This AVAX price prediction piece will explore the future of Avalanche by taking a detailed look at the layer-1 blockchain and its native coin, AVAX. Like Ethereum, the network supports DApps, customizable blockchain networks, and smart contracts (due to its DApp coverage). But does this make AVAX a good investment in the short and long term? Let us find out!

- Avalanche price prediction and the role of fundamentals

- Avalanche and the DeFi presence

- AVAX price prediction and the relevant tokenomics

- Key metrics and the future AVAX price prediction levels

- Avalanche price prediction and technical analysis

- Avalanche (AVAX) price prediction 2023

- Avalanche (AVAX) price prediction 2024

- Avalanche (AVAX) price prediction 2025

- Avalanche (AVAX) price prediction 2030

- Avalanche (AVAX’s) long-term price prediction until 2035

- Is the AVAX price prediction model accurate?

- Frequently asked questions

Want to get AVAX price prediction weekly? Join BeInCrypto Trading Community on Telegram: read AVAX price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

Avalanche price prediction and the role of fundamentals

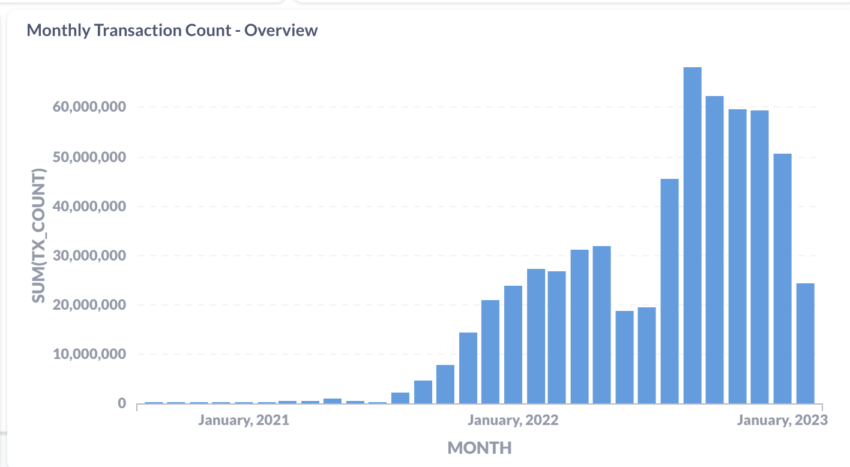

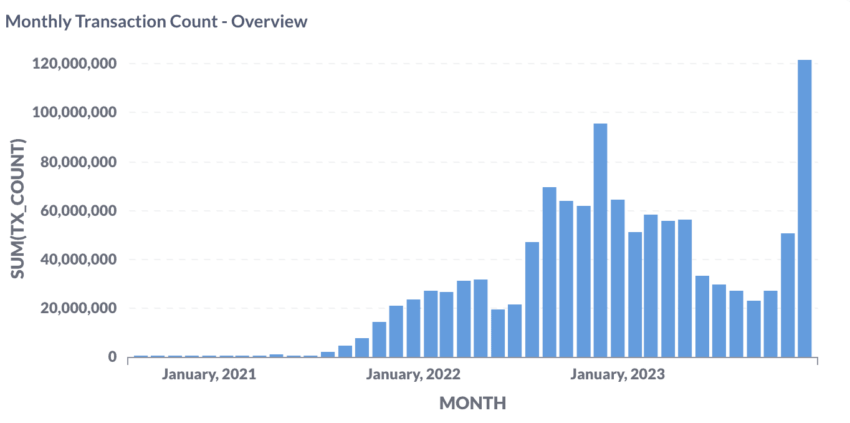

Avalanche as a network has a lot of positives. The network surged close to 10% over the past 30 days as of Feb. 15, 2023. The YoY transaction growth peaked by over 1500% in 2022, as reported by Nansen. This followed the tide change for Avalanche’s C chain or the Contract chain. Plus, the otherwise muted state of NFT also started to look up in Q4 with the Ethereum native OpenSea expanding to Avalanche.

