Many are acquainted with the Crypto.com platform, yet fewer might be aware of its native token, Cronos (CRO). If you’re looking to understand what this token represents and how to buy Cronos, here’s a guide that will walk you through the process.

Methodology

BeInCrypto meticulously curated a list of wallets for storing Cronos (CRO), ensuring each selected wallet provides seamless storage solutions for CRO. This list encompasses both hot and cold wallets, designed to be user-friendly for beginners and seasoned users.

Furthermore, we highlight the leading platforms for purchasing CRO, distinguished by their comprehensive range of features and functionalities. These include, but are not limited to, margin trading, futures, staking, lending, and borrowing. Our evaluation of these tools thoroughly focused on the wallets’ functionality, user interface, and the platforms’ extensive feature sets.

Our product teams invested six months in extensive testing of each wallet to ensure our recommendations are based on robust findings and comprehensive assessments.

Wallets

Crypto.com DeFi Wallet:

- User-friendly interface: Designed for beginners and experts, making navigation and management of assets straightforward.

- Secure storage: Offers high security for your Cronos (CRO) through both hot and cold storage options.

SafePal:

- Wide compatibility: Supports Cronos (CRO) among many other cryptocurrencies, catering to users with diverse portfolios.

- Ease of use: Features a clear and intuitive interface, ideal for users of all experience levels.

OneKey:

- Multi-platform support: Compatible with various operating systems, ensuring accessibility for all users.

- Enhanced security: Focuses on providing secure storage with advanced security features to protect your assets.

MetaMask:

- Highly accessible: Easily integrates with web browsers and mobile devices, offering convenient access to your CRO.

- Community trust: Widely used and trusted in the crypto community, known for its reliability and ease of use.

Platforms

Coinbase:

- User-friendly platform: Known for its straightforward interface, making it easy for newcomers to buy and sell CRO.

- Diverse features: Offers services, including staking, lending, and a secure wallet for storing cryptocurrencies.

Uphold:

- Transparent pricing: Clear and upfront about fees, making it easier for users to manage their investments.

- Multi-asset platform: Allows trading across cryptocurrencies, precious metals, and other assets, all from one account.

OKX:

- Advanced trading options: Offers margin trading, futures, and spot trading for more experienced users.

- Comprehensive security: Implements robust security measures to protect user accounts and assets.

KuCoin:

- Wide range of altcoins: Offers a vast selection of cryptocurrencies, including CRO, catering to diverse trading preferences.

- User-friendly for traders: Provides an intuitive trading interface with advanced charting tools for analysis.

Gate.io:

- Extensive trading features: Supports various trading options, including margin trading and futures.

- High liquidity: Ensures easy buying and selling of CRO due to high trading volumes.

For further details on BeInCrypto’s verification methodology, follow this link.

- Top 5 platforms to buy Cronos (CRO)

- What is Cronos (CRO)?

- Coinbase

- Uphold

- OKX

- KuCoin

- Gate.io

- How to buy Cronos (CRO)

- How does Cronos (CRO) work?

- Cronos (CRO) vs. other cryptocurrencies

- Cronos (CRO) ecosystem

- Cronos (CRO) wallets

- SafePal

- Crypto.com DeFi Wallet

- OneKey

- MetaMask

- Trust Wallet

- Cronos (CRO) staking

- Pros and cons of investing in Cronos (CRO)

- Beyond the buy: Exploring your future with Cronos

- Frequently asked questions

Top 5 platforms to buy Cronos (CRO)

If you’re looking to buy Cronos, you must first choose a suitable exchange which supports the CRO crypto. Here’s a quick list of BeInCrypto’s tried and tested top picks.

Coinbase

Coinbase is an online crypto trading platform designed for the buying, selling, transferring, and storing of cryptocurrency. In June 2012 by Brian Armstrong, a former Airbnb engineer, and Fred Ehrsam, a former Goldman Sachs trader created Coinbase. It is based in the U.S. and is one of the more established platforms in crypto.

