Creating a non-EVM-compatible blockchain can help developers explore alternative consensus mechanisms and governance structures. It offers distinct advantages over the EVM-based Ethereum network. In certain cases, it also provides greater flexibility in designing consensus algorithms, transaction processing speeds, scalability solutions, and smart contract functionalities that can be tailored to specific use cases. Non-EVM blockchains also foster healthy competition within the blockchain ecosystem, driving advancements and diversity in decentralized technologies.

However, building and scaling non-EVM blockchains is challenging. Compatibility issues with existing Ethereum-based DApps and smart contracts arise. Establishing a developer ecosystem and achieving network scalability are common challenges. Overcoming these challenges requires a robust technical roadmap, developer community support, and a strong value proposition. This guide explores approaches to tackling these challenges.

KEY TAKEAWAYS

- Non-EVM blockchains offer unique advantages like custom consensus and smart contracts but struggle with Ethereum app compatibility and scalability.

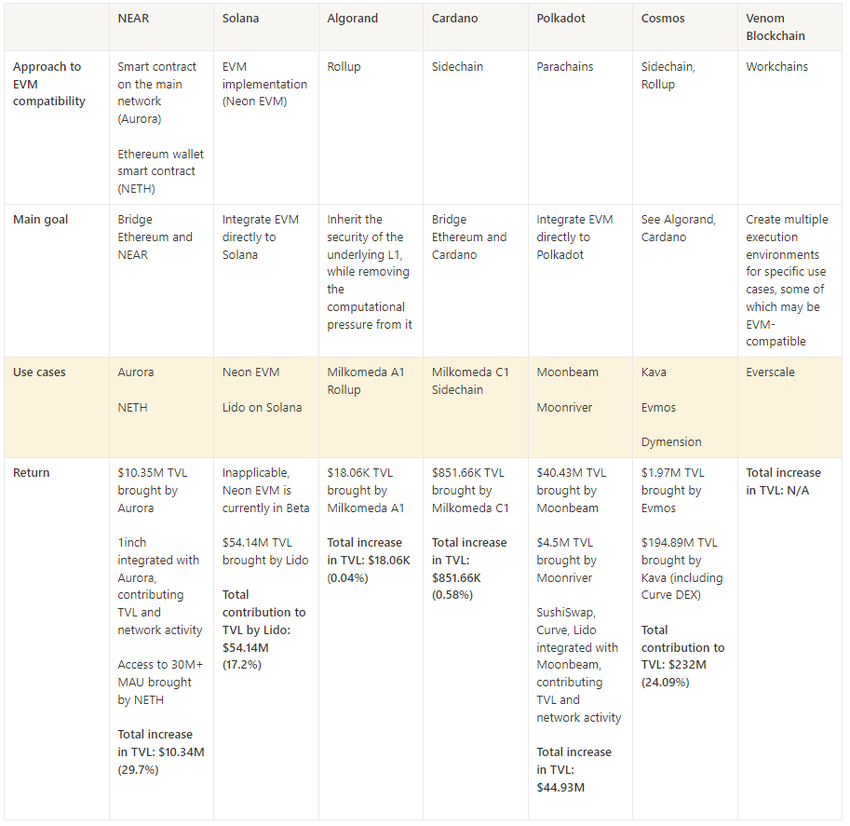

- Some of the key non-EVM blockchains around today include NEAR, Solana, Algorand, Cardano, Polkadot, Cosmos, and Venom. Each of these blockchains comes with unique attributes and varying levels of Ethereum compatibility.

- Several non-EVM blockchains have now developed methods to achieve Ethereum compatibility. For instance, NEAR uses Aurora, Solana has Neon EVM, Algorand deploys Milkomeda A1, and Cardano uses Milkomeda C1.

- The commercial success of EVM solutions for non-EVM compatible chains can be measured by the amount of TVL and new users they attract (along with the liquidity they bring from Ethereum).

- Ongoing and upcoming projects like Neon DAO, Lido, and Milkomeda underline the growing push for greater interoperability.