December 2023 came, and we can see how the monthly transaction count kept on growing for the entire 2023. That explains AVAX’s bullishness.

Positive sentiments surrounding Avalanche seemingly played a significant role in pushing the prices higher. Yet, these are only the latest developments. Let us now assess the reliability of the Avalanche Network.

Did you know?Avalanche is one of the few platforms to achieve transaction finality in under a second.

Also, here is what the official website claims:

First things first, Avalanche isn’t a standalone blockchain. Instead, it has three blockchains built within — the X-chain, the C-chain, and the P-chain. The chains are intended to send/receive AVAX, handle DeFi apps, and take care of AVAX staking vis-a-vis validator activity. Overall, as a proof-of-stake ecosystem, the Avalanche network has almost everything to rival Ethereum.

Here are some more insights that make us optimistic about the long-term Avalanche price prediction:

- Avalanche subnets work like stepping stones into web3.

- The network helps build Ethereum-compatible decentralized apps.

- You can launch customized private and even public blockchains using the Avalanche network.

- It boasts infinite TPS courtesy of subnet integration.

- Avalanche boasts a less-than-2-second finality.

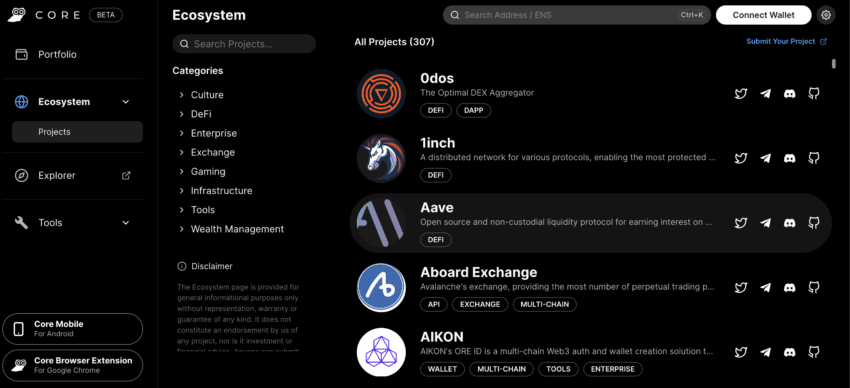

- The Avalanche ecosystem houses DeFi, Enterprise-grade, gaming, and other relevant DApps.

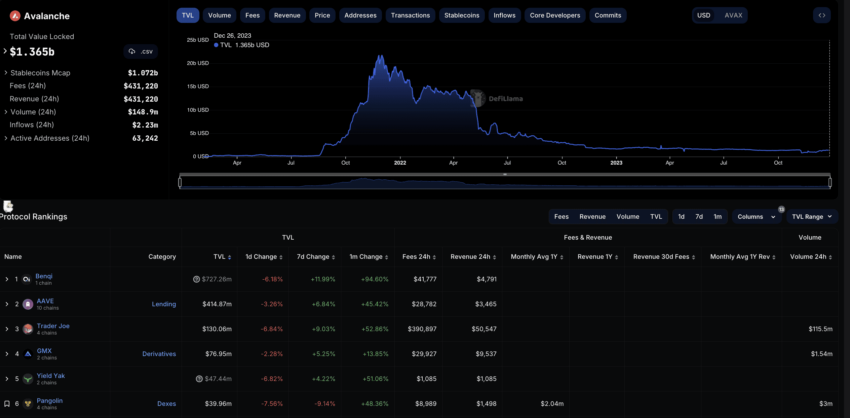

Here is what the ecosystem dashboard looks like (as of February 2023)

Avalanche and the DeFi presence

Yes, the Avalanche-specific DeFi TVL took a hit in 2022, dropping significantly compared to the $15 billion mark in 2021. Well, the bearish crypto market is to be blamed.

Yet, it still ranks seventh in terms of TVL, immediately behind Solana. The current TVL value is close to $1.38 billion.

As far as popular Avalanche DeFi protocols are concerned, the likes of Benqi and Trader Joe’s have seen serious growth rates, month-on-month.

