Money has been referred to in many ways throughout history. For example, people might refer to money as cash or use more formal terms like “fiat currency” or “legal tender.” Fiat currency is a term that stands out because it has a unique meaning. This type of money isn’t backed by physical assets but is valuable because the government deems it so.

This article thoroughly explores the meaning and origins of “fiat currency” while discussing its distinctions from cryptocurrency within the global financial system.

Securely transform your fiat into crypto with few clicks

YouHodler

Best for free BTC cloud mining

Paybis

Best for Easier Transactions

Coinbase

Best for beginners

What is fiat currency?

Fiat currency is simply a government-issued money that is not backed by a physical asset such as gold or silver; instead, its value is rooted in the trust and authority of the issuing government. It’s a legal tender declared by a government devoid of any fixed value or tangible commodity support.

How does it work?

The government exercises control over the money supply, adjusting it according to market demand and supply dynamics. Notable examples of fiat currencies encompass the U.S. Dollar, British Pound, Japanese Yen, and the Euro, with most national currencies fitting the fiat category.

Fiat currency is usually stable. This stability is different from currencies backed by assets or cryptocurrencies. Governments and regulators use this stability to control things like interest rates and the availability of credit to help manage the economy. However, even with these controls, we can still see inflation and recession at times. To keep the currency stable, governments need to be careful not to print too much money, as this can lead to hyperinflation. To better understand the concept of fiat currency, let’s take a glimpse into its history.

History of fiat currency

The earliest form of metal money was created around 1000 BC in China during the Zhou dynasty. First, the paper money that looked similar to what we use today. This caused economic problems because the government didn’t manage it well. At that time, China didn’t have enough gold to meet its huge demand. To solve this problem, a new idea was devised: using paper notes that represented a certain value backed by the country’s gold reserves. This was the beginning of what we now call fiat money.

As time progressed, money took various forms: commodity, representative, and fiat. Commodity money, such as gold or silver, inherently possessed value due to its tangible nature. Often embodied in paper notes, representative money represented a value linked to a tangible commodity, usually gold or silver. However, nations shifted from the gold standard to more flexible monetary policies during the transition from representative to fiat money. In this transition, the value of money became intrinsically tied to governmental regulation and the collective acceptance of its worth.

The end of the dollar peg

During the late 19th and early 20th centuries, the gold standard was pivotal in the global monetary system. However, this system had inherent vulnerabilities despite its notable merits, especially during economic contractions. The decision to reintroduce the gold standard in the late 1920s inadvertently triggered a difficult period characterized by recession and deflation. Faced with these economic challenges, countries felt compelled to abandon the gold standard and instead adopted fiat currency, marking a significant shift in the course of global finance.

“Today, the acceptance of fiat money — currency not backed by an asset of intrinsic value — rests on the credit guarantee of sovereign nations endowed with effective taxing power, a guarantee that in crisis conditions has not always matched the universal acceptability of gold.”

Alan Greenspan, Former Chair of the Federal Reserve of the United States LinkedIn

In August 1971, then-President Richard M. Nixon of the United States made a significant announcement that marked a pivotal moment in the global financial landscape. He declared the suspension of the dollar’s convertibility into gold or other reserve assets. This decision ended the Bretton Woods system and initiated the gradual abandonment of the gold standard. Within two years, as most currencies had no commodity backing, major currencies started to “float,” and their values fluctuated based on market demand, like supply and demand.

Why is it called fiat money?

A “fiat” refers to an authoritative directive or proclamation. Therefore, the term “fiat currency” is used because governments issue it through a directive.

For example, U.S. dollar bills have the inscription that says: “This note is legal tender for all debts, public and private.” This statement represents the government’s declaration regarding the acceptance and worth of the currency. Unlike alternative forms of currency like gold or checks, fiat money stands out because its value isn’t linked to any tangible asset or financial instrument.

How fiat currency works

Fiat currency is the cornerstone of contemporary economies and plays a major role in how central banks regulate the money supply. With this government-issued currency, regulatory bodies can ensure constant monitoring and adept management to safeguard economic stability and forestall potential crises. Let’s explore in detail the major components of fiat currency to better understand how it works.

The role of central banks

Central banks occupy a main role in any nation’s monetary framework. The central bank’s primary mandate encompasses the regulation of the money supply and operates with autonomy from the government to manage interest rates, preserve the financial system’s stability, and shield itself from undue political influence. In the United States, for example, the Federal Reserve, often referred to as the Fed, fulfills this function.