Uphold

Uphold, originally named Bitreserve, was founded by Halsey Minor in 2013. It rebranded to Uphold in 2015 to better reflect its mission of providing a comprehensive platform for digital money. The platform is known for enabling users to convert, hold, and transact across various assets, not limited to cryptocurrencies but also including fiat currencies and precious metals.

OKX is a global cryptocurrency exchange that was founded by Star Xu in 2017. It operates as both a spot and derivatives trading platform and is one of the largest exchanges by trading volume. OKX serves millions of users worldwide and is headquartered in Seychelles.

KuCoin

KuCoin is a global cryptocurrency exchange that provides a platform for the buying, selling, and trading of various digital assets and cryptocurrencies. It was founded in 2017 and has become known for its user-friendly interface, wide range of supported cryptocurrencies, and additional services such as margin trading, futures trading, and staking.

Gate.io is one of the oldest cryptocurrency exchanges originating from China, operational since 2013. It underwent a rebranding to Gate.io in 2017 and has since grown into one of the fastest-developing crypto platforms. The exchange has a wide array of available cryptocurrencies, and additional financial services such as margin trading with leverage, and lending or borrowing.

What is Cronos (CRO)?

Cronos is the utility token of Crypto.com. For those unfamiliar, Crypto.com is a cryptocurrency exchange and payment platform offering various products. These services include a crypto exchange, debit cards, a wallet app, and interest-earning accounts for multiple cryptocurrencies.

“Crypto.com is a trusted, global, regulated cryptocurrency platform. We’ve got over 80 million users on it. And what you can do with our products is buy one of many hundreds of cryptocurrencies you can trade. You can spend it with a Visa card that we are issuing…It’s a complete ecosystem of cryptocurrency products that anybody and millions today are using.”

Kris Marszalek, CEO of Crypto.com

Kris Marszalek, Rafael Melo, Gary Or, and Bobby Bao originally founded the company in Monaco in June 2016. The company rebranded to Crypto.com in July 2018 after acquiring the domain name for a reported several million dollars.

The headquarters of Crypto.com is located in Singapore, although the company has a global presence with operations spanning across continents from Asia to Europe and North America. This extensive network enables Crypto.com to serve a diverse international customer base and innovate within the growing digital currency space.

Did you know? Cronos (CRO) was previously known as Crypto.com or Crypto.org coin before the name was changed to Cronos. The change reflected an effort to move towards a more decentralized appearance.

How to buy Cronos (CRO)

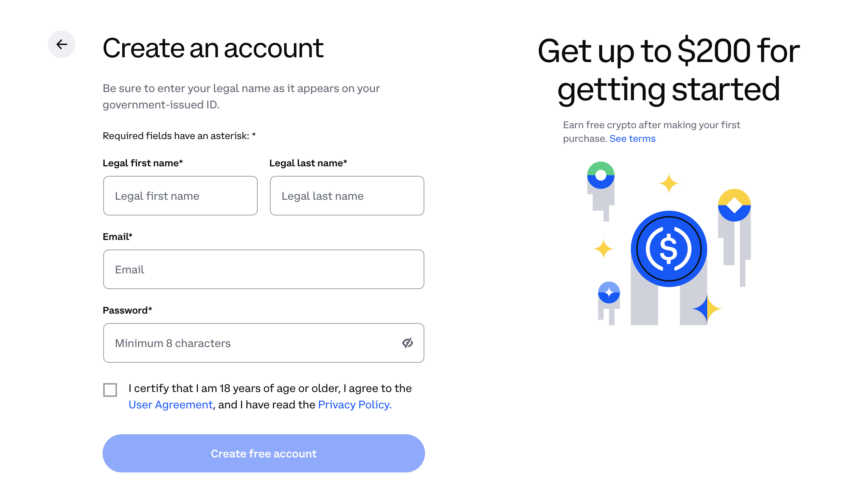

1. Sign up for an account: Before buying Cronos, you must create an account on an available platform. We will use Coinbase to demonstrate the process. First, enter your phone number or email address and create a strong password to create an account on Coinbase.

