labor between nodes is vertical (across the different validation stages for each transaction) rather than horizontal (across different transactions, as with sharding),” Flow says. Thus, unlike sharding, every Flow blockchain node still participates in validating every transaction. The difference is that nodes focus on different stages of the validation process.

The four different types of validation nodes are collection, consensus, execution, and verification nodes. There are more than 440 nodes powering the Flow network.

Collection nodes

According to Flow’s white paper, “the central task of the Collector Role is to receive transaction submissions from external clients and introduce them to the network.”

Consensus nodes

These nodes form blocks from the transaction submissions, which are sent via the collection nodes. Consensus nodes maintain and extend the core Flow blockchain.

These nodes also have a second task: block sealing. After verifier nodes have verified a block, consensus nodes publish a block seal. This proves that a supermajority of verifier nodes have accepted the block’s veracity.

Execution nodes

Execution nodes compute the outputs of all finalized blocks provided by the consensus nodes. For each executed block, execution nodes publish an “execution receipt” for verifier nodes to check over.

Verifier nodes

These check the computation of the execution nodes. Once a block has been verified, these nodes publish a “result approval” note. A block cannot be sealed unless an “execution receipt” and a “result approval” have been generated.

What makes flow unique?

A number of features separate the Flow chain from its major competitors.

Multi-node architecture

The multi-node approach to proof-of-stake blockchain validation allows speed and scale without needing either sharding or rollups (i.e., layer-2 scaling solutions).

Developer-friendly Cadence programming language

Elsewhere, Flow uses its own smart contract programming language: Cadence. Dapper Labs created the language with the help of Meta Platforms developers.

According to Flow’s developer website, the language aims to:

- Provide safety and security.

- Offer enhanced audibility via easier readability and simplicity.

- Make it easier for developers to write code.

Upgradeable smart contracts

Flow also features upgradeable smart contracts, reducing the likelihood of smart contract bugs. These can cost crypto users large sums of money via hacks should funds become permanently locked.

Benefits of the Flow blockchain

Flow’s unique architecture solves the scaling issues of some of its major competitors.

The chain also benefits from a $725 million development fund, which aims to hypercharge innovation across the community. The fund’s participants include big-name crypto investors such as Andreessen Horowitz, CoinFund, and the Digital Currency Group.

Flow is also user-friendly for crypto beginners as well as developers. Some of Flow’s proponents have consequently referred to it as the “normie” blockchain – a chain designed to onboard regular (non-crypto native) people.

Flow also claims to be a carbon-friendly web3 network. According to a 2021 report from Deloitte, the network’s annual energy usage was 0.18 GWh. This is comparatively less than Solana’s 11.05 GWh and Polygon’s 0.79 GWh. As a result, Flow claims that minting an NFT on its platform uses less energy than the average social media post.

Criticisms of Flow

A common criticism of the altchain is that it is too centralized. Flow approved permissionless node operations on its network in December 2022. However, developers looking to deploy smart contracts on the Flow blockchain must still request approval from Dapper Labs. This has arguably stifled the development of the ecosystem.

As of 2023, only seven execution nodes operate on the network, all run by corporations partnered with Dapper Labs. The founding company remains a central presence within the Flow network.

Flow has also been criticized for its corporate connections, including links to Meta’s former Libra project. Critics complain that flow is more concerned with onboarding big-name brands than partnering with fellow crypto projects. Some point to flow’s lack of interoperability with other chains as evidence of this point.

Many crypto natives remain skeptical of the role of Dapper Labs in the Flow blockchain. Unlike the Ethereum Foundation — the non-profit that supports the development of the Ethereum blockchain — Dapper Labs is a profit-making company. It is also directly involved in building decentralized applications on the Flow blockchain. For example, Dapper Labs is the parent company of NBA Top Shots, a role that other crypto blockchain foundations do not take up.

