What if we told you there was a dual-layered blockchain project focusing on building universal applications? One chain that can seamlessly shift between layer-1 and layer-2 without losing efficiency? If it sounds too good to be true, it’s time to learn about the Nervos Network — an innovative blockchain scaling solution. This CKB price prediction will consider the potential of the Nervos Network while assessing the future value of its native utility coin.

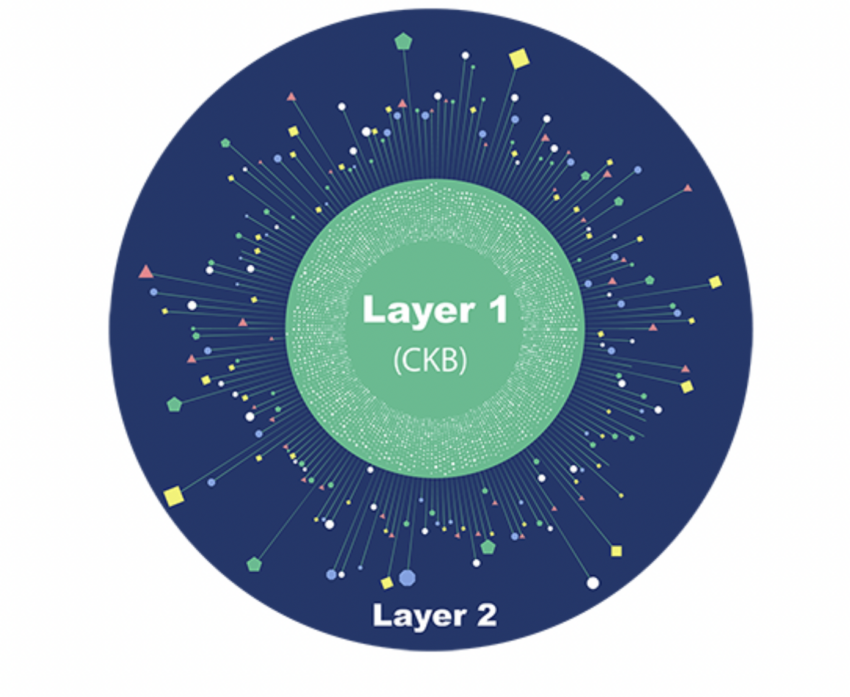

But first, here is some background on the Nervos Network. For starters, it takes its name from the nervous system. The network comes with two layers. The first one is the base layer (CKB-layer), which takes care of the consensus and has CKB as the native coin. The layer-2 of the Nervos ecosystem is the computation layer, meant for hosting DApps. Finally, CKB is a direct part of Nervos Network’s economic model as it translates to storage space on the base layer.

Simply put, the more CKB coins you have, the more storage space you get on the base layer. This makes way for additional security. So, are we bullish about the price of CKB? Let’s take a look.

Want to get CKB price prediction weekly? Join BeInCrypto Trading Community on Telegram: read CKB price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

- CKB price prediction using fundamental analysis

- The price of the Nervos Network coin and tokenomics

- CKB price forecasting using historical data and trading markets (2022-23 data)

- On-chain metrics and social volume (2022-23 data)

- CKB price prediction using technical analysis

- Nervos Network (CKB) price prediction 2023

- Nervos Network (CKB) price prediction 2024

- Nervos Network (CKB) price prediction 2025

- Nervos Network (CKB) price prediction 2030

- Nervos Network (CKB) long-term price prediction until the year 2035

- How accurate is the price prediction model?

- Frequently asked questions

This article may be outdated, we suggest you visit our new Nervos Network Price Prediction tool.

CKB price prediction using fundamental analysis

The Nervos Network is two blockchain layers paired as one. Here is what a simple version of that might look like:

Did you know? The Nervos network supports smart contracts, can host DApps, and follows a mineable, proof-of-work consensus.