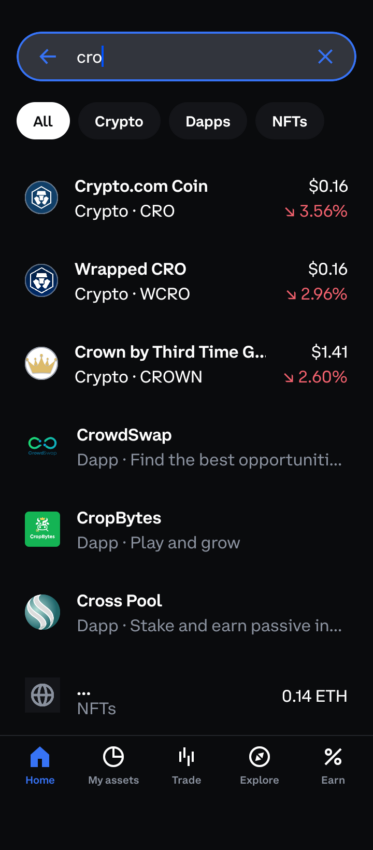

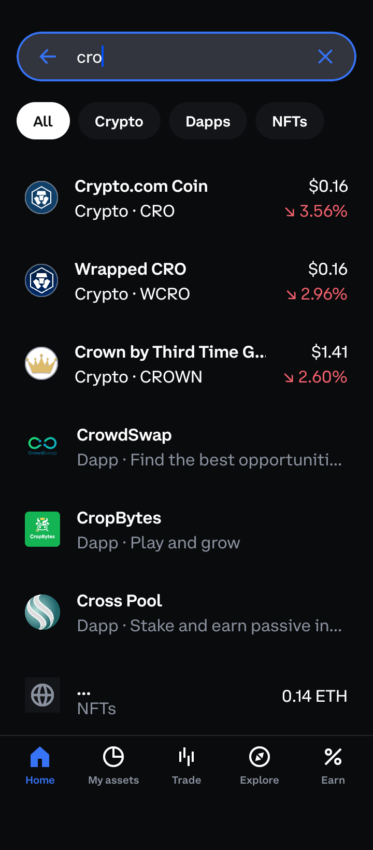

2. Open the Coinbase app: Open the Coinbase app and look for CRO in the search tab. You can also select the trade button at the bottom of the screen to search for CRO.