- The money supply: This is the aggregate sum of currency in circulation within an economy

- Physical currency: Governments, in collaboration with entities such as the Royal Mint, oversee the production of tangible currency in the form of paper notes and coins.

- Seigniorage: As governments manufacture physical currency, they accrue a profit termed Seigniorage.

- Digital money by private banks: The majority (around 97%) of money exists digitally through private banks. When a bank extends a loan, it effectively generates fresh money.

Inflation and deflation

Inflation happens when the value of money diminishes over time, causing a significant hype in the prices of goods and services. Since fiat money has no inherent value, inflation might occur or even become worthless in the event of hyperinflation. A notable example is Hungary’s post-WWII hyperinflation, along with Zimbabwe, which experienced a 99.9% loss of its currency’s value.

Conversely, deflation happens when the money supply contracts, leading to an augmentation in the value of money. While this might initially appear advantageous, extreme deflation can stifle economic growth and curtail consumer expenditure.

The exchange rate

Every fiat currency has a distinct value and an exchange rate against other currencies. The U.S. dollar, as the world’s primary reserve currency, holds significantly higher value than the Indian rupee, for example. Fluctuations in these exchange rates can substantially influence global trade, investments, and economic stability.

Advantages of fiat currency

- Stable value: One advantage is the government’s ability to maintain stable currency value over time by using central bank policies to control inflation, ensuring economic predictability and fostering investment.

- Widely accepted: Widespread acceptance ensures efficient domestic and international transactions, as people and businesses have confidence in using the currency.

- Easy to use: Fiat currency is highly convenient for everyday transactions. It is available in various denominations and forms, including paper money and digital currency in bank accounts. This versatility and ease of use contribute to its popularity.

Regulated: Fiat currencies are regulated by governments and central banks, providing a level of oversight and control. This regulation allows authorities to manage the money supply, interest rates, and other economic factors to promote economic stability and growth.

Disadvantages of fiat currency

- Lack of intrinsic value: The most significant disadvantage of fiat currency is that it has no intrinsic value. It’s essentially a piece of paper or digital representation with no inherent worth.

- Inflation risk: Fiat currencies are susceptible to inflation, which erodes their value over time. When governments print more money, it can lead to increased prices, reducing purchasing power.

- Dependence on trust: The value of fiat currency relies on trust in the government and its responsible management. If this trust is undermined, the currency can become worthless.

- Boom-bust cycles: Fiat currency systems can lead to boom-and-bust cycles due to excessive money printing during economic booms and austerity measures during busts.

- Limited store of value: Fiat currencies are not reliable stores of value over the long term compared to assets like gold, which tend to retain their value.

- Vulnerable to political influence: Governments can manipulate fiat currency for political purposes, which can lead to economic instability.

- Crisis vulnerability: Fiat currency systems can face crises, leading to a shift toward commodity-based currencies during times of economic turmoil.

What is cryptocurrency?

Cryptocurrency, often referred to as crypto, is a digital currency used as an alternative medium of exchange, store of value, or as an investment. The term cryptocurrency is derived from its cryptographic system enabling secure transactions between two nodes in a blockchain network. Unlike fiat currency, with cryptocurrency, people can seamlessly and securely buy, sell, or trade without needing a controlling authority, such as a government or financial institutions.

History of cryptocurrency

The term cryptocurrency can be traced back to the early days of “cyber currencies” in the 1980s, then the present-day global surge of bitcoin and the broader cryptocurrency market. Fast-forward to the contemporary landscape, we witness the remarkable ascent of bitcoin and the expansive cryptocurrency market.