Here are some Nervos Network insights to help us consider the possible fate of CKB going forward:

- CKB is deployed as a form of compensation meant to incentivize the resources to keep the network safe.

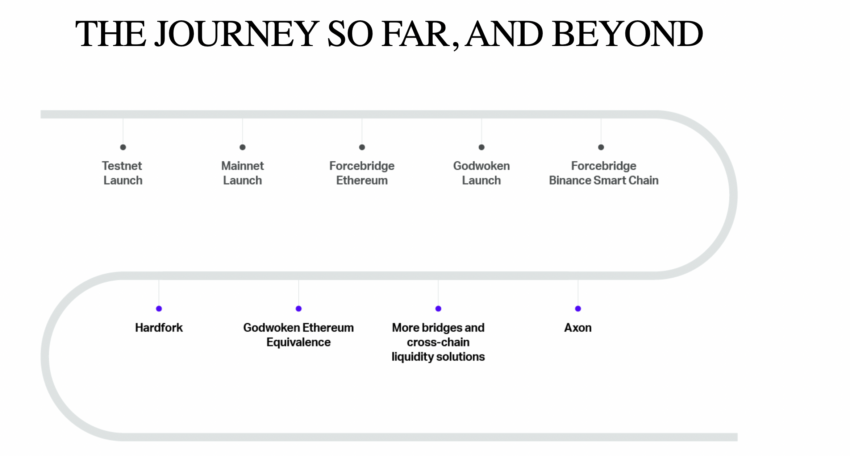

- It has a very tech-heavy roadmap focused on bringing cross-chain bridges, custom chains via a new Muta framework, and a layer-2 sidechain named Axon. There’s even a DEX template. Axon is already alive and kicking.

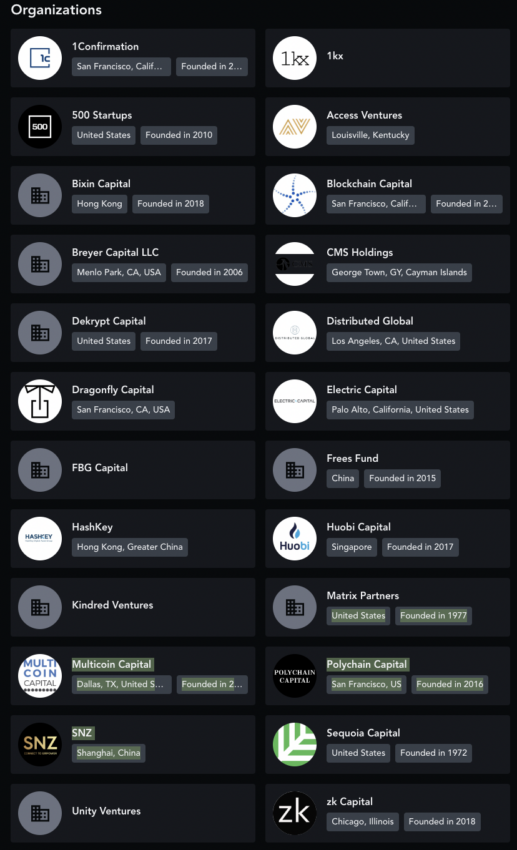

- The Nervos ecosystem has a celebrated lineup of investors.

The project looks strong, and the PoW consensus mechanism makes the Nervos network even more desirable since Ethereum moved away from mining.

The price of the Nervos Network coin and tokenomics

Tokenomics is essential for gauging the price action of any crypto asset. For the Nervos Network, we’re focused on the tokenomics of CKB.