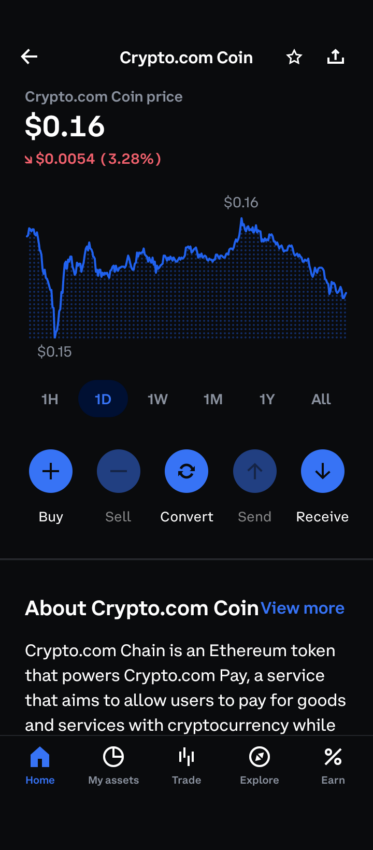

3. Select the “Buy” button: Once you have selected CRO, select the buy “Buy” button to continue to the next step.

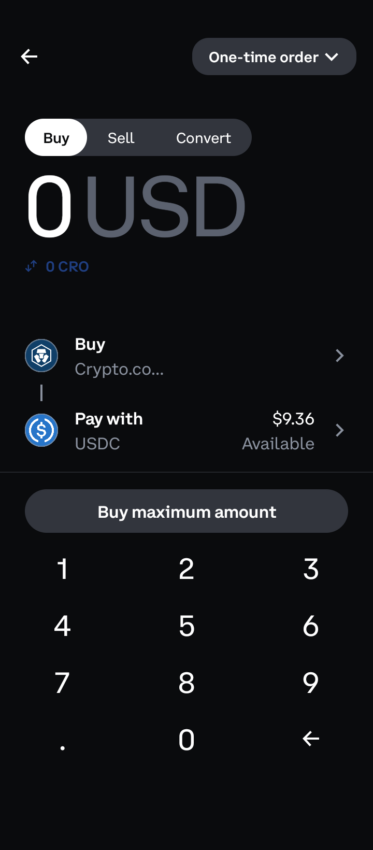

4. Select an amount: Once you click “Buy” select the CRO you want to purchase. Keep in mind that Coinbase allows you to choose between several payment methods. You can also create recurring purchases.

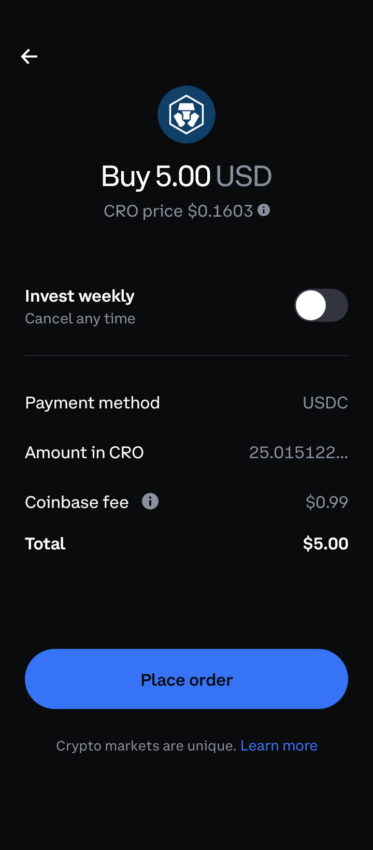

5. Confirm your order: After completing the previous step, you will navigate to the following screen to confirm your order. Make sure that all of the information is correct before you proceed. Then press “Place Order.”

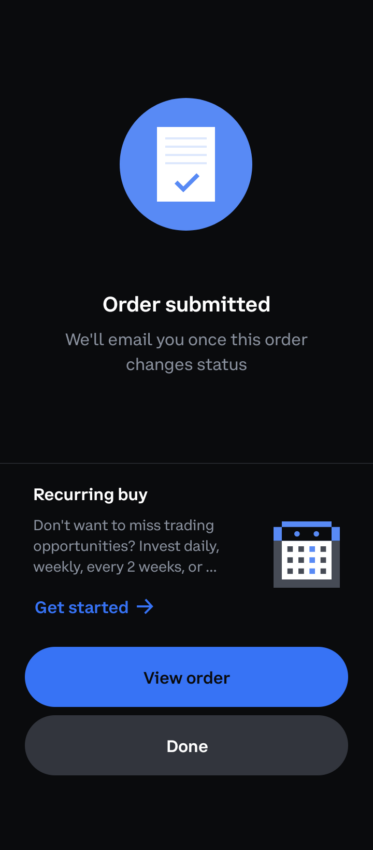

After you have placed your order, you will receive a confirmation. You can choose to view your order or press “Done” and continue to explore the Coinbase app.

How to sell Cronos (CRO)

1. Open the app and search for CRO: Open the app and search for CRO. You can also navigate to the “My Assets” tab and press “Sell All” if you are only holding CRO or would like to sell all of your assets.

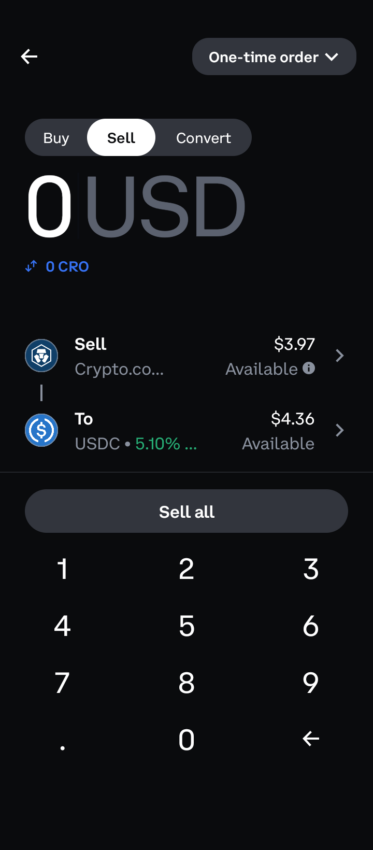

2. Select the “Sell” button: Search the screen for the “Sell” button and press it. Below, you can see your CRO balance, as well as all other assets that you hold.

