With almost 15 years of experience under its belt as a social trading and investment app, eToro is a relatively familiar name in investors’ circles worldwide. From stocks and cryptocurrencies to commodities and indices, the platform offers a wide range of assets for users to trade and invest in. This detailed guide aims to present you with a 360-degree view of eToro’s multi-asset trading platform.

KEY TAKEAWAYS

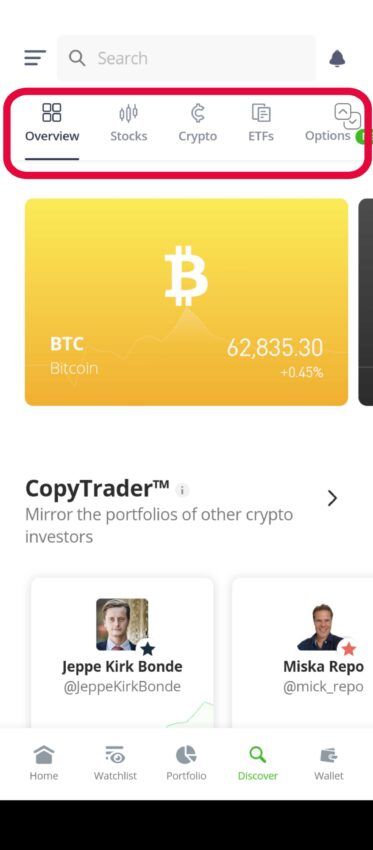

► eToro is a multi-asset investment that offers stocks, cryptocurrencies, indices, commodities, ETFs, currencies, and options.

► Its social trading and Smart Portfolio allow users to copy the trades of experienced investors and access professionally managed portfolios.

► eToro supports various payment methods, has low minimum deposit requirements, and provides a user-friendly interface with educational resources.

► eToro emphasizes security and legitimacy, but users should be aware of its regulatory status in their specific country.

eToro at a glance: Our overall assessment

eToro has cultivated an expansive platform that is growing by the year. It has fair offerings and a multitude of features that cater to both pro traders and novices. However, it will have to consider the regulatory environment and respond appropriately to continue operating and expanding at its current rate.

| Criteria | Security | Customer support | Fees | Assets | Features | BeInCrypto score |

| Score | 5/5 | 4/5 | 3/5 | 4/5 | 4/5 | 4 |

What is eToro?

eToro started its journey in 2007 with the vision of making financial markets accessible to everyone, including the average Joe. The company started off as an online forex broker under the brand name RetailFX and later rebranded as eToro. Shortly after rebranding, it started offering financial instruments in other asset classes, including indices and commodities.

eToro expanded its services in 2010 by launching a social trading feature that enables users to automatically copy the trades of more experienced and successful traders on the platform.

The company then dipped its toes into the crypto space for the first time in 2014. Over the next four years, more digital assets were added to the platform, including Ethereum (ETH) and Ripple (XRP), among others. In 2018, it added more to its crypto offerings by launching eToroX, an institutional-grade crypto exchange for professional and institutional traders.

eToro’s headquarters is in Tel Aviv, Israel, and it operates globally from its registered offices in Australia, the U.K., the U.S., and Cyprus. As of JDecember 2024, it claims to have a global user base of more than 35 million and operates in more than 100 countries.

eToro’s regulatory status

The platform operates under the regulation and authorization of the CySEC in the EU, FinCEN in the United States, the FCA in the United Kingdom, GFSC in Gibraltar, and ASIC in Australia. This gives eToro the legitimacy you normally expect from a platform offering high-risk financial instruments such as CFDs.

However, despite its adherence to regulations and acquisition of licenses in several jurisdictions, eToro has faced some regulatory challenges. In Sept. 2024, the U.S. SEC reached a settlement with eToro for operating an unlicensed broker and clearing house to U.S. citizens.

In an announcement by the SEC, eToro was ordered to pay $1.5 million. eToro will also reportedly offer only three cryptocurrencies — Bitcoin, Bitcoin Cash, and Ether.

Without admitting or denying the SEC’s findings, eToro agreed to the entry of a cease-and-desist order, to pay a penalty of $1.5 million, and, within 187 days of the order, to liquidate any crypto assets being offered and sold as securities that eToro is unable to transfer to its customers, and return the proceeds to the respective customers.

