What if we told you that the Bitcoin we all know and love might not be the original Bitcoin? This Bitcoin SV price prediction will discuss why this blockchain might be closest to Satoshi Nakamoto’s vision of Bitcoin.

Bitcoin SV, with its native coin BSV, is an independent blockchain, albeit with similarities with the current Bitcoin. Bitcoin SV’s approach toward stability and scalability is aligned with the original version of the blockchain. This is the primary reason that some purists are biased toward it and expect the price of Bitcoin SV to scale higher. But will it? Let’s take a look.

- BSV price prediction and fundamental analysis

- Bitcoin SV tokenomics and trading markets

- Bitcoin SV price prediction and other key metrics

- BSV price forecast and technical analysis

- Bitcoin SV (BSV) price prediction 2023

- Bitcoin SV (BSV) price prediction 2024

- Bitcoin SV (BSV) price prediction 2025

- Bitcoin SV (BSV) price prediction 2030

- Bitcoin SV (BSV’s) long-term price prediction up to 2035

- Is the Bitcoin SV price prediction model accurate?

- Frequently asked questions

BSV price prediction and fundamental analysis

Bitcoin SV, emerging as a fork of Bitcoin Cash, which itself forked from the original Bitcoin, has garnered attention for reasons beyond its lineage. This discussion focuses on the factors making the price of Bitcoin SV (BSV) noteworthy.

Firstly, Bitcoin SV aims to stay true to the original vision of Bitcoin’s creator, Satoshi Nakamoto, by maintaining a scalable blockchain that prioritizes peer-to-peer transactions. This commitment to Satoshi’s vision is a key aspect of its appeal.

Secondly, Bitcoin SV returns to the early operational principles of the Bitcoin ecosystem, a development that has excited Bitcoin purists. By expanding the block size to 4GB, BSV enables a remarkable throughput of over 50,000 transactions per second, significantly enhancing its capacity.

Thirdly, the increased block size of BSV accelerates transaction finality but also contributes to lower transaction costs and fees, making it an efficient choice for users and investors alike.

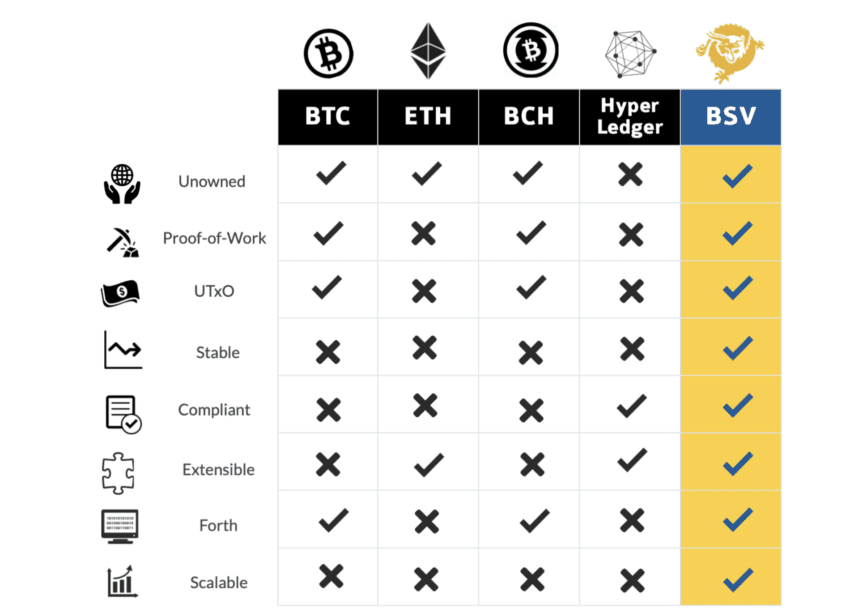

Other traits that make Bitcoin SV popular are detailed in the graphic below:

Bitcoin SV aims to rival the offerings of Visa in a way the more popular Bitcoin could not. It also has the scope to include smart contracts freely, something Bitcoin hasn’t adopted openly.

Overall, the fundamentals look strong, especially from an enterprise perspective. BSV can literally scale as per requirements, making it the more robust version of the original Bitcoin vision.

Did you know? Bitcoin SV stands for larger block sizes to speed up transactions, as envisioned by Satoshi Nakamoto, the OG Bitcoin creator.