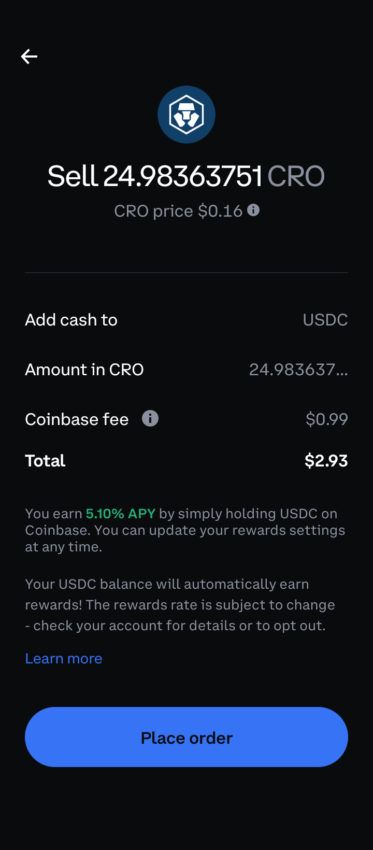

3. Select the amount: Once you have selected CRO from your portfolio, enter the amount you want to sell. As you can see below, you can choose different assets to convert your CRO balance to. Coinbase pays up to 5.10% for holding USDC so we will convert our CRO balance to USD Coin.

4. Confirm your choices: On the next page, ensure all the information is correct before you confirm your choices. If all of the information is correct, press “Place Order.”

After you have placed your order, you will be redirected to the following page. You can choose to view your order or select “Done” to continue navigating the Coinbase app.

How does Cronos (CRO) work?

CRO serves multiple purposes within the Crypto.com ecosystem:

- Trading/purchase rebates: CRO is used to receive trading fee discounts when trading on the Crypto.com exchange. Users who stake CRO on the crypto exchange can benefit from reduced trading fees, enhancing the trading experience and reducing costs.

- Cashback rewards on cards: One of the notable uses of CRO is offering cashback rewards through the Crypto.com Visa cards. Users can receive a percentage of their purchases back in CRO when they use their Crypto.com Visa card, which can vary depending on their tier of card and the amount of CRO they stake.

- New user incentives: CRO provides incentives for new users joining the platform. This can include sign-up bonuses, referral rewards, and other promotions to attract and retain users.

- Staking rewards: Users can earn interest or rewards by staking CRO tokens. Staking involves locking up a certain amount of CRO for a predetermined period to support the network and, in return, receive rewards.

- Access to services: Staking CRO can also grant users access to various services on the Crypto.com platform, such as premium Visa card tiers, higher lending limits, and exclusive events and offers.

- Payment and settlement: CRO can be used as a payment and settlement currency on the Crypto.com Pay service, allowing users to pay for goods and services with cryptocurrency and receive CRO rewards for doing so.

These functionalities aim to incentivize the use and adoption of CRO within the Crypto.com ecosystem, enhancing its utility and value to users.

