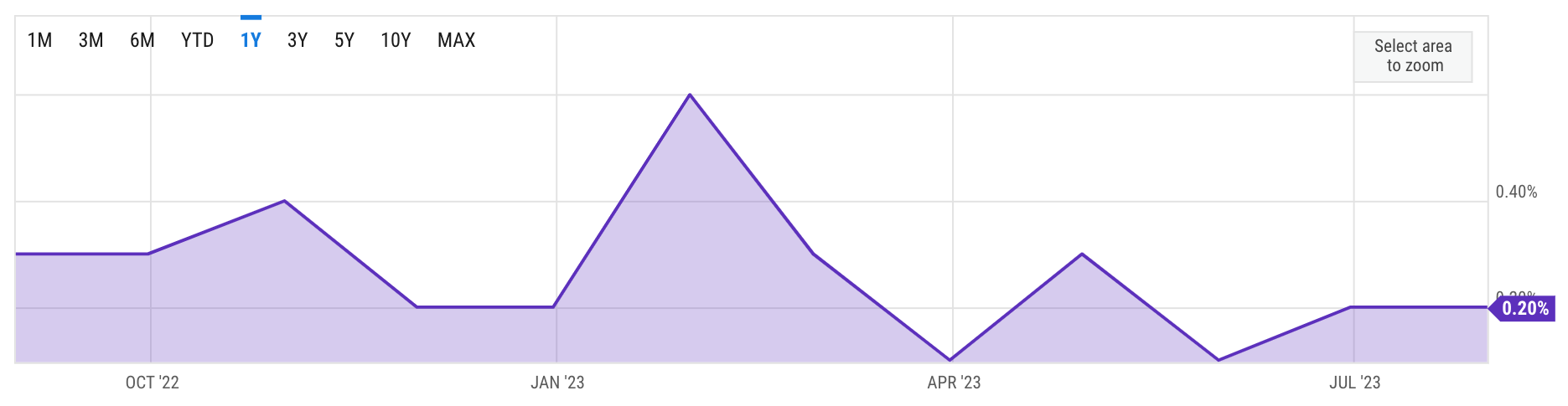

The US Personal Consumption Expenditure (PCE) Index rose 0.2% month-on-month in July, while jobless claims were lower than estimates at 228,000, prompting speculation of an imminent pause in Federal Reserve (Fed) interest rate increases.

The so-called core PCE price index that excludes food and energy rose 4.2% yearly, matching expectations, while headline PCE came in at 3.3%.

Revised jobless claims for June were 232,000, confirming a deceleration in job creation but not necessarily a decline in unemployment. Lower unemployment and falling PCE inflation suggest the Fed may consider pausing or even cutting rate hikes to bring the Consumer Price Index (CPI) closer to 2%.

Bitcoin Oddly Muted as Markets Absorb Potentially Bullish News

The US PCE Index is a gauge of how consumers change their spending habits as prices rise. While the Fed looks at the CPI as the primary indicator of price changes, the PCE offers vital clues on how the average household is affected by rising prices.

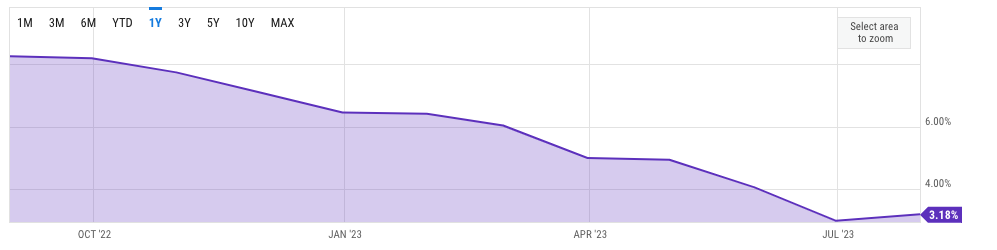

Flat monthly and slightly higher yearly PCE numbers and steady jobless claims indicate the economy may be cooling and eventually prompt an interest rate cut. Citi Chief Economist Andrew Hollenhorst predicts one more hike in November, and then the question will be when the central bank will start cutting.

Looking for a change of job? Click here to find new opportunities in the world of Web3.

He expects the rate hikes will bring the US Gross Domestic Product closer to 2% rather than 5-6% in 2023 and predicts a recession in 2024. He argues that diminishing supply is also creating a tight housing market.

Since rallying above $28,000 following Grayscale’s victory over the US Securities and Exchange Commission (SEC) earlier this week, Bitcoin has lagged the Dow Jones Industrial Average and S&P 500. After the PCE numbers, the asset spiked to $27,259 before falling back to $27,255.

Ethereum (ETH) was mostly flat, rising marginally to $1,711 before falling back to $1,708.

Fed Needs Data to Determine Whether to Increase Interest Rate

The Fed’s battle against inflation “is not over,” Chairman Powell affirmed at last week’s central banker symposium in Jackson Hole, Wyoming. The banker said that despite annual headline inflation reaching 3% last month, food and energy prices remain volatile, and the central bank may further tighten policy to reach its 2% target.

Tired of the Fed’s gyrations and want to beat inflation? Read more here.

The consensus among economists is that the Fed may need to revise its models to account for shocks introduced by shock events like the COVID-19 pandemic and the Russia-Ukraine war. Hollenhorst argues that the central bank must depend on real-time data in the absence of a workable model.

“What is the theoretical framework we are using to assess the economy? If you don’t have a theoretical framework, you have to rely on data.”

Got something to say about how the latest US jobless claims will impact the US economy or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).