Bitcoin SV tokenomics and trading markets

Like Bitcoin, Bitcoin SV has a capped supply of 21 million. At present, 93.29% of the same make the circulating supply. The market cap is a steady $868.10 million, and BSV — the native crypto — is ranked 55 globally as of early 2023. By December 2023, the ranking has changed to 18th.

In terms of utility, the BSV token is used to pay for block rewards and transaction fees. And even BSV follows a halving schedule similar to Bitcoin. As such, the tokenomics model is disinflationary and deflationary after the circulating supply equals the fixed supply.

“The bitcoin protocol was set in stone to create a system that is stable. Bitcoin is not a Cryptocurrency. By definition, Cryptocurrencies are anonymous and untraceable. Bitcoin is pseudonymous and traceable, it is digital cash.”

Dr. Craig White, Chief Scientist at nChain: X

Plus, if you look at this all-time market cap chart, you will notice that BSV’s market capitalization peaked all the way to $7.93 billion in May 2021. The trading volume during the peak was also high — $3.3 billion, to be precise.

In comparison, the early 2023 levels were pretty underwhelming, even with a crypto rally around. As of Jan. 22, 2023, the market cap and trading volume of BSV were $868.10 million and $42.76 million, respectively.

However, things are looking up as we are about to move to 2024. BSV market cap has reclaimed the $1.6 billion mark and is now trading at the highest levels of 2023.

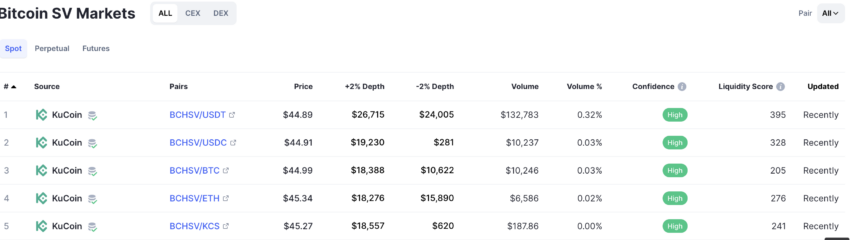

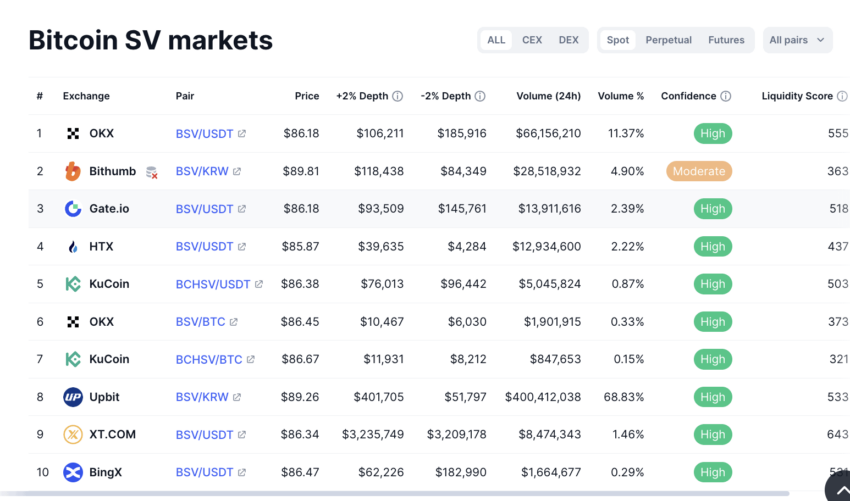

Also, spot trading markets for BSV indicate there weren’t many other players, except KuCoin and its multiple trading pairs, in early 2023. Also, BSV has recently been delisted from Robinhood (as of Jan. 11, 2023) — another prominent exchange — pushing the prices down due to negative social sentiments. This shows that the trading popularity and intensity have dipped slightly compared to its better-established sibling — Bitcoin.

However, the exchange spread is wider now, with OKX, HTX, and others coming into the fold.

Bitcoin SV price prediction and other key metrics

Let us start with something interesting. Holder statistics back in January 2023 showed that the top 100 BSV holders only managed 28.46% of the circulating supply. This statistic gave hope to the retail investor, ensuring that massive token dumps and crashes aren’t BSV commonplaces. And it was a reason why the prices soared, eventually.

Moreover, the 4-week price volatility of BSV has seen a significant dip in 2023. And as expected, the prices have started looking up since. Despite the Robinhood debacle, BSV prices recovered at a clip and are currently trading close to $45.