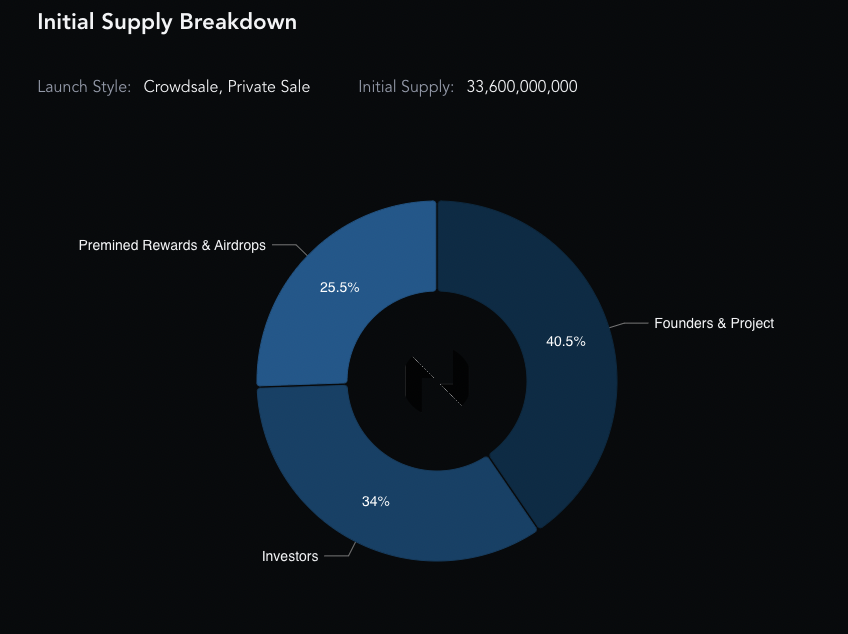

The total supply of CKB stands at over 44 billion. Out of which, almost 43.7 billion CKB coins are already in circulation. The genesis block of the Nervos Network initially featured 33.6 billion CKB coins, of which the ecosystem burned 8.4 billion, thereby creating initial scarcity.

Currently, the coin allocation looks like this:

- Almost 34% of CKB to investors

- 25.5% as pre-mined rewards and even airdrops

- 40.5% to the project (15% to the team with a four-year vesting timeline)

Do note that May 2022 saw a massive coin unlock event for CKB. This was when the vesting timeline ended.

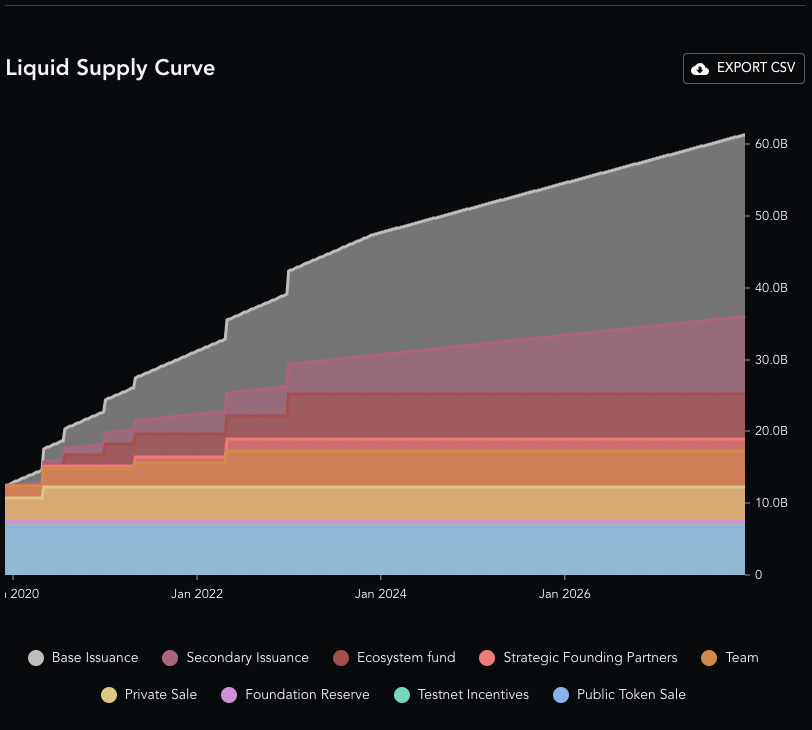

There are ongoing emissions to consider as CKB issuance halves every four years (like BTC). However, the primary issuance stops once the circulating supply hits 33.6 billion. There is also a secondary issuance of 1.344 billion CKB coins each year to incentivize the ecosystem’s state and security.