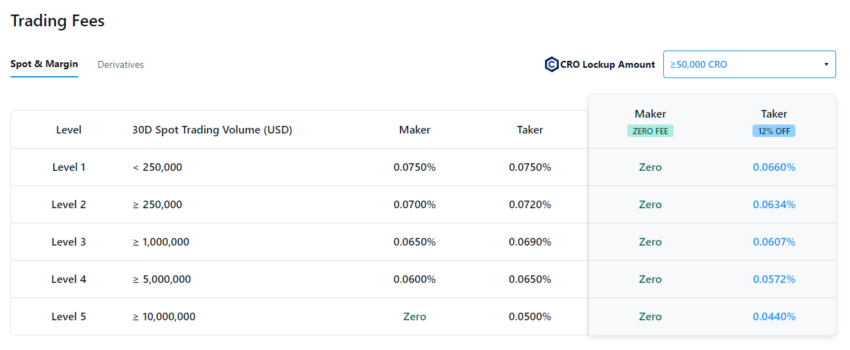

CRO cashback and trading rebates

In the case of fees, Crypto.com encourages users to hold CRO for trading discounts by offering up to 30% in rebates for taker fees. The amount of rebates you receive depends on how much CRO you hold. In the example below, users that hold 50,000 CROs or more will receive 12% off on taker fees and zero fees on maker fees.

Regarding Crypto.com’s Visa card, you can also receive cashback rewards through CRO. Users should remember that there are cashback limits, staking requirements, eligibility requirements, and more.

Depending on the card tier, different Crypto.com Visa cards also give different cashback rewards, between 1-5%. Here is a brief guide:

- Obsidian: 2-5%

- Icy White/Frosted Rose Gold: 1-3%

- Royal Indigo/Jade Green: 0-2%

- Ruby Steel: 0-1%

Why is Cronos (CRO) so popular?

Cronos is popular due to its affiliation with Crypto.com. Crypto.com gained popularity through a combination of strategic marketing, broad service offerings, and high-profile partnerships. The platform has engaged in significant marketing campaigns. Its most notable includes securing the naming rights for the Staples Center in Los Angeles, now known as Crypto.com Arena, and partnering with sports teams and celebrities.

Cronos (CRO) vs. other cryptocurrencies

A comprehensive explainer must include a comparison of Cronos with other cryptocurrencies. Here’s how Cronos stacks up against one of the leading digital assets, Ethereum.

Cronos (CRO) vs. Ethereum: An ultimate comparison

CRO and ETH have both grown over the period covered, from 2019 through projections into 2024. ETH’s growth is more pronounced, with sharper increases in market cap, highlighting its significant role in cryptocurrency. CRO’s growth, while substantial, appears more gradual early on.

In July 2019, CRO’s market cap was notably lower, highlighting its early stage relative to Ethereum, which already had a substantial market presence. The peak in November 2021 for CRO, with a market cap of about $10 billion and a significant trading volume, marks a critical point of investor interest and market activity.

In 2024, both cryptocurrencies are projected to have increased market caps, with ETH showing a particularly optimistic growth trajectory. CRO’s market cap also grows but stabilizes, suggesting a consolidation phase after its earlier volatility.

Cronos and Ethereum blockchains

In the case of blockchain architecture, although there are many similarities between the Cronos blockchain and Ethereum, there are also significant differences. For instance, Cronos blockchain is a proof-of-authority (PoA) chain, while Ethereum is a proof-of-stake (PoS).

This ultimately means that Ethereum is more decentralized. Any users downloading an Ethereum client can spin up their own node to validate the network as long as they have 32 ETH. On the other hand, Cronos is a permissioned blockchain. Only a privileged set of users can validate the blockchain. You can only become a validator by invitation. This does have some tradeoffs, however.

While Ethereum has often been criticized as slow and expensive, Cronos is the opposite. Because it is PoA, transactions are processed much faster and cheaper. However, there are currently only 27 Cronos validators, and invitations to become one are closed.

Cronos (CRO) ecosystem

As previously mentioned, Cronos (CRO) is just one element of a much larger ecosystem. Here’s a brief overview of what is happening within the Cronos ecosystem.

Cronos EVM

CRO is not just the utility token of Crypto.com but also the native cryptocurrency of the Cronos blockchain. The Cronos blockchain is built using Ethermint. Ethermint is a scalable, high-throughput PoS blockchain toolkit. It is a portmanteau of Ethereum and Tendermint. Tendermint is a blockchain consensus engine. It is the foundation for the Cosmos Network, which aims to create an internet of blockchains by allowing different blockchains to communicate.

