Crypto hacks and exploiters had a ball in July with around 50 attacks resulting in hundreds of millions in losses. An equally bumper August for cyber criminals could hamper any recovery for the decentralized finance (DeFi) sector.

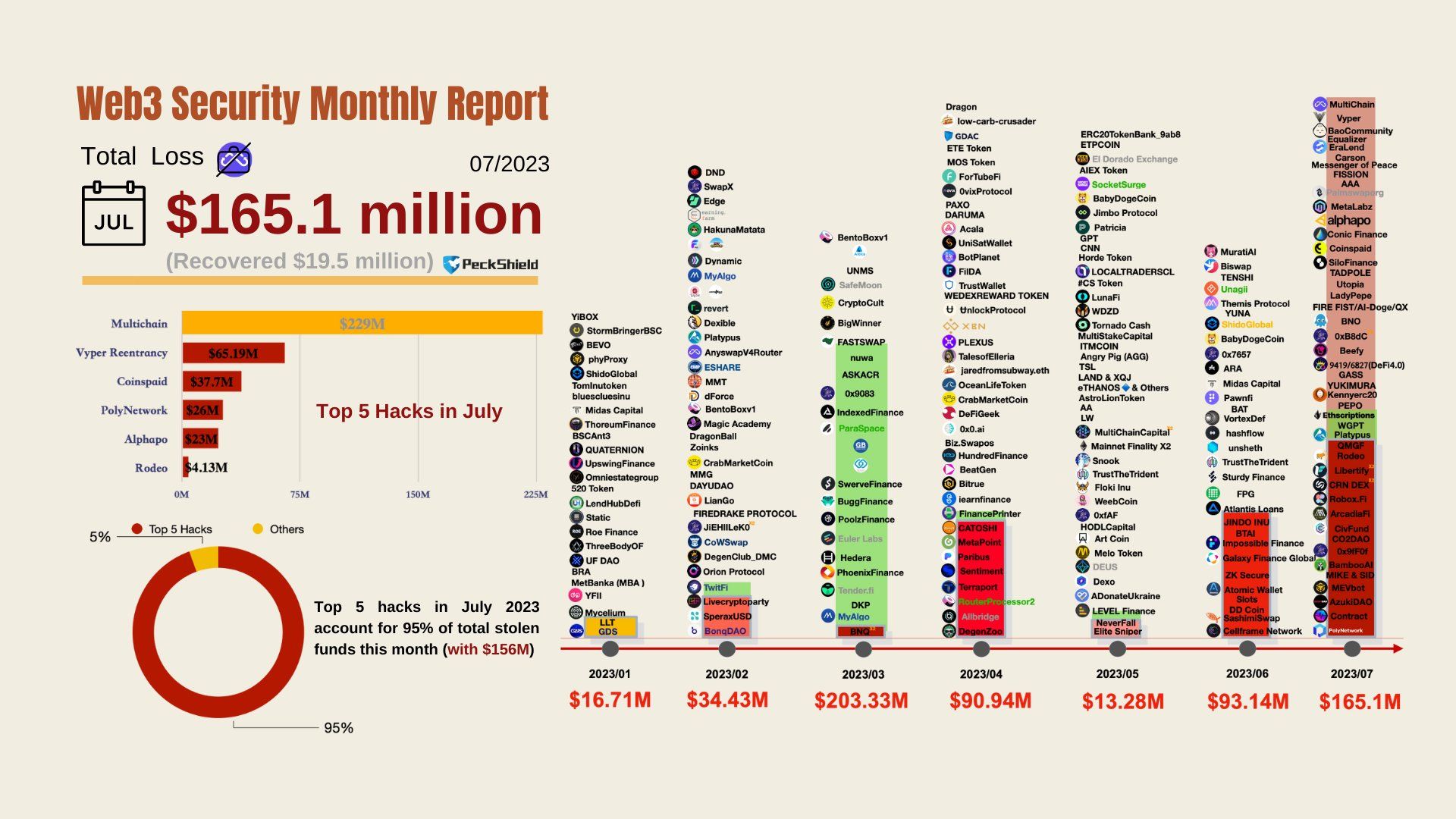

According to blockchain security firm PeckShield, there were more than 48 major hacks in July, leading to around $165 million in losses.

Crypto Hacks Take an Upper Hand

Remarkably, this figure did not even include the $209 million drained from the cross-chain bridge platform Multichain.

PeckShield reported that the top five hacks accounted for 95% of total stolen funds last month at $156 million. July has been the second-highest month for hacking losses after March, when more than $200 million was pilfered.

The largest attack was the Vyper reentrancy exploit that targeted Curve Finance stable pools. Furthermore, a raft of other DeFi protocols were also affected, resulting in around $65 million in losses.

Moreover, the fallout of that particular attack is still being felt, as the total value locked in the DeFi sector has dropped $3.5 billion since the incursion.

The second largest hack in July was the crypto payments platform CoinsPaid which lost $37 million on July 22. The firm has fingered the notorious North Korean hacking collecting Lazarus Group in the heist.

(Dis)Honorable Mentions

Poly Network lost $26 million in an access control exploit, while AlphaPo lost $23 million in a similar attack.

De.Fi claims that losses for July were much greater, making it the worst month of the year. It claims $486 million in crypto was lost last month.

However, the platform includes all types of exploits, incursions, and misdemeanors, including rug pulls, social media account hacks, access control issues, and flash loan attacks.

As we enter August, a series of memecoin rug pulls such as BALD could be added to the tally this month. De.Fi’s Rekt database shows the latest rug pull could have resulted in a loss of $23 million.

Crypto markets have finally reacted to a week of exploits and are starting to drop fast. Total capitalization has dumped 2% on the day in a fall to $1.2 trillion. Around $30 billion has left the space over the past 12 hours or so, according to CoinGecko.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.