Yes, you guessed right. Apes are behind ApeCoin — the decentralized project envisioned as part of the famed BAYC and MAYC (Bored/Mutant Ape Yacht Club) ecosystem. But what about the native token APE? Is APE a good investment at current price levels and even long-term? This ApeCoin price prediction piece uses data-backed validations, fundamentals, and technical analysis to find out.

ApeCoin, powered by the utility token APE, is primarily a content-creation and NFT-specific token. The ApeCoin DAO is a governing body aiming to further the vision of the Ape ecosystem — taking it beyond NFTs. Yet, in the short term, the success of APE as an investment option will depend on how the Ape ecosystem’s NFT collections fare. So, let’s dive in and see what all the future could look like for short-term and long-term APE holders.

- ApeCoin price prediction and fundamental analysis

- ApeCoin price forecast and tokenomics

- APE price forecast and key metrics

- APE price prediction and technical analysis

- ApeCoin (APE) price prediction 2023

- Short-term price prediction for APE

- ApeCoin (APE) price prediction 2024

- ApeCoin (APE) price prediction 2025

- ApeCoin (APE) price prediction 2030

- ApeCoin (APE’s) long-term price prediction until 2035

- Is the APE price prediction model accurate?

- Frequently asked questions

ApeCoin price prediction and fundamental analysis

The Ape ecosystem is more than just the NFTs. It hosts several play-to-earn games — including Benji Bananas. The ecosystem is loaded with gaming and interactive possibilities. ApeCoin DAO is the community behind the ecosystem. Owning APE tokens allows participants access to DAO.

This gives APE holders an edge with governance, buying services and products, and even owning in-game assets. As ApeCoin DAO is more like the decision-maker relevant to the Ape ecosystem, the native ERC-20 tokens look popular on the surface. ApeCoin is built on Ethereum, making APE an ERC-20-compliant token.

Other developments

But that’s not everything there is about ApeCoin. Here are some additional insights to gauge APE tokens fundamentally:

- Unlike some of the more established cryptocurrencies, ApeCoin was launched in 2022 in a bearish crypto market.

- The project has ended up partnering with the likes of Animoca Brands to further its expansion vision.

- Holding APE tokens allows users to contribute towards the growth of the ecosystem.

- Holding APEs offers access to the exclusive areas of the ecosystem.

- APE staking was launched on Dec. 5, 2022, and another use case with ApeCoin was attached. On the very day of launch, the staking contract saw tokens worth $30 million flow in. The price of APE has been in an uptrend since, up almost 14%, month-on-month.

- Other ApeCoin use cases include incentivization and spending unification — making the token more like an open currency.

The average price of APE in any year directly relates to ecosystem developments. The Ape Foundation and ApeCoin DAO are poised to grow in the future, especially once the bearish market fizzles out.