U.S. Securities and Exchange Commission announcement

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro market and products

The platform supports basic market, limit, and margin orders (although margin trading is not available to US users). US customers only have access to real crypto assets and stocks.

eToro offers a wide range of financial instruments in the following asset classes:

- Stocks

- Cryptocurrencies

- Indices

- Commodities

- ETFs

- Currencies

- Options

eToro claims to be one of the easiest platforms where you can buy stocks of leading companies. The simplest investment in stocks for a newbie would be a BUY (long) position, which promises dividends proportionate to the number of stocks owned.

The entry price is pretty low, too — comparatively speaking. In fact, you can start investing in stocks for as low as $100. eToro lists over 3,500 stocks in its ever-evolving “stock bank.” eToro also offers ETFs and CFDs. All leveraged and Short (SELL) positions are executed through CFDs.

If you don’t know what ETFs are, you might want to check BeInCrypto’s detailed guide explaining ETFs. Similarly, if you’re fuzzy on the concepts surrounding CFDs, we have a guide explaining CFDs, too.

(Note that while these guides focus primarily on crypto ETFs, the underlying concepts are similar across all asset classes.) Head over to the eToro market for an up-close look at all the financial products available on the platform.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

“BeInCrypto is compensated if you access certain of the products or services offered by eToro USA LLC and/or eToro USA Securities Inc. Any testimonials contained in this communication may not be representative of the experience of other eToro customers and such testimonials are not guarantees of future performance or success.”

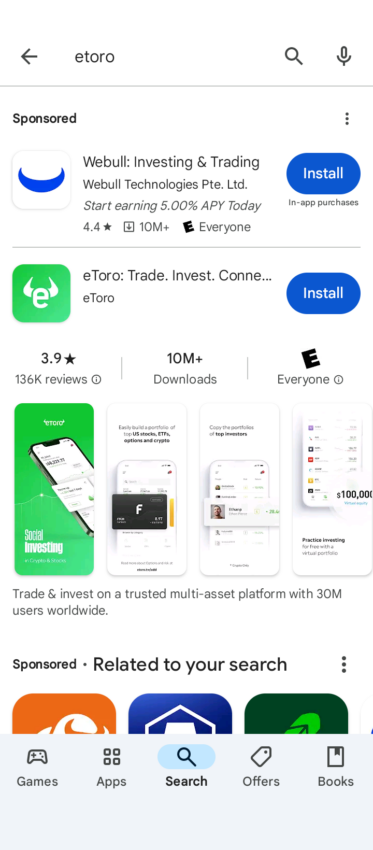

How to get started

The procedure to open a new account is pretty simple and consists of the following steps.

Opening an eToro account

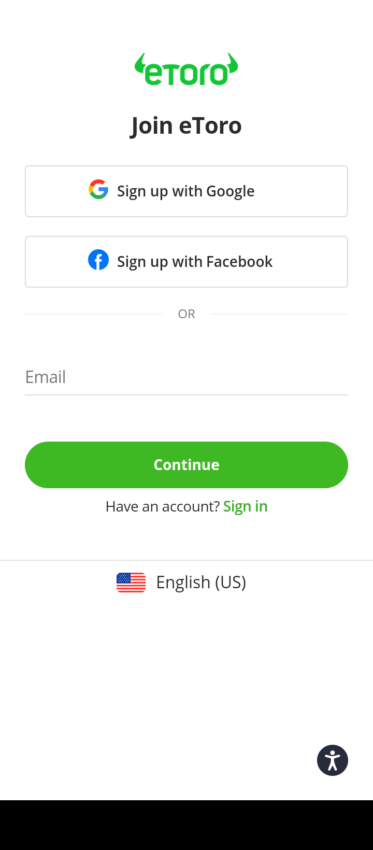

1. Go to eToro.com and click on the button marked “Start Investing” for non-U.S. customers or “Join eToro” for U.S. customers. You can also download the app on your mobile device.