Use cases of non-EVM compatible blockchains

We selected seven originally non-EVM compatible blockchains: NEAR, Solana, Algorand, Cardano, Polkadot, Cosmos, and Venom. While some have already established an efficient, interoperable environment connected to Ethereum (NEAR, Polkadot, Cosmos), others are still on their way to connect their ecosystems with Ethereum-based DApps and the Ethereum development community (Algorand, Solana, Cardano, Venom).

NEAR

NEAR Protocol has its own virtual machine, called the NEAR Virtual Machine (NEAR VM), which is specifically designed for the NEAR blockchain. It is optimized for scalability and high throughput. Smart contracts are developed using the Rust programming language.

NEAR interacts with the Ethereum-based environment primarily through Aurora, an independent Ethereum-compatible blockchain that runs directly on NEAR. Users with Ethereum wallets can also gain access to NEAR via the NETH smart contract.

Aurora

Aurora is NEAR’s version of an EVM that runs a node within Ethereum. It represents a layer-2 blockchain on top of NEAR and an EVM implementation that runs a smart contract. This smart contract is set apart from Ethereum and is executed directly on NEAR.

Aurora is a significant addition to the NEAR Protocol blockchain as it provides full Ethereum compatibility. This means that developers can easily transfer their Ethereum smart contracts to NEAR, expanding the range of DApps and tools available on the platform. By leveraging the extensive Ethereum ecosystem, Aurora attracts Ethereum developers and promotes cross-chain interoperability.

NETH

NETH is a smart contract that allows Ethereum wallet users to sign transactions on NEAR without switching to a NEAR-based wallet. It creates a paired NEAR account where the signature is transferred within the NEAR ecosystem. NETH is the first solution that facilitates the direct onboarding of Ethereum users onto non-EVM compatible blockchains.

NETH has successfully bridged the gap between NEAR and the vast user base of MetaMask and other Ethereum wallets, comprising over 30M monthly active users (MAU). As a result, these users can now directly sign transactions in NEAR dApps using their Ethereum wallets.

Solana

Solana was developed as a unique blockchain that prioritizes fast processing, low delays, and scalability. To achieve these goals, the Solana team used a custom-designed blockchain instead of the Ethereum Virtual Machine (EVM). They also implemented a special consensus mechanism called proof-of-history (PoH) to enable fast transaction confirmation and high network throughput.

Solana uses the Solana Virtual Machine (SVM) for executing smart contracts. SVM is designed to maximize performance and supports programming languages like Rust, C, and C++. Solana’s architecture and consensus mechanism enable high-speed transaction processing and scalability.

The Wormhole Bridge was launched in October 2020 to allow users to bridge assets between Ethereum and Solana in both directions. Wormhole acts as a gateway, providing liquidity and interoperability for users to bridge tokens across multiple ecosystems, expanding the possibilities for decentralized finance and cross-chain applications.

Solana recognized the importance of EVM compatibility and the existing ecosystem built around Ethereum. Neon EVM, a highly-anticipated smart contract for Ethereum-like transactions on Solana, is meant to help the Solana community leverage the familiarity and functionality of the EVM ecosystem while benefiting from Solana’s scalability and performance advantages.

Neon EVM

Built on Solana, Neon EVM is an implementation of the Ethereum Virtual Machine (EVM) that has been adapted to run on the Solana blockchain platform.

Neon EVM enables developers to deploy and execute Ethereum-compatible smart contracts on the Solana network, leveraging the existing Ethereum tooling and ecosystem. It aims to provide developers with a familiar environment and a seamless transition from Ethereum to Solana.

In contrast to Aurora, Neon EVM operates an emulation of Ethereum smart contracts that adhere to the rules of both the Solana and Ethereum networks. This emulation is achieved by utilizing Vyper/Solidity compilers, which facilitate transaction signing on Solana while complying with Ethereum’s established regulations.

