Coinbase Global Inc., one of the prominent crypto exchanges, is targeting the self-managed pensions sector in Australia.

The exchange aims to tap into the growing demand for crypto investments within this segment, which forms a substantial portion of the country’s $2.5 trillion pension system.

Coinbase Targets the Crypto Demand in Australia’s Pension Funds

John O’Loghlen, Asia-Pacific Managing Director at Coinbase, revealed that the company is developing a service tailored for self-managed super funds (SMSFs). The service will target clients who prefer to make a single allocation in SMSFs rather than actively managing it.

“We are working on an offering to service those clients really well on a one-off basis — to have them trade with us and stay with us,” O’Loghlen stated.

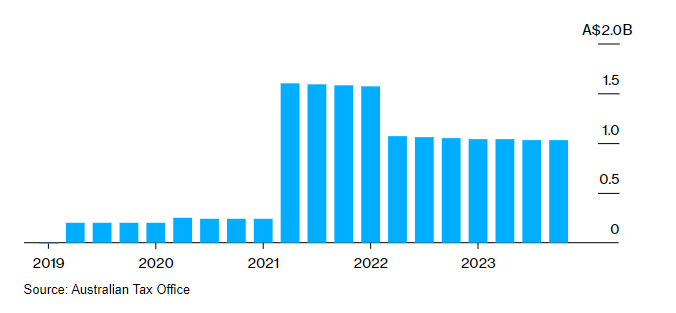

According to the latest data from the Australian Taxation Office, pension funds have allocated approximately 1 billion Australian dollars ($664 million) to cryptocurrencies. Therefore, it is plausible that Coinbase wants to capture a share of this market.

Read more: 7 Ways To Handle Retirement With Increasing Inflation

This initiative by Coinbase aligns with a broader trend. Several pension funds have shown interest in Bitcoin and other cryptocurrencies. This is notable given the typically conservative nature of pension funds, which usually avoid highly volatile markets like crypto.

In March, Japan’s government pension fund began exploring “illiquidity assets” such as Bitcoin. Additionally, a recent filing with the SEC for Q1 2024 disclosed that The State of Wisconsin Investment Board, a US public pension fund, holds significant spot Bitcoin exchange-traded funds (ETFs), including $64 million worth of Grayscale Bitcoin Trust (GBTC) and $99.2 million worth of BlackRock’s iShares Bitcoin Trust (IBIT).

Industry experts have also expressed optimism about the possibility of pension funds tapping further into digital assets. Michael Saylor, co-founder of MicroStrategy and a prominent Bitcoin advocate, recently suggested that US pension funds will need to incorporate Bitcoin into their portfolios.

“There are thousands of pension funds in the United States managing ~$27 trillion in assets. They are all going to need some Bitcoin,” Saylor wrote on X (Twitter).

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Asset manager giants like BlackRock and Fidelity shared optimism about institutional interests in digital assets. BeInCrypto previously reported that both firms witness interest from institutions, including pensions, endowments, sovereign wealth funds, insurers, and family offices. Moreover, they see these institutions starting to take a proactive approach toward embracing digital assets through the spot Bitcoin ETF.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.