Decentralized finance has always been a go-to use case for crypto enthusiasts. But centralized bodies like 3AC and FTX going belly up in 2022 further strengthened DeFi’s case. While there are several prominent DeFi projects and protocols — including the likes of AAVE and Euler — here we will discuss Compound. This reputed lending protocol’s native token is COMP. So is COMP a worthy investment? What is the likely future of the token? This comprehensive Compound price prediction uses fundamentals, on-chain analysis, and social metrics to find out.

KEY TAKEAWAYS

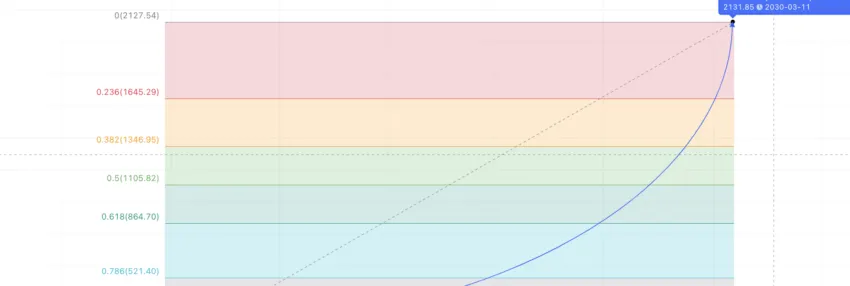

➤ Compound’s (COMP) price projections reveal a potential for substantial long-term growth, with a projected high of $2,127.54 by 2030.

➤ Compound’s price movement follows identifiable patterns influenced by historical trends, technical analysis, and Fibonacci levels.

➤ COMP is positioned as a governance-focused token within a robust DeFi ecosystem, but its price is subject to market conditions.

- Compound (COMP’s) long-term price prediction

- Compound price prediction using technical analysis

- Compound (COMP) price prediction 2024 (successful)

- Compound (COMP) price prediction 2025

- Compound (COMP) price prediction 2030

- Compound price prediction using fundamental analysis

- Compound tokenomics

- How accurate is the Compound price prediction?

- Frequently asked questions

Compound (COMP’s) long-term price prediction

The below figures trace the price of COMP till 2035. The analysis that follows sets out how we reached these levels.

| Year | Maximum price of COMP | Minimum price of COMP |

| 2025 | $217.30 | $113.55 |

| 2026 | $325.95 | $202.08 |

| 2027 | $521.52 | $260.76 |

| 2028 | $912.66 | $456.33 |

| 2029 | $1,368.99 | $684.49 |

| 2030 | $2,127.54 | $1,319.07 |

| 2031 | $2,553.04 | $1,991.37 |

| 2032 | $3,318.96 | $2,389.65 |

| 2033 | $4,148.70 | $3,235.98 |

| 2034 | $5,393.31 | $4,206.78 |

| 2035 | $6,741.64 | $5,258.47 |

Do note that percentage gain and loss for attaining the yearly highs and lows are crypto market dependent. Therefore, the focus should be on locating the average price of COMP rather than fixating on extreme price levels.

Compound price prediction using technical analysis

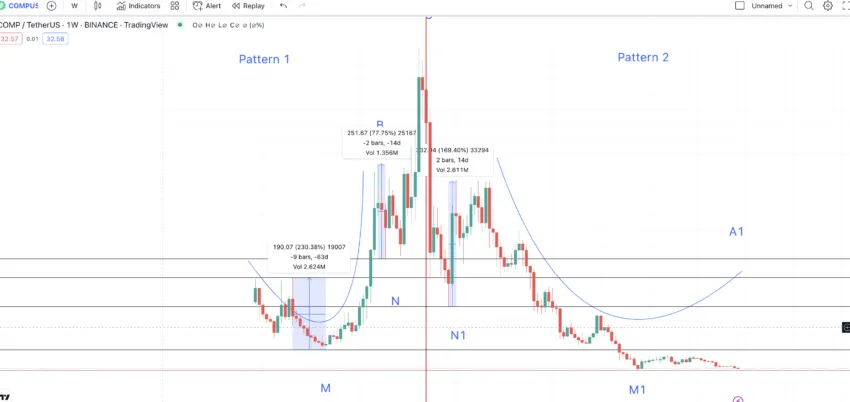

Here is the weekly price chart of COMP, from when we first began COMP analysis.

While you look at it and try to determine a pattern, let us quickly go over some of the insights that might help you make sense of COMP’s previous moves:

Key pointers:

- The maximum price of a COMP token is $911.20, which it reached on May 12, 2021.

- The minimum price came on Jun. 10, 2023, when COMP reached $25.55

- The peak market cap is $4.34 billion, which surfaced on May 12, 2021 — the day prices peaked.

Identifying the pattern

If you look at the weekly chart, you will notice a broader trend. The COMP price starts at a peak, makes a rounded bottom, and peaks again. It then forms another bottom, then finally forms the highest price peak. The mirror image of Pattern 1 follows with a bottom and then a lower high.

However, after the lower high, COMP makes another mini swing-high pattern with three lower highs. As you can see, COMP must make another high to complete the rounded bottom formation identified in pattern 1.