The Neon EVM team recently introduced a closed beta version of Neon EVMβ on Solana’s mainnet. This beta release provided users with the opportunity to deploy and evaluate Neon EVMβ, ensuring smooth integration ahead of the official launch on the Solana Mainnet. NEON, a utility and governance token, will support the Neon EVM ecosystem. The project remains in active development. Upcoming plans include the establishment of Neon DAO, integration with platforms such as The Graph, Chainlink, and Pyth, the launch of grant programs, and more.

Lido on Solana

Lido, a liquid staking protocol and one of the most recognized Ethereum-based projects, was deployed to Solana without the involvement of any EVM infrastructure. The deployment was performed by Chorus One, a staking integrations provider.

The Chorus One team had to develop a Solana-specific version of the liquid staking protocol. This involved creating new smart contracts and adapting the underlying infrastructure to work with Solana’s programming model and consensus mechanism. Later, ownership of Lido on Solana was transferred to P2P Validator, a notable participant within the Solana ecosystem, who actively supported projects like Wormhole Bridge, Pyth, and Neon EVM.

The end project utilizes both Solana’s and Lido’s infrastructure:

…The Lido program collects the deposited SOL and releases the newly minted stSOL to the user. Beneath the layer, the Lido Program will distribute this SOL uniformly across those validators that are participating. When these delegations accrue rewards on the allotted stake, the total SOL under management increases and this increases the value of stSOL tokens. The Lido DAO governs the Lido Program — and also controls the list of validators that are part of this program.”

Chorus One – Announcing Lido for Solana: A Liquid Staking Protocol: Medium

Algorand

Algorand stands out for its unique consensus mechanism, pure proof-of-stake (PPoS), which enables fast and secure transaction confirmation without needing energy-intensive mining. It offers massive scalability, capable of processing thousands of transactions per second with minimal latency, making it suitable for large-scale applications.

Like the NEAR and Solana communities, the Algorand Foundation brought EVM compatibility to the mainnet to enhance scaling and interoperability. In October 2022, the foundation granted funding to Milkomeda, a cross-chain solutions provider, to develop EVM capabilities in Algorand.

Milkomeda A1

Milkomeda is an independent blockchain-agnostic protocol that enhances blockchain interoperability by bringing EVM capabilities to non-EVM blockchains. It achieves this by implementing L2 scaling solutions, such as rollups, which operate on top of existing layer-1 blockchains and connecting them through a permissionless bridge.

Milkomeda enables non-EVM ecosystems to leverage key features from EVM-based ecosystems, including rollups, Solidity support, and access to the full suite of EVM tools, simplifying the process of building, deploying, debugging, and auditing, similar to Ethereum. This means that developers can easily port their projects from Ethereum, resulting in a larger selection of DApps being available on supported L1 blockchains.

The code deployed on multiple chains has the same security properties, eliminating the need for individual audits per chain. In the future, zero-knowledge technology innovations can be implemented as L3+ solutions on top of Milkomeda. Milkomeda also empowers startups to build on chains like Cardano, Algorand, and Solana while tapping into the resources of the largest community for smart contracts (Solidity).

The Milkomeda A1 is a rollup made for Algorand. It utilizes mALGO as a gas and fee token, meaning that the transactions are executed on Algorand and then bundled and sent to Ethereum, retaining its security properties. To access the A1 Rollup Mainnet, users need an Algorand native wallet containing $ALGO, as well as an EVM-compatible wallet like MetaMask (source).

With Milkomeda’s permissionless bridge, users can bridge their Algorand-based assets into Milkomeda A1 to interact with EVM-based DApps. The TVL contribution to Algorand has been negligible so far.

Cardano

Cardano is another non-EVM compatible blockchain with a strong focus on governance, aiming to enable community-driven decision-making and secure the long-term sustainability of the platform. The altchain is known for its rigorous scientific approach to blockchain development, combining peer-reviewed research with a layered architecture to achieve scalability, security, and sustainability. It utilizes a unique proof-of-stake consensus algorithm called Ouroboros, which ensures energy efficiency and decentralization.