Flow partnerships

Flow has secured extensive partnerships with big brands and sports franchises. The blockchain is the official web3 partner of the NBA; UFC; NFL; La Liga; Dr. Seuss; Samsung; Ubisoft; Animoca brands; Genies, and the Warner Music Group.

The altchain also secured a partnership with Instagram, allowing select users to connect their Dapper wallet to the Instagram platform and showcase their NFT collection. However, Instagram’s flirt with NFTs was (initially at least) short-lived, with the app dropping its support for digital collectibles in May 2023.

Flow coin (FLOW)

Use cases for the FLOW coin

For starters, FLOW can be used as a medium of exchange on a peer-to-peer basis within the Flow blockchain. Applications can use FLOW to charge for services or to reward users. FLOW coin holders can also earn yield with their tokens via staking. Meanwhile, small amounts of FLOW are required to pay for transactions.

The coin can also be used as a deposit for data storage and as collateral for secondary tokens. Eventually, FLOW is set to become the governance coin for a future Flow blockchain DAO.

Flow coin tokenomics

When Flow launched, there were 1.25 billion coins in circulation. Flow sold $30 million worth of coins in three sales in 2019 and 2020. These coins are on a vesting schedule, creating modest FLOW inflationary pressure.

In the first four years after the launch of Flow, the total FLOW coin supply has risen by 162 million or 13%.

How FLOW staking works

Flow guarantees a set payout to those staking FLOW coins via nodes. The chain issues new coins to reach this mark if network transaction fees fall short. If fees are lower than the network validator payout, new FLOW coins are created, generating inflation.

As transaction fees approach the validator payout amount, FLOW inflation approaches zero. However, if network fees surpass the payout, FLOW becomes deflationary.

While the aggregate payout for Flow network validators is pre-set, the rewards for different types of nodes will vary over time. This ensures the network maintains an appropriate ratio of validator types. Staking rewards are in the 8.8% APY region, while delegators get around 8%. Users need to lock up their tokens for at least seven days to be able to stake. Flow aims to have 51.8% consensus nodes, 7.8% execution nodes, 23.6% verification nodes, and 16.8% collection nodes.

To stake FLOW as a collection node, users need 250,000 FLOW coins. To stake as an execution node, 1.25 million FLOW is required. Verifier nodes must stake 135,000 FLOW, and consensus nodes require 500,000 FLOW coins.

Flow wallets on the Flow blockchain

Over 22 million wallets are registered on Flow as of July 2023. Users can choose from a variety of custodial and non-custodial wallet providers. Popular options include Dapper Lab’s own Dapper Wallet (custodial), Math Wallet (non-custodial), and Ledger (non-custodial and hardware).

How to buy Flow coin

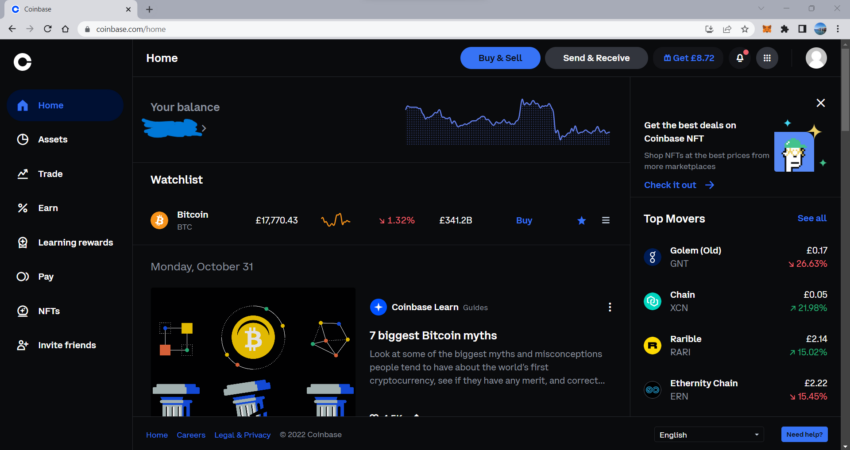

FLOW can be bought on many major cryptocurrency exchanges. Here’s an example of how to buy FLOW on Coinbase.

