The price of bitcoin (BTC) has been consolidating for more than two weeks after it experienced one of the biggest crashes in crypto history. Although the market has calmed down, holding back further declines, we do not see a quick V-shape recovery.

However, the possibility of one is still in the game. One of the best-known analysts in the crypto space, PlanB, has suggested that it might occur soon. A clear pattern in the cryptocurrency options market seems to impact the BTC price heavily this year.

PlanB discusses a V-shape recovery

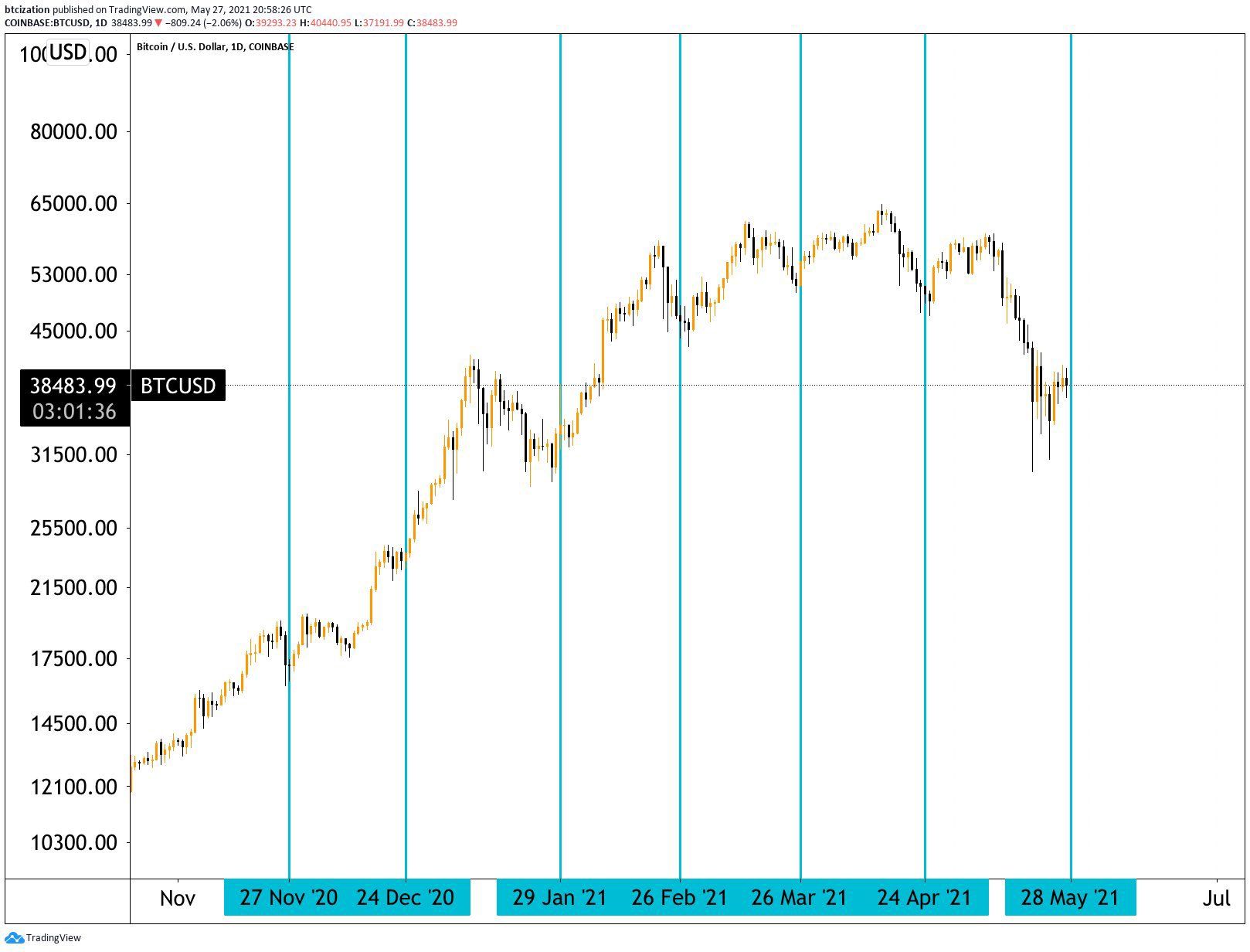

In a recent tweet by PlanB, the popular cryptocurrency analyst and creator of the BTC stock-to-flow model presented a chart of this year’s BTC price action. It marked periods of drops and rallies. They all follow a similar V-shape recovery pattern.

By far, the biggest drop has occurred in the last month, between May 12 and 19. This is where bitcoin dropped from around $57,000 to a low of $30,000.

PlanB marked this area as the longest isosceles triangle. It also put a question mark on it, wondering if the pattern will be realized again.

If that were to happen, the coming period could lead to an increase in the price of the main cryptocurrency by over 50%.

However, it should be remembered that the price action to date in 2021 was most likely following the Wyckoff distribution pattern. Upon its completion, one expects not an immediate recovery back to the highs but rather an extended period of accumulation.

Monthly options expiration

PlanB argues that his V-shape recovery hypothesis is based on a pattern of liquid and illiquid trading periods at different times of each month.

From the beginning of this year, a clear pattern of price increases in the first weeks of the month. In addition, declines in the second half of the month are seen.

Such behavior of traders is most often explained by the cycle of opening and expiring derivative financial instruments in the crypto market – options, including the futures market.

Traders open positions at the beginning of the month, usually on the first Monday. These options expire, and positions usually close on the last Friday of the month.

As shown on the chart by another Twitter user, @T6nis05, each last Friday of the month on the BTC market was an indicator of a local low (blue lines), followed by a dynamic increase.

If the situation were to repeat, then from May 28, we should observe a BTC price rally. Indeed, since last Friday, the price of the main cryptocurrency has increased by 18%.

It also attempted to break out of the symmetrical triangle in which it was trading from the monumental drop on May 19.

Unfortunately, the breakout turned out to be fake. At the press time, bitcoin has returned to the triangle structure with a price around $36,500.

This move, however, does not rule out the possibility of continuation of the V-shape recovery in the following days. Since local declines occurred after increases almost every month.

Nevertheless, it is worth recalling that the bitcoin drop in May was one of the biggest crashes in the entire history of the crypto market.

Therefore, it is doubtful to be followed by an instant recovery to the all-time high area. However, cryptocurrencies may surprise us – they always do!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.