KEVM, a project of Cardano’s Goguen era, represents an early effort towards EVM compatibility by offering a smart contract virtual machine compatible with the EVM. KEVM uses “formal semantics for elements such as the configuration and transition rules of EVM, resulting in a more secure virtual machine for smart contracts,” per the project’s roadmap. IOHK, the engineering company behind the project, paused its development to focus on other priorities.

Milkomeda C1

Milkomeda C1 is a sidechain that was officially launched in April 2022 and now acts as the primary bridge between the Cardano and Ethereum ecosystems. Unlike Milkomeda A1, Milkomeda C1 operates as a sidechain, serving as an independent blockchain network capable of processing transactions and executing smart contracts separate from the main Ethereum chain. This arrangement provides greater flexibility as Cardano can utilize its own consensus mechanism and block validation environment.

Analogously to Milkomeda A1, C1 uses mADA as its main asset for gas and fees. This simplifies the onboarding experience for users who want to interact with Ethereum DApps.Initially, Milkomeda C1 contributed a significant share of TVL compared to Cardano. However, its share in total TVL has since decreased to nearly zero.

Polkadot

Polkadot implements a unique method of achieving blockchain interoperability through its parachain auction system. Here, projects can bid for a slot on the Polkadot network and deploy their own blockchain as a parachain. This dynamic framework offers flexibility, allowing any project to participate and attract validators. However, due to the limited number of available slots, competition among projects vying for a slot may arise.

Parachains in Polkadot have their own consensus mechanisms and validators and can have their own rules and governance models. They benefit from the security and interoperability provided by the Polkadot network, allowing for efficient communication and asset transfers between parachains and the wider ecosystem.

Parachains are autonomous blockchains that are connected to a designated relay chain. They depend on the relay chain’s consensus mechanism to ensure security and interoperability. In contrast, sidechains are separate blockchains that can run parallel to the mainchain and may employ their own consensus mechanism. Sidechains can function independently or with limited interaction with the mainchain. Moonbeam, which was launched in January 2022, is Polkadot’s first parachain.

Moonbeam

Moonbeam uses Substrate and offers full compatibility with the EVM. This enables Ethereum developers to deploy and execute their smart contracts on Polkadot. The bridge between Ethereum and Polkadot offers the benefits of Polkadot’s scalability, interoperability, and shared security to Ethereum developers and their DApps.

Moonbeam supports existing Ethereum tooling, DApps, and smart contracts seamlessly on Polkadot. It makes it easier for Ethereum developers to transition their projects to Polkadot while leveraging Polkadot’s scalability, interoperability and shared security.

Polkadot takes a unique approach to EVM compatibility. In contrast to NEAR’s focus on bridging Ethereum and initiatives like Aurora and NETH and Solana’s integration with Neon EVM, Polkadot aims to offer Ethereum developers a seamless experience. It does this by replicating the EVM environment and enabling them to deploy and run their smart contracts on Polkadot directly.

Moonriver

Moonriver is a canary network to Moonbeam. Designed to provide a stable and secure environment for testing and deploying DApps, it enables developers to leverage the interoperability and scalability features of Polkadot while maintaining compatibility with the Ethereum tooling and ecosystem.

Cosmos

Cosmos represents a newer class of blockchains, a layer-0 blockchain. It stands out for its focus on interoperability, enabling different blockchains to communicate and exchange assets through its Inter-Blockchain Communication (IBC) protocol. It offers a scalable and secure platform for developing sovereign blockchains, allowing them to maintain their own governance models and consensus algorithms while benefiting from the broader Cosmos ecosystem.

Similar to some of the layer-1 solutions discussed in this report, Cosmos utilizes a sidechain to enable EVM capabilities.

Kava

Kava is an L1 blockchain built on Cosmos SDK that acts as a sidechain for Cosmos. Just like the previously mentioned sidechains, it facilitates interoperability between Ethereum and Cosmos. The L1 also enhances scalability and contributes to the overall expansion of the Cosmos ecosystem.

Kava EVM is part of the Kava ecosystem. Kava EVM is a smart contract execution platform that is fully compatible with Ethereum. It allows Solidity developers to build DApps and benefit from Kava’s scalability and security.