As a result, Cronos is designed to be interoperable and aims to bridge the worlds of Ethereum and the Cosmos ecosystems. With minimal changes, developers can port their Ethereum DApps to the Cronos chain. This also allows it to run Ethereum-based applications on a faster and more cost-effective platform.

This EVM designed for the Cronos blockchain is structured to have seamless interoperability. With transaction costs below one dollar, the complexity of the EVM is retained without the high costs.

Additionally, the platform is engineered to handle a high volume of up to 50 million daily transactions. It also has rapid transaction finality, typically within five to six seconds, mirroring the block processing time. Key to Cronos’s functionality is the integration of the IBC Protocol, enabling direct communication and asset transfer with other IBC-compatible Cosmos-based chains. These would include the Cosmos Hub, Osmosis, and Injective.

This interoperability significantly boosts the usability of Cronos’s native assets across different ecosystems while enabling the network to accommodate a diverse range of native tokens from these interconnected chains.

Cronos PoS and Cronos zkEVM

The Cronos POS Chain, built on the Cosmos SDK, is tailored primarily for staking CRO and underpins several Crypto.com applications. Its design focuses on delivering swift transaction speeds to its users, who can also utilize CRO to cover transaction fees.

In contrast, the Cronos zkEVM is a layer-2 network in the testnet phase. It resides atop the Ethereum mainnet and is a product of the Matter Labs’ ZK Stack framework. This network aims to create a seamless movement of assets across hyperchains, effectively tackling the issue of fragmented liquidity.

Furthermore, on the Cronos zkEVM, users can earn yields on assets like ETH and CRO and select stablecoins directly, significantly simplifying the investment process. The network also introduces smart contract accounts (account abstraction) and Paymasters.

Cronos (CRO) wallets

Choosing the right storage solution for your assets is crucial if you plan to invest in Cronos. Below, you’ll find a carefully selected list of hot and cold wallets, allowing you to store your Cronos seamlessly, whether you prefer online access or offline storage’s enhanced security.

SafePal

SafePal is a cryptocurrency hardware wallet provider that offers users a secure way to store, manage, and trade their cryptocurrencies. Launched in 2018, SafePal provides a comprehensive solution for digital asset security through its hardware wallets.

Crypto.com DeFi Wallet

The Crypto.com DeFi Wallet is a non-custodial, decentralized wallet that allows users full control over their cryptocurrencies. Users have the sole authority over their private keys and, thus, their crypto assets, enhancing security and privacy. The wallet supports over 1,000 different cryptocurrencies across more than 30 blockchains.

OneKey

The OneKey hardware wallet is an open-source cryptocurrency wallet that prioritizes security and usability for managing digital assets like cryptocurrencies, DeFi, and NFTs. It’s known for supporting many cryptocurrencies and offering features to enhance user security and experience, such as biometric verification.

MetaMask

MetaMask is a popular cryptocurrency wallet designed primarily for the Ethereum blockchain, which allows users to store Ether and other ERC-20 tokens. It’s available as both a browser extension and a mobile app. With MetaMask, users can securely manage their digital assets, interact with decentralized applications (DApps), and engage with the web3 ecosystem, including DeFi (decentralized finance) and NFTs (non-fungible tokens).

Trust Wallet

Launched in November 2017 and later acquired by Binance in 2018, Trust Wallet supports more than 70 blockchains and offers a wide range of functionalities including token swaps, staking, and NFT management directly from the app. It provides an integrated DApp browser for mobile users, enabling seamless interaction with web3 platforms and DeFi applications.

Cronos (CRO) staking

The Cronos PoS Chain is a blockchain network utilizing a proof-of-stake (PoS) framework. It offers CRO token staking through a delegated-proof-of-stake (DPoS) consensus mechanism. Here’s a simplified overview:

- Delegation process: Users, also referred to as Delegators, can allocate their native CRO tokens to Validators. These Validators operate network nodes, confirming transactions on the Cronos POS Chain and earning block rewards in return.

- Earning and commission: The earned rewards, in CRO tokens, are shared with the Delegators, deducting a commission for the Validators’ services.