From a tokenomics perspective, the Nervos Network price forecasts look bright. Despite being inflationary, issuance is supposed to decrease every year courtesy of the burning and halving.

CKB price forecasting using historical data and trading markets (2022-23 data)

In crypto, we usually trace the path of a coin from its historical data. For CKB coins, we can look at the market cap and trading volume as historical data points to understand how the price is performing.

The peak market cap of CKB was on April 1, 2021, when it reached $1.02 billion. The trading volume at that time was $129.49 million.

As of 20 December, 2022, the market cap was at $72.27 million, whereas the daily trading volume was at $8,72,916.32.

The turnover ratio in the first case is 0.127.

The turnover ratio in the second case is 0.012.

As the turnover ratio is lower in the current scenario, the CKB’s volatility is higher.

CKB’s trading spot spread is surprisingly positive. The CKB-USDT pair on Binance hogs the most volume and comes with a sufficiently high liquidity score. This indicates volatility is currently in check.

On-chain metrics and social volume (2022-23 data)

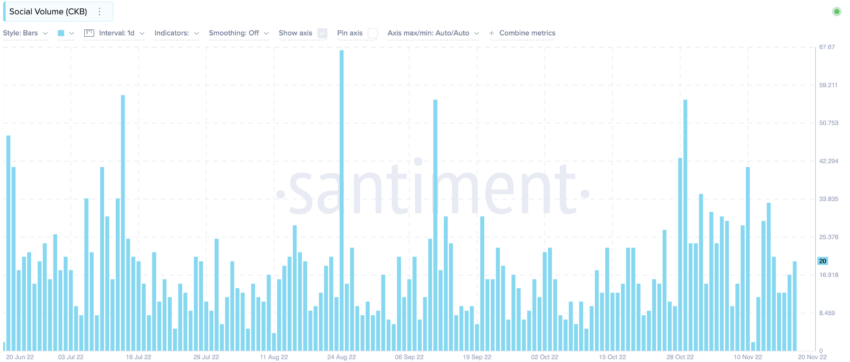

Development activity within the open-source Nervos network peaked in late November 2022. However, the prices didn’t see any upward move and continued to trade sideways.

The social volume associated with the Nervos network was rising in November 2022. Something similar happened on Aug. 24, 2022. Social chatter around the Nervos network and CKB price increased. But prices didn’t respond.

CKB price prediction using technical analysis

Now, let’s shift to technical analysis. Here, we will try to build a CKB future price prediction model by looking at CKB price charts pulled out from 2022.

/Related

More Articles

Here are the things we already know about CKB:

- The all-time high for the price of CKB is $0.04412.

- CKB reached this level on May 31, 2021.

- The all-time low surfaced on Dec. 20, 2022.

- The lowest price was $0.002083, which is also a strong support level for CKB.

Let us begin with this raw weekly chart and try to locate a pattern:

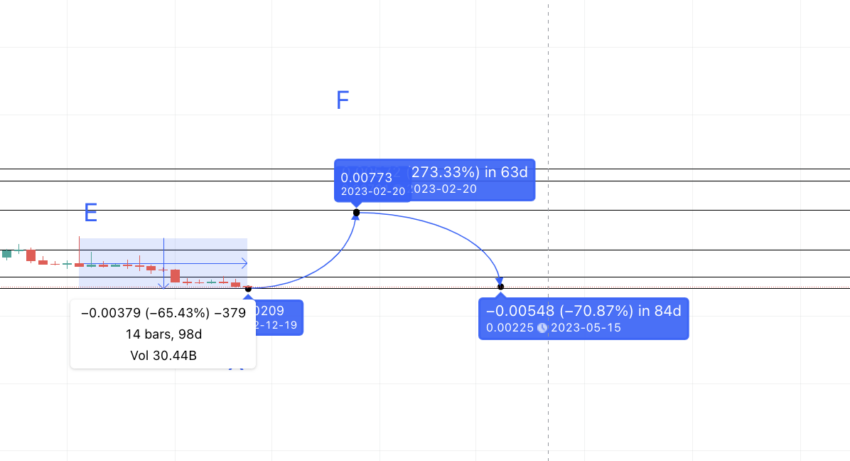

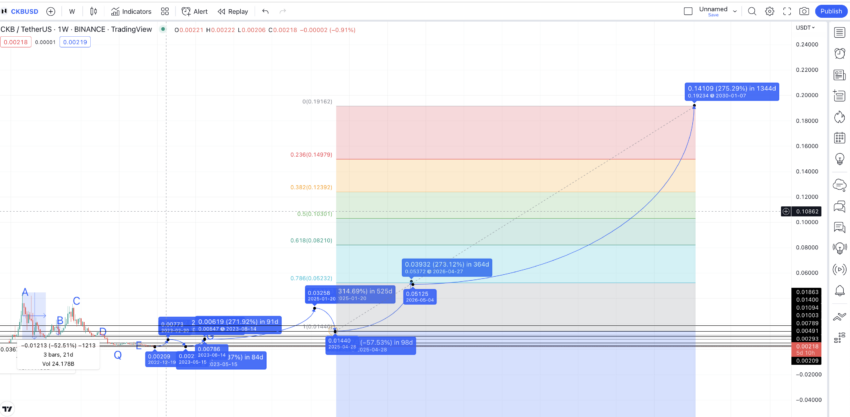

We can see a clear pattern where a low is followed by a high, and so on. Note that the highs are alternates: one higher high followed by a lower high and a higher high. However, E is the only exception as a lower high after D. This can be due to the massive CKB sell-off post the unlock event.

The lows till P were higher lows, signaling some strength at the CKB counter. However, since the coin unlocking event in May, the prices dipped, forming a new low at Q and then recently at X.

In our Nervos Network price prediction model, we assume that the market conditions might change. A new high above E might show up, furthering the old and relatively successful pattern.

Price Changes

Outlook: Bullish

For deciding on the next high, we shall plot the distance and price difference between the previous lows and the subsequent highs.

Here is the data for the same:

M to A = 63 days and 804.37% price change; N to B = 49 days and 191.85% price change; O to C = 56 days and 225.03% price change; P to D = 35 days and 39.53% price change; Q to E = 91 days and 104.44% price change.

Now the average distance from the next low to the next high comes to 59 days and 273%.

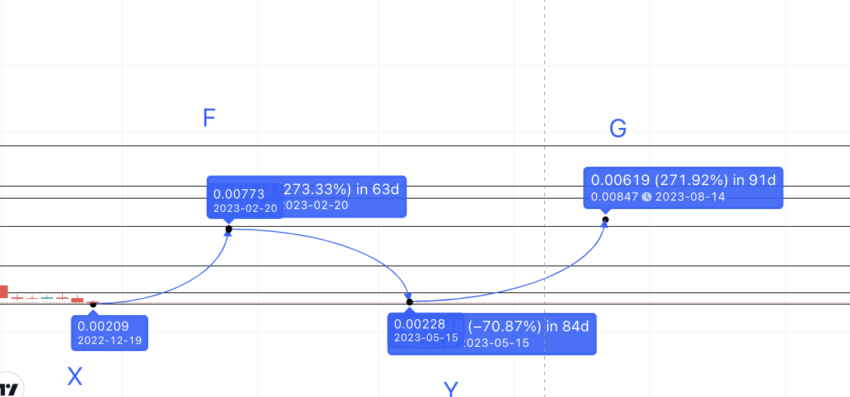

On plotting the same from X (assuming it is the current low), we get the next high at $0.00781. This is justified as it coincides with N, one of the higher lows from the old pattern. This means there is strong resistance at this point.