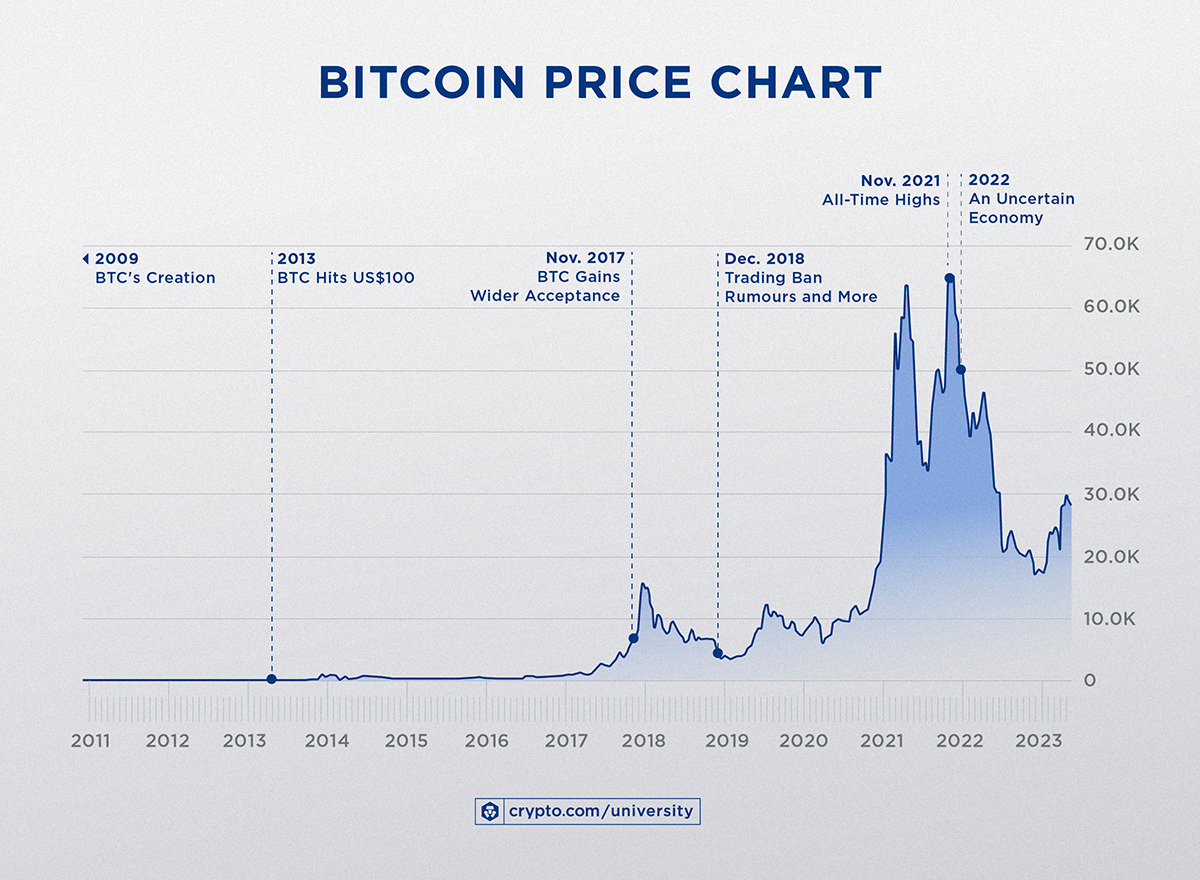

Significant turning points in this context include Satoshi Nakamoto’s release of a whitepaper in 2008, ushering in the concept of a decentralized digital currency system devoid of trust. Following this, in 2009, bitcoin’s inception marked the dawn of an epoch characterized by digital currencies that transcend borders and operate in a decentralized manner.

Bitcoin’s early days saw it as the sole player in the market, with its value initially just a few cents. As time passed, new cryptocurrencies emerged, their prices oscillating in tandem with bitcoin’s performance, leading to skepticism about cryptocurrencies as investment vehicles.

However, late in 2017, cryptocurrencies, including bitcoin, experienced an unprecedented surge in value, propelling the total market capitalization to $820 billion in January 2018, albeit followed by a crash. Amid these fluctuations, challenges, and scams, bitcoin’s significance endured, symbolizing the ideals of decentralization and anonymity, and its popularity continued to grow, whether attributed to its 2017 price surge or the facilitation of access through cryptocurrency exchanges.

How cryptocurrency works

Cryptocurrencies run on a technology called blockchain – a public ledger that records all transactions securely and maintains accurate ownership records.

Single units of cryptocurrency, called coins or tokens, are created through mining, involving computer power, solving complex math problems, and receiving payment in bitcoin. More recently, units have been created through proof-of-stake.

Unlike fiat, cryptocurrency is decentralized, which means owning cryptocurrency allows you to move a record or a unit of measure from one person to another without needing a central intermediary.

Advantages of cryptocurrency

- Lower transaction fees: Lower fees compared to traditional payment methods, resulting in efficient cost savings for both individuals and institutions.

- Faster transaction: While credit cards and banks can take hours or even days to clear payments, cryptocurrencies offer immediate transaction processing.