For the sake of understanding, let us divide the chart into two patterns and assign identifiers to the highs and lows.

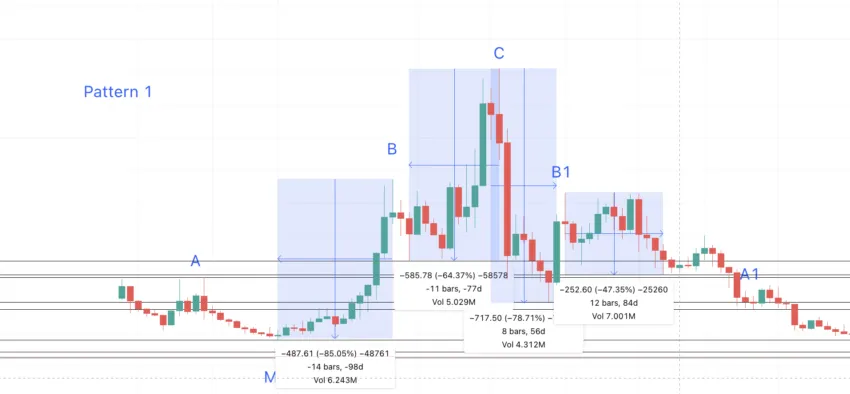

Price change

Do note that the B1-M1-A1 curve in the pattern one should trace a similar path as B-M-A for the pattern theory to hold. Let us mark the lows from C to B and C to B1 as N and N1, respectively. This will help us calculate the low to high range and allow us to find the location of A1.

Data set 1 is as follows: N to B = 14 days and 77.15% price change; N1 to B1 = 14 days and 169.4% price change; M to A = 63 days and 230.68% price change.

Average percentage increase: 159.27%

As we have fewer points here, we may be unable to calculate the distance properly using the table above. For that, let us take the distance between B and A to generalize the distance between B1 and A1.

B to A is 161 days and a 52.30% drop. Therefore, B1 to A1 might show up around the same interval and percentage drop.

If we draw the first point from B1, using the data above, A1 surfaces at $252.91 and on Dec. 13, 2021. Now see that the point is a success on the chart, showing that our prediction was accurate. So we now shift the A1 to the Dec. 13, 2021 point and realign the patterns.

The higher-high and lower-low set becomes the first pattern. We must use the foldback pattern to create Pattern 2 from scratch. Even the M1 shifts to be between B1 and A1. If we use the bars pattern, the next pattern or the new Pattern 2 should be like Pattern 1, using historical data.

The new pattern

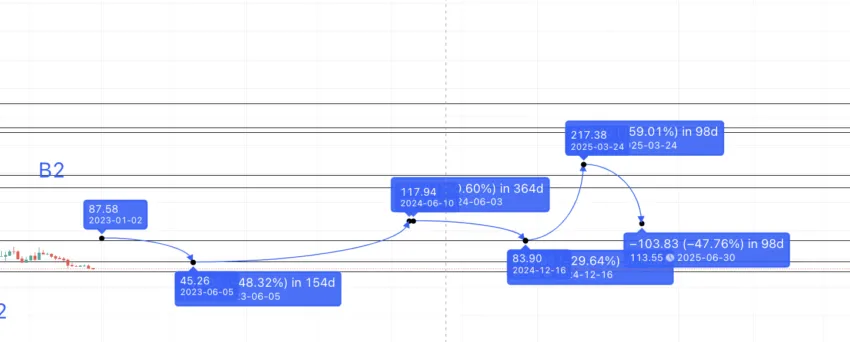

If we shift the bar pattern a bit, we see that the previous low, now M2, can be considered the first low of Pattern 2. The immediate high before that can be the A2 of the next pattern. Now that we have the new A2 and M2, we can extrapolate the locate the values at B2 and C2.

Data set 2 is therefore as follows: M to B = 98 days and 594.2% price change; M1 to B1 = 84 days and 89.75% price change

The average comes to be 91 days and 341.98%. Hence, the distance from M2 to B2 can be anywhere in the range presented in data set 2. If we draw a forecast line from here, we see that the new high is lower than A2. This proves that COMP is in a downtrend.

Now, let us take the distance and price difference between B and C and B1 and C to locate the next peak.

Data set 3 emerges as: B to C = 91 days and 59.44% price change; B1 to C = 56 days and 73.04% price change

The average comes out to be 74 days and 66.24%.

Therefore, if we plot the same from B2, we get C2 at $87.57. COMP almost reached this level in early 2024, making our price predictions hold.

Compound (COMP) price prediction 2024 (successful)

Our COMP price prediction for 2024 was on point as COMP reached $120, while we predicted $118.

Data set 1 shows the average distance from the low to the high was 159.27%. The timeframe varied depending on the state of the crypto market. From the 2023 low, we plotted the next line at a high of 159.27%, which surfaced at $117.94. Therefore, the COMP price prediction for 2024 was above $100.

The current state of the crypto market might put the high in a year from the previous low. The low can be at the strong support level of $82.50, which coincides with M from Pattern 1.