This high might surface in early February 2023. But if the crypto market continues to be weak, we can take the upper limit as 91 days.

Nervos Network (CKB) price prediction 2023

We predicted a high of $0.00781 for CKB in 2023. However, it breached past the $0.01 mark in early 2024. As we know, the timeline of the expectations might vary, but CKB didn’t disappoint.

Now that we have the high at $0.00781 (we will name it F), we can plot the highs to lows to find the next low. This will help us identify the trend that the price of CKB could follow once the bear market releases its grip.

A to N = 112 days and -82.4% price change; B to O = 21 days and -52.51% price change; C to P = 91 days and -72.07%; D to Q = 77 days and -80.44%; E to X = 98days and -65.43%

The average distance from the next projected high to the next projected low is 80 days and -71%.

Now, if we plot the path from F, the next low can be expected at $0.00225.

Here is the path that traces the CKB price prediction in 2023:

Will the short-term Nervos Network price forecasts hold: how’s the trend looking?

Outlook: Bullish

In 2023, we can expect a high of $0.00781 and a low of $0.00225 (mark it as Y). The timeframe is of little relevance as the Nervos Network price forecasts will look to the broader crypto market in general. So how are things looking in the short term?

The CKB future price prediction currently depends on the descending wedge pattern that is visible at CKB’s counter, according to the daily chart. If CKB manages to break the upper trendline, we can see prices rising in the short term.

The broader RSI pattern shows the price of CKB tokens has been making lower lows, whereas the RSI was making higher lows. That’s a bullish divergence and a positive short-term sign. Still, buyer discretion is advisable.

CKB looks set to move to the projected levels in 2023.

Nervos Network (CKB) price prediction 2024

Outlook: Very bullish

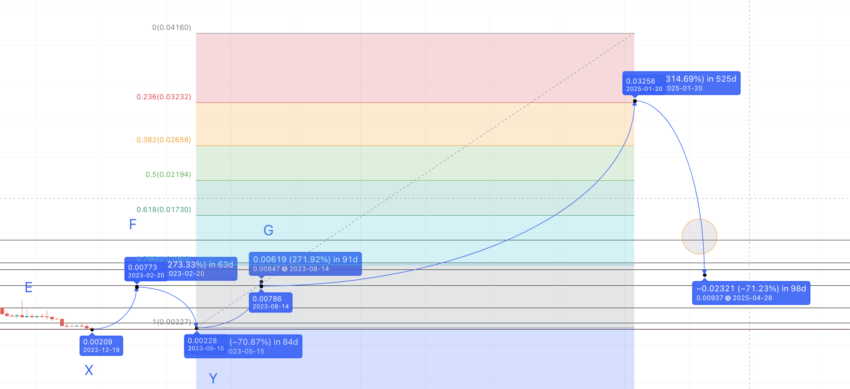

Now, if we move back to the weekly chart, we can plot the next high from Y. Also, as Y is higher than X, CKB should have successfully defeated the lower low pattern by then.

So, the next high could be at a 273% high from Y. The point is at $0.00847. While it may show in 2023, the bearish crypto market might push that high to early 2024. That is exactly what happened, but with better results. As CKB is already trading at $0.015 at the time of writing, we expect the prices to go as high as $0.02 in 2024.

Projected ROI from the current level: 33%

Nervos Network (CKB) price prediction 2025

Outlook: Bullish

We can use the Fib indicator to connect the low Y and the new high (say G) and plot a CKB price prediction for 2025.

The current slope puts the price of CKB at $0.03258 for 2025. The low can be at a 71% drop from the high and somewhere within the 100-day mark — according to data set 2.

However, the strong support line at $0.01400 (coincides with D — one of the peaks) could keep the price of CKB from falling lower than that.