ApeCoin price forecast and tokenomics

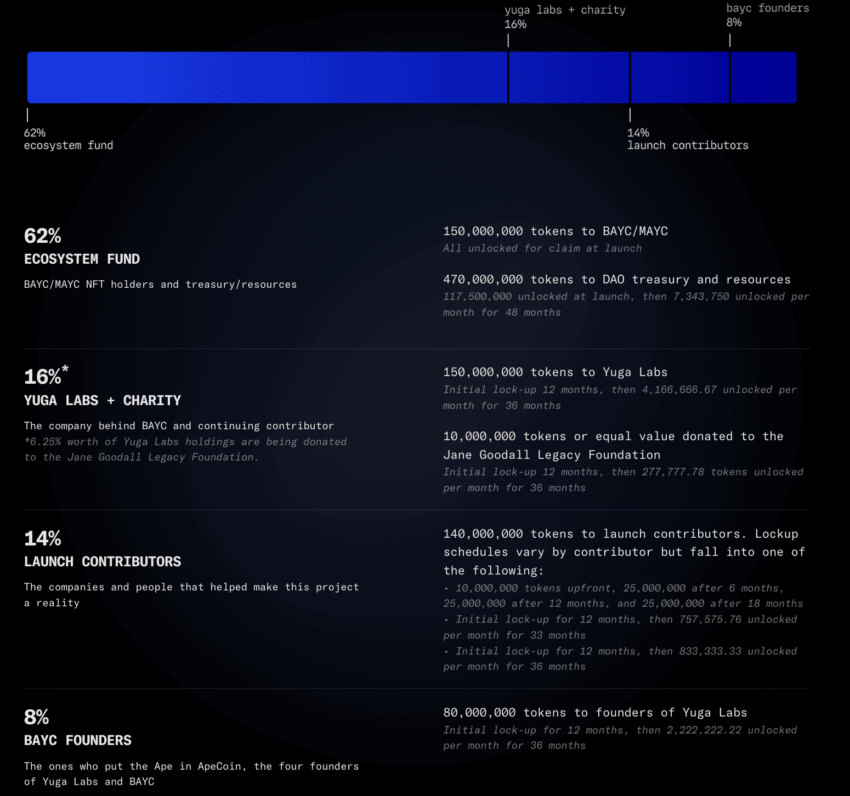

The ERC-20 token APE has a realistic and investor-friendly tokenomics model. Firstly, the issuance is fixed — 1 billion tokens, to be exact. Secondly, the initial supply distribution saw 15% of the total issuance moving to Bored Ape Yacht Club and Mutant Ape Yacht Club holders.

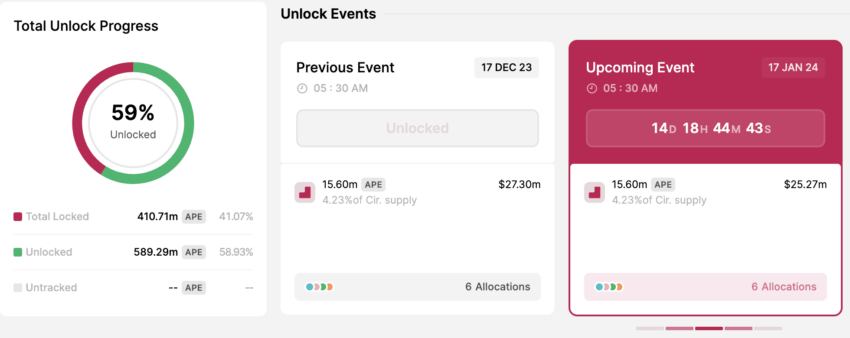

Did you know? ApeCoin’s next token unlock event is slated for Jan. 17, 2024, where we are expecting almost 15.60 million APE tokens to get introduced to the circulating flow.

Founders are set to receive 8% of the supply, whereas 14% will eventually go to the standard investors or the launch contributors. This form of supply distribution accounts for 37%. The remaining 63% is allocated to the DAO treasury, Yuga Labs, and other development requirements.

Alexis Ohanian, Founder of Seven Seven Six: X

This is one way of looking at the distribution. Read on for another version of the same:

If you look at more specific distribution figures, 62% is the total supply of the ecosystem fund. These tokens are unlocked at launch and meant for NFT holders and the treasury. The remaining 16% goes to Yuga Labs and charity but with a 12-month initial vesting period and then a timed release spanning across 36 months.

14% is allocated to the investors, as discussed previously. However, these tokens also come with specific vesting periods, going as high as 36 months. And finally, 8% is meant for the founders of BAYC as a token of respect. This form of distribution also comes with a 36-month vesting period.

Multiple vesting periods are meant to safeguard the price of APE from market volatility. As of Jan. 2, 2023, APE tokens have a circulating supply of 36.86%.

APE price forecast and key metrics

Since its launch, ApeCoin’s volatility looks to have dropped. The prices have also nosedived since the highs made in March 2022. But, the decreasing volatility might be good news for the short-term future price of APE. Well, that is what we thought.

The 4-week volatility chart, as of Jan. 2, 2024, revealed that the metric has been making lower highs but is still moving up at times. However, the volatility metric seems to have bottomed out at press time, and the prices are holding steady at the drop — which looks like a bullish sign.