2. Next, select your preferred sign-up method. You can sign in with Google, Facebook, or another email provider.

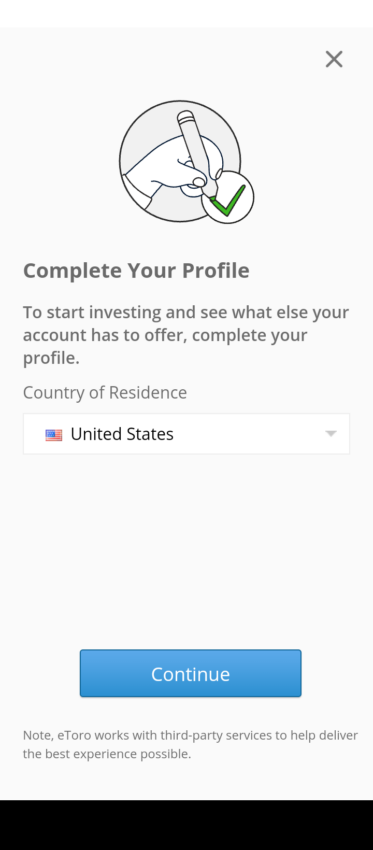

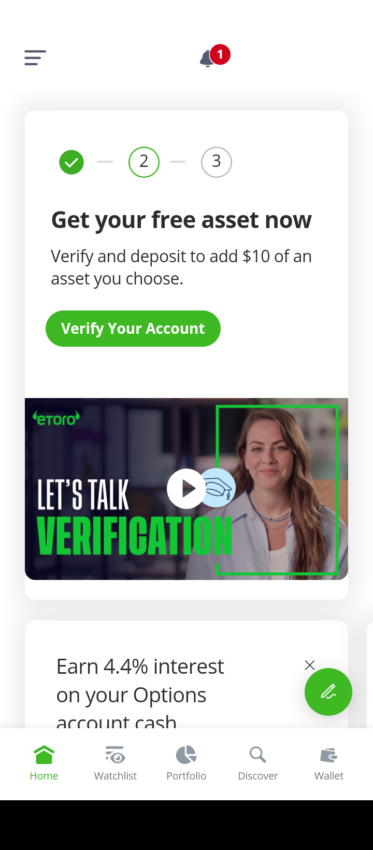

3. Complete the KYC process with details such as your name, age, email ID, country, etc. Review all the details you have submitted and check eToro’s Terms & Conditions and privacy policy.

4. Once you have completed the KYC process, you will have full access to the platform and receive any bonus offers or promotions.

Deposits and withdrawals

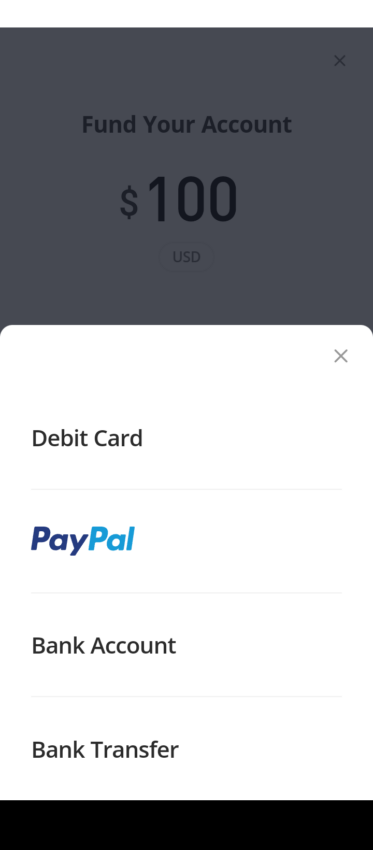

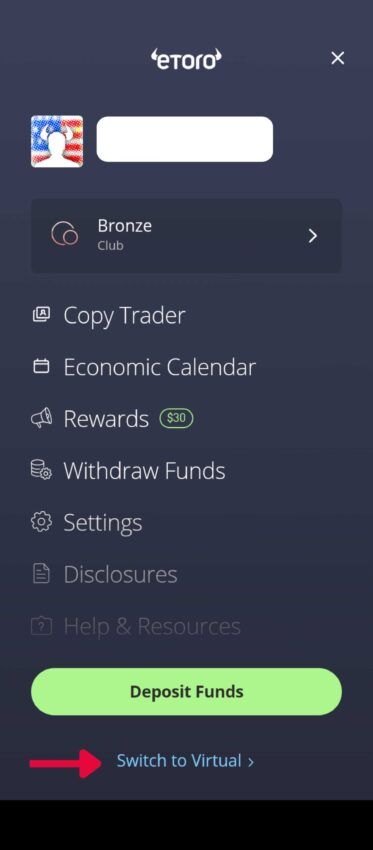

eToro supports several payment methods for deposits, including credit and debit cards, bank transfers, eToro Money, PayPal, Skrill, and Neteller, among others. To deposit:

- Log into your eToro account.

- Click on the button marked “Deposit Funds.”

- Select the currency and enter the amount you want to deposit.

- Select a payment method.

It is worth mentioning that using eToro Money gives you more bang for your buck. That’s because the platform usually promises various perks to eToro Money users, such as zero conversion fees on fiat deposits and so on.

eToro money is a payment app that supports different fiat currencies and cryptocurrencies. You can withdraw funds from your account at any time. It may take anywhere between 2–10 business days for the fund to reach your source account, depending on the payment method.

