Bitcoin stands out as a frontrunner in the cryptocurrency industry, with analysts predicting an exponential rise in adoption rates.

According to renowned analyst Willy Woo, Bitcoin is on the verge of a monumental leap, expecting to match the Internet’s growth trajectory from 1997 to 2005.

What One Billion Bitcoin Holders Means

Woo believes this seismic shift in adoption has been brewing for years. For this reason, “1 billion people will own Bitcoin by the end of this cycle,” Woo asserted. He highlighted the digital currency’s accelerated adoption rate, which outpaces that of the early Internet.

Given Bitcoin’s accelerating acceptance worldwide, cryptographer Adam Back suggested that the market is eyeing a much loftier goal, with $100,000 being viewed as “way overdue.”

“Bitcoin tapped $73,000 Tuesday. No one said anything. Spent much of Wednesday above $73,000. I think the reason things are muted is that $100,000 seems way overdue, for a few years now, so there’s not much bull market euphoria as the $1,000 to $5,000 green candles scroll by,” Back said.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

Interestingly, the catalyst behind such a Bitcoin price prediction is largely attributed to institutional demand.

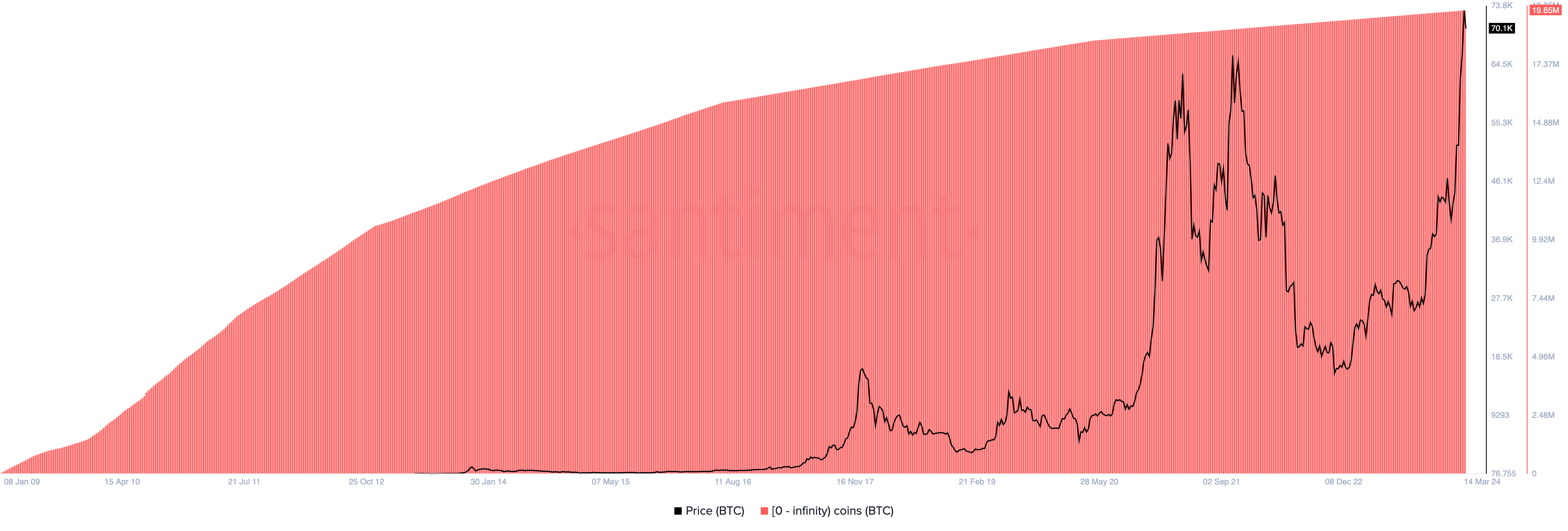

As CryptoQuant’s CEO, Ki Young Ju, pointed out, a “sell-side liquidity crisis” looms on the horizon if institutional inflows persist. This surge in demand, coupled with the successful launch of spot Bitcoin exchange-traded funds (ETFs) in the US, has validated Bitcoin as a viable institutional investment and introduced a paradigm where demand may soon outstrip supply.

Indeed, spot Bitcoin ETFs have marked their entry as the most successful ETF launch in history, amassing nearly $30 billion. As Ju elucidated, this influx could precipitate a supply-induced price shock. This scenario is where the available Bitcoin fails to meet the growing demand.