Evmos

Evmos is an Inter-Blockchain Communication (IBC) protocol and a proof-of-stake network that incorporates EVM capabilities. It serves as a means of value transfer between Ethereum and Cosmos. With over 20 interoperable blockchains on the Cosmos network, Evmos addresses the crucial need for compatibility with Ethereum. It is constructed using the Cosmos SDK framework and leverages Tendermint Core’s Byzantine Fault Tolerance (BFT) consensus mechanism. This ensures the network’s resilience, even in the presence of failed or malicious nodes. EVMOS is used for governance and staking, as well as a gas and fee token in Evmos.

Dymension

Dymension, a network of modular blockchains, is developing an L2 rollup solution compatible with the EVM for the Cosmos ecosystem. This rollup aims to support developers in deploying Ethereum applications on Cosmos, addressing the challenges posed by code differences between the two platforms.

Dymension’s rollup is currently undergoing testing. The plan is for Dymension’s EVM-compatible rollups to function on different Cosmos chains and establish seamless communication with them, thereby eliminating the necessity for bridges. This development enables the creation of multiple EVM-compatible rollups that can efficiently interact with various Cosmos chains.

Venom blockchain

The Venom blockchain is part of the Venom Foundation ecosystem. Venom Foundation is the first entity licensed by the Abu Dhabi Global Market to provide support for a blockchain. Notably, it can handle 100K TPS and incorporates dynamic sharding. It has a multilayer structure with a master chain, work chains, and shard chains.

The workchains are designed to adhere to different security, compliance, and privacy standards in various industries. The use of workchains allows for catering to the needs of particular apps while complying with the regulatory environment.

Additionally, integrating an EVM is one of the possible use cases for the workchains. Easy integration of Ethereum DApps is further enabled by the programming language used by the Threaded Virtual Machine, a smart-contract code execution platform in the Venom master chain and base chain. The language is called Threaded Solidity.

Threaded Solidity is an asynchronous dialect of Solidity, which is adapted to the Threaded Virtual Machine (TVM). T-Sol is similar to Solidity and, therefore, can easily be used by Ethereum developers. According to Venom documentation, TVM was designed to be language-agnostic.

Everscale

Everscale, one of Venom’s investments, initially emerged as an independent blockchain known as “Free TON.” It was launched based on Telegram’s “Telegram Open Network” whitepaper and open-source code (TON). Later, Venom Foundation acquired Free TON to support its workchains environment. The primary objective of Everscale is to address existing flaws in Ethereum’s architecture, particularly in terms of scalability. It achieves scalability through a combination of data sharding, implemented through work chains, and execution sharding, achieved via threads.

It is confirmed by Sergey Shashev, a member of the Everscale DeFi Alliance, that Venom adopted Everscale in part for its EVM capabilities:

“There is a world of EVM, there are many blockchains: Ethereum, BNB, Polygon, etc. The more development branches you have, the better for the technology, because you can launch different technological and economic experiments in different networks and what shoots, it can scale on other networks…

… The presence of different networks on the same architecture can accelerate the growth of this technology. We have 4 TVMs, ideally before the end of the year, everyone should build a relationship with everyone. That’s what I do.”

Sergey Shashev, co-founder of @Broxus and Everscale DeFi Alliance: Everkit

Everscale plays a vital role within the Venom ecosystem that goes beyond creating workchains. It also establishes connections between zero-level blockchains and facilitates the harmonious collaboration of TVM networks.

“As a unique Everscale feature, it will be possible to call smart contracts from an EVM compatible workchain to other Everscale workchains and vice versa, creating a homogeneous environment for smart contract execution and enabling real EVM integration into Everscale, as well as making it possible to create synchronous, asynchronous, and combined applications within one blockchain or to extend existing ones.

This will open up incredible prospects not available in any of the solutions currently existing on the market.”

