JMP Securities projects an unprecedented surge in Bitcoin’s value, potentially reaching $280,000.

This prediction comes from the firm’s latest research report. It forecasts a substantial $220 billion influx into spot Bitcoin exchange-traded funds (ETFs) over the next three years. This reflects the growing investor interest in cryptocurrency and positions Coinbase to benefit from these developments.

Bitcoin Price to $280,000

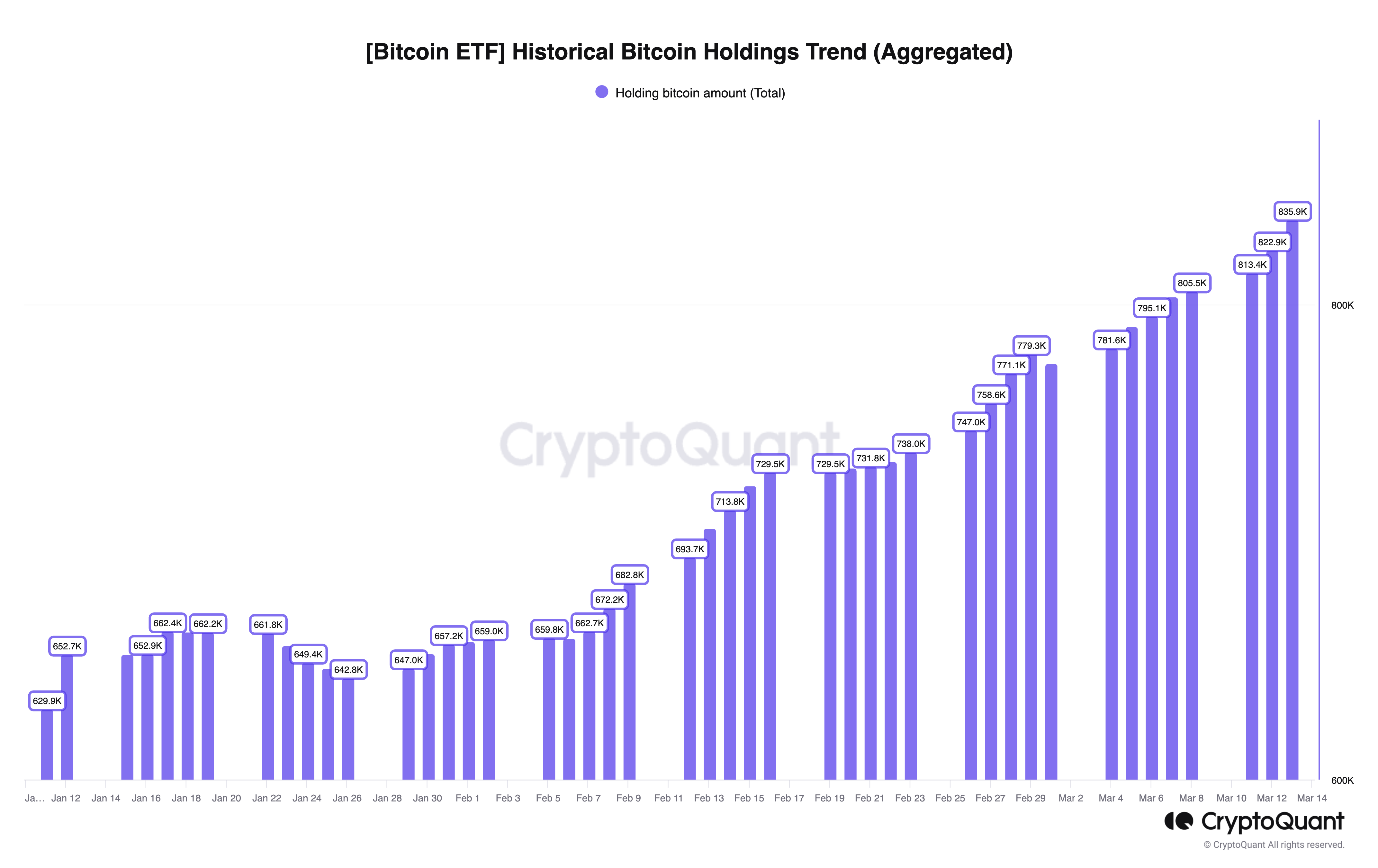

The JMP report emphasizes the remarkable journey of spot Bitcoin ETFs, which saw inflows hitting $10 billion two months post-launch. According to the analysts, such a staggering figure represents the initial phase of a much larger trend.

With ETF approval acting as a catalyst, the expectation is for these inflows to continue escalating. Indeed, CryptoQuant CEO Ki Young Ju highlighted that a “sell-side liquidity crisis” is imminent if the influx of institutional investments into Bitcoin continues.

“Bears can’t win this game until spot Bitcoin ETF inflow stops… At this rate, we’ll see a sell-side liquidity crisis within 6 months… Once a sell-side liquidity crisis happens, its next cyclical top may exceed our expectations due to limited sell-side liquidity and thin orderbook,” Ju said.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Central to this optimistic outlook is the potential multiplier effect of new capital on Bitcoin’s price. JMP analysts, including Devin Ryan, articulated that a projected inflow of $220 billion could magnify the cryptocurrency’s market cap exponentially, attributing to a valuation of $280,000 per Bitcoin.

This projection relies on an estimated current multiplier of new capital at approximately 25X. Therefore, it suggests a significant impact on Bitcoin’s overall market capitalization.

Interestingly, JPMorgan analyst Nikolaos Panigirtzoglou stated the recent influx could actually be due to a shift in capital from traditional crypto platforms, like exchanges, to spot Bitcoin ETFs. However, he acknowledged that this may change in the future.

“Crypto exchanges saw a cumulative Bitcoin outflow of around $7 billion since the spot Bitcoin ETF launch. In other words, it is more likely that the net flow from retail investors into the newly created ETFs is closer to $2 billion rather than $9 billion,” Panigirtzoglou said.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

Panigirtzoglou pointed out that the spot Bitcoin ETF market will expand to $62 billion within the next two to three years. And Coinbase is well-positioned to benefit from the growing ETF market, with JMP Securities adjusting its price target for the COIN stock to $300, up from $220.