AVAX price prediction and the relevant tokenomics

The Avalanche network’s native coin, AVAX, comes with a supply cap of 720 million. As of December 2023, 50.76% of the total supply makes the circulating supply. As far as the tokenomics model is concerned, 50% of the total supply focuses on staking rewards, making the entire supply disinflationary in nature.

Currently, the yearly inflation rate is 3.75%, which is at par with Dogecoin. However, the issuance rate is still on the higher side compared to the likes of Cardano. Any drop in the yearly issuance can impact the AVAX price levels positively.

“Avalanche has delivered many of the promises of other chains before those other chains.”

Emin Gün Sirer, Founder of Avalanche: X

Key metrics and the future AVAX price prediction levels

As an investor, price volatility is the first metric on which to focus. The chart shows that the recent volatility bottom might already be in the works for AVAX. The Avalanche price forecast looks positive for now, as historically, every trough or bottom has pushed prices higher.

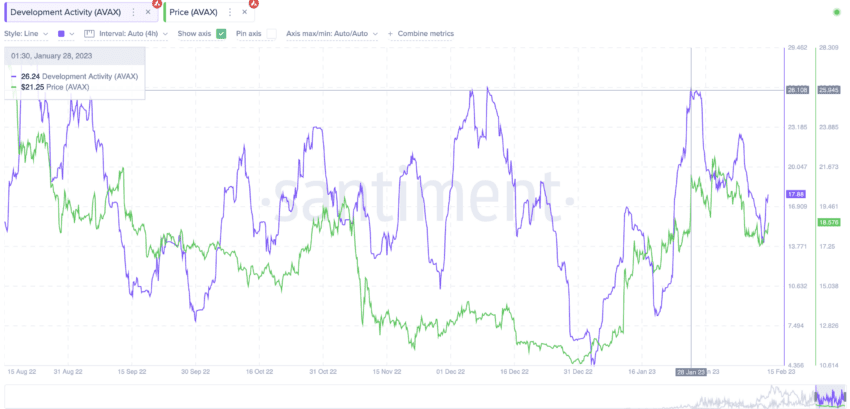

The development activity related to the Avalanche network might have an impact on the price of AVAX. The February chart shows that the price surges are clear after every development activity peak.

With transactions and web3 activity led by smart contracts looking up, the development activity peak made on Jan. 28, 2023, brought for the price of AVAX.

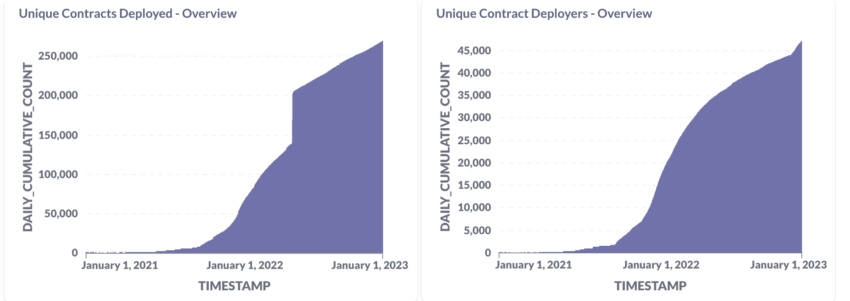

If development is akin to smart contracts on Avalanche, the latest contract deployment rate surges do look good for AVAX.

Here are a couple of charts showing the surge in the number of unique contracts deployed and contract deployers, year on year.

Avalanche price prediction and technical analysis

Before we delve deeper into the long-term Avalanche price, let us take a look at the current or, rather, the short-term future price forecast.

