Mixed sentiments precede the release of the US Federal Reserve’s (Fed) September meeting minutes, where it announced its “higher-for-longer” interest rate plan to lower US inflation. Bankers are split over whether higher bond yields could cause the central bank to reconsider rate hikes or if stubbornly high inflation means further increases.

Fed governor Michelle Bowman argues the Fed may raise interest rates and keep them high for longer to tame inflation while keeping one eye on the US Treasury market. San Francisco Fed President Mary Daly said on Wednesday that the so-called R-star, the rate at which the economy neither grows nor shrinks, may be higher than during the pandemic, meaning the Fed will likely keep rates higher for longer.

R-Star May Still be High

Daly said the rate, which was 2.5% before the pandemic, could now lie between 2.5% and 3%. The Fed raises its interest rate above the inflation-adjusted R-star gauge when it needs to lower inflation.

Calvin Yeoh of Blue Edge Advisers said that if anything, Daly’s comments were catching up to, rather than setting the tone for markets. In any case, a 2.5% R-star rating is conservative unless a recession hits, he speculated.

“The simple arithmetic of positive growth, above-target inflation and a tight labor market while one-year real rates are above 1.5% tells you that a nominal 2.5% long-term rate is ambitiously low unless we get a recession.”

Fed Awaits Economic Data Ahead of Next Meeting

Economic data out this week could shed more light on the Fed’s next move to combat inflation.

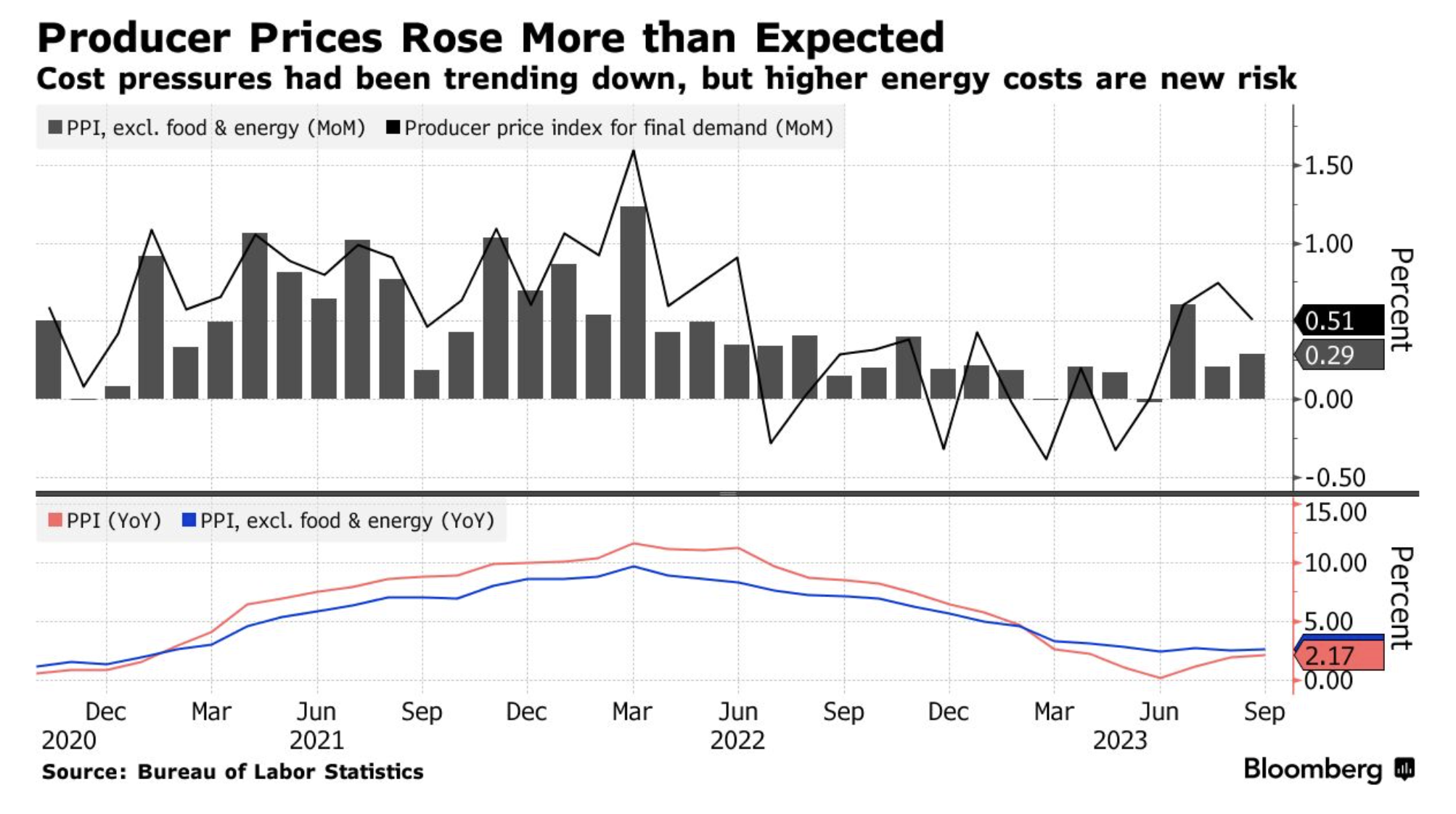

The US Producer Price Index (PPI), a measure of the change in prices domestic producers receive for their finished goods, rose for the third consecutive month in September. The PPI for final demand came in at 0.5%, while the so-called core PPI, excluding food and energy, increased by 0.3%.