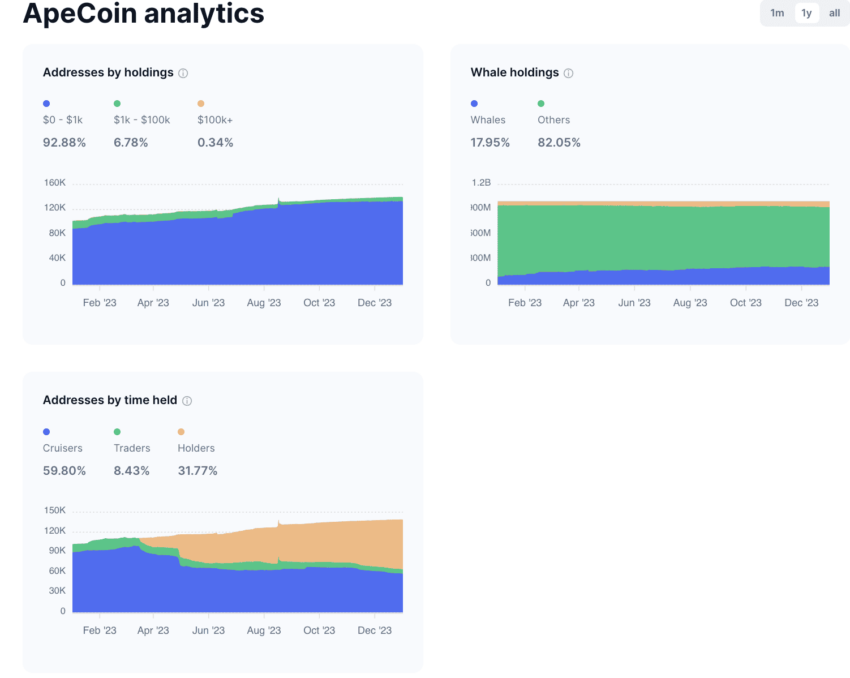

If you look at the active address count, the increase in the number of wallets holding APE in August 2023 was evident. However, this led to a price bottom, citing that most of these addresses could be sell-driven ones.

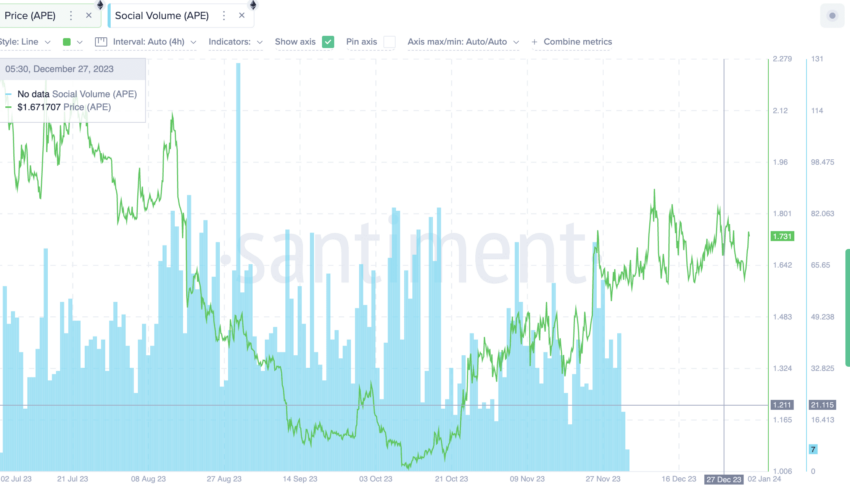

BAYC and MAYC are popular NFT projects with huge social followings. Any form of an increase in social activity seemingly has a positive impact on prices.

As of early December 2022, even steady social volume pushed the prices higher. If we move our attention to November 2023, the social volume metric has been moving steadily — a reason why even the prices felt bullish.

Finally, another interesting pattern surfaces for APE. Despite this being a newer project, the APE whales only control close to 18% of the supply, a strong long-term signal for the price action.

APE price prediction and technical analysis

We have discussed the fundamentals, tokenomics, and a handful of on-chain metrics. Now, it’s time to shift focus to technical analysis. This will help us locate a pattern that is important for a relatable and data-backed future price forecast.

But before we move to a deeper analysis, let us track the short-term price action of APE to see how things are moving in 2024:

Our January 2023 analysis

APE is currently trading inside a symmetrical triangle pattern, closing in on the upper trendline. However, the momentum looks a tad weak, with RSI making lower highs and hinting at a bearish divergence. If the volumes weaken and the upcoming token unlock event causes panic, we might see APE drop to as low as $1 to take support.

However, if the price breaks on the upside, invalidating the bearish trend, the $2.33 level could be the immediate level for APE.

Let us now shift our attention to the broader patterns:

Notice that we used the daily chart instead of the weekly one. This is because APE is a newly launched token. There isn’t enough historical data to study weekly charts regarding market capitalization and trading volume.

There is a clear long-term trend with APE making a high, trying to breach that high with another high but failing. Then, multiple lower highs are made since the first lower high.

However, the recent monthly rally at APE’s counter seems to be trying hard to defeat the lower-high pattern. This might be optimistic for the future price of APE. The encircled region shows a new higher increased possibility.

Note: We have only marked the most distinguishable highs and not everything in between.

Price changes

Now we have the pattern visible; we can mark all the highs and lows to calculate the next leg of movement for ApeCoin.

Here is the marked chart with all the key points identified. Do note that these levels can also act as key support and resistance lines when the future price of APE is concerned. It is now time to trace the path from A to Q, including all the highs and lows.