The current volatility metric is indicating a surge, which could be due to the massive trading volume around. However, a lower high in regards to volatility, compared to the October 2023 levels could be good news.

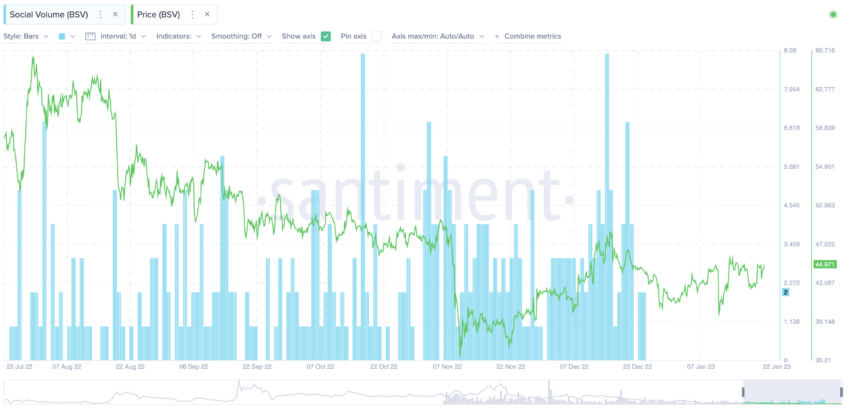

As of late December 2022, the social volume of BSV peaked. If you look at the historical data associated with social volume, the prices have always responded positively to the increase in chatter. If BSV continues to make news — obviously in a positive sense — you can expect the price of BSV to surge.

BSV price forecast and technical analysis

Before we look at the broader price action of BSV, here is a quick short-term analysis to determine the crucial support and resistance levels:

Our December 2023 analysis

As of now, BSV seems to have just broken out of the tapering wedge pattern, adding to its bullish strength. Despite being overbought levels, even the RSI is not budging and is still showing momentum. For a sharper price rise, we need to keep an eye on the $10.3.48 level.

Now, let us shift our focus to the weekly price chart of BSV, looking for patterns.

Here is the raw chart for your reference:

There is a clear pattern in sight. The price of BSV will start making higher highs till it reaches a peak of $491.64 in April 2021. Post that, there have been two lower high formations, hinting at a foldback or mirror-image formation. Therefore we can expect the left side of the chart to repeat itself once the price of BSV hits a low on the right side.

Let us mark all the crucial highs, lows, and corresponding horizontal lines to locate the average price moves and the days taken for the same.

Price changes

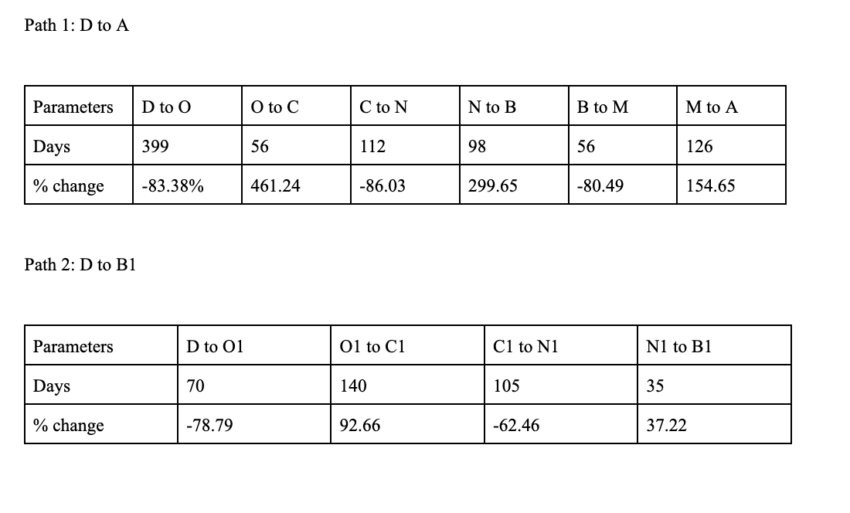

Assuming that the price of BSV traces the path from A to D, we can now identify the price changes — both percentages and time taken. We shall focus on two paths here: D to A and D to B1. Once we have the values, we will try to locate the next low after B1, which can be M1, and then the next high to A1.

Columns with negative values signify high-to-low moves. The average of that, in terms of price change percentage and days taken for the same, is -78.23% and 148 days.

Columns with positive values signify low-to-high moves. The average price change percentage and days taken is 209.08% and 91 days, respectively.