Compound (COMP) price prediction 2025

Outlook: Bullish

The next high can again be at 159.27%. However, by this time, COMP should be able to move in close to 98 days — the distance from M to B. Therefore, the future price of COMP in 2025 can reach a high of $217.30.

We can now take the average of all high to low drops, to find the ideal low level for the following years.

Data set 4 is as follows: B to M = 98 days and -85.05%; C to N = 77 days and -64.37%; C to N1 = 56 days and -78.71%; B1 to M1 = 84 days and -47.35%

The average distance and drop come to be: 79 days and 68.87%.

So from the high of 2025, the next low might surface at $68.61. However, if COMP keeps the uptrend going, the next low could be at a 47.35% drop (the minimum point from the table above). This puts the 2025 low at $113.55.

Projected ROI from the current level: 154%

Compound (COMP) price prediction 2030

Outlook: Very bullish

Now, if we take the 2025 high and the 2024 low into consideration and draw the Fib levels, we can forecast Compound’s future price action. Do note that the path to 2030 follows the same path from 2022 to 2025. It assumes widespread growth and adoption of the lending platform.

The Compound price prediction for 2030 high, as per the Fib levels, surfaces at $2127.54.

Projected ROI from the current level: 2393%

Compound price prediction using fundamental analysis

Compound is a DeFi lending instrument allowing users to deposit their crypto to specific pools to earn interest. The protocol already has a delectable use case for those seeking passive income.

Users who deposit tokens to a pool get a receipt token in return. As the exchange rate of these receipt tokens increases, users can redeem more of the deposited assets. And that’s how they keep earning passive income.

While this looks like a standard business model, here’s what else we should know before forecasting Compound’s future price.

- Compound also offers secured loans against deposited collateral.

- The Compound Network has a massive DeFi presence.

- It is built on Ethereum and works on algorithmically set interest rates.

- A new version — Compound III — came into existence in August 2022 with a focus on gas-fee-efficient lending.

- The broader financial ecosystem, also called Compound Finance, also works as a money market.

- COMP, the native ERC-20 token of this DeFi lending ecosystem, comes with governance-specific capabilities.

- It uses smart contracts for fund management across pools.

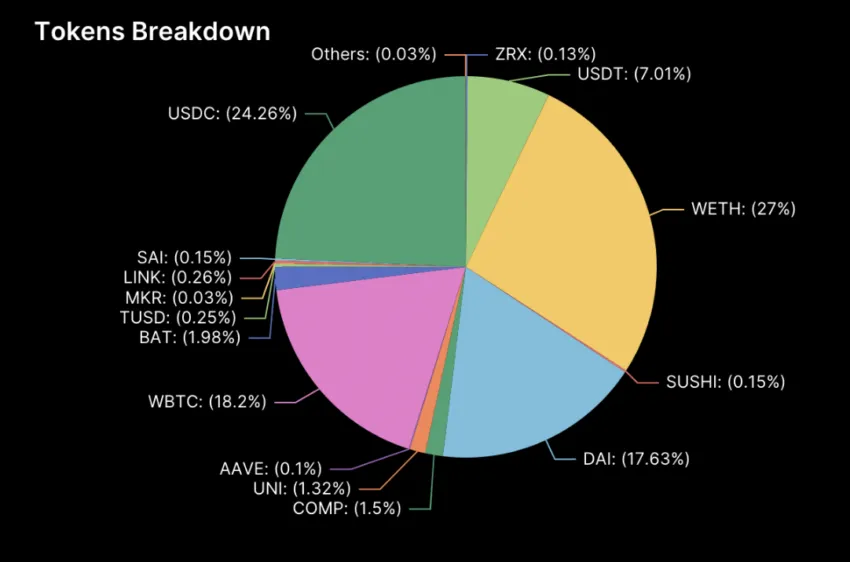

- Compound, the lending protocol, has a pretty even distribution of digital assets. WETH and USDC form the majority of the pool strength.

Compound looks strong, fundamentally. With DeFi lending growing in popularity, the future price of COMP might improve once the bear market subsides.

Compound tokenomics

The token model of digital assets does impact their future prices. COMP tokens, relevant to the Compound network, are primarily used to determine the ecosystem’s state. They do not come with a quintessential investment structure. Eventually, token holders might be able to make ecosystem-specific decisions.

How accurate is the Compound price prediction?

This Compound price prediction model is built on detailed technical analysis, on-chain detailing, and fundamental profiling. Therefore, you can expect all the price prediction levels to be practical and attainable. As explained above, it is wise to focus on the average annual COMP price to paint a more accurate long-term picture. And for each year, you should take the existing state of the crypto market to tweak the price expectations accordingly.

Disclaimer: This analysis is specific to Compound (COMP) and is for informational purposes only. The projections are based on historical data, technical analysis, and current market conditions, which are subject to change. Compound’s performance as a DeFi token depends on broader market trends, adoption of DeFi lending platforms, and technological advancements. Cryptocurrency investments, including COMP, carry significant risks. Always conduct your own research (DYOR) and consult a financial advisor before making any investment decisions.

Frequently asked questions

How much will Compound be worth in 2025?

Does Compound coin have a future?

Can Compound reach $10000?

Is Compound safe crypto?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.