The Fed will use the PPI and September’s Consumer Price Index (CPI), due on Thursday, to inform its next interest rate decision. Fed economists use PPI data to calculate the Personal Consumption Expenditure Index, a measure the central bank regards as a truer reflection of price increases than the CPI.

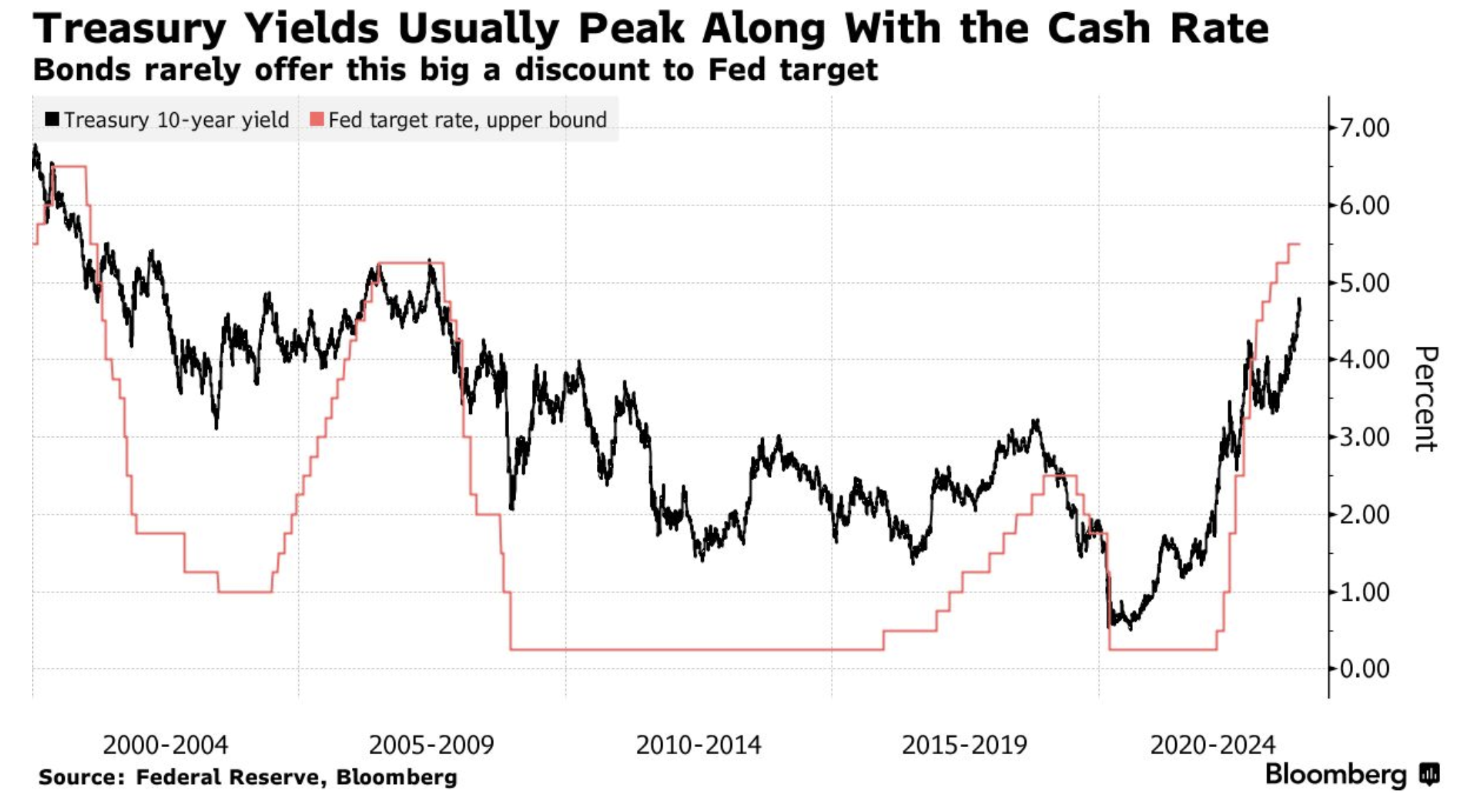

The federal funds rate, now between 5.2% and 5.5%, is the highest in 22 years. The Fed started increasing rates in March 2022, ending the pandemic era of easy money and near-zero interest rates.

How Rates Impact Crypto Investments

In the meantime, the unprecedented aggression of rate hikes has increasingly pushed investors into safer bets, such as US government treasuries. But fears the Fed will keep rates elevated for longer has seen sovereign bondholders absorbing heavy losses for the third consecutive year.

Read more: Crypto Portfolio Management: A Beginner’s Guide

Companies have also refinanced billions in corporate bonds this year, believing that interest rates are not going to go lower before their bonds mature. Major banks, such as JPMorgan, Bank of America, and Charles Schwab, are expected to report major unrealized losses in the quarterly earnings reports this Friday due to increases in the 10- and 30-year bond yields.

Investors’ flight to government bonds suggests that crypto has also grown less attractive, with investments in derivatives seeing significant outflows in recent weeks. Higher borrowing costs have discouraged leveraged-based trading, in which traders supply collateral to increase their returns from a profitable product or asset class.

Adding to the negative sentiment is the lack of regulatory approval for a spot Bitcoin exchange-traded fund (ETF). While Ethereum futures ETFs made a temporary splash on derivatives venues in recent weeks, institutions still view a spot Bitcoin ETF as the best way to get exposure to crypto.

The US Securities and Exchange Commission (SEC) has delayed approvals for spot ETFs due to market manipulation fears.

Read more: Mistakes To Avoid When Trading Bitcoin with Leverage

Do you have something to say about how higher interest rates are affecting crypto investments, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).