Bitcoin, US equities, and gold rallied after the US headline Consumer Price Index (CPI) increase for July matched 0.2% estimates and increased expectations of a Fed rate pause. Most of the monthly price increases came from shelter costs, which rose 7.7% for the month and 4.4% for the year.

After news of the CPI increase broke, gold, Bitcoin (BTC), and equity futures rose. Bitcoin was up roughly 0.3% at $29,594.60.

Crypto Price Action Correlates With Equities After US Inflation Report

Ethereum (ETH) also rose marginally, while Ripple’s XRP increased five-tenths of a percentage more to $0.634. In addition, US equity futures were up, with the Dow Jones Industrial Average rising 200 points and Treasury yields falling.

The price of gold increased to $1,926.35 per ounce.

The boon in financial markets belies investor belief the US Federal Reserve (Fed) may soon pause rate hikes. Annual inflation has fallen almost 6% from its 2022 high after 11 interest rate increases since March 2022.

Annual Inflation Grew for the First Time in 13 Months

But industry experts caution against popping the champagne just yet.

While the month-on-month headline CPI increase was steady, the 0.2% annual increase from June is the first in 13 months. Additionally, without considering food and energy, inflation rose 4.7% year-on-year and 0.2% for the month.

Tired of being at the mercy of Fed rates? Find out here how to take control of your financial future.

Both annual core and headline inflation fall well-short short of the Fed’s 2% target. The central bank considers core inflation as a better predictor of inflation than the headline.

But optimism remains regardless, helped in part by a nonfarm payrolls report for July which suggested more unemployed people found jobs while hourly wages grew moderately. The report indicates the Fed is getting closer to its other goal of “maximum employment” where supply and demand equalize.

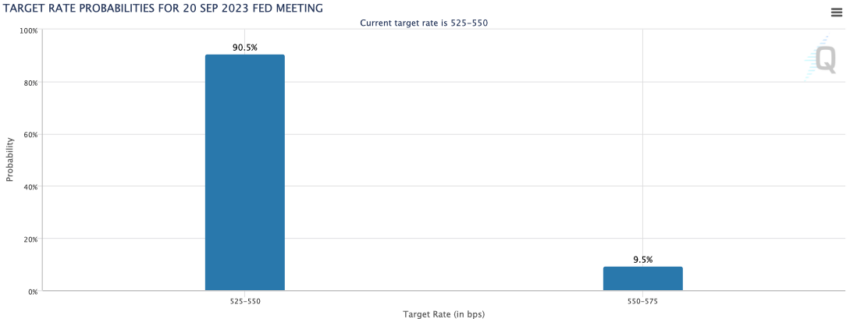

The CME’s FedWatch tool indicates a 91% chance the Fed will pause rates at 5.25%-5.5%. It last halted rate increases in June.

Got something to say about the CPI increase or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.