Projected ROI from the current level: 117%

Nervos Network (CKB) price prediction 2030

Outlook: Bullish

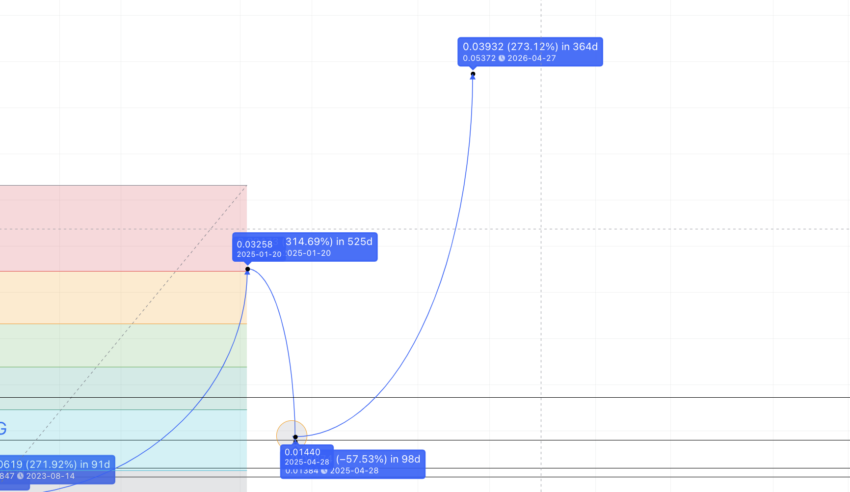

The low in 2025 may steady itself at $0.01440 or even $0.01863 (another strong support level). If so, we can expect prices to increase aggressively in the years to come.

The next high, perhaps in 2026, can be at a 273% peak from the 2025 low of $0.01440. We have purposefully kept it at 364 days for the sake of clarity. If Nervos Network lives on this long, we can expect a 273% move from the previous year’s low. So the high in 2026 can be anywhere close to $0.05372.

By that time, the price of CKB tokens would be at their all-time high levels.

If we again connect the Fib levels using the lows and highs, the CKB price for 2030 surfaces at $0.192. Do note the slope of growth till 2030 remains the same as before.

Here is what the CKB price prediction path might look like if we zoom out:

Projected ROI from the current level: 1171%

Nervos Network (CKB) long-term price prediction until the year 2035

Outlook: Bullish

Below are the yearly price prediction points up to 2035.

You can easily convert your CKB to USD here

| Year | | Maximum price of CKB | | Minimum price of CKB |

| 2024 | $0.002 | $0.01 |

| 2025 | $0.03258 | $0.01400 |

| 2026 | $0.05372 | $0.0333 |

| 2027 | $0.06983 | $0.0349 |

| 2028 | $0.10475 | $0.0649 |

| 2029 | $0.12570 | $0.09804 |

| 2030 | $0.192 | $0.1190 |

| 2031 | $0.240 | $0.187 |

| 2032 | $0.312 | $0.193 |

| 2033 | $0.468 | $0.365 |

| 2034 | $0.655 | $0.393 |

| 2035 | $0.983 | $0.766 |

Note that the average price of CKB tokens for any year might float between the maximum and minimum price. Also, the future price, comprising the highs and lows, can vary depending on the nature of the crypto market.

How accurate is the price prediction model?

The CKB price prediction model takes fundamentals, on-chain metrics, and even sentimental factors into consideration. Even with the technical analysis, we’ve considered several factors, including patterns, calculations, short-term momentum, and key resistance and support lines. Therefore, you can expect these Nervos Network price forecasts to be reliable and practical. Regardless of the projections, the price of the Nervos Network (CKB) can vary with the broader crypto market conditions.

Frequently asked questions

Does CKB have a future?

What will CKB be worth in 2030?

What price can CKB reach?

Is CKB coin a good investment?

Is Nervos on Ethereum?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.