Path 1: Low-to-High

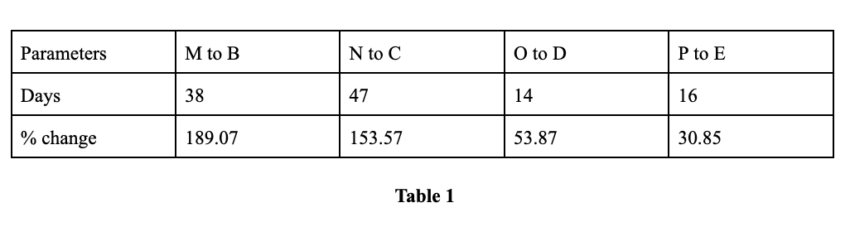

Table 1

The average distance and price change from a low to a high comes to be: 29 days (maximum is 47 days) and 106.84%. The distance might vary as there isn’t a lot of historical data for APE. Plus, the crypto market is relatively weak at present. The total distance from M to E is 115 days, which can also be where the next high appears.

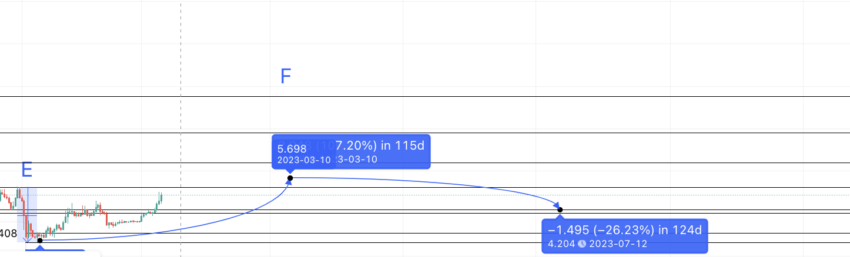

Therefore, if the last low is marked Q, the probable high could surface at $5.698 around March 2023.

Path 2: High-to-Low

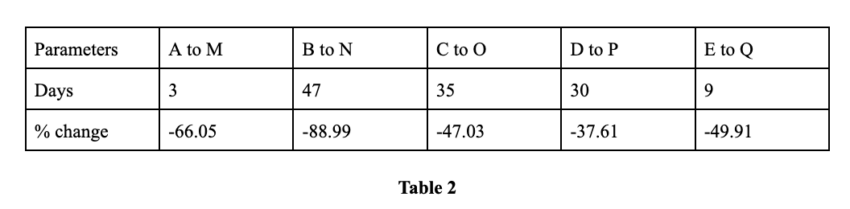

Table 2

The average distance and price change from a high to a low comes to 25 days (maximum between 47 days and 124 days) and- 57.92%.

We will use the datasets from the tables above to prepare the ApeCoin price forecast for 2023.

ApeCoin (APE) price prediction 2023

We predicted a high of almost $5.7 for APE in 2023, and it exceeded our expectations, scaling as high as $6.29. Here is how our past analysis went:

According to the data tables, if we mark the next high after E as F, the level might surface at $5.698. Do note that F is still lower than E, meaning that APE, even in March 2023, might not form a higher high pattern. The drop from F could surface at a low of 57.92% in 124 days.

Considering that the market conditions will improve by mid-2023, we can expect the drop to be restricted to $4.20 — which coincides with the support level of $4.177. This is the point where the downtrend seen on the ApeCoin price chart (marked by lower lows) might be defeated.

Hence, the ApeCoin price prediction model 2023 calculations suggest a high of $5.698 and a low of $4.20.

Short-term price prediction for APE

We even put forth a short-term analysis during the same time last year, where we even added token-led movements and identified key price levels. Read on to learn more about the same:

The short-term daily chart of APE shows the token breaking out of the ascending triangle pattern. However, the relief rally might still go the distance. This is because the 50-day moving average (green line) is closing in on the 100-day moving average (blue line). If the green line crosses above the blue line, we can see the rally extending further.

Also, the APE token has breached the strong support of the 200-day moving average. Yes, the RSI is in the overbought zone; therefore, some range-bound consolidation might surface. We might see a week of tepid price movements before any attempts by APE to speed things up again.

However, data from the on-chain analytics platform Lookonchain suggests that quick selling pressure might soon build at APE’s counter. One staker withdrew over 450K tokens and deposited the same to Binance. The average receiving price is less than $4, and selling might therefore be profitable. Therefore, if you are only invested in APE for short-term gains, this might be a development to keep an eye on. Here is the tweet thread for your reference:

ApeCoin (APE) price prediction 2024

Outlook: Bullish

Our Jan. 2024 analysis mentioned that the first level to beat for APE would be $2.3. For the rest, we can project the levels for 2024, keeping the hypothetical 2023 levels in mind. Also, it is worth noting that our 2023 low for APE was at $1.02; hence, the low-to-high average of 106.84 puts the 2024 high at close to $2.3, which we identified in the first place.

