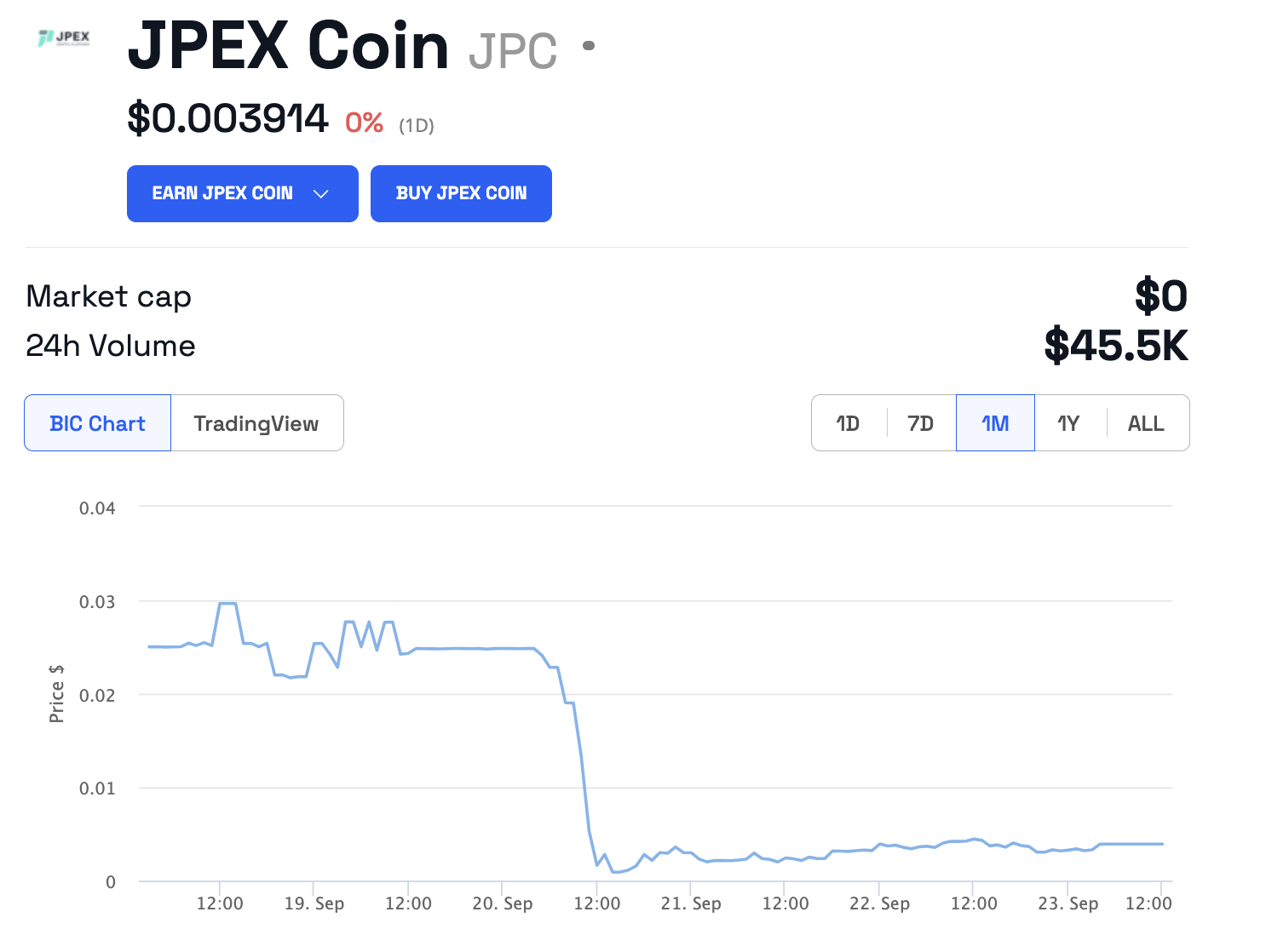

Users of the Hong Kong exchange JPEX claim they cannot withdraw assets after JPEX converted their holdings to JPC. Their protests come less than 24 hours after the exchange floated a new restructuring plan approved by 68% of customers.

According to one user, their funds became unavailable because the exchange had converted their USDT and other crypto assets to JPEX’s JPC token. They said the conversion was done without knowing the exchange rates between JPC and other tokens.

Is JPEX Locking Users’ Funds After DAO Proposal?

“Given the unknown price and the impossibility of withdrawal, our assets have now become just waste paper.”

The customer, who chooses to remain anonymous, said they knew of others experiencing similar challenges. JPEX has not publicly responded to the allegations.

Reports of withdrawal difficulties come less than 24 hours after the exchange finalized a dividend proposal to pay concerned customers.

On October 4, 2023, over two-thirds of JPEX customers agreed to a new proposal to convert JPEX into a decentralized autonomous organization (DAO).

As voting members, JPEX users would become shareholders eligible for payouts according to a DAO Shareholder Dividend Scheme. Each user will earn some of the fees JPEX charges for listing new tokens and enabling spot and derivative trades.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

The company will distribute its JPC coin and USDT in proportion to a user’s dividend percentage. This will happen until the USDT in the exchange’s vaults has been exhausted.

DAO dividends can be claimed two years after they are allocated. This means they are effectively illiquid before that, which could explain why customers cannot withdraw.

JPEX Advertising May Come Under Scrutiny

JPEX’s restructuring comes shortly after police arrested individuals allegedly involved in $191 million fraud at the exchange. Police have already apprehended at least 11 individuals and formed a joint task force with the Securities and Futures Commission staff to tackle crypto crimes.

The two government departments will share information and perform comprehensive risk assessments on “risky” crypto exchanges. A point authorities will likely focus on during the JPEX investigation is allegedly fraudulent marketing messages to attract retail customers.

Like FTX, the collapsed exchange that once made Hong Kong its home, JPEX spent heavily on local influencers to promote their products to ordinary Hong Kongers.

Its promotional messages claimed it applied for an SFC license and contained words like “high-yield,high-return,” and “low-risk.”

On October 8, new laws in the UK will attempt to fix this problem by only allowing companies authorized by the Financial Conduct Authority to create and publish crypto promotional material.

The US Securities and Exchange Commission also tabled a proposal requiring financial companies to be more specific in describing their products.

Read more: Everything You Need To Know About Ripple vs SEC

Do you have something to say about JPEX allegedly locking users’ funds after its recent restructuring proposal or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.