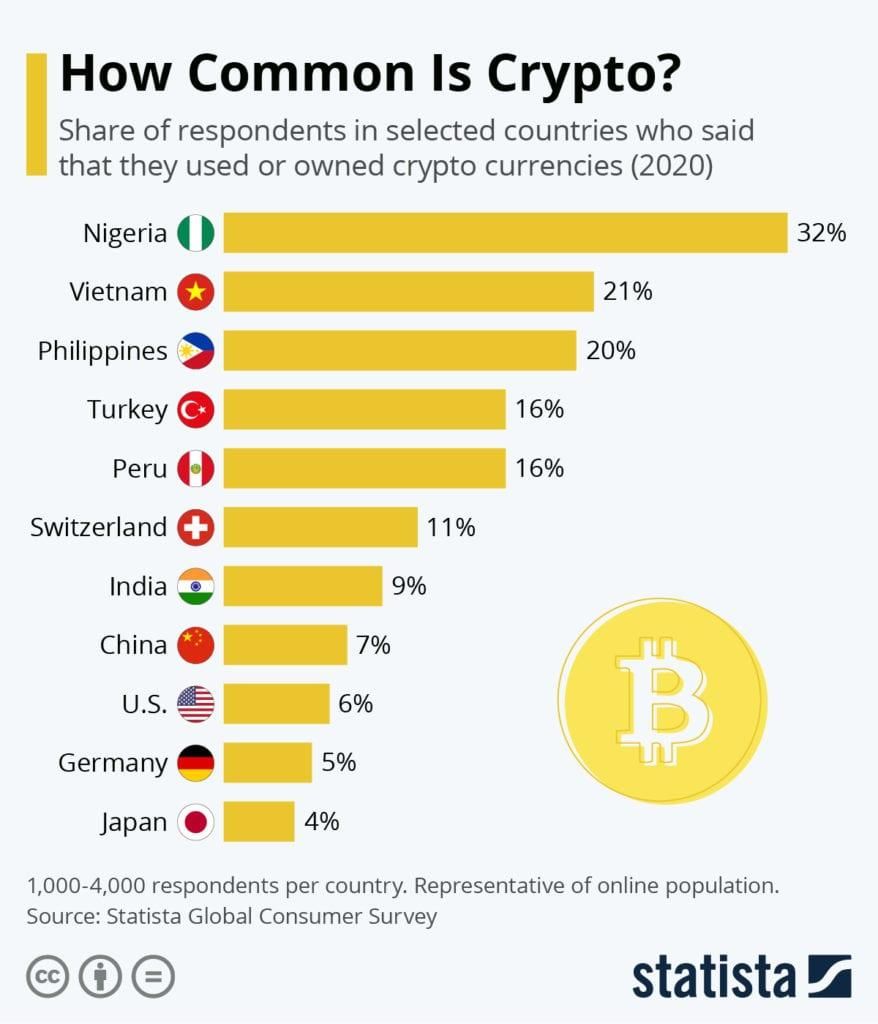

We all know North America, Europe, and Asia as the hubs of technological innovation and development, but Africa, too, has progressed significantly in terms of fintech and blockchain adoption. As a continent with a predominantly young population, it is ripe for becoming crypto Africa.

You may have heard of cardano (ADA) landing a historic contract with Ethiopia, tracking through smart contract blockchain the performance of its 5 million students. Now, it’s time to take a look at Africa’s biggest adopters; Nigeria, South Africa, and Kenya.

Why has bitcoin become so popular in Africa?

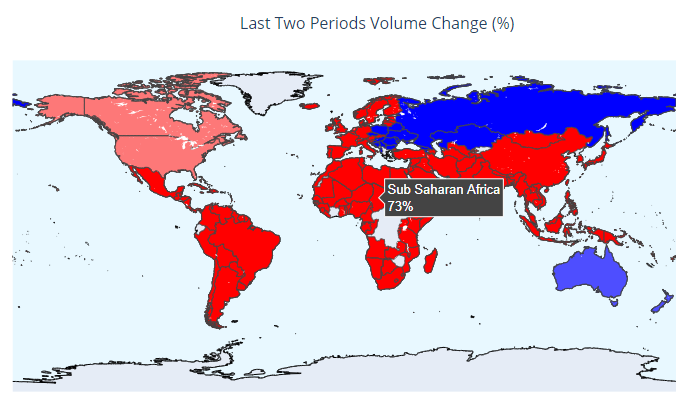

During the last year, Africa, specifically Sub-Saharan Africa, has experienced a 73% increase in bitcoin trading volume on LocalBitcoins and Paxful alone. In contrast, North America’s growth was only 8%. Last month, in May, crypto trading volume held at $17 million, representing a 50% growth from the same month the previous year.

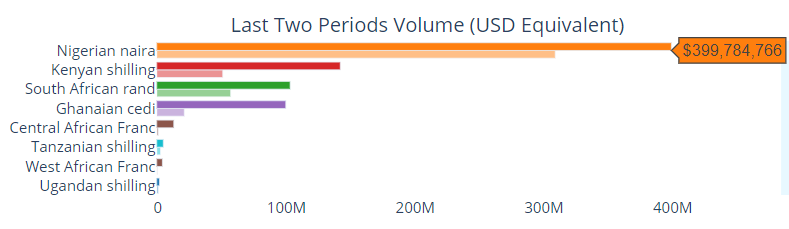

As the most populous African nation at 201 million, of which half are under 19 years of age, Nigeria by far leads the way in crypto trading volume.

M-Pesa laid the groundwork for crypto Africa adoption, as an African equivalent to PayPal, currently serving 48 million customers. First launched in 2007, in Kenya, this fintech platform has one key advantage over PayPal — mobile payments but without requiring a bank account. Instead, money transfers link to one’s SIM card, which in turn links to user identities created in the contract with the telecommunication company.

Inflation and remittances fuelling crypto in Africa

M-Pesa was a godsend for the many millions of unbanked or underbanked Africans, especially those in rural regions. The platform’s innovation spread the usage of smartphones and busted the door for wide crypto adoption.

Outside of novel and convenient mobile payments for the unbanked, there are a couple of key reasons why Africa is seeing such a rapid rise in crypto adoption:

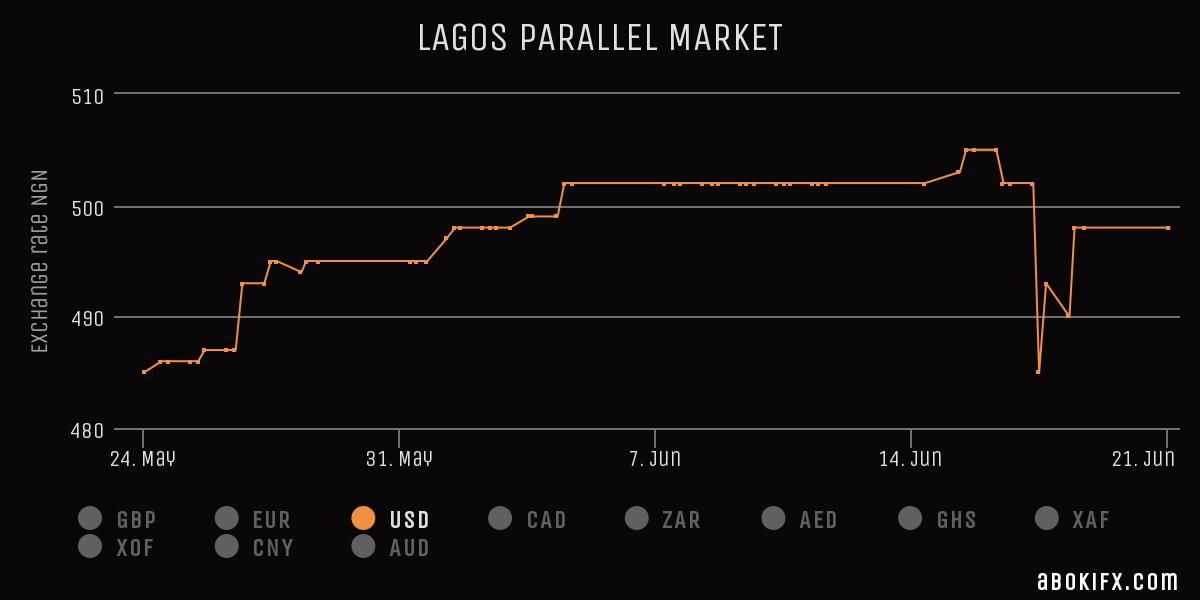

- Devaluation of local currencies – Nigeria alone has suffered record-high inflation four years in a row, reaching an ATH of 18% this March. Meanwhile, Nigeria’s food prices topped nearly 22% this February. The same situation is occurring in other African nations, with Sudan leading the pack at a 102% inflation rate during 2016 into 2017.

Likewise, when Zimbabwe was on the verge of hyperinflation five years ago, its young population turned to bitcoin as a cryptocurrency haven. Correspondingly, from Ghana and Kenya to Nigeria and South Africa, deflationary bitcoin has reached a coveted status, as one would expect from digital gold. - Demand for frictionless remittances – with the growing African diaspora rises the demand for international payments. However, due to undeveloped banking infrastructure, sending money into Sub-Saharan Africa is particularly expensive, on average incurring an 8.2% fee in contrast to the global average at 6.5%.

While pandemic disruptions dropped remittance flow into Nigeria by 28%, the rest of Sub-Saharan Africa had experienced a robust 2.3% rise. Altogether, remittances into Sub-Saharan Africa dropped by 12.5% in 2020 to $42 billion, according to the World Bank data.

Bitcoin is more affordable than using the conventional financial pathways. Furthermore, its pseudonymous nature allows the senders and receivers to retain a greater chunk of the money. Naturally, governments and central banks don’t like this feature of cryptocurrencies. So let’s take a closer look at how each nation in crypto Africa deals with it.

South Africa

Up until recently, crypto assets in South Africa have been unregulated. The nation’s central bank issued a formal statement in 2014, warning potential investors that cryptocurrencies pose a speculative risk. This was the only major action taken until recently.

However, on 11 June 2021, the Intergovernmental Fintech Working Group (IFWG) published a paper advocating for the regulation of crypto assets. This is a predictable consequence of Mirror Trading International (MTI) in December 2020.

IFWG recommended a gradual transition from an unregulated to regulated status, with three phases of implementation:

- Combating the Financing of Terrorism (CFT) and Anti Money-Laundering (AMT). These protocols will have to be followed by licensed crypto asset service providers (CASPs), i.e., crypto exchanges, much like in other countries.

- All cross-border payments should be monitored and reported by CASPs, under the auspice of the Financial Surveillance Department of the South African Reserve Bank.

- As for the status of cryptocurrencies, they will be viewed as financial products. CASPs will have to register with the Financial Intelligence Centre (FIC).

Regulation recommendations follow large crypto scams in South Africa

Such strict regulations are a consequence of the Mirror Trading International (MTI) scandal that occurred in December 2020. Involving over 23k investors, it was dubbed as one of the largest crypto scams in the world. No doubt, this is bad news for South African crypto startups, burdening them with extra costs for development, tracking and implementing all the compliance protocols.

Moreover, all crypto transactions worth about $1839 in rand will have to be reported. However, the saving grace might come from the upcoming proposal for UBI — universal basic income. This “Basic Income Grant” should be an add-on to the existing Social Relief of Distress (SRD) grant — the latter serving to relieve South Africans of pandemic woes.

Considering the rand’s depreciating value since apartheid’s abolishment, it’s reasonable to think that the grant could flow into the cryptomarket. Bitcoin, in particular, could be seen as a deflationary hedge.

Nigeria

Nigeria is not only Africa’s leader in crypto adoption, but in the world as well. Following the devaluation of its fiat currency naira (NGN), which caused soaring inflation of foods and spiking unemployment, bitcoin has become a hot commodity. In 2017, Nigeria’s Central Bank (CBN) first addressed the crypto phenomenon, banning cryptocurrency trading. However, this ban had a near-zero effect on Nigeria becoming the crypto juggernaut of Africa.

This unmatched adoption follows the fact that 185 million of the 201 million people have smartphones as of 2019. Combined with the high inflation rate, this made an official ban rather impotent. So much so that BTC price achieved a premium soon after CBN issued a ban on banks dealing with crypto exchanges, effectively cutting off easy fiat-to-crypto conversion.

Soon after, the CBN official clarified the ban, stating that “What we have just done was to prohibit transactions on cryptocurrencies in the banking sector.” Fortunately, the latest ban was sufficiently unpopular, leading to the Nigerian vice-president calling for regulation instead.

The change in Nigeria’s stance on cryptocurrencies is yet to transpire. It’s equivalent to the SEC putting hold on all regulatory plans after CBN issued the ban in February. In practical terms, ordinary citizens are still trading in cryptocurrency, which is not illegal. However, crypto startups still cannot deposit or withdraw fiat money within the largest African nation.

These startups served as local exchanges, which have now been supplanted by peer-2-peer (P2P) platforms like BuyCoins. During the last five years, Nigeria has accumulated $566 million in crypto transactions. If taxed, even a fraction would boost the nation’s economy, which may come to fruition later in 2021.

Kenya

As is the case with South Africa, Kenyan authorities have neither banned nor given cryptocurrencies a particular status. However, the nation’s central bank (CBK) informed the public that cryptocurrencies were not legal tender in a statement in 2015. Therefore, if a company or an individual who deals with crypto assets suffers a loss, they cannot seek governmental protections.

Similarly, CBK warned financial institutions to avoid dealing with virtual currencies, either directly or through crypto exchanges and start-ups. On 21 February 2018, Kenyan Capital Markets Authority (CMA) once again issued a cautionary notice regarding ICO (initial coin offering) projects. This came after a slew of fraudulent ICOs during the so-called ICO craze during 2017 and 2018.

However, in the same year, the Kenyan government established the Distributed Ledger Technology (DLT) and Artificial Intelligence Task Force. Its mission was to devise a roadmap for the development of fintech and crypto sectors.

Consequently, Kenya does not yet have specific cryptocurrency laws per se. Instead, both the CBK and CMA interpret the National Payment Systems (NPS) and the Banking Act laws generously. Under this, crypto businesses are given licenses depending on the specific project.

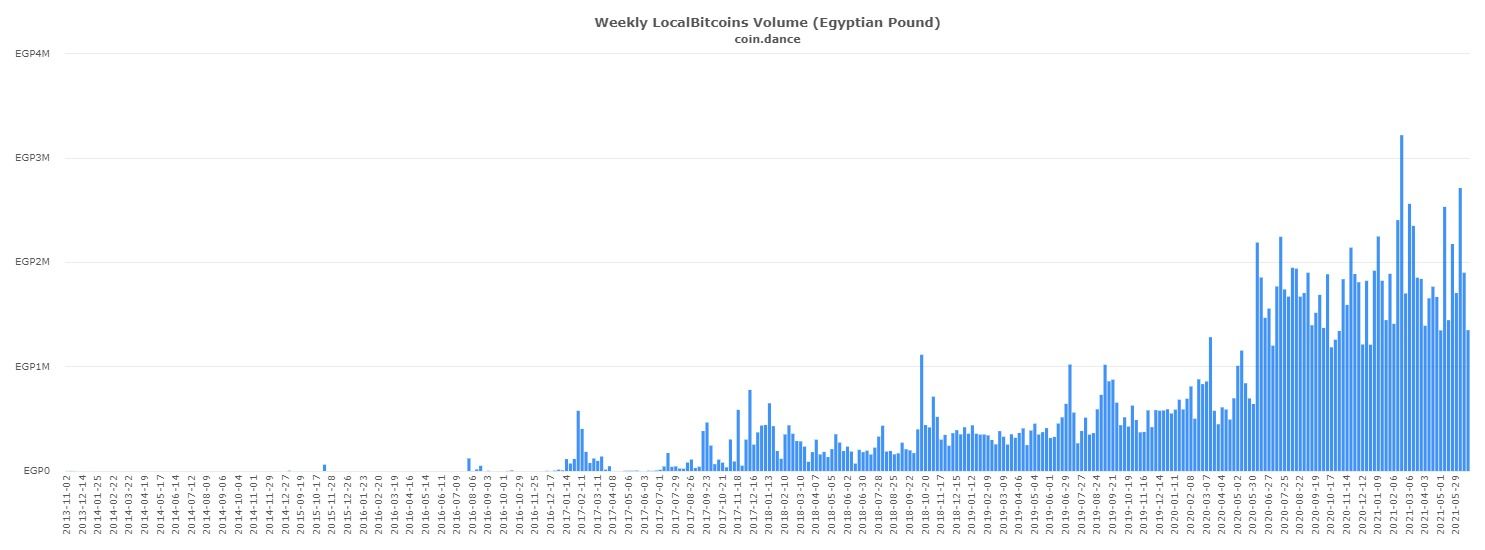

Egypt

While Nigeria’s the most populous nation in Sub-Saharan Africa, Egypt is the same in North Africa, with over 100 million. Due to similar religious makeup, Egypt had also banned cryptocurrency, as much as that is meaningful. In 2018, the nation’s highest religious figure, the Grand Mufti Shawki Allam, issued a crypto fatwa.

Fatwa means forbidden under Islamic law. This translated to Egypt’s central bank (ECB) avoiding to issue any regulatory framework for cryptocurrencies. However, the ECB can issue a license under its banking law for trading and promoting cryptocurrencies. Without such a license, one risks arrest, even for mere promotion. This happened in February, when authorities arrested a bitcoin promoter on Facebook, confirming that he had a crypto wallet.

Nonetheless, due to the problem of devaluation of their currency, Egyptians resorted to crypto investing. During January, the trading volume on UK’s CEX.IO surged by 250% from users registered in Egypt. Bitcoin transactions alone rose by 400% from December to January of 2021.

Ghana

Close to Nigeria, Ghana, had issued a note to banks, the public, and deposit-taking institutions regarding cryptocurrencies in 2018. In it, the Bank of Ghana (BoG) said that cryptocurrencies weren’t regulated under the Payments System Act 2003. However, they did acknowledge the great potential of blockchain technology. Unfortunately, nothing came out of that initially promising stance.

In early 2021, Ghana’s SEC issued a warning asking for the avoidance of cryptocurrency transactions because they are illegal and unregulated. Paul Ababio, SEC’s Deputy Director-General, did, however, hinted at a possible change of policy in the future.

“(The) Bank of Ghana does not treat it as a form of payment, it is not a legal tender but we will be engaging further to come out with frameworks.”

Furthermore, BoG is closing in on issuing the nation’s CBDC — central bank digital currency. It will be called “e-cedi,” which suggests that Ghana has no plans to make bitcoin legal. Nonetheless, one can still buy bitcoin via P2P platforms, such as Binance P2P, Coinbase, mybfx.co, and other exchanges.

What the future holds for Africa

It seems that crypto Africa is largely unregulated at best or antagonistic towards bitcoin at worst. In both cases, high inflation rates have a predictable effect — inhabitants see bitcoin as a guardian and multiplier of wealth. Because it isn’t technically possible to ban cryptocurrencies, all such edicts do is complicate the method to obtain them.

P2P platforms have thrived in such an environment. However, in the wake of El Salvador’s embrace of bitcoin as legal tender, other African nations may follow suit. Tanzania President Samia Suluhi Hassan had already announced crypto integration in the first half of 2021. If all goes well, this may form a pressure wave that spreads throughout the continent.

Frequently asked questions

What are the difficulties of regulating cryptocurreny?

How do governments address regulatory challenges?

What are the consequences of inadequate crypto regulation?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.