But then the bull market can do strange things to an asset’s price. Here is what can happen as the best-case scenario for APE:

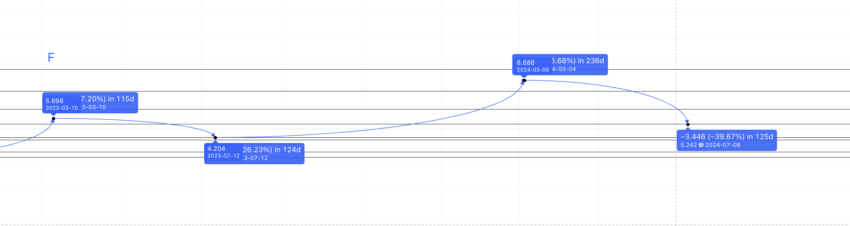

Now that we have the 2023 low at $4.20, we can extrapolate the path till 2024. Using the low-to-high average of 106.84%, we can plot the ApeCoin price prediction path for 2024. The price can, therefore, go as high as $8.688.

The distance, however, can be as high as 230 days — M to E is 115 days, and E to F is 115 days — depending on the state of the crypto market and the previous growth path of ApeCoin.

In 2024, the low can surface in 124 days and at $5.242. Notice that this level doesn’t align with the average percentage drop and is in sync with the smallest drop percentage, per the data in Table 2. The drop from high to low in 2024 might account for -39.67%.

Projected ROI from the current level: 402%

ApeCoin (APE) price prediction 2025

Outlook: Bullish

From the lows in 2024, we can plot another forecast line using the low-to-high average of 106.84%. The levels surface at $10.85 and can show up in early 2025. This can be the maximum ApeCoin price prediction for 2025.

The minimum ApeCoin price prediction for 2025, using the table-specific data, can hit the strong support level of $6.40. This translates to an acceptable drop of almost 40.96% —in line with the lowest drop value from table 2.

Projected ROI from the current level: 527%

ApeCoin (APE) price prediction 2030

Outlook: Moderately bullish

The price of APE can drop to $6.40 by 2025. However, if the average growth percentage of 106.84% is followed, the rise by early 2026 can put the APE high for 2026 at $13.256.

The formation of higher highs is evident if you carefully look at the APE price predictions for 2023, 2024, 2025, and 2026. Now we have the 2026 high and 2025 low at our disposal; we can extrapolate the path till 2030 using the Fibonacci levels.

If the same growth path from 2023 to 2026 is followed, the ApeCoin price prediction 2030 model can return a high of $50.854.

The predicted low price for 2030 might surface at $39.40. This previous all-time high of APE occurred last on March 17, 2022. Also, for APE to form a new all-time high in 2030, ApeCoin must breach the previous all-time high of $39.40 by 2029.

Projected ROI from the current level: 2839%

ApeCoin (APE’s) long-term price prediction until 2035

Outlook: Bullish

As per the ApeCoin price prediction 2030 model, the maximum price of APE should rest at $50.854. However, if you plan on holding APE deep into 2035, the table below can help us form longer-term price predictions.

You can easily convert your APE to USD

| Year | | Maximum price of APE | | Minimum price of APE |

| 2023 | $6.29 | $1.02 |

| 2024 | $8.688 | $5.242 |

| 2025 | $10.85 | $6.40 |

| 2026 | $13.256 | $8.22 |

| 2027 | $17.23 | $10.68 |

| 2028 | $25.84 | $20.15 |

| 2029 | $40.052 | $24.83 |

| 2030 | $50.854 | $31.52 |

| 2031 | $63.56 | $49.57 |

| 2032 | $95.35 | $74.37 |

| 2033 | $114.42 | $88.24 |

| 2034 | $148.74 | $92.21 |

| 2035 | $185.93 | $145.02 |

The average annual price will depend on the market cap, trading volume, and network growth. Also, it will be necessary to keep an eye on the popular NFT collection (s) relevant to the ecosystem.

Is the APE price prediction model accurate?

This APE price prediction model is heavy on datasets, especially regarding the technical analysis. Further, this price prediction piece captures and considers the fundamental essence of the project. We also discuss on-chain metrics and tokenomics, which look investor-friendly for now. Therefore, this model keeps APE projections and ROIs attainable. Of course, the crypto market is volatile, and the future success and integration of web3 are things to keep a close eye on.

Frequently asked questions

How high can ApeCoin go?

What will ApeCoin be worth in 2030?

Is ApeCoin a good investment?

Can ApeCoin reach $100?

Does ApeCoin have a future?

Is ApeCoin on Ethereum?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.