- Staking specifics: Users must stake native CRO tokens specific to the Cronos POS Chain Mainnet. This is distinct from staking ERC20 CRO tokens found on the Ethereum network.

- Unstaking period: While there’s no minimum staking requirement, and users are free to stake and unstake at will, it’s important to note that unstaking initiates a 28-day unbonding period. The CRO tokens are locked during this time and do not earn rewards.

- Reward distribution: Rewards are calculated and distributed with every blockchain block, which occurs approximately every 5-6 seconds. Active participants in the network can potentially see annual returns as high as around 20%.

This framework offers an accessible way for everyday users to engage with blockchain technology, supporting network security and operations while potentially earning rewards. However, like all staking, it involves certain commitments, like the un-bonding period, which should be considered carefully before participating.

Pros and cons of investing in Cronos (CRO)

| Pros | Cons |

|---|---|

| You can stake CRO to earn yield | Centralized blockchain |

| Fast block times and transactions | Must purchase CRO to stake |

| Earn cashback and trading rebates | |

| Vast support from wallets |

The Cronos blockchain doesn’t win many points for decentralization. If you are building a DApp on this blockchain, and Crypto.com ceases its operations, then you no longer have a business. This is similar to many other blockchains or layer-2 blockchains today. That being said, because it is centralized, users of the Cronos blockchain enjoy super fast block times and high transaction throughput.

Options to stake CRO to earn yield are also enticing. If you plan to do this, it may help to buy CRO from Crypto.com. Simply put, Crypto.com can inflate the supply while you trade real value (in the form of currency) for diminishing returns.

Is Cronos (CRO) a good investment for you?

It is important to note that whether Cronos (CRO) is a good investment for you entirely depends on your financial situation. With this in mind, users should stay cognizant of the pros and cons above. Cronos may benefit from broader macroeconomic conditions, such as the Bitcoin halving, interest rates, etc. As seen in the image below, the price of CRO has a correlation with BTC.

However, the utility of CRO largely depends on the features of Crypto.com. This makes it less likely to have a strong performance as an investment vehicle. CRO Holders benefit more from the proximity to Crypto.com than CROs as a store of value or unit of account. This does not mean that it would not make a good trading instrument, as traders benefit from price movements in both directions.

Beyond the buy: Exploring your future with Cronos

You’ve now successfully learned how to buy Cronos (CRO), which equips you with the key to exploring the broader Cronos ecosystem. As you proceed, it’s important to move with diligence, secure your investments with a solid crypto wallet, and prioritize your security in the digital sector. With each transaction, you’re gaining valuable experience and contributing to the evolving narrative of digital finance.

Frequently asked questions

To buy Cronos, go to a decentralized exchange (DEX) or centralized exchange (CEX) like Coinbase. Sign up for an account. After this, you are free to buy Cronos (CRO).

You can purchase the ERC-20 version of CRO at any DEX on Ethereum. You can also buy CRO at exchanges like Coinbase, Uphold, OKX, and others. If you want to purchase CRO to stake, you will have to go to Crypto.com.

To invest in CRO, simply come up with an investment strategy. Look for an exchange that supports your preferences and purchase CRO. Lastly, never invest more money than you can comfortably afford to lose.

It is possible for Cronos to reach $1. It is important to note that CRO has yet to reach $1, just falling short at $0.96. However, this does not mean that it can not break resistance.

Whether or not CRO is worth investing in entirely depends on your personal financial situation. It is important to note that CRO is primarily a utility token for the Crypto.com platform. Investors should keep this in mind before investing in CRO.

According to our experts, CRO could possibly hit $0.28 in 2025. Readers should keep in mind that a multitude of factors goes into price predictions. CRO could possibly reach go higher or lower than the aforementioned price.

Whether or not Binance will list CRO depends on a few factors. However, CRO is the utility token of a rival exchange. Therefore, it is unlikely that Binance will list CRO, but not impossible.

Cronos is the utility token of the Crypto.com exchange. It is used for trading rebates, cashback rewards, staking, new user incentives, and many other activities. Crypto.com is a popular exchange that purchased the naming rights to the Crypto.com Arena.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.