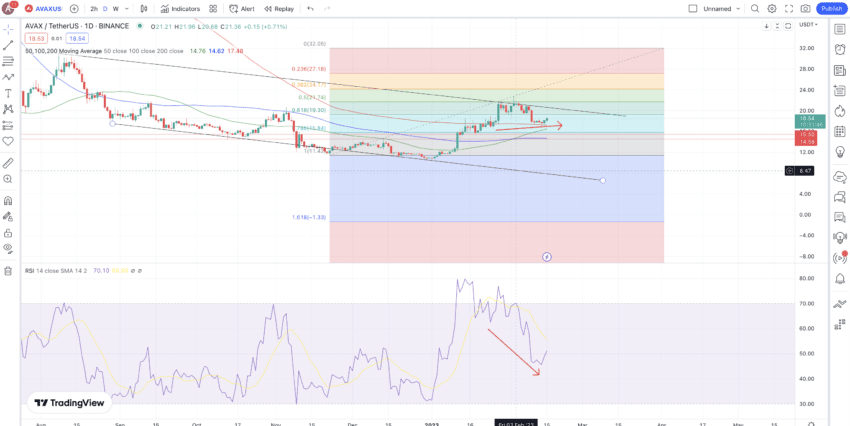

Our early 2023 analysis

We identified a crucial resistance level at $27.18, which AVAX ably breached. Here is how our early 2023 analysis read.

The descending channel, as the price pattern, is quite obvious. A break above the upper trendline, followed by decent trading volume, can push the price of AVAX toward $19.30. The long-term resistance of $27.18 might still be on the cards, provided the broader crypto market shows strength.

However, the RSI is making lower lows in comparison to the higher lows made by the price of AVAX. Hence, a correction and a dip till $14.58 — a strong support level — isn’t out of the equation.

So, the stakes favoring a rise and a dip cancel each other out. However, the 50-day moving average line (green) is inching closer to the 200-day moving average line (red). Further, if the golden crossover happens, the bullish trend might just be able to outpace the beamish buildup.

Our December 2023 analysis

The current AVAX/USD chart from Coinbase reveals chances of a short-term correction. AVAX, per the chart, is trading inside an ascending channel, with the lower trendline acting as a strong support. Even the RSI is showing signs of bearish divergence, a move that might push the prices lower. A breach under $30 could lead to a deeper dip.

However, if the prices break past the upper trendline with high volume, a level of $69+ might be possible in months to come.

Now, let us circle back to the weekly chart and see whether there is a pattern in sight.

Pattern identification

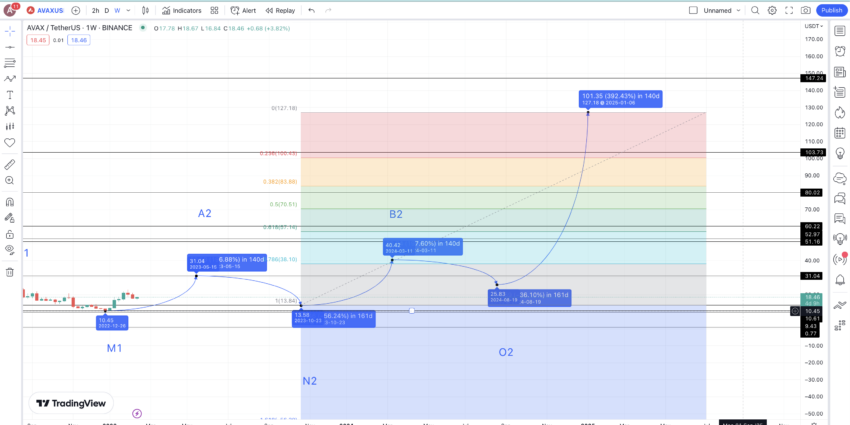

The weekly AVAX-USDT chart reveals a basic symmetrical or rather foldback pattern. The higher highs on the left side of the chart ultimately lead to the peak. From the peak, we have two clear lower highs. Also, the bullish RSI divergence shows that this pattern might be coming to an end, and a new repeat pattern might be on the cards.