Last week’s net flows into spot ETFs of over 30,000 BTC further exacerbate a potential liquidity crisis.

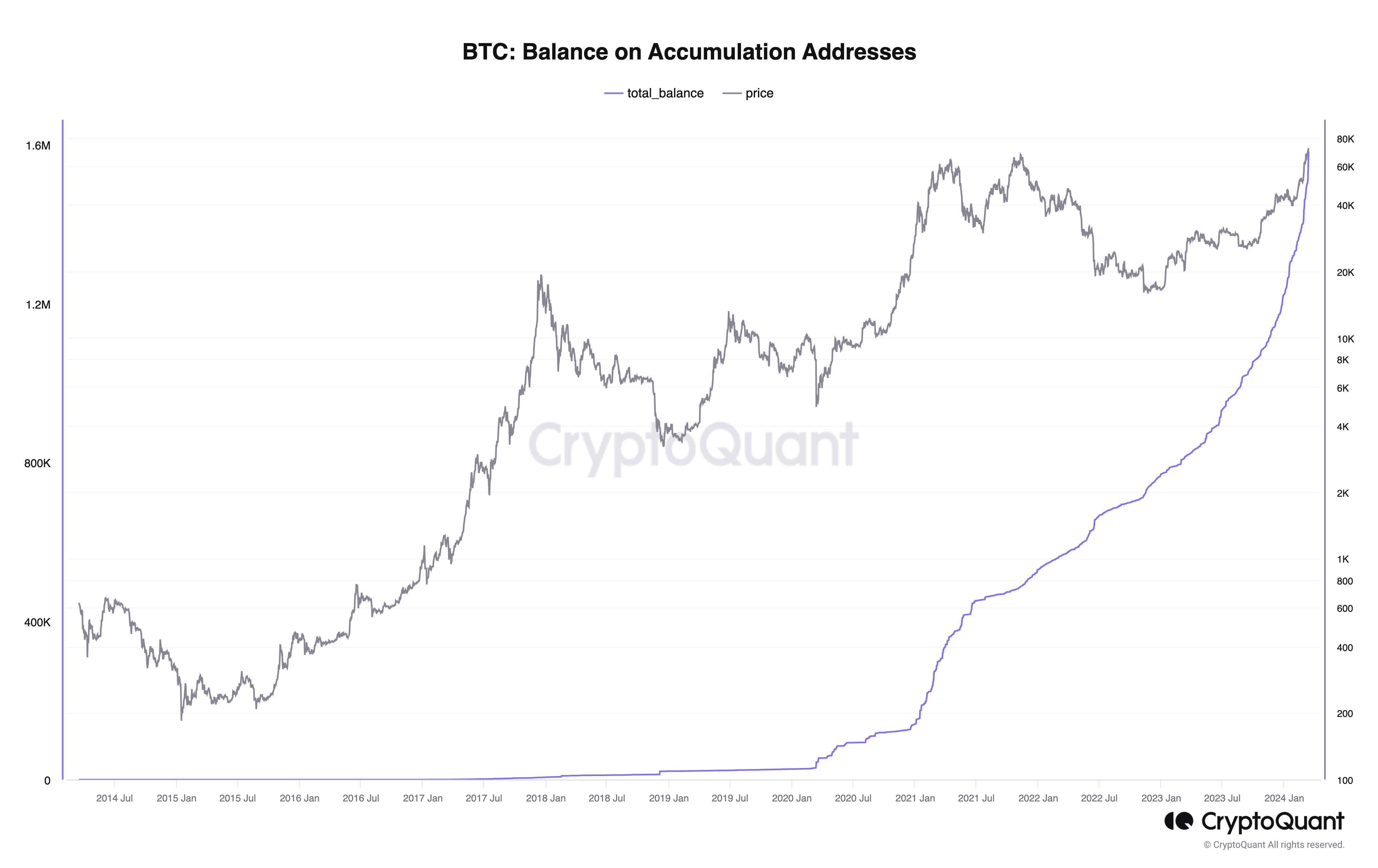

Moreover, Ju’s analysis sheds light on the accumulation of Bitcoin by wallets that only receive transactions. This uptrend in accumulation addresses signals a growing hoarding behavior. If it continues, it could herald the onset of a sell-side liquidity crunch.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

As Bitcoin’s adoption curve steeply ascends towards the 1 billion mark, the interplay between escalating demand, particularly from institutional investors, and dwindling supply could catalyze unprecedented price impacts.