- Immutable blockchain: A blockchain records transactions that cannot be changed or reversed. This immutability improves security and helps mitigate the risk of fraud

- Proof of ownership: Counterfeiting or double-spending cryptocurrencies is impossible, ensuring the uniqueness of each unit and enhancing security and trust in the system.

- Accessibility: Cryptocurrency is accessible to anyone around the world. Its inclusivity gives users a sense of control over their funds — anywhere, anytime.

Disadvantages of cryptocurrency

- Limited acceptance: While crypto offers several intriguing features, it still suffers mainstream adoption. Not a lot of businesses accept crypto as payment, which limits its utility in some cases.

- Regulatory uncertainty: Regulation varies from region to region and constantly evolves. This is a bit daunting for individuals and businesses to stay compliant.

- Price volatility: Most cryptocurrencies experience significant price volatility. Their values can fluctuate dramatically over short periods, making them risky as a store of value or medium of exchange. Some stablecoins attempt to address this issue by linking their value to tangible or intangible assets.

- Lack of inherent value: Some cryptocurrencies lack inherent value and derive their worth primarily from speculation and market sentiment. This makes them susceptible to bubbles and crashes, posing investment risks.

Differences between fiat currency and cryptocurrency

Fiat currencies and cryptocurrencies exhibit certain common traits: neither possesses intrinsic value and lacks a backing commodity such as gold or silver. Instead, their value predominantly stems from their widespread acceptance among global populations. Nonetheless, it is crucial to recognize the significant differences that set cryptocurrencies apart:

Centralized vs. decentralized

- Fiat currency: Centralized and issued by governments and central banks. A central authority controls them, possessing the authority to print more money and regulate its

- Cryptocurrency: Decentralized and not controlled by any single entity or government. Cryptocurrencies are underpinned by blockchain technology and function as decentralized digital currencies, enabling transactions without intermediaries and allowing transparent, verifiable coin creation. No central authority can manipulate the supply or value of cryptocurrencies.

Regulated vs. unregulated

- Fiat currency: Undergoes rigorous regulation orchestrated by governments and central banks. They are subject to monetary policies, interest rates, and government interventions designed to stabilize their value.

- Cryptocurrency: Often operates in a comparatively unregulated space. While certain countries have introduced regulatory measures, the global regulatory framework for cryptocurrencies such as bitcoin is still developing, resulting in varying levels of oversight across different regions.

Stable vs. volatile

- Fiat currency: Fiat currencies are generally stable in the short term, with governments aiming to control inflation and maintain price stability. However, they can still be subject to inflation, devaluation, and currency fluctuations.

- Cryptocurrency: Cryptocurrencies are known for their volatility. Prices can fluctuate dramatically over short periods due to factors like market sentiment, adoption, and speculative trading. While stability is the goal of some cryptocurrencies, most people consider them speculative assets.

Scarcity vs. abundance

- Fiat currency: Governments can print or digitize fiat currencies as needed. They are not inherently scarce and rely on central authority management.

- Cryptocurrency: Many cryptocurrencies, including bitcoin, intentionally limit their total supply to create scarcity. For example, there will only ever be 21 million bitcoins, creating a perception of digital scarcity. This scarcity can influence their store of value.

Will cryptocurrency replace fiat currency?

Throughout history, humanity has employed diverse items as a medium of exchange, ranging from livestock to exotic cowrie shells, eventually transitioning to the more practical gold and silver and now fiat currency and cryptocurrency. As a result, one can reasonably assert that cryptocurrency will replace fiat currency. One group of researchers has suggested that bitcoin will one day replace fiat currency, with 54% of the group predicting that this will happen by 2050 at the latest.

Additionally, certain governments might consider incorporating bitcoin as a reserve asset, akin to gold; it appears highly improbable that any major nation-state will willingly embrace it as their primary or exclusive currency. Such a move would entail a range of highly unfavorable consequences from the government’s perspective, ranging from increased debt costs to subdued consumption and heightened business cycle fluctuations.

How will fiat currency coexist with cryptocurrency?

Rather than an outright replacement, cryptocurrencies are likely to coexist and integrate with fiat currencies, with potential applications in digital payment systems, cross-border transactions, and as part of traditional asset portfolios. Many countries are already exploring Central Bank Digital Currencies (CBDCs), driven by blockchain technology and adoption.

In an era that prioritizes financial inclusivity and asset diversification, cryptocurrencies and fiat currency are likely to continue to exist increasingly harmoniously.