Here are key points to consider:

Price changes

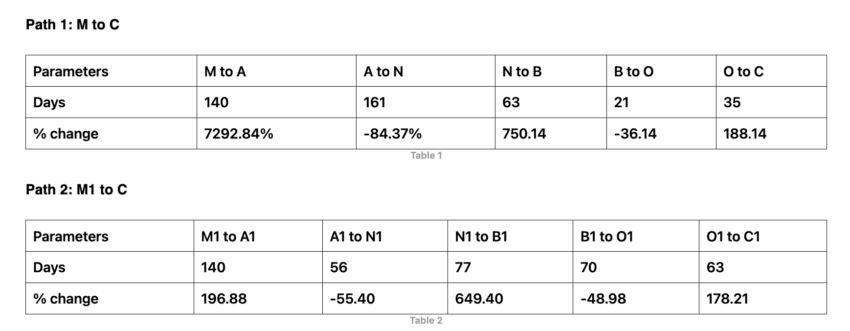

We can now trace the distance and price change percentages for all the points between M to C and M1 to C to create datasets for future Avalanche predictions.

We can disregard the M to A percentage change as it doesn’t align with other values on the chart and might disturb the calculation-specific balance.

Calculations

We use different column values to determine the average change in Avalanche’s price predictions. Negative column values help us calculate the average high-to-low price change, while non-negative columns are used for the low-to-high average price percentage change.

We observed a change of -56.22% for the high-to-low average, with the potential for the lowest drop to be around 36.14% in a strong bull market. Conversely, the low-to-high average shows a significant increase of 392.55%, though the lowest peak in bearish crypto market conditions might only reach 178.21%.

It’s important to note that the timeframe for these movements can vary based on market conditions. High-to-low activities can occur within a span ranging from 21 to 161 days, whereas low-to-high movements may take anywhere from 35 to 140 days.

With these datasets in mind, we will map out the next phase of Avalanche’s price predictions.

Avalanche (AVAX) price prediction 2023

AVAX exceeded our 2023 price prediction level by over 30%. Here is what we inferred earlier this year.

Now that we have the last low or M1 in sight, we can use the low-to-high price percentage data to trace the 2023 price of AVAX. Considering that AVAX keeps seeing a steady rise in trading volume, we can expect the Avalanche price forecast for 2023 to surface at $31.04. So, we can mark this as level A2.

Notice that A2 might coincide with A1’s price level. This would show that the downtrend is wearing off, and a new higher-high pattern might emerge.

This translates to a 196.88% price increase, which is higher than the minimum price hike but still lower than the average value of 392.55%. This also happens to the third-highest price peak percentage. We have taken this value into consideration, keeping the current state of the crypto market in mind. Also, the time taken can be 140 days — the maximum timeframe for a low-to-high move.

The low from this level can drop to $13.58 — translating into the average drop percentage of 56.22%, and that too in 161 days (the maximum distance).

Avalanche (AVAX) price prediction 2024

Outlook: Very bullish

From the new low, N2, the next high could again follow the third-highest percentage peak of 196.88%, consistent with the previous low-to-high hike.

This would put the next high, or B2, at $40.42, by March 2024. However, AVAX has already breached this level; we can circle back to our short-term analysis and locate $69.51 as the next possible level for 2024.

Further, the minimum price of AVAX in 2024 could go as low as $25.83. Notice that we didn’t consider the average high-to-low percentage drop here. The reason is the growing strength at AVAX’s counter — something that might surface quite readily by 2024.

Projected ROI from the current level: 60%

Avalanche (AVAX) price prediction 2025

Outlook: Bullish

From this low, we can expect the new high or C2 to follow the average low-to-high percentage hike of 392.55%, courtesy of strong crypto market conditions.

This could put the AVAX price prediction level for 2025 at $127.18. The next low from C2 could surface at $55.53 — in line with the average percentage drop of 56.34%.