Minimum deposit and withdrawal amount

The minimum first deposit amount varies depending on where you are from. If you are from the U.S. or the U.K., you can start with as little as $100 ($50 for UK). However, that threshold increases 5x for most of Europe, as well as some Asian countries. For most of the rest of the world, it is $200.

Head over to eToro to find the updated list of minimum first deposits by country/region. The minimum withdrawal amount, meanwhile, is $30. Note that eToro charges a flat $5 fee on all withdrawals and 1% in trading fees.

Minimum trade size

| Asset class | Minimum trade amount |

| Stocks | $10 |

| ETF | $10 |

| Cryptocurrencies | $10 |

| Commodities | $1,000 |

| Indices | $1,000 |

| Currencies | $1,000 |

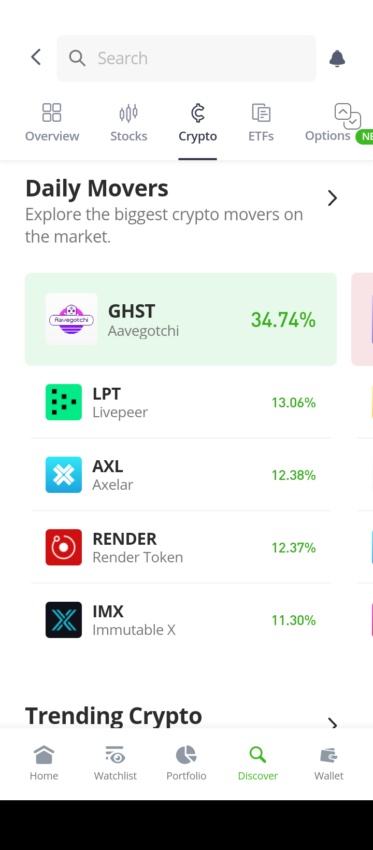

Is eToro good for cryptocurrencies?

eToro offers more than 25 cryptocurrencies for trading. Some of the more popular coins listed by the platform include:

- Bitcoin

- Ether

- Bitcoin Cash

- Ripple (XRP)

- Dash

- Litecoin

- Ethereum Classic

- Cardano

- EOS

- Compound

- Neo

- Yearn Finance

- Aave

- Cosmos

- Polygon

- Bancor

- Basic Attention Token

The full list of cryptocurrencies available for trading on eToro is available here. You can start trading dozens of crypto instruments on eToro, starting at just $10. This low barrier to entry gives newbies with little to no prior exposure to digital assets a chance to test the waters before going all in.

In fact, the platform also offers a demo (or virtual) account with a $100,000 balance. You can use the demo account to learn and practice different trading strategies without risking real money.

The platform also promises to give you full ownership of your crypto stash through its homegrown digital wallet; however, some features are not available to US customers. Dubbed eToro Money, this digital wallet lets you:

- Buy cryptocurrencies

- Securely transfer your favorite cryptocurrencies from the eToro trading platform

- Send/receive crypto to and from other crypto wallets

- Convert one coin or token for another without requiring to pay hefty fees

The company touts eToro Money as one of the safest crypto wallets loaded with security features such as multi-signature, DDoS protection, and more.

Additionally, to help beginners get up to speed, eToro offers an array of crypto portfolios managed by an investment committee. The committee consists of experienced traders on the platform who specialize in digital assets.

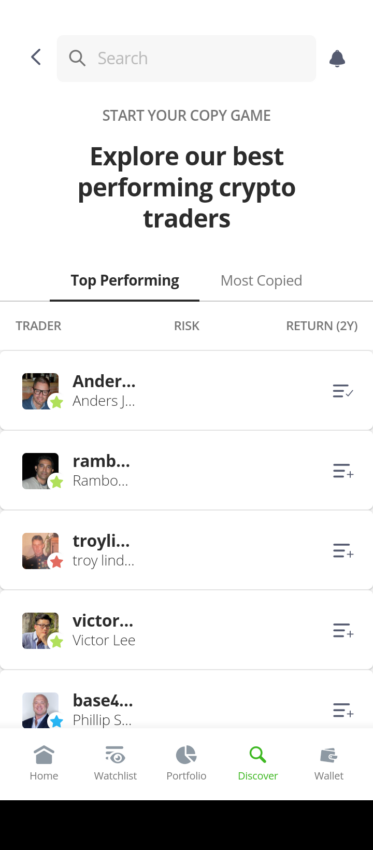

Social trading and CopyTrader

eToro pitches itself as one of the world’s largest social trading platforms, both in terms of user base and trading volume. It has a sizable online library of educational content related to trading and investment.

In addition, the platform also seems to be actively pushing market-related news and updates using daily blogs, social media news feeds, and mobile app notifications. Like any other social network, eToro’s social trading platform also lets you create accounts, follow fellow investors and traders, and share/comment on posts.

Every time a user you are following posts something, you get a notification. Thus, you gradually familiarize yourself with an ever-expanding community of traders. Along the way, you may find many users with pretty smart and rewarding trading/investment strategies. If you so wish, you can easily start copying their strategies with one of eToro’s flagship tools: CopyTrader.

What is CopyTrader?

Perhaps the most popular feature on the platform, eToro’s CopyTrader enables you to copy the investment and trading strategies of other users automatically. That is to say that when the user you are copying sells, you also sell. You do not even have to manually mimic the strategy of that particular investor — CopyTrader will do that automatically on your behalf.

Not just that, you may select up to 100 Popular Investors to copy at the same time if you so wish. At some point, if you feel that the strategies of one or more of these investors are not working all too well for you, you can stop copying them at the push of a button.

And if you are already a skilled trader and investor, you can also apply to join the program. Once you are selected as a “Popular Investor,” you can simply let other users copy your trades and earn up to 2.5% in commission when people copy your trades.

Smart Portfolios

Smart Portfolio is eToro’s premium portfolio management service. Formerly known as CopyPortfolios, it deploys a specific theme or strategy to group a range of financial instruments.

These portfolios promise diversified exposure and long-term potential with zero management fees. And as you would expect, the onus of managing Smart Portfolios lies on a team of experienced financial managers. The managers carefully calibrate each strategy as per prevailing market conditions before finally deciding where and how much to invest.

eToro offers three types of Smart Portfolios:

- Top Trader Portfolios

- Thematic Market Portfolios

- Partner Portfolios (Partners include established brands such as WeSave, Tipranks, and Meitav Dash, among others)

Each of these Smart Portfolios uses different approaches based on region, industry, asset type, and investment strategy. However, all three share the same objective of managing your assets under the guidance of a team of experts.

You need to invest $5,000 minimum to open a Top Trader Portfolio. Open Thematic Market and Partner Portfolios are comparatively more affordable as they require a minimum investment of $500.

Customer support

When it comes to customer support, eToro has quite a few options. For starters, there is a Help Center. The Help Center is a place where customers and visitors can receive answers for some of the most commonly asked questions on the platform.

There is also a learning center, eToro Academy. Here, you can learn about topics in general, like trading for example. If you need even more help, you can open a support ticket. If that doesn’t help, your last line of defense is the Live Chat.

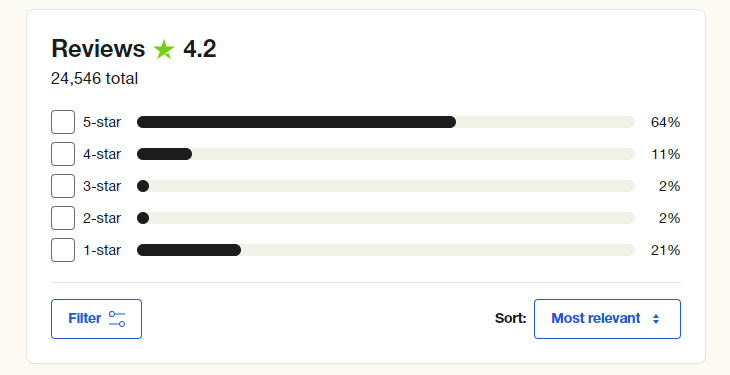

According to Trustpilot, eToro receives overwhelmingly positive reviews. It has a Trustpilot score of 4.2. Many of the customers praise the platform for its account managers and easy-to-use platform. The more critical reviews however, tend to vary widely.

Should you choose eToro?

Are you relatively new to trading? Are you someone with little to no prior exposure to complex and inherently risky financial instruments such as CFDs and ETFs? Or are you someone who prefers the “learning on the job” approach? If your answer to the questions above is YES, then maybe it is worth considering trying out eToro — you might actually feel at home with its active user community and learning tools/features.

Even users with mid-to-high level experience might find features like CopyTrader and Smart Portfolios pretty useful. The Popular Investor program, meanwhile, can benefit skilled and experienced traders by bringing them an additional avenue for passive income.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Frequently asked questions

What is eToro?

Is eToro regulated?

What is eToro CopyTrader?

Is eToro available in the USA?

What is Smart Portfolio?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.