Note the price drop and growth might not always follow the average values. They will move between the lowest and highest values depending on the condition of the crypto market.

Bitcoin SV (BSV) price prediction 2023

We predicted a high of almost $107 for BSV in 2023, tracking its fundamentals and other metrics. As of December 2023, BSV has already moved as high as $90.5. Here is how we tracked our way to a successful price prediction:

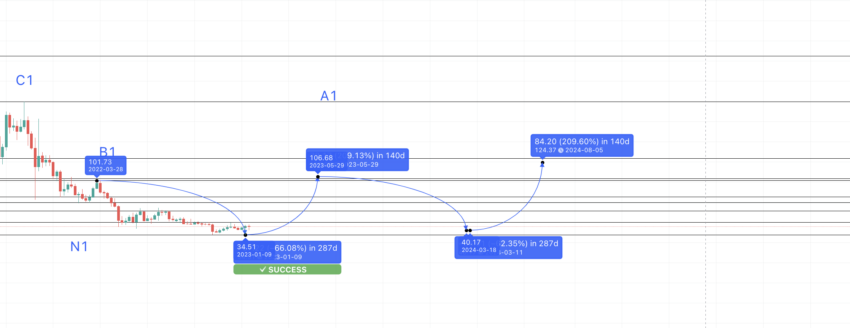

Now that we have the last point at B1, we can use the high-to-low average to locate the next low. Let us see if the low is in sight or already here.

The average drop in price is 78.23% and might happen in 148 days — per the average from the tables above. But then, we will even take a drop of 62.46% — which is the lowest drop percentage from the table above. Do note there was a drop to $34.51 — a dip of 66.08% — which aligns with our calculations. This shows a successful BSV price prediction level — validating our calculations further.

Also, this level showed up in 2023 and might just surface as the minimum BSV price prediction level for 2023.

We can mark this minimum price point as M1. From M1, we can use the low-to-high average to locate the next point or A1. As per the left side of the pattern, A1 might just be lower than B1.

The low-to-high average is 209.08% from the table above. While the average distance is 91 days, it can go as high as 140 days (maximum time as per Table 2), depending on the state of the crypto market. Also, at an average price hike of 209.08%, we can expect the price to sit at $106.68 — by mid-2023.

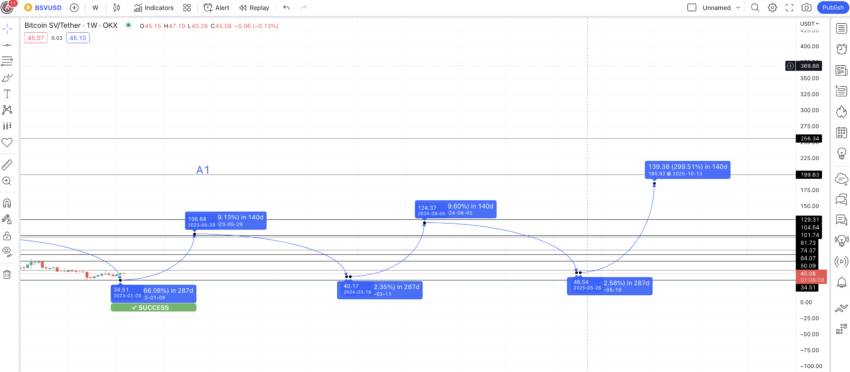

Bitcoin SV (BSV) price prediction 2024

Outlook: Bullish

Notice A1 moves higher than B1, hinting at a possible uptrend at BSV’s counter. This might break the previous foldback pattern and ensure that BSV follows a different path altogether. Also, considering the average price drop of 78.23% and the lowest price drop of 62.46%, we can plot the Bitcoin SV price prediction low for 2024 at $40.17.

Do note as the 2023 low took 287 days from B1 to show up, we have also taken 287 days to plot the price prediction low for 2024.