Projected ROI from the current level: 193%

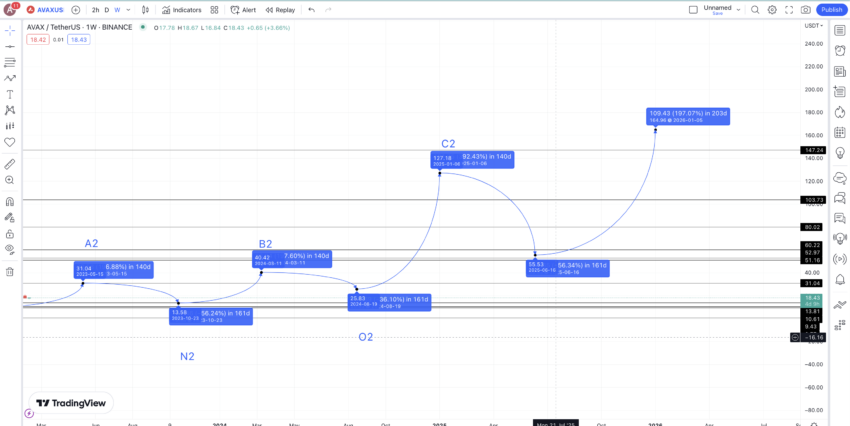

Avalanche (AVAX) price prediction 2030

Outlook: Very bullish

By this point, you can expect the price of AVAX to correct a little. This is owing to the previous pattern where the right side of the chart saw the formation of lower highs. This could coincide with some market correction, and the next high from the low of $55.53 can surface at $164.96 — translating into a price hike of 196.88%.

We expect this high to surface in 2026. This would also mean a new all-time high price for Avalanche.

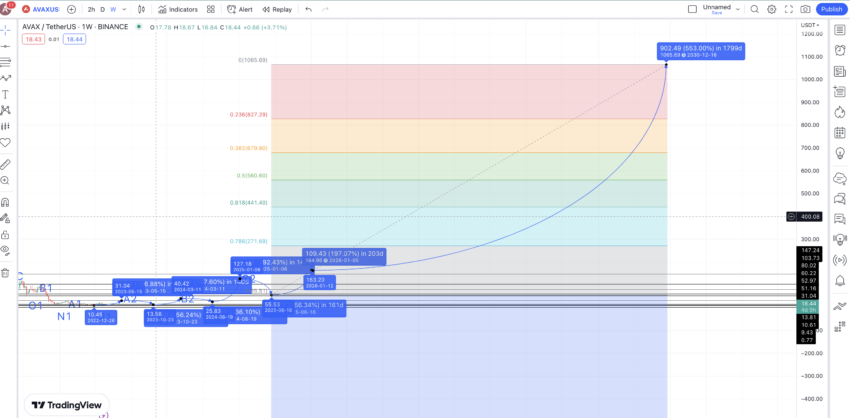

With the 2026 high and the 2025 low in focus, we can connect the points using the Fib indicator. This would help us trace the price of AVAX till 2030. The projection, following the same growth path, puts the maximum price of AVAX in 2030 at $1065.69.

However, this price growth would be possible if the market cap and trading volume of Avalanche keep growing steadily. Maybe even beating the broader crypto market.

Projected ROI from the current level: 2357%

Avalanche (AVAX’s) long-term price prediction until 2035

Outlook: Very bullish

Now that we have the minimum and maximum prices of AVAX till 2030, here is a table that can help you locate the price of AVAX through 2035.

You can easily convert your AVAX to USD here

| Year | | Maximum price of AVAX | | Minimum price of AVAX |

| 2023 | $31.04 | $13.58 |

| 2024 | $69.51 | $25.83 |

| 2025 | $127.18 | $55.53 |

| 2026 | $164.96 | $102.27 |

| 2027 | $247.44 | $153.41 |

| 2028 | $556.74 | $345.18 |

| 2029 | $751.60 | $586.25 |

| 2030 | $1065.69 | $831.23 |

| 2031 | $1598.53 | $991.08 |

| 2032 | $1918.24 | $1496.22 |

| 2033 | $2205.97 | $1720.65 |

| 2034 | $2757.47 | $2150.82 |

| 2035 | $4136.20 | $3226.23 |

Is the AVAX price prediction model accurate?

This AVAX price prediction model considers multiple factors — including detailed fundamental and technical analysis. We have used a data-backed approach to capture and analyze key Avalanche network metrics in detail, ensuring the model is well-rounded and practical.

As such, this price prediction is as accurate as possible in a volatile and, at times, unpredictable crypto market.

Frequently asked questions

Is Avalanche a good investment?

Will AVAX reach $100?

What will Avalanche be worth in 2025?

Is Solana better than AVAX?

Is Avalanche an Ethereum killer?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.