- Log into your Coinbase account. You will be automatically directed to the “Home” tab.

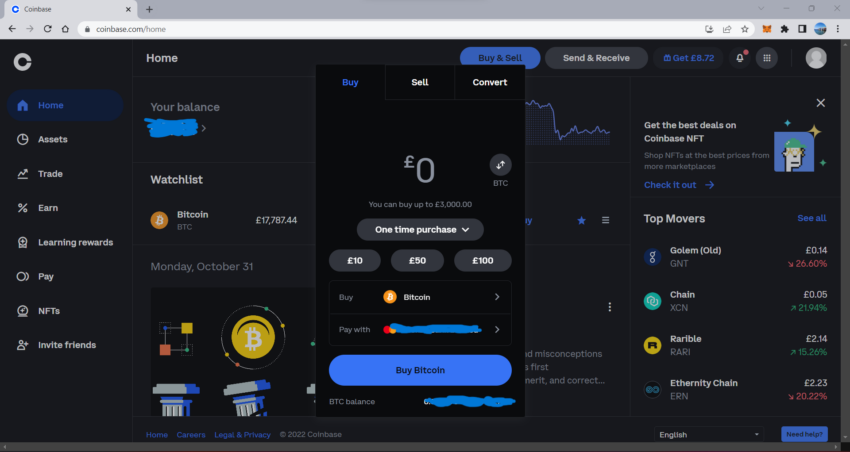

- Press the “Buy & Sell” button. Enter the amount in the fiat currency of the FLOW you want to buy. Select the FLOW cryptocurrency and your preferred payment method.

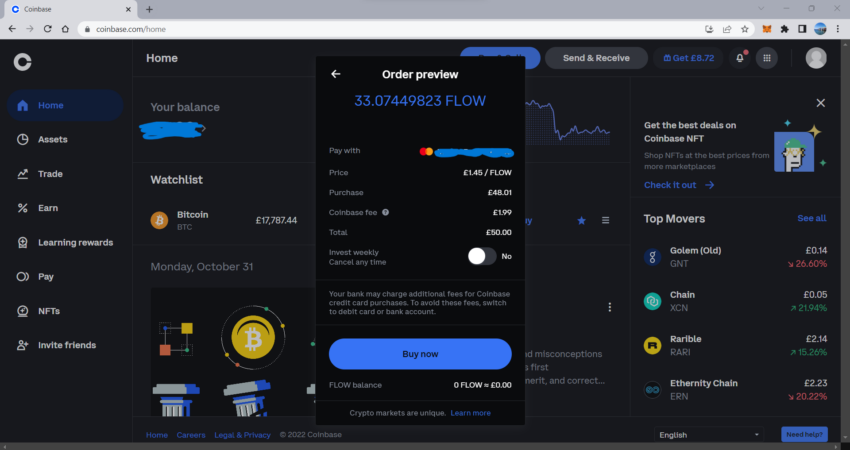

- Click “Preview Buy” for a preview of the exchange rate Coinbase offers and a rundown of the fees you will pay to Coinbase for their services.

- Choose “Buy Now” to go ahead with the purchase.

Flow could dominate despite low expectations

Flow’s approach to the crypto ecosystem has its detractors. An emphasis on securing brand deals and delivering consumer-ready applications over decentralization has alienated swathes of the crypto community.

But what if Flow’s big bet on creating a consumer and gaming-focused blockchain pays off? What if Flow continues to deliver further hit crypto applications? It certainly has the deals to do so. All in all, despite centralization concerns, Flow has the potential to become one of the most widely used altchains of the coming decade.

Frequently asked questions

Is Flow crypto a good investment?

What is Flow coin?

Does Flow coin have a future?

Is the Flow blockchain on Ethereum?

Is Flow an L1 blockchain?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.