Projected ROI from the current level: 48%

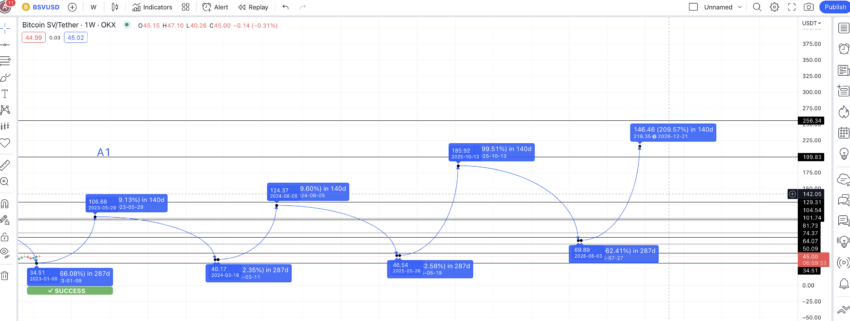

Bitcoin SV (BSV) price prediction 2025

Outlook: Bullish

If the same growth path is followed and the adoption of BSV grows among the purists, the next high can surface in 140 days and at a level 209.08% higher than the 2024 low of $40.17. This puts the maximum price prediction for BSV in 2024 at $124.37.

Following the same path, we can place the 2025 low for Bitcoin SV at $46.54. Notice we have used the standard “287 days” timeframe. The next high might surface at a high of 299.65% (higher percentage growth from the tables above) from the 2025 low. By now, BSV should be able to move higher than average, owing to the lasting higher high formation.

This assumption places the Bitcoin SV price prediction for 2025 at $185.92.

Projected ROI from the current level: 121%

Bitcoin SV (BSV) price prediction 2030

Outlook: Bullish

The low, post-2025 high, can again trace the “287-day and 62.46%” path. The 2026 low for the price of SV can, therefore settle at $69.89. The next high from this level should account for a standard correction. Therefore, we can circle back to the average growth percentage of 209.08% instead of the 299.65% hike we assumed in 2025.

This average percentage growth places the Bitcoin SV price forecast level for 2026 at $216.35. Notice that the price prediction for BSV in 2026 isn’t much higher than the 2025 high. This seems like a standard practice as every price forecasting calculation should take some weakness at the counter over the years.

Now we have 2025 low and 2026 high. So, we can connect the points using the Fib indicator. This way, we can trace the path till 2030 and beyond. If the same growth pattern is followed, we can expect the BSV price prediction for 2030 to reach a high of $1555.34.

This level can only become a reality if the price of BSV manages to breach its previous all-time high of $491.64 by mid-2028.

Projected ROI from the current level: 1843%

Bitcoin SV (BSV’s) long-term price prediction up to 2035

Outlook: Bullish

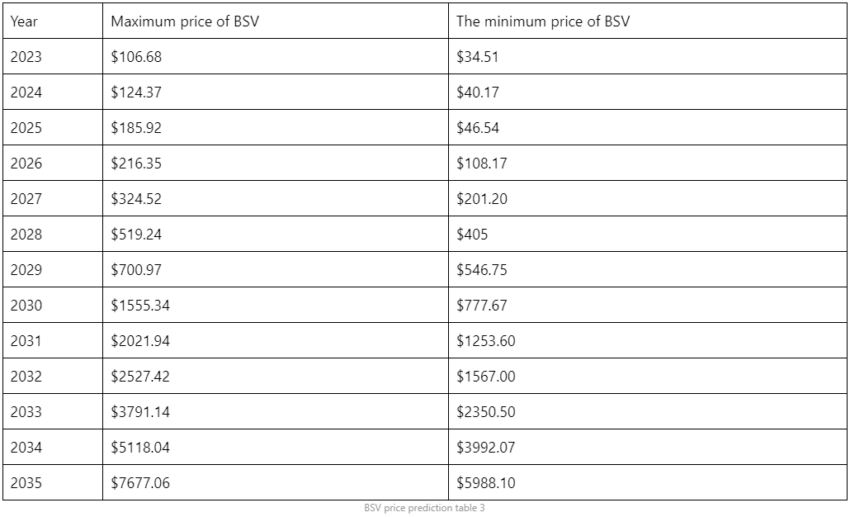

You can refer to this table if you plan on holding BSV through to 2035 as a long-term investment option.

You can easily convert your BSV to USD here

Is the Bitcoin SV price prediction model accurate?

This Bitcoin SV price prediction focuses on data-backed technical analysis. It also captures short-term price impacts courtesy of crucial on-chain metrics and fundamentals. As such, this BSV price prediction model covers every aspect of Bitcoin SV’s probable growth and future price. Of course, the crypto market is volatile, and tracking average prices, as opposed to highs and lows, will offer the most accurate reflection of BSV’s future price.

Frequently asked questions

Will Bitcoin SV reach $10,000?

Is Bitcoin SV better than Bitcoin?

Is Bitcoin SV a good coin?

Is BSV a stablecoin?

Who owns BSV?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.