John Everscale, EVM Workchains in Everscale: Medium

Implications for TON

Economic performance of use cases

The commercial success of EVM solutions for non-EVM compatible chains can be measured by the amount of TVL and new users they attract and the liquidity they bring from Ethereum. However, there are a few examples of commercially successful solutions:

- Aurora smart contracts on NEAR have contributed an additional 29.7% of the TVL to the platform. NEAR is part of a highly developed ecosystem with several prominent DEXs and lending protocols. Notably, its unique approach to EVM compatibility sets it apart. It does not fall into the common subcategories of L2 solutions such as rollups or sidechains. The primary motivation behind NEAR’s creation was to attract Ethereum developers to the NEAR platform rather than solely deploying Ethereum-based projects on NEAR.

- Moonbeam and Moonriver are parachains on Polkadot, contributing a substantial $44.93M to the TVL. They have successfully attracted prominent Ethereum-based projects such as SushiSwap, Curve, and Lido to the Polkadot ecosystem. Like Aurora, Moonbeam and Moonriver possess unique architectural characteristics that defy classification into a specific type of L2 solution. Parachains operate with their own distinct execution environments and rely on the properties of the Polkadot relay chain.

- Kava is a sidechain on Cosmos that attracted $194.89M in TVL from several widely adopted Kava-based DeFi protocols, as well as the Curve DEX.

- Lido on Solana has brought a significant TVL of $54.14M, making up a 17.2% contribution to Solana’s ecosystem. Notably, Lido was deployed on Solana directly, without requiring EVM-compatibility tools, as it runs natively on the Solana blockchain. Additionally, Lido had previously been deployed on Terra Classic — also not an EVM-compatible chain — before its eventual collapse.

Milkomeda C1, A1, Neon EVM, and Evmos didn’t demonstrate substantial traction. Meanwhile, Everscale and Dymension have not been officially released on a mainnet as of November 2023.

What about bringing EVM to TON?

There are several properties that may affect the choice of a particular solution for bringing EVM capabilities to TON:

- Asynchronous structure and Infinite Sharding. Asynchronous structure and Infinite Sharding are key pillars in TON’s market positioning. This distinctive architecture sets TON apart from Ethereum and limits the options that can be used to achieve EVM compatibility.

- “Blockchain of blockchains” structure. TON supports the creation of workchains (”blockchains with their own rules”). Creating a work chain is a complex and expensive process that requires approval from TON validators. TON workchains, theoretically, can be based on EVM and run Solidity contracts.

Theoretically, everyone in (the) community can create their own workchain. In fact, it’s pretty complicated task to build it, after that to pay (expensive) price of creating it and receive 2/3 of votes from validators to approve creation of your Workchain …

A good example is to make a workchain that works on the base of EVM to run Solidity smart contracts on it.”

TON documentation: TON

- Onboarding TON users to Ethereum DApps is a higher priority than onboarding Ethereum users to TON. Streamlining the onboarding process by connecting Ethereum-based wallets may be beneficial in the future. However, the network’s immediate priority lies in attracting major Ethereum-based platforms such as Aave or Uniswap to increase TON’s TVL. Consequently, solutions like NETH on Near (Ethereum wallet smart contract) are currently less relevant.

For the TON team, the ultimate objective of the integration can be summarized as follows: deploying DeFi projects based on Ethereum and bridging Ethereum’s liquidity to TON while maintaining TON’s distinctive architectural characteristics.

Which approach to EVM would suit TON?

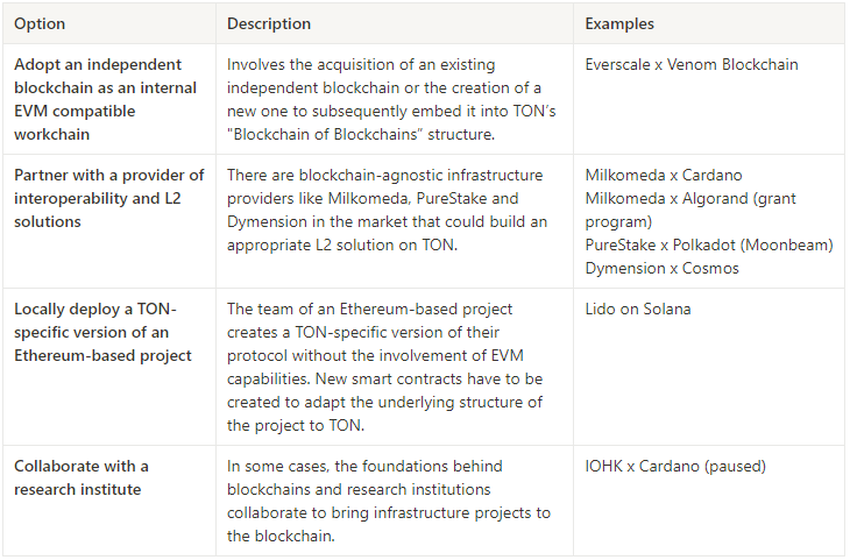

The mentioned examples of other non-EVM blockchains can be summarized into five categories.

EVM sidechains and workchains appear to be the most appropriate options for TON. This is due to their ability to utilize TON’s unique scaling and transaction processing capabilities while being able to onboard TON users to EVM-based projects. The concept of an EVM-compatible workchain is outlined in TON docs and seems to be the most obvious solution.

Alternatively, adopting a rollup could help TON avoid excessive architectural complexity. Notably, transactions could be rolled up directly to the network while utilizing its security properties:

“I believe the path forward to bring Ethereum DApps over to TON is by adopting a rollup. A zkEVM rollup utilizes the existing TON infrastructure (no need for an extra workchain that the network will have to verify and validate), and at the same time, inherit the same security of TON. In addition to that, A zkEVM Rollup on TON could act as a bridge between the TON ecosystem and Ethereum’s ecosystem where tokens from both chains can flow around. This increases liquidity available in the TON ecosystem.”

Ahmad Mazen Bitar, Ethereum Core Developer

Regardless of the specific solution chosen, deploying Ethereum-based protocols can potentially bring in an increased TVL to TON, as observed in peer blockchains that are not EVM-compatible.

Implementation strategy

Here are some options for implementing EVM capabilities on non-EVM compatible blockchains (other than building an internal solution without involving third parties):

Acquiring an existing blockchain is a viable option for TON, but it necessitates a carefully tailored setup. The acquisition of Everscale by Venom, for instance, was a reasonable decision owing to Everscale’s commercial challenges and Venom’s superior scaling capabilities and reputation. Another approach is to develop an L2 blockchain with the assistance of an L2 solutions provider.

What can be learned from other non-EVM blockchains?

Identifying a consistent pattern between the type of L2 solution adopted by a blockchain and the commercial success achieved through EVM compatibility is challenging. This is due to the highly distinct architectures of each case, customized to align with the specific properties of their respective blockchains.

Moreover, the choice of an approach to EVM compatibility may also be influenced by a blockchain’s market positioning. For example, a sidechain may be preferred compared to a rollup to preserve the blockchain’s unique consensus mechanisms, governance models, and economic parameters.

All successful cases of bringing EVM capabilities to non-EVM compatible blockchains vary significantly. This is because they are tailored to the unique requirements of each blockchain. For TON, it is advisable to prioritize the cost-efficiency of transferring Ethereum-based projects to the network rather than attempting to replicate solutions from other blockchains.

Frequently asked questions

Why a non-EVM blockchain may benefit from EVM capabilities?

How to bring EVM capabilities to non-EVM blockchains?

What are some successful cases of bringing EVM capabilities to non-EVM compatible blockchains?

How to choose an optimal solution for achieving EVM capabilities in a non-EVM blockchain?

About the author

Anastasia is an analyst at The Open Platform, a pioneering venture builder & VC company specializing in launching and scaling web3 startups on TON Blockchain. She is responsible for preparing overviews of developments within and outside TON with a special focus on the DeFi segment, as well as supporting projects on their fundraising journey. With a major in Finance, Anastasia is also interested in crypto